Across the financial world, one thing is clear: customers now expect their money to move as fast as their messages. And traditional banking or payment channels can’t keep up with that pace.

But mobile wallet apps can.

And that's why they’ve become more than payment tools. They’re now full-fledged financial ecosystems where your users save, pay, borrow, and earn, all within a few taps.

For financial businesses like yours, this shift is the gateway to staying relevant in an increasingly digital financial economy.

So, building your own mobile wallet app isn’t just about adding a new feature. It’s about creating a unified digital experience that strengthens customer relationships, lowers costs, and opens new revenue streams.

This guide walks you through exactly how to do that: from concept to compliance, from design to deployment. This blog will help you transform an idea into a wallet that drives real business impact.

Let’s begin by understanding the mobile wallet industry!

Mobile Wallet App Industry Overview

The mobile wallet industry has come a long way.

What started as a simple peer-to-peer (P2P) payment tool is now the backbone of digital economies worldwide.

Your customers now expect e wallet apps to do more than just store value. They expect them to manage everything from utility bills to loyalty points.

Plus, the rise of open banking, government-led financial inclusion programs, and fintech innovation has fueled wallet adoption across every region.

Emerging markets in Africa, Southeast Asia, and the Middle East are witnessing explosive wallet growth due to smartphone penetration and affordable internet access.

Yet, this is only the beginning.

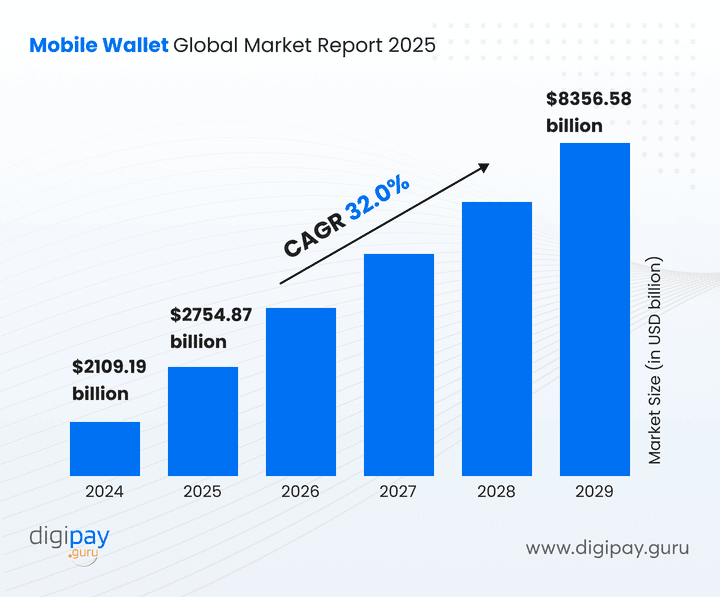

Mobile Wallet Market 2024–2029 (USD Million)

According to market projections by “The Business Research Company”:

- Mobile Wallet market size has reached $2109.19 billion in 2024!

- And is expected to reach $8356.58 billion in 2029 at a CAGR of 32%!

This shows the amazing growth and potential of mobile wallet apps.

And the key drivers to this growth are:

- Expanding digital payment infrastructure

- Rapid adoption of NFC and QR code payments

- Demand for contactless, user friendly solutions post-pandemic

- Widespread integration of AI and analytics for personalized offers

For financial businesses like yours, this is a wake-up call: Build now, or risk being left behind.

What is a Mobile Wallet App?

In simple terms, a mobile wallet app (or e-wallet app) is a digital version of your customers’ leather wallet. It stores money, credit cards, and transaction history in one secure place.

But in the modern and digital fintech era, it’s much more than that. A wallet app allows your users to:

- Send and receive money transfers instantly

- Make contactless payments via QR codes or NFC

- Link multiple credit cards or bank accounts

- Pay bills, buy tickets, and even manage subscriptions

With the right technology, your business can launch its own branded version tailored to your users and market.

Why Building a Mobile Wallet App is a Smart Move for Financial Businesses

You might ask: Do I really need to build my own mobile wallet app when others already exist?

The short answer to this question is: Absolutely yes!

Here’s why:

1. Stronger Customer Engagement & Loyalty

A mobile wallet keeps your customers interacting with your brand daily, not just when they visit your branch or website. It becomes the digital touchpoint that builds loyalty over time.

2. Lower Transaction Costs

Wallet-based payments bypass traditional card networks and third-party processors. That means lower transaction fees and higher control over payment flows.

3. Enhanced Security & Fraud Protection

Modern mobile wallet software integrates advanced security mobile wallet features like biometric login, two-factor authentication, and tokenization to ensure every transaction is secure and away from fraud possibilities.

4. Valuable Data Insights

Your wallet app collects transactional data that helps you analyze the spending patterns of your customers while using your app.

With this data, you can improve your services and launch targeted offers.

5. Staying Ahead of the Competition

As legacy banks modernize and new fintechs emerge, having a wallet application gives you a clear digital edge.

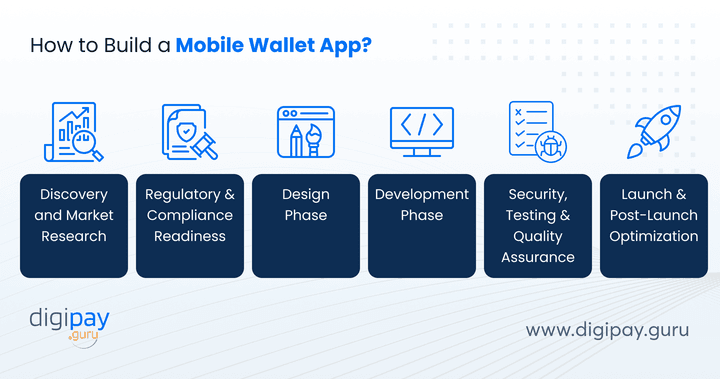

Step-by-Step Roadmap: How to Build a Mobile Wallet App

Building a mobile wallet app isn’t just about hiring developers or integrating a payment gateway. It’s a strategic process that blends technology, compliance, and user experience, all aligned to your business goals.

If you’re looking to create a scalable, compliant, and revenue-driven wallet, having a clear roadmap helps you avoid delays, costly mistakes, and regulatory pitfalls.

Here’s a simplified yet practical roadmap financial innovators like you can use to move from idea to live wallet launch efficiently:

Step 1: Discovery and Market Research

Every great product starts with understanding the market it serves.

- Identify your audience segments: urban professionals, MSMEs, or underbanked users.

- Research competing wallet apps

- Study what users love and what they avoid, and

- Define your core value proposition

The clearer your market insights, the sharper your product direction.

Step 2: Regulatory and Compliance Readiness

Before any coding for wallet application building starts, your foundation must be compliant.

- Ensure your wallet complies with KYC, AML, PCI DSS, and data protection regulations.

- Partner with legal and technology teams to align your digital wallet API and user verification process.

This step helps build credibility with regulators and trust with customers.

Bottom line: A compliant start saves you from expensive fixes and penalties later.

Step 3: Design Phase: Prioritizing User Experience

Design is where your wallet begins to take shape. And a beautiful app is useless if it’s not intuitive.

Hence, your wallet’s user interface should be simple, fast, and accessible. So, you should:

- Use clear icons, intuitive navigation, and visual feedback to make it user-friendly.

- Test your wireframes early and collect user feedback to refine functionality.

In short, a well-designed wallet doesn’t just look good; it makes transactions effortless.

Step 4: Development Phase

The development phase is where technology and creativity meet. This is where ideas become code.

Your development team will handle both front-end and back-end development, thereby connecting the interface with the database and secure APIs.

Key components include:

- Payment gateway integration

- Wallet API for transfers

- Database and cloud setup for scalability

- Cross-platform compatibility for Android and iOS

Choose a flexible technology stack that supports scalability, multi-device access, and smooth API communication.

Step 5: Security, Testing & Quality Assurance

Security isn’t a step in mobile wallet application development; it’s an ongoing responsibility.

- Implement encryption, tokenization, and multi-factor authentication.l

- Check for encryption flaws, authentication errors, and payment delays.

- Test every possible scenario: from failed transactions to simulated cyberattacks.

This is essential because a small vulnerability can become a big risk in finance, so don’t compromise on testing.

Step 6: Launch & Post-Launch Optimization

Launching a mobile wallet app is just the beginning.

Here’s how you can proceed:

- Once the app passes security and QA, release a pilot version for early users.

- Gather feedback and track real-time data on performance and user behavior.

You also need to optimize your app after launch:

- After launch, maintain your app continuously.

- Update features, monitor security, and integrate user feedback for better retention.

Remember: A great wallet evolves with your users and the market.

Must-Have Mobile Wallet App Features (2026 Edition)

Building a wallet without essential features is like building a car without wheels.

Here’s what your 2026-ready wallet must have:

- KYC onboarding and biometric login

- NFC and QR code payments for seamless checkouts

- Multi-currency support with real-time exchange rates

- Bill payments, mobile top-ups, and P2P transfers

- Credit card integration and card management tools

- Loyalty programs, rewards, and referral tracking

- Real-time analytics and transaction notifications

- Fraud alerts, data encryption, and two-factor authentication

Each of these features improves your app’s usability & long-term stickiness and helps your brand stay ahead of wallet giants (your potential competitors).

How to Build a Mobile Wallet on Top of DigiPay.Guru’s Platform

By now, you know that building a mobile wallet app from scratch takes time, capital, and deep technical expertise. Between compliance, infrastructure, and integrations, the journey can easily stretch to a year or more, unless you have the right technology partner.

That’s where DigiPay.Guru steps in.

DigiPay.Guru isn’t just another wallet software. It’s a complete, white-label digital wallet platform built specifically for banks, fintechs, and financial institutions like yours. It helps you move from idea to deployment faster, with enterprise-grade security and full regulatory readiness.

Here’s how your mobile wallet can be built efficiently and securely on top of DigiPay.Guru’s infrastructure:

1. Configuring the Infrastructure and Services

Every successful digital wallet starts with a solid foundation. DigiPay.Guru provides a pre-configured, three-layer architecture designed to scale and stay secure.

- Development Environment: A sandbox space for your teams to test new features and integrations safely.

- Pre-Production Environment: A staging area for QA, UAT, and compliance testing, thereby ensuring stability before launch.

- Production Environment: The live setup where your wallet operates at full capacity with optimized performance and security.

This layered setup allows your teams to build, test, and deploy faster, without business disruption or compliance risk.

2. System Configuration

Once the environments are ready, DigiPay.Guru helps configure the systems that keep your wallet running smoothly across every stage.

Requirements for production and test environments include:

- Server setup: High-availability servers to ensure uninterrupted service and quick scaling as user volume grows.

- Database configuration: Encrypted and backup-ready databases for reliability and data protection.

- Network setup: Load-balanced and API-secure connections to ensure fast transactions and uptime.

- Security controls: TLS/SSL encryption, firewalls, and role-based access to keep every transaction safe.

- User management: Dedicated roles for admins, merchants, and customers. This ensures controlled access and accountability.

In simpler terms, you get an infrastructure that’s financial-grade: strong enough for banks, flexible enough for fintechs, and compliant enough for regulators.

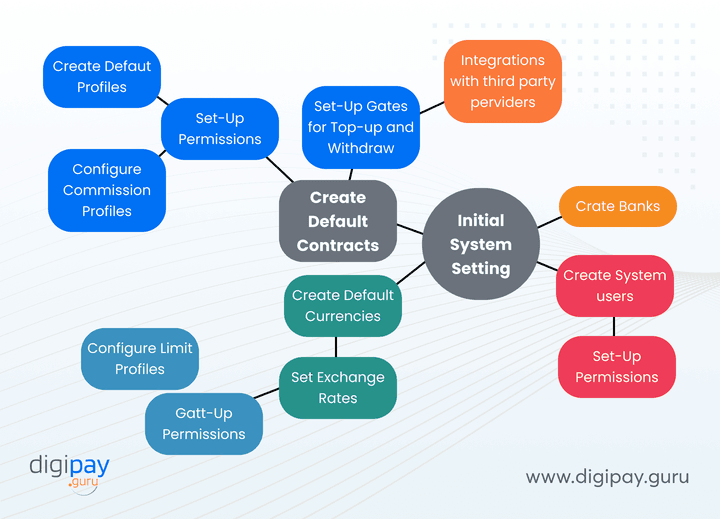

3. Initial System Settings

Once the infrastructure is ready, your next step is to define the initial system settings. It's the backbone of how your wallet ecosystem will operate.

This stage ensures that every component, like users, banks, currencies, and integrations, works seamlessly before the wallet goes live.

At this stage, DigiPay.Guru enables you to:

- Create banks and configure institutional roles.

- Create system users and assign permissions based on roles.

- Create system currencies and define exchange rates.

- Configure default contracts, commission profiles, and limit profiles.

- Set up top-up and withdrawal gates for different channels.

- Integrate third-party providers like payment gateways or KYC services.

These configurations form the operational blueprint of your digital wallet.

Here’s the flow:

Everything from how transactions are processed to how commissions are distributed starts here.

4. Wallet Configuration and Business Rules

At this step, your wallet begins to take its business shape. DigiPay.Guru gives you the freedom to define how your wallet functions, earns, and interacts.

You can easily:

- Create currencies and manage exchange rates.

- Configure top-ups, withdrawals, and transfers based on your business model.

- Set commission rules and transaction limits for different user tiers.

- Define merchant contracts and settlement processes.

It’s a complete rule engine that allows your team to fine-tune operations without custom coding.

5. Customizing UI and Third-Party Integrations

A wallet is as strong as the experience it offers. DigiPay.Guru allows you to fully white-label your app: design it with your brand’s logo, color theme, and user flow.

Want to plug in your favorite KYC provider, card processor, or payment gateway? You can.

The platform’s open API ecosystem makes integration effortless, whether it’s:

- KYC/AML verification systems

- Card issuance and processing APIs

- Loyalty and cashback modules

- Payment gateways and merchant onboarding tools

This flexibility helps your wallet adapt to your unique business ecosystem and not the other way around.

6. Launch Faster with DigiPay.Guru’s Modular Software

The fintech world moves fast, and DigiPay.Guru is built to keep pace.

Instead of spending 9–12 months building from scratch, DigiPay.Guru’s modular mobile wallet software lets you go live in a matter of weeks.

Each component, from user onboarding and transaction management to analytics and fraud detection, is pre-built, tested, and ready to deploy.

That means your team can focus on strategy and innovation, not backend firefighting.

Post-launch, DigiPay.Guru provides continuous monitoring, updates, and support, while ensuring your app performs flawlessly as your user base scales.

With DigiPay.Guru, you don’t just build a wallet; you build a digital financial ecosystem that’s agile, compliant, and ready for global scale.

Why Choose DigiPay.Guru’s Mobile Wallet Software

With DigiPay.Guru, you don’t just get software, you get a strategic fintech partner. It offers:

- White-label flexibility: Launch under your brand identity.

- Regulatory compliance: Built-in KYC, AML, and PCI SSF/DSS layers.

- Scalability: Handle millions of transactions seamlessly.

- Fraud prevention & monitoring: Advanced algorithms safeguard every payment.

- Real-time data insights: Understand your users and optimize engagement.

DigiPay.Guru has already helped banks and fintechs across Africa, Asia, and the Middle East launch their wallet apps in as little as 90 days.

Case study:

Conclusion

The way people manage and move money is changing faster than ever. Modern customers don’t think about banking or payments; they think about convenience. They expect every transaction to be instant, secure, and available right where they are.

That’s why building a mobile wallet app isn’t just about keeping up with technology. It’s about staying connected to how your customers live, spend, and interact in a digital world.

And for financial businesses like yours, it’s a chance to simplify experiences, reduce costs, and open new doors to growth.

If you’re ready to take that step, DigiPay.Guru makes it simpler. With a modular, white-label wallet platform designed for speed, security, and compliance, you can launch a wallet that fits your business goals and not the other way around.

The best thing is: you can launch it faster and with built-in security, compliance, and scalability. It’s time to build your own mobile wallet app and empower the next generation of digital payments.

FAQs

A mobile wallet app is a digital platform that stores money, credit cards, and user information for payments, transfers, and purchases.

You can build a wallet app by defining your use case and business needs. This ensures compliance (KYC/AML), thereby designing the interface, integrating payment APIs, and testing before launch.

The cost varies depending on features, design, compliance, and integrations. Using a platform like DigiPay.Guru can significantly reduce cost and time: It’s white-labelled, scalable, and secure.

Wallet apps typically use secure APIs, cloud hosting, and frameworks that support Android/iOS. Integrations include payment gateways and card issuance systems.

Use encryption, tokenization, and biometric authentication. OR choose a solution that has built-in advanced security and compliance features and implement it into your business. Moreover, regular security audits and PCI DSS compliance are critical.

From planning to launch, a custom-built wallet can take 6–12 months. But with DigiPay.Guru’s flexible, secure, and modular eWallet solution, you can go live in under 90 days. Contact us for more information.