If you have worked on a payment and remittance solution in Africa, you know the product is rarely the hard part.

Approvals take longer than expected. Integrations behave differently in each country. Settlement timelines do not always match assumptions. Reversals and reconciliation issues start appearing once volumes pick up.

It is then, teams realize that the hardest part was never the solution. It was the infrastructure underneath it. Soon, partners and regulators begin asking questions.

Banks experience this as reputational and compliance risk. Fintech teams feel it as delayed launches and operational drag. MTOs feel it when corridor expansion slows down. Different institutions, same underlying problem.

In most cases, the issue is not the business idea. It is the infrastructure choice. Many platforms are not designed for regulated, multi-market African environments.

That is why the conversation has shifted. Institutions now ask who owns compliance, settlement accuracy, and scale at the infrastructure layer, not just who provides features.

So, to answer such questions and guide you along the line, we brought this guide.

It reviews leading white-label fintech platforms used to launch wallets and remittance apps in 2026.

It is written for banks, fintechs, and MTOs operating in regulated African markets who want practical clarity before committing to long-term infrastructure decisions.

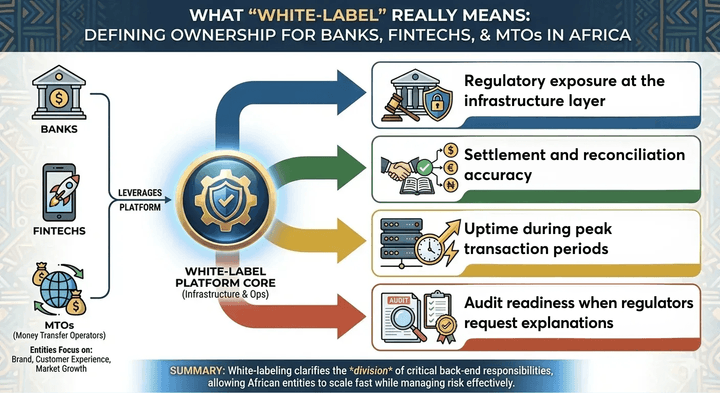

What “White-Label” Really Means for Banks, Fintechs, and MTOs in Africa?

In African fintech, white-label does not simply mean putting your logo on someone else’s software.

For banks and licensed institutions, white-label fintech platforms are often used to modernize customer-facing services without disrupting core systems. For fintechs and MTOs, they are a way to access regulated payment rails while maintaining control over product design and customer relationships.

There are important differences to understand:

White-label fintech platforms provide regulated infrastructure, APIs, and operational tooling under your brand.

Wallet SDKs focus on front-end features but leave compliance, settlement, and reporting to you.

Remittance engines handle corridors and payouts but may not support full wallet ecosystems.

In African markets, where regulatory interpretation varies by country and payment rails behave differently, white-label platforms are often the only practical way to launch at speed while staying compliant.

Why Banks, Fintechs, and MTOs Are Choosing White-Label Platforms in 2026?

By 2026, the choice to use white-label fintech platforms in Africa is no longer driven by convenience. It is driven by survival and scale.

Institutions are choosing white-label because it allows them to:

-

shorten time to market without cutting compliance corners

-

reduce dependency on fragmented, country-specific integrations

-

launch wallets and remittance services under their own brand

-

expand into new markets without rebuilding core systems

As transaction volumes grow, operational complexity increases faster than expected. Each new corridor introduces FX rules. Each new country introduces different reporting standards. Each new payment rail adds reconciliation and dispute scenarios.

White-label platforms help institutions absorb this complexity at the infrastructure level, allowing internal teams to focus on product differentiation, partnerships, and customer experience rather than rebuilding plumbing.

Non-Negotiable Capabilities for Fintech Platform for Wallet and Remittances in African Markets

In Africa, feature lists are less important than operational reliability. A platform that looks complete on paper but fails during audit, becomes a liability.

Banks, fintechs, and MTOs evaluating white-label platforms consistently prioritize the following capabilities:

-

Digital wallet infrastructure with accurate ledgers and balance management

-

White-label remittance software supporting cross-border flows and payout methods

-

Multi-currency handling with clear FX logic and settlement visibility

-

Built-in KYC, AML, and transaction monitoring aligned with regulatory expectations

-

Strong reconciliation and reporting tools for multi-party payment environments

-

API-first fintech platform design that supports customization and integration

-

Regulatory reporting and audit readiness across countries

-

Operational controls for reversals, disputes, and exception handling

Platforms that lack these capabilities may work at low volumes but struggle as usage grows and regulatory scrutiny increases.

How We Evaluated These White-Label Fintech Platforms?

The platforms in this list were evaluated based on how well they support wallet and remittance businesses operating in regulated environments.

Evaluation criteria included:

-

maturity of wallet and remittance infrastructure

-

depth of compliance tooling and reporting

-

ability to support banks, fintechs, and MTOs under different operating models

-

API flexibility and integration effort

-

readiness for multi-country and multi-rail expansion

-

operational stability as transaction volumes increases

The focus was not on who has the longest feature list, but on which platforms enable institutions to launch responsibly, operate confidently, and scale without constant rework.

| Platform | Wallet Infrastructure | Remittance Engine | Cards | Banking / FX | API-First | Compliance & Reporting | Best Suited For |

|---|---|---|---|---|---|---|---|

| DigiPay Guru | ✅ Full | ✅ Full | ✅ | ✅ | ✅ | ✅ Built-in | Banks, fintechs, MTOs in regulated African markets |

| Flecible | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | Fintech startups |

| FinLego | ✅ | ✅ | Optional | ✅ | ✅ | ✅ | Wallet-led fintechs |

| SDK.finance | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | Scaling fintech teams |

| Youtap | ✅ | ✅ | ❌ | Limited | ✅ | ✅ | Remittance-focused businesses |

| PrimeFin Labs | ✅ | ✅ | ❌ | FX routing | ✅ | ✅ | Corridor-based MTOs |

| ArthaTech | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | Banks and large institutions |

| Boxo (via Nium) | ❌ | ✅ | ❌ | ✅ | SDK | ✅ | Remittance enablement |

This comparison highlights an important distinction: not all platforms support both wallets and remittance as first-class, integrated capabilities, especially in regulated, multi-country African environments.

Top White-Label Fintech Platforms to Launch Wallets & Remittance Apps (2026)

Let us look into the most popular white label remittance platform that are present in the African market -

1. DigiPay Guru

Best for Banks, Fintechs, and MTOs Operating in Regulated African Markets

DigiPay Guru is a white-label, API-first fintech payments infrastructure designed specifically for institutions operating under regulatory oversight.

DigiPay Guru functions as the infrastructure layer beneath wallets, remittance apps, agency banking, and merchant acquiring solutions. The cross border payment platform is much flexible around customer product development.

Key strengths

-

Integrated wallet and remittance infrastructure in a single stack

-

Support for multi-rail payments including mobile money, bank transfers, and cards

-

Built-in KYC, AML, transaction monitoring, and reporting aligned with regulated environments

-

Strong reconciliation and settlement visibility for multi-party payment flows

-

White-label deployment that preserves institutional branding and trust

-

Designed to scale across African markets without repeated re-architecture

Best suited for

-

Banks launching or modernizing digital wallet and remittance services

-

Fintechs operating under EMI or PSP licenses

-

MTOs expanding corridors while maintaining compliance and settlement control

Where DigiPay Guru fits best

DigiPay Guru is the most effective for institutions that view payments infrastructure as a long-term foundation, not a short-term workaround. It is designed for teams that want to move fast without inheriting regulatory and operational fragility.

2. Flecible

Good for Early-Stage Fintech Startups

Flecible offers a modular, API-driven platform that supports wallet and remittance use cases with a focus on speed and flexibility. It is often used by startups looking to launch quickly and iterate on product features.

Its strength includes an API-first design with a faster initial setup for wallets or remittance models. It requires greater internal ownership of compliance when scaling. Also, less depth in operational tooling, when comes to multi-country deployments.

It is best suited for early-stage startups and teams with limited initial regulatory exposure.

3. FinLego – Wallet-as-a-Service

FinLego positions itself as a wallet-centric platform with additional remittance and banking capabilities. It is often chosen by fintechs building wallet-led ecosystems with regulated components.

Due to its wallet-centric design it has mature wallet ledger and account management. It has API-driven architecture, and also provides integration services for banking and forex. However, remittance capabilities may require additional configuration. The platform is not that much focused into African specific operations.

Best suited for wallet focused fintechs.

4. SDK.finance

SDK.finance provides a broad, modular fintech platform with strong API coverage and customization options. It is often attractive to technically mature teams that want control over their stack.

SDK.Finance has a strong holding with extensive API and module coverage. It supports wallets and is flexible for customer product development. But you’ll need greater operational responsibility on the client side when choosing this platform provider. Along with responsibility you need to have a team with strong technical and compliance knowledge.

Best suited for scaling fintechs and growing teams with complex infrastructure.

5. Youtap

Youtap is commonly used for remittance and payment enablement, with wallet functionality available as part of a broader digital payments offering.

The company has good experience in remittance and payment flows, which is suitable for domestic and international remittance models. However, wallet ecosystems may require additional customizations. They have limited focus on full-stack wallet models.

Works best for remittance focused fintechs and MTOs. Institutions prioritizing payout.

6. PrimeFin Labs

PrimeFin Labs is positioned primarily as a remittance and FX routing platform, supporting payout and cross-border use cases. PrimeFin Labs has a strong foot in corridor based remittance capabilities, FX routing and settlement support. Their limitation stand as they do not provide a complete wallet infrastructure. It can only be used as a part of broader ecosystem.

They fit well with expanding MTOs into new corridors, remittance-first business models.

7. ArthaTech

Broad Fintech Infrastructure for Large Institutions

ArthaTech offers a wide range of fintech modules covering payments, wallets, lending, and compliance. It has extensive module coverage. It is suitable for complex institutional environments. However there are complexities in integration. While having full implementations it has longer deployment timelines.

It is often selected by banks and large institutions undertaking digital transformation initiatives.

8. Boxo (via Nium Integration)

SDK-Based Remittance Enablement

Boxo, often used through integrations such as Nium, provides SDK-based access to remittance and payment services rather than a full white-label platform.

The fintech platform for startups provides fast integration for remittance enablement, suitable for adding remittance features to existing apps. But you can not expect a full wallet platform from them. They have limited white-label and operational control.

Best suits to businesses adding remittance as a feature and not ideal for a full wallet ecosystem.

What This Comparison Should Make Clear?

There is no single “best” platform for every use case.

However, for banks, fintechs, and MTOs operating in regulated African markets, platforms that combine wallet infrastructure, remittance capability, compliance readiness, and operational visibility consistently outperform narrow or SDK-only solutions.

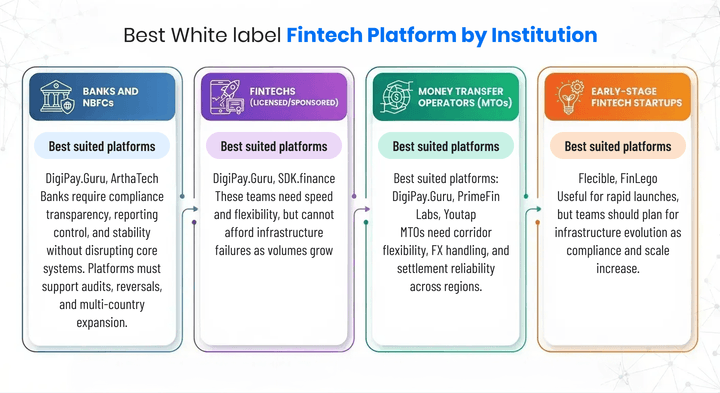

Best White-Label Fintech Platform by Institution Type

Different institutions carry different risks. The right platform depends on regulatory exposure, operating model, and growth plans.

This breakdown helps institutions shortlist platforms that align with their current reality, not just their ambition.

How to Choose the Right White-Label Fintech Partner?

Choosing a white-label fintech platform is a long-term infrastructure decision. The wrong choice often leads to forced migrations, operational stress, and regulatory risk.

| Question | Why It Matters |

|---|---|

| Can this platform support my 3–5 year roadmap? | Avoids costly re-platforming |

| What compliance responsibilities are shared? | Prevents regulatory gaps |

| How flexible is customization? | Supports unique business models |

| What are the real deployment timelines? | Sets realistic launch expectations |

| How does pricing scale with volume? | Protects long-term margins |

| What regions and corridors are live today? | Determines expansion speed |

| What operational support is included? | Reduces downtime and incident risk |

Institutions that ask these questions early tend to launch faster and scale more predictably.

See a real wallet and remittance deployment flow for African markets →

Why DigiPay.Guru Is Built for White-Label Wallet and Remittance Businesses in Africa?

DigiPay Guru functions as a white-label, API-first fintech payments infrastructure, supporting wallets, remittance, agency banking, and merchant acquiring under one unified platform.

What DigiPay.Guru delivers in practice?

-

Wallet and remittance infrastructure built for regulated environments

-

Multi-rail payment processing across mobile money, banks, and cards

-

Built-in KYC, AML, transaction monitoring, and reporting

-

Strong reconciliation, settlement, and operational visibility

-

White-label deployment that preserves brand and customer trust

-

Country-level flexibility without duplicating core systems

For African banks, fintechs, and MTOs, this means faster regulatory alignment, lower operational risk, and a foundation that supports expansion without repeated rebuilds.

DigiPay Guru does not dictate business models. It supports them quietly, reliably, and compliantly.

FAQs

A white-label fintech platform provides regulated payment and financial infrastructure that institutions can deploy under their own brand, without building core systems from scratch.

Timelines vary by country and license, but white-label platforms typically reduce launch time significantly compared to building in-house.

Compliance depends on the platform’s tooling and operating model. Strong platforms support KYC, AML, reporting, and audit readiness aligned with central bank expectations.

Yes. Many banks use white-label platforms to modernize digital channels while keeping core banking systems unchanged.

While license fees exist, white-label platforms often reduce long-term costs by limiting compliance overhead, operational complexity, and re-engineering.

Scalability depends on how well the platform handles multi-currency, local payment rails, and regulatory variation.