We recently visited Kigali, Rwanda, from 27 July 2025 to 1 Aug 2025, with one clear intention: to understand the market more deeply and build genuine relationships with the people shaping Rwanda’s fintech ecosystem.

There’s something powerful about being on the ground and being able to listen directly, see the ecosystem up close, and have real conversations beyond calls and emails. During this business visit, our team had the opportunity to engage with fintech leaders, innovators, and key stakeholders who are working every day to strengthen Rwanda’s digital financial services landscape.

And what we experienced in Kigali was encouraging. Not just in terms of opportunity, but in the clarity of vision and the strong ecosystem mindset that continues to drive Rwanda’s digital transformation forward.

Purpose of the Visit

This was not an event-driven trip. It was a focused business visit designed to learn, listen, and explore collaboration pathways in a way that is meaningful and aligned with Rwanda’s local priorities.

Our objectives in Kigali were clear:

- Understand the local market needs and the payments ecosystem landscape

- Explore the market readiness and opportunity areas for digital financial enablement

- Meet prospects and decision-makers to explore partnership and collaboration models

- Share scalable software capabilities that can support Rwanda’s digital payment expansion

For us, the intention was simple: listen first, understand next, and collaborate only where it adds real value.

Engagements with the Fintech Ecosystem in Kigali

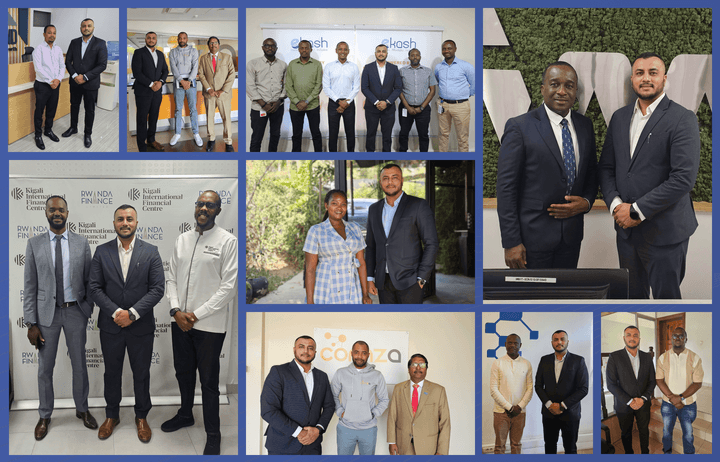

Throughout our visit, we had the privilege of connecting with fintech leadership teams, executives, and ecosystem stakeholders who are actively shaping the next phase of fintech growth in Rwanda.

The conversations were meaningful because they were grounded in reality. In what institutions are building today, what challenges they face while scaling, and what they need from technology and infrastructure partners to move forward with confidence.

We are also proud to share moments captured with several senior decision-makers during the visit. More than just photographs, these moments represent conversations built on mutual respect and a shared belief that the future of financial services is strengthened through the right partnerships.

Key Collaboration Themes Discussed

Across our discussions, one thing became very clear: Rwanda’s fintech progress is not driven by isolated innovations. It’s driven by ecosystem alignment.

Some of the collaboration themes that came up consistently were:

- Scalable digital payment enablement that supports long-term ecosystem growth

- Infrastructure readiness for higher transaction volumes without operational strain

- Merchant payment acceptance enablement as a practical driver for everyday adoption

- Compliance-first onboarding, including secure identity verification and risk alignment

- Partnership-driven rollout models focused on sustainable adoption and trust

These discussions reinforced what matters most in fintech: reliability, trust, and infrastructure that can scale smoothly as adoption grows.

Key Takeaways from the Kigali Visit

One of the most valuable parts of being on-ground is recognising patterns across multiple conversations.

In Kigali, a few consistent insights stood out:

- The ecosystem is partnership-oriented: Stakeholders value collaboration models that strengthen the entire ecosystem.

- Scalability is a key expectation: Institutions want platforms built for growth and not short-term deployment.

- Merchant acceptance is central to adoption: Strengthening digital commerce use cases remains a priority.

- Trust and compliance are foundational: Onboarding, KYC readiness, and operational controls are central to sustainable scale.

- Customer experience matters deeply: Seamless journeys and interoperability are essential for long-term engagement.

These takeaways left us optimistic because the market is clearly building with intention, not just speed.

The Beginning of Strategic Partnerships

What made this visit meaningful wasn’t only the opportunity. It was the alignment.

Many of the conversations we had felt like the early stages of long-term partnership building. The relationships formed in Kigali represent the beginning of strategic collaboration possibilities focused on supporting Rwanda with:

- Seamless digital payment experiences

- Reliable transaction infrastructure

- Locally relevant, scalable fintech enablement

We strongly believe that the most sustainable fintech growth happens when solutions are built with the ecosystem.

Our Commitment to Rwanda’s Digital Transformation Journey

By being present in Rwanda and engaging directly with stakeholders, we reinforce our commitment to understanding market realities and not making assumptions.

This visit reflects our long-term approach:

-

Invest time in listening

-

Build trust through presence

-

Create partnerships rooted in real operational needs

We are encouraged by Rwanda’s direction, and we look forward to contributing in a way that is practical, collaborative, and aligned with the country’s journey toward a more inclusive and innovation-led digital economy.

Looking Ahead

Our time in Kigali was valuable, and we see it as the start of deeper engagement with the ecosystem.

We look forward to continuing these discussions and exploring structured collaboration pathways with fintechs, banks, and financial institutions in Rwanda.

If you are a bank or financial institution in Rwanda exploring partnership opportunities for digital payment enablement, merchant acceptance, scalable onboarding infrastructure, or ecosystem expansion, we at DigiPay.Guru welcomes the opportunity to connect and collaborate.