The COVID-19 pandemic is now perhaps regarded as an economic catastrophe more than a health catastrophe. It’s due to the fact it has adversely impacted almost all the business sectors around the world.

Giant corporates announcing layoffs and stopping their operations in many countries shows how big of an impact of this pandemic has had on the world economy in general.

COVID-19 pandemic has also impacted the payment industry, especially the global remittances which are considered as one of the key forms of financial inflows in the developing nations. According to the World Bank, there has been a sharp decline of around 20 per cent in the global remittances due to COVID-19 pandemic.

This fall is considered as the sharpest decline in recent history and the main reason behind it is the drop in the wages and salaries of migrant workers.

Here, it’s important to understand that the migrant workers are most vulnerable to lose their employment during such an economic crisis taking place in the host country. If we talk about the remittances to the LMICs (low and middle-income countries) then there has been an estimated fall of 19.7 per cent to $445 billion.

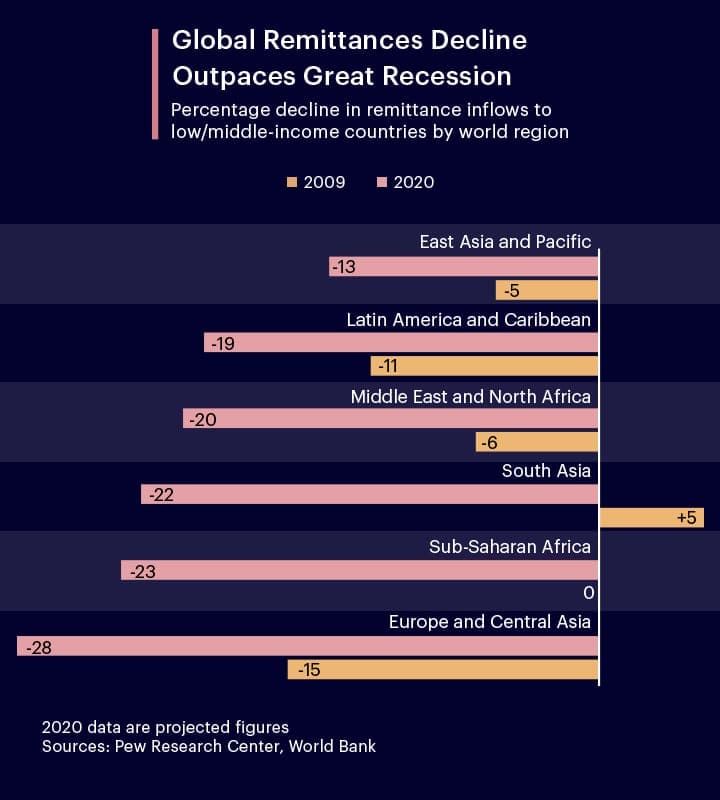

The decline in remittance is not only restricted to any particular region but is quite evident in all parts of the world. As per the World Bank, Central Asia and Europe will face the largest amount of decline of 27.5 per cent followed by a 23.1 per cent decline in Sub-Saharan Africa.

The regions of South Asia and MENA (Middle East and North Africa) will witness a decline of 22.1% and 19.6% respectively. Whereas Latin American and the Caribbean region will see a decline in their remittance by about 19.3 per cent followed by East Asia and the Pacific with a declining percentage of 13. This decline in remittance is historic as it has outdone the decline of the great recession of 2009.

International remittance stats by regions

We just had a look at how the remittance in all the major regions of the world has been impacted with the COVID-19 pandemic. Now, let’s have a look at how the international remittance stats in these regions for pre-COVID as well for post-COVID.

East Asia and Pacific

The remittance flows in this region grew by around 2.6 per cent to $147 billion in the year 2019. However, this growth was lower than in 2018 by 4.3 percentage points. In the year 2020, this flow expected to decline by around 13 per cent.

The major reason for this drop is the decline in the remittance inflows from the United States which is the largest source of remittance in this region.

If we talk about the remittance costs than the average cost for sending $200 to East Asia and Pacific region has dropped to 7.13% for the first quarter of 2020. If we have a look at average cost corridors then its 2.6 per cent for the five lowest-cost corridors. Whereas, the average for the five highest cost corridors is 15.4 per cent for Q4 2019.

Latin America and the Caribbean

The region of the Caribbean and Latin America witnessed a growth of 7.4 per cent to $96 billion for the year 2019. However, this growth was uneven as countries like Honduras, Brazil and Guatemala saw an increase of 12 per cent whereas countries like Panama, Ecuador, Colombia, and Nicaragua saw an increase just over 6 per cent.

Moreover, countries like Paraguay and Bolivia saw a decline of 2.2 per cent and 3.8 per cent respectively.

MENA region

MENA region is all set to witness a decline of around 19.6 per cent to $47 billion in the year 2020. This comes after a 2.6 per cent of growth in the year 2019. This slowdown is caused due to global slowdown and lower oil prices in the GCC countries.

Remittances from the Euro area are also going to be impacted due to the economic slowdown and depreciation of Euro against USD during the pre-COVID-19 times. The situation might get better in 2021 with a low growth rate projected at 1.6 per cent.

South Asia

The main causes in the remittance decline in the South Asia region are the global economic crisis lead by COVID-19 pandemic. Furthermore, oil prices declines have also contributed to the decline of the remittances to this region.

The economic slowdown will also affect the remittance outflows from the countries like United Kingdom, United States, and EU countries to South Asia. Moreover, declining oil prices will cause a fall in remittance outflows from Malaysia and GCC countries.

Sub-Saharan Africa

In the Sub-Saharan African region, the decline in remittance due to COVID-19 is projected around 23.1 per cent to $37 billion in 2020. The main reason behind this decline consists of several factors that are driven by the COVID-19 pandemic in countries where African migrants reside such as the United States, EU area, China, and the Middle East.

These countries are the home of the huge number of migrants that hails from Sub-Saharan Africa. Apart from this, the reason for the decline is that there’s a severe locusts attacks in many countries of the Eastern African region. These attacks have threatened the food supply in the region.

What are the challenges faced by remittance service provides due to COVID-19?

Migrant workers and their families are not the only affected party due to low global remittance volumes, even the remittance service providers (RSPs) have been affected greatly.

According to a survey conducted by the International Association of Money Transfer Network (IAMTN) in collaboration with UNCDF (United Nations Capital Development Fund), around 91 per cent of the 75+ RSP participants from more than 30 countries said that they had experienced notable changes in the overall remittance volumes.

Whereas the majority of them (69%) have experienced a sudden decrease. The COVID-19 pandemic has posed several challenges in front of RSPs. Let’s have a closer look at this one by one.

Operating at reduced staff and working hours

The COVID-19 pandemic has caused lockdowns and shutdowns in many parts of the world due to which many remittance agents have to either shut down their operations or work with reduced staff and working hours.

RSPs around the world have identified a few common challenges such as limited staffing, agent networks, and reduced remittance volumes.

Since remittance and cross-border money transfer business don’t come under essential businesses, many RSP agents are not operating at regular business hours.

Even if the RSPs decide to remain open in the sending country, then there are chances that the RSPs location in the receiving country might be closed. This adversely impacts the transactions like cash-over-the-counter placed at the pick-up location.

Health issues

Health issues are proving to be major challenges for RSPs around the world. Handing cash notes and direct customer contacts at the agent outlet without a protective gear poses massive health risks for the staff.

Many RSPs have stated that even though many of their staff is working remotely, but still a substantial number of agents have fallen ill.

Liquidity challenges

Many agents are also struggling with the liquidity challenges due to cashflow disruptions and volatile exchange rates which causes hindrance in the rebalancing of cash and digital accounts. Furthermore, restriction on transportation and movement makes access to bank services a difficult task.

Mounting operational costs

As the remittance volumes are declining, the operational costs for RSPs are rapidly translating into losses. There has been a sudden decrease in the remittance volume due to lockdowns, loss of employment, and repatriation to the home countries.

Meanwhile, RSPs are continuously incurring various costs such as rental and building maintenance, operating expenses, and salary payments. The gap between operational expenses and the reduced business volumes is increasing which is resulting in lower revenues for RSPs, thus putting their livelihoods at risk.

How to overcome COVID-19 challenges in remittance?

Migrants and RSPs are facing lots of problems in the remittance due to COVID-19. However, these challenges can be overcome if the necessary steps are taken. Here we will discuss as to how migrants, RSPs, and authorities can together overcome remittance challenges posed by COVID-19.

Recognize remittance as an essential service

Authorities, policymakers, and regulators from all over the world must come forward and consider remittance service providers or agents as an essential financial service. This will allow RSPs to operate amidst of lockdowns or curfews imposed due to the pandemic.

More importantly, it will enable migrants to send funds to their families staying in their native country. However, RSPs must ensure social distancing and health measures at their agent outlets so that the safety of RSPs and migrants is not compromised.

Create a conducive remittance policy

Currently, the remittance industry is at their all times low. During this time, these services must be supported with non-discriminatory legal, sound, and regulatory framework that can mitigate remittance decline, expand usage of digital solutions, and improve the formal channels for cross-border payments.

Governments must come forward to offer concessional lines of credit to already struggling remittance providers. They must think of waiving off their expenses and fees at this time. Governments can also encourage digitization of wage payments which can avoid in-person transactions and result in cost and time savings.

Embrace digital solutions

Embracing digital money transfer solutions for remittance seems to be the best way to cope with the COVID-10 challenge. However, to achieve that, we must promote the use of digital solutions to broaden the reach of digital financial channels.

To digitize the remittance services, there’s a serious need for scaling up the digital solutions and exploring partnerships with FinTech enterprises to execute innovative ways of cross-border transactions. Integration of mobile money solutions with remittance service is also a good idea to increase the disbursements for the recipients.

However, to encourage the digital remittance channels, there are many critical issues in regards to the access which must be resolved first. The most critical of which is the issue of KYC.

If anyone wants to create a new digital account like a mobile wallet, then regulations in several countries would need physical IDs and customer signatures. In times of COVID-19 pandemic, these requirements pose higher health and safety risk. However, it can be resolved by using electronic signatures for low-value transactions accounts.

Digital business models like mobile money are ideal to combat the current scenario in the remittance and it’s already making the difference. A partnership between UNCDF, UNDP, and Vodafone Fiji has enabled the M-PAiSA platform users to send and receive remittances absolutely free for two months. This system was introduced after a severe tropical cyclone named Harold has hit the island.

If we have a look at the pre-COVID remittances then the average is around 6,500 transactions per month with a value just over $900,000. However, with the introduction of fee-free initiative, the transaction volume increased to 12,500 in the month of April with the value of over $1.8 million.

In the next month May, the transaction volume crossed the 22,000 mark with a valuation of more than $3.1 million. If this trend continues then we might see a rapid increase in the transaction volume in the coming months.

Adopting FinTech solutions

To ensure the success of digital channels, RSPs must work with public institutions to increase the adoption of FinTech services in both senders as well as the receivers. They must reach people in both host and home countries to bring awareness about digital solutions by promoting digital literacy among the less-privileged section.

Read More: How DigiPay is shaping FinTech leaders of tomorrow?

End-to-end digitization

End-to-end digitization is the need of the hour for remittance services. In the wake of COVID-19 pandemic where social distancing has become the new normal, this is the only way as to how remittance services can work in these scenarios.

End-to-end digitization of remittance services involves digitizing each and every step of the remittance service right from the customer onboarding to the moment when the user completes his transaction.

It also means that the migrants receive their wages directly into their accounts and their families or receivers can make bill payments and merchant payments from the digital channels itself.

Advantages of remittance services going digital

Digital remittance services are beneficial for both remittance service providers and users. Let’s have a look at some of the biggest advantages of remittance services going digital.

Eliminates dependency on informal remittance channels

Most cash-based remittance services are informal and unreliable. With digitization, the reliance of these cash-based services and be decreased significantly which will ultimately reduce frauds and increase trust and reliability among the users.

Financial inclusion

Digitization will also ensure that there’s a technology-centric framework for the remittance services which can make the remittance services more accessible to the unbanked people thus increasing the financial inclusion.

Safe operations

Digitization and contactless payments also ensure safety as consumers don’t need to visit the physical money transfer outlet or banks, wait in the line, and speak with the cashier for sending or receiving money.

This helps RSPs and the users to maintain social distancing while using remittance services thus reducing the chances of getting infected with COVID-19.

Cheaper cost with faster process

In the traditional remittance services, users have to face several problems while making money transfers such as:

- High transfer fees

- Poor exchange rates

- Lack of flexibility over means receiving funds

- Transfers consuming more time due to banks’ slow processing times

Digital remittance services via online platforms offer a simple and swift way for users to make cross-border payments from the utmost comfort of their home. Digital solutions also eliminate the middlemen and other informal channels this reducing the overall commission and in turn reducing the remittance costs.

Furthermore, digital solutions offer a greater level of convenience, safety, and control over cross-border transfers by improving cost efficiency, reducing steps involved in the money transfer process, and enabling users to make transfers autonomously.

Conclusion

There’s no doubt about the fact that these are dire times for the remittance industry as a whole as global remittance volumes witness unprecedented declines due to the COVID-19 pandemic. However, this also provides remittance service providers with a golden opportunity to reduce their dependency on cash with end-to-end digitization powered by mobile money solutions.

Digitization of remittance services can enable RSPs to continue their work amidst the pandemic along with maintaining all the safety measures. Moreover, it can also offer fast, simple, and secure cross-border payment experience to their users.