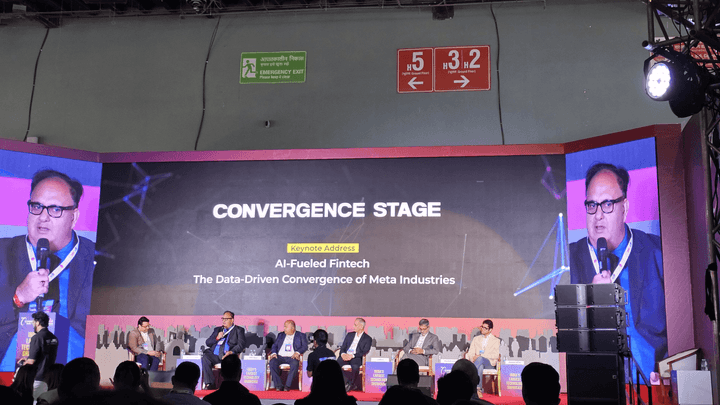

From March 19 to 21, 2025, Bharat Mandapam at Pragati Maidan in New Delhi hosted Convergence India Expo 2025—one of the country’s biggest and most impactful technology events.

As a global digital payment solution provider, DigiPay.Guru was proud to be part of this power-packed platform that brought together key players from telecom, IT, media, entertainment, and fintech sectors—all under one roof.

All About Convergence India Expo 2025

With over 1,000+ brands, 268 startups, 48,000+ visitors, and representation from 28 countries, the Convergence India Expo 2025 showcased India’s rising dominance in technology and digital transformation.

From smart mobility and AI to embedded tech and digital payments, this event spotlighted the latest developments shaping a smarter and more connected future. The co-located Fintech India Expo was especially relevant for DigiPay.Guru, as it unlocked new insights into:

- Digital wallets

- Payment gateway innovations

- International remittance infrastructure

- Neobanking models

- Blockchain & cybersecurity in finance

Attendees included regulatory leaders, BFSI (Banking, financial services, and insurance) professionals, SaaS product managers, digital transformation officers, investors, and founders. This made the event a melting pot for innovation and collaboration.

Be it the intention of networking, launching new products, or simply exploring what’s next, this expo offered it all—from one-on-one investor meetings and startup pitches to immersive tech experiences and powerful panels.

DigiPay.Guru’s Participation at the Event

For us at DigiPay.Guru, the Convergence India Expo 2025 was more than just an event. It was an opportunity to immerse ourselves in the fintech and telecom ecosystem of tomorrow.

Here’s how we made the most of it:

-

Engaged with key decision-makers from the telecom, IT, and BFSI sectors to better understand cross-sector collaboration possibilities.

-

Explored breakthrough innovations in 5G, mobile payments, and embedded fintech platforms that align with our roadmap for mobile money, prepaid cards, and international remittance solutions.

-

Discovered market signals that revealed how financial institutions across India are evolving to meet the demands of digitally savvy users.

-

Listened to experts and innovators discuss current challenges such as secure onboarding, interoperability gaps, and rising demand for real-time payments.

Key Takeaways from Convergence India Expo 2025

1. Emerging Trends in Digital Payments

The demand for quick, secure, and user-friendly payment solutions is only growing. From face-authentication-based eKYC to blockchain-based remittances, digital payment innovations were everywhere. And they align perfectly with DigiPay.Guru’s vision for a cashless future.

2. Networking Opportunities that Matter

We connected with fintech leaders, startup founders, government representatives, and global enterprises—all under one roof. These conversations can help us build better partnerships and deliver more value to our clients.

3. Insights into the Indian Market

The Indian fintech space is maturing rapidly. Whether it’s Tier-1 cities adopting hyper-personalized mobile wallets or rural areas being empowered by agent banking services, there’s a clear shift toward inclusive digital finance.

4. Technological Advancements

From AI-driven fraud detection to IoT-connected financial ecosystems, the expo was buzzing with next-gen ideas. We look forward to integrating these innovations into DigiPay.Guru’s growing range of solutions.

5. Current Challenges: Real Talk

Many institutions still struggle with infrastructure bottlenecks, regulatory uncertainty, and interoperability challenges. These gaps highlighted the need for agile, modular solutions—something we’ve already built our platform around.

Final Thoughts

Participating in the Convergence India Expo 2025 was not just about showcasing innovation. It was about keeping pace with what the future holds. At DigiPay.Guru, we believe in walking the talk when it comes to digital transformation. This event reaffirmed that our commitment to delivering robust & future-ready fintech solutions is right on track.

We’re thrilled to bring the insights and ideas gathered at the expo into our product evolution to help banks, fintechs, and financial institutions worldwide embrace the future of finance.