Quick Summary

Closed loop and open loop wallets have become essential in the digital payment sector, benefiting both merchants and customers. By exploring the pros and cons of both types of wallets ‘closed loop vs open loop’ you will be able to make informed decisions about which one is the best for your business as well as your customers.

It doesn’t matter if it is for a merchant or a customer, both parties need a payment system that works for them. And wallets have become pretty popular in that field. The global transaction value for digital wallet solutions was $ 9 trillion in 2023 and is expected to grow to $ 16 trillion by 2028, showing a 77% growth during the forecast period.

But what kind of wallet will be perfect for them? The battle is between two: closed loop vs open loop wallets. The merchants and customers function differently. So, there is a possibility that different wallets will be suitable for them. But it's not proven yet.

In this blog post, you will get a complete insight into the pros and cons of closed loop vs open loop wallet for both the parties: merchants and customers. So let’s spill the beans!

What are closed loop wallets?

It is a closed-loop payment system of a digital wallet solution that operates within a specific network or ecosystem, allowing users to make transactions only within that closed network. Closed-loop wallet solutions are often associated with specific brands, retailers, or merchants, and can only be used to make purchases from those entities.

Use cases of closed-loop payments are Starbucks rewards, Disney magic band, and Subway cards.

What are open loop wallets?

Open loop wallets are a type of digital wallet solution that allows users to make purchases with a variety of different merchants and businesses, regardless of whether or not those merchants have a direct relationship with the wallet provider.

Some real-life examples of open loop wallets include PayPal, Apple Pay, and Google Pay

Closed loop vs open loop wallets - merchant's perspective

Now that you have a basic understanding of both wallets and know the difference between closed loop vs open loop wallets, let's get straight to the point: Advantages and disadvantages of closed loop system as well as open loop mobile payments.

Pros & cons of closed-loop wallet solution for merchants

To get a clear picture of whether the closed-loop payment system is suitable for merchants, let's have a look at the advantages of closed loop system as well as its disadvantages:

Advantages of closed-loop wallet solution for merchants

Closed loop wallets are becoming increasingly popular as a merchant payment solution for businesses of all sizes, offering a range of benefits for merchants who adopt them.

Here are some advantages of closed loop system:

-

Increased Security: A closed-loop wallet solution can provide merchants with added security features, such as MFA and fraud detection tools, to protect against fraudulent transactions.

-

Improved Customer Experience: Closed loop payments can provide a more streamlined & user-friendly payment experience which can improve overall customer satisfaction while making closed loop mobile payments.

-

Enhanced Brand Loyalty: Closed loop payments can help merchants build stronger relationships with their customers by offering exclusive discounts, rewards, and other incentives.

-

Increased Control Over Customer Data: Closed-loop wallet solutions can give merchants greater control over their customer data, allowing them to collect, analyze, and use this data to improve their business operations and marketing efforts.

-

Enhanced Marketing Opportunities: With a closed-loop wallet solution, merchants get valuable marketing opportunities to promote their brand and products through the app.

-

Faster Payments: As transactions in a closed loop mobile payments are processed within a secure and controlled network, they are processed more quickly than traditional methods like credit cards or bank transfers.

Disadvantages of closed loop system for merchants

-

Limited Acceptance: Closed-loop wallets may not be accepted at all merchants or within all ecosystems, which can limit the reach and convenience of this payment method.

-

Limited Functionality: Closed-loop wallets may have limited functionality compared to traditional payment methods, which can limit the options and convenience for customers. This can turn out to be a critical disadvantage of closed loop system.

-

Limited Options for Customers: These wallets may not offer customers so many payment options. This can be a drawback for merchants who want to provide a seamless & convenient checkout experience.

-

Dependency on Third-Party Providers: Merchants rely on third-party providers for processing payments. This can create failure if the third-party provider experiences technical issues.

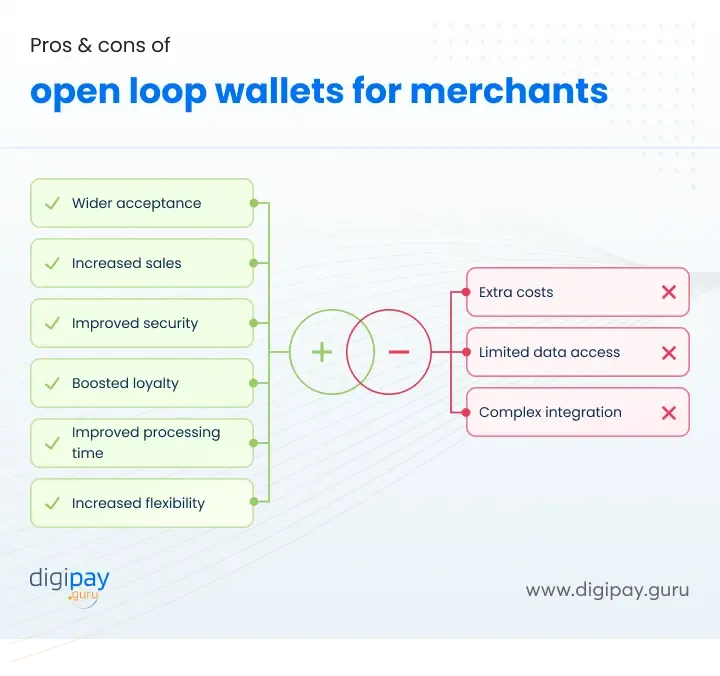

Pros & cons of open loop wallets for merchants

Now let’s get to understand the advantages and disadvantages of open loop system to make an informed decision about what would be more perfect for the merchants:

Advantages of open loop system for merchants

As mobile payment solutions continue to gain popularity, merchants are constantly looking for ways to improve their payment systems. The use of open loop wallets allows customers to use funds from various sources, such as credit cards, bank accounts, or even other digital wallets, to make purchases.

Here are some prominent advantages of open loop system:

-

Wide acceptance: Open loop wallets allow customers to use a variety of payment methods. So, the merchants who accept open loop mobile payments can attract a wider range of customers, including those who prefer to use a specific payment method.

-

Increased sales: By accepting open loop payments, merchants can make it easier for customers to complete transactions without manual inputs which are time-consuming & frustrating. This can lead to increased sales!

-

Increased security and reduced fraud: Open loop mobile payments enhance security and reduce fraud by using advanced encryption and tokenization to safeguard customer data.

-

Increased customer loyalty: Merchants can boost customer loyalty by providing a flexible payment system that lets customers use their preferred payment method, which makes them more likely to return.

-

Improved payment processing times: One of the amazing advantages of open loop systems is that they use NFC technology. It enhances payment processing times and efficiency.

-

Increased flexibility: Open loop wallets can offer increased flexibility for merchants, as they can be used in a variety of settings.

Disadvantages of open loop system for merchants

For merchants, there are several disadvantages of open loop system that can impact their bottom line. They are:

-

Additional Costs: Merchants need to invest in equipment such as card readers or point-of-sale terminals, which can be a significant upfront cost along with transaction fees for accepting open loop payments.

-

Limited Access to Customer Data: Customers can store multiple payment methods in a single account making it difficult for merchants to track & analyze customer data.

-

Integration Challenges: For integration, they may have to collaborate with a third-party provider, incurring extra charges and technical complexities.

Closed loop vs open loop wallets - customer’s perspective

Closed loop and open loop wallet can be significantly different for your customers. By exploring the pros and cons of closed loop vs open loop wallets for customers, you will understand what would be the best choice for your customers.

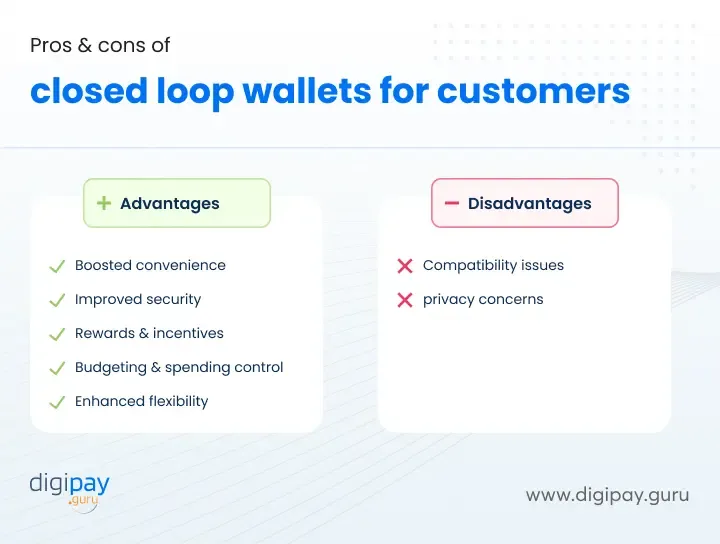

Pros & cons of closed loop wallets for customers

Will a closed loop wallet be a perfect mobile payment solution for your customers? It can only be known by understanding its pros and cons.

Advantages of closed loop wallets for customers

There are a range of advantages of closed loop systems via closed loop mobile wallets for customers looking for a fast, secure, and convenient way to make payments.

-

Increased Convenience: This advanced mobile money solution makes mobile payments easy by allowing customers to store payment info in the app and make purchases with a few taps

-

Improved Security: Transactions within a closed-loop payment system are processed within a secure and controlled network, reducing the risk of unauthorized access or other security breaches.

-

Varied Rewards and Incentives: These wallets can offer customers a range of rewards, discounts, and other incentives for using the app to make purchases.

-

Budgeting & Spending Control: It can help customers better manage their finances by providing real-time information on their spending and account balances.

-

Enhanced Flexibility: Closed-loop wallets can be used for a variety of payment scenarios, from in-store purchases to online transactions and peer-to-peer payments.

Disadvantages of closed loop wallets for customers

-

Compatibility Issues: Customers can make closed loop mobile payments only at the merchant or retailer associated with it. It may not be compatible with customers who prefer different merchants or retailers.

-

Privacy Concerns: Merchants can collect customer data such as purchase history, location, and personal information. This can be a concern for customers who value their privacy.

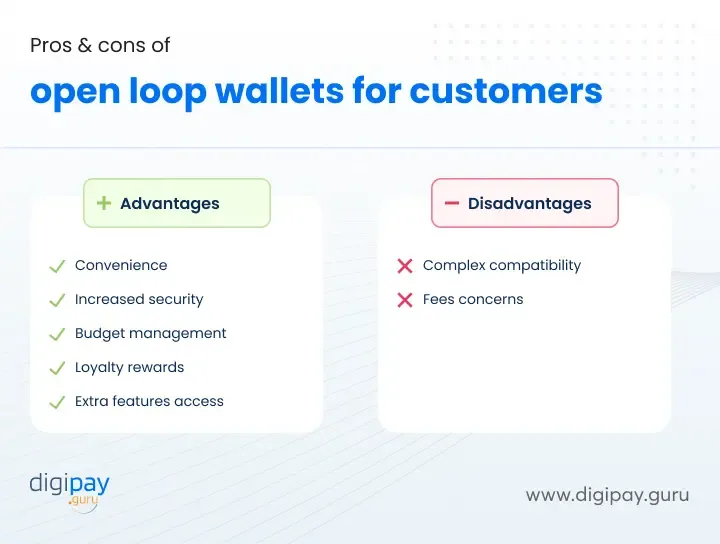

Pros & cons of open loop wallets for customers

The last in the race to understand what is better for customers: closed loop vs open loop wallets, are the pros and cons of open loop wallets. Let’s understand them closely.

Advantages of open loop wallets for customers

-

Convenience: These wallets provide customers with a convenient way to make payments with varied payment methods.

-

Increased security and privacy: These wallets also offer increased security and privacy for customers through biometrics, encryption, and tokenization to protect customer information.

-

Enhanced budget management: These wallets can help customers manage their budgets more effectively, as they allow for real-time tracking of transactions to stay on top of their finances.

-

Loyalty rewards: Open-loop wallets offer loyalty rewards like cash back or future discounts, incentivizing customers to use the service more and leading to cost savings.

Read More: Customer loyalty programs made for your mobile wallet solution

- Access to additional features: It gives access to additional features, such as sending money to friends and family or paying bills. This adds to the overall convenience of the service.

Disadvantages of open loop wallets for customers

-

Complex compatibility: Open-loop wallets may not be compatible with all merchants, restricting customers from using them for purchases.

-

Fees: Using this wallet can incur transaction fees for purchases and fees for loading or withdrawing funds. This can add up over time, decreasing the wallet's convenience and value.

Closed loop vs open loop wallets - the comparison

Now that you know what closed and open loop wallets are, let's have a look at the key differences between closed loop vs open loop wallets:

| Factor | Closed Loop Wallets | Open Loop Wallets |

|---|---|---|

| Use | Limited to a specific merchant or group of merchants | Can be used at multiple merchants and payment networks |

| Loyalty Programs | Often linked to merchant-specific loyalty programs | May or may not offer loyalty programs |

| Fees | May have lower transaction fees or no fees at all | May have higher transaction fees or fees for certain features |

| Security | Tend to be more secure due to limited use | Security depends on the specific wallet and payment networks used |

| Integration | Integration may be easier since it is limited to one merchant or group of merchants | Integration may be more difficult due to the multiple merchants and payment networks involved |

| Customer Data | Merchants have access to more customer data for targeted marketing and loyalty programs | Limited customer data for merchants to access |

| Flexibility | Less flexible since they can only be used by a specific merchant or group of merchants | More flexible since they can be used at multiple merchants and payment networks |

| Transaction Limit | Often have lower transaction limits | Often have higher transaction limits |

How DigiPay.Guru can help?

DigiPay.Guru offers both advanced open-loop and closed-loop wallet solutions to provide merchants with both their self-branded wallets and other popular open-loop wallets so that the users can have a seamless experience and varied options at the same time.