Let’s face it, when people talk about fintech growth, Africa doesn’t always get top billing. Yet, quietly and consistently, it has become one of the fastest-growing remittance markets in the world.

In 2024 alone, remittance inflows to Africa crossed $100 billion, according to the World Bank. This surpassed both foreign direct investment (FDI) and official development assistance. For many African countries, remittances are now the largest source of foreign exchange, thereby fueling not just households, but entire economies.

But here’s the catch: despite this scale, Africa’s remittance opportunity remains largely untapped. High transaction fees, fragmented payment rails, and a deep reliance on cash continue to limit digital transformation.

That’s why fintechs, banks, and money transfer operators (MTOs) like yours are now eyeing this market with fresh ambition. The question is no longer “Is Africa ready?” It’s “Are you ready for Africa?” Let’s explore this market in this blog and understand where you stand in the market of remittances in Africa!

The Current State of Remittances in Africa

To understand why this opportunity is so big, you need to look at the numbers, and they tell a clear story.

Here they are:

| Region | Top Recipient Countries | 2024 Inflows (USD Bn) | Growth Rate (YoY) |

|---|---|---|---|

| West Africa | Nigeria, Ghana, Senegal | 50 | 4.8% |

| East Africa | Kenya, Tanzania, Uganda | 18 | 6.1% |

| North Africa | Egypt, Morocco | 20 | 5.3% |

| Southern Africa | South Africa, Zimbabwe | 5 | 3.9% |

Among all, Nigeria leads the list of remittances in Africa by country, receiving nearly $20 billion annually, while Egypt follows closely behind. Together, these two nations account for almost half of total remittance inflows across the continent.

But growth isn’t uniform. East Africa is witnessing the fastest rise in digital remittances with mobile money ecosystems like M-Pesa and Airtel Money. And Southern Africa, on the other hand, is still grappling with high costs and limited digital infrastructure.

In short, the takeaway is: Africa’s remittance market carries multiple evolving economies.

The Economic Impact of Remittances in Africa

For millions of African families, remittances are more than financial flows; they are lifelines. They fund education, healthcare, housing, and entrepreneurship. Plus, they keep local economies alive when other capital sources dry up.

Here’s how Africa compares globally in terms of remittances as a share of GDP:

| Region | Avg. Remittances (% of GDP) | Digital Adoption |

|---|---|---|

| Africa | 8–10% | Moderate (growing) |

| South Asia | 6–8% | High |

| Latin America | 4–6% | High |

| MENA | 6–9% | Medium |

The countries like The Gambia, Lesotho, and Cape Verde are the remittance destinations in Africa that contribute more than 20% of GDP. That’s massive.

Despite these numbers, digital adoption remains moderate. Most transfers still rely on cash-based remittance channels: informal networks that are slow, costly, and hard to trace.

In short, the potential is enormous, but the system needs modernization.

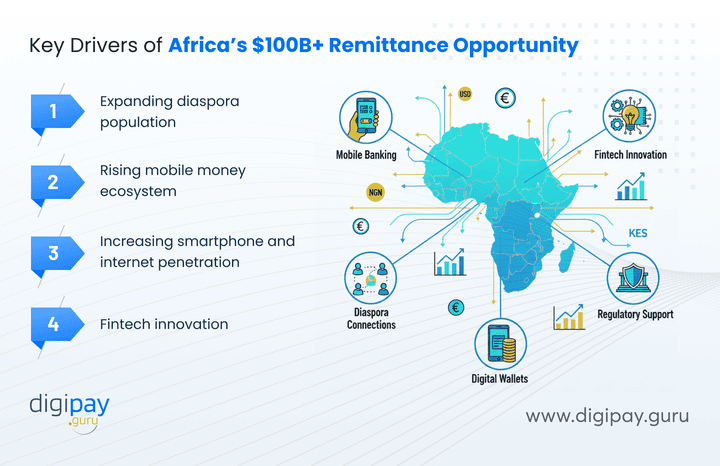

Key Drivers of Africa’s $100B+ Remittance Opportunity

Africa’s remittance growth isn’t a coincidence. It’s being powered by clear, measurable forces. And technology sits at the heart of all of them.

The key drivers for Africa’s remittance opportunities are:

1. Expanding diaspora population

The African diaspora exceeds 40 million people, spread across Europe, the U.S., and the Gulf. This population continues to grow while driving steady remittance flows back home.

2. Rising mobile money ecosystem

Over 500 million registered mobile money accounts across the continent have created new, faster, and more affordable ways to send money.

3. Increasing smartphone and internet penetration

With smartphone penetration crossing 50%, users are becoming more open to digital remittance apps and cross-border fintech platforms.

4. Fintech innovation

APIs, cloud infrastructure, and modular fintech solutions now allow even small institutions to connect to global payment networks.

Still, one big issue persists: cost. Here’s the corridor-based fees breakup:

| Corridor | Avg. Fee (%) | Global Avg. (%) | Gap |

|---|---|---|---|

| Europe → Africa | 9.2 | 5.0 | +4.2 |

| USA → Africa | 8.1 | 5.2 | +2.9 |

| GCC → Africa | 7.8 | 4.7 | +3.1 |

According to the World Bank, sub-Saharan Africa remains the most expensive region to send money to, which is almost double the global average.

For businesses like yours, this high cost is both a problem and an opportunity. And if you can reduce the fee gap, you unlock billions.

Why Africa Remains an Untapped Opportunity

So, what’s holding Africa back? The challenges are real, but they’re not insurmountable.

The key challenges in tapping into Africa’s market and their impact, along with their solution, are as under:

| Barrier | Impact | Fintech/Tech Solution |

|---|---|---|

| Fragmented payment rails | Slower transfers | Unified API platforms |

| Compliance & KYC gaps | Limited onboarding | e-KYC & RegTech integration |

| High cash dependence | Low digital adoption | Mobile-first digital wallets |

| Cross-border currency limits | FX delays | Multi-currency settlement layers |

Let’s understand these barriers in interpretations.

First, fragmented payment rails mean that each country often has its own isolated infrastructure. That leads to long settlement times and unnecessary costs.

Second, compliance gaps slow down onboarding for users and partners. Without proper AML or KYC systems, financial institutions like yours can face regulatory risks that hinder growth.

And finally, there’s the cash conundrum. A huge part of Africa’s economy still runs on physical cash, which limits the reach of digital channels.

The good news is: Every challenge on this list also represents a ripe fintech opportunity. Unified APIs, eKYC verification, and mobile-first wallet solutions are already transforming how money moves across African borders.

The Rise of Mobile Money and Fintech Partnerships

If there’s one factor changing Africa’s financial landscape faster than anything else, it’s mobile money.

Platforms like M-Pesa, MTN MoMo, and Orange Money have redefined what it means to transact in Africa. For millions, a mobile phone is now a bank in their pocket.

The best thing is: These platforms are no longer just local. They’re expanding regionally and internationally through fintech partnerships.

By connecting mobile money ecosystems with remittance software providers and banking APIs, the continent is finally building the digital rails needed for seamless transfers.

For businesses like yours, this means one thing: partnership is power.

When you collaborate with fintech innovators, the results can be revolutionary: faster transfers, lower costs, and better financial inclusion.

And yes, many fintechs are also driving trust through transparent digital channels that let customers track their transfers in real time. This means Africa is also making its way to cashless.

How Banks and Fintechs Can Tap into the $100B+ Market

So, how can you, as a bank, fintech, or remittance business, actually capture this opportunity?

Here’s how you can tap into the $100B+ remittance market:

1. Deploy White-Label Remittance Software

Why build from scratch when you can deploy an enterprise-grade white-label remittance platform in weeks?

With ready APIs, compliance tools, and FX management, you can go to market 4x faster and at a fraction of the cost.

2. Enable Cross-Border API Integrations

APIs are the new lifelines of finance. They allow you to connect instantly with MTOs, exchanges, and payment aggregators across continents while ensuring that remittance flows are instant, transparent, and compliant.

3. Offer Multi-Service Platforms

Modern customers want more than “send and receive.” So, you can combine digital remittances, wallets, and bill payments into one mobile app to build stickier relationships.

4. Build Trust with Transparency

Features like Electronic Remittance Advice (ERA) allow you to provide real-time confirmation and audit trails for inbound and outbound transfers.

Now, let’s look at how traditional banks compare to white-label fintechs like DigiPay.Guru in this space:

| Success Factor | Traditional Banks | White-Label Fintechs (e.g., DigiPay.Guru) |

|---|---|---|

| Time to Market | 12–18 months | 4–6 weeks |

| Customization | Low | High |

| Cost | High setup | Pay-as-you-grow |

| Compliance | Manual | Automated |

| Customer UX | Legacy systems | Mobile-first |

The difference is clear. Agility wins. This means white-label is the real power to tap into the $100B+ market efficiently.

Regulatory Landscape: Building Trust and Safety in Cross-Border Transfers

You can’t talk about remittance in Africa 2025 without mentioning regulation. It’s both the backbone and the barrier.

Central banks are tightening AML/KYC norms while encouraging fintech collaboration through sandboxes and pilot programs. Initiatives like PAPSS (Pan-African Payment and Settlement System) and AfCFTA are helping to standardize regional payment systems.

At the same time, digital-first solutions like eKYC, AML screening, and RegTech APIs are making compliance simpler and faster.

Platforms like DigiPay.Guru are helping banks and fintechs like yours to automate these checks to ensure each remittance channel is secure, traceable, and regulation-ready.

In short, the road to scaling remittance operations in Africa starts with one word: “trust”. And trust is built through transparency and compliance.

The Future of Remittances in Africa

The story of digital remittances in Africa is just beginning.

As technology advances, the continent is on track to become the most dynamic remittance ecosystem globally. With blockchain-based corridors, multi-currency settlement layers, and real-time payment APIs, Africa could soon redefine how money moves between borders.

We’ll see diaspora bonds emerging as new investment channels, thereby enabling Africans abroad to contribute to national development beyond just remittances.

The World Bank projects steady growth through 2025 and beyond, with digital adoption cutting transfer costs by nearly 40%.

For banks and fintechs like yours, it’s a clear call to innovate, collaborate, and build the future of payments together.

Conclusion

Africa’s remittance landscape is evolving faster than ever. With more than $100 billion flowing into the continent each year, remittances now fuel economies, uplift families, and strengthen financial inclusion.

Still, high costs, fragmented systems, and limited digital access continue to hold back Africa’s full potential.

For banks, fintechs, or MTOs like yours, this moment offers a clear path forward: embracing digital transformation through reliable, compliant, and scalable platforms. Thus, technology is creating new ways to connect African communities to global opportunities.

That’s where DigiPay.Guru steps in.

As a trusted white-label international remittance software provider, DigiPay.Guru helps financial institutions launch and scale cross-border remittance solutions with speed, security, and compliance built in.

Plus, our platform empowers you to go to market faster, reduce costs, and deliver transparent, mobile-first experiences your customers can trust.

In a market as dynamic as Africa’s, DigiPay.Guru isn’t just a technology partner; it’s your bridge to the continent’s next $100B opportunity.

FAQs

The rise of Africa’s remittance market is driven by a growing diaspora population, increasing mobile money adoption, and expanding fintech infrastructure.

With better connectivity and smartphone access, more Africans are turning to digital remittance channels that offer speed, transparency, and affordability compared to traditional cash-based systems.

Africa remains the most expensive region to send money to, with fees averaging nearly 8%–9% per transaction. This is due to fragmented payment networks, limited competition, and heavy reliance on cash-based intermediaries.

High compliance costs and a lack of interoperability between countries also keep transfer fees elevated.

Fintechs can lower costs by using unified APIs, blockchain-based settlement, and mobile-first digital wallets. These tools remove unnecessary intermediaries, automate KYC and AML checks, and enable real-time transfers.

The result is a faster, cheaper, and more transparent cross-border payment experience for both senders and receivers.

Mobile money has become Africa’s biggest enabler of financial inclusion. It allows users to send, receive, and store funds securely without needing a bank account.

By linking remittance systems with mobile money platforms like M-Pesa and MTN MoMo, cross-border transfers are now faster, cheaper, and more accessible even in rural regions.

DigiPay.Guru empowers banks, fintechs, or MTOs like yours with a white-label remittance platform that accelerates go-to-market timelines. Its modular APIs, automated compliance tools, and multi-currency support enable secure, low-cost international transfers.

This way, you can quickly scale and compete in Africa’s fast-growing remittance ecosystem with full transparency and trust.

Nigeria consistently ranks as the top recipient of remittances in Africa, thereby attracting nearly $20 billion annually, followed by Egypt and Kenya.

These nations benefit from large diaspora communities and growing adoption of digital remittance channels, especially through mobile and online platforms.

The biggest challenge remains financial fragmentation with too many disconnected systems and heavy cash dependency. This makes cross-border payments slow and costly, limiting access for millions of unbanked users.

Solving this requires collaboration between banks, fintechs, and regulators to create unified, digital-first payment ecosystems.

Remittances are a vital source of foreign exchange and economic stability. They directly support household spending, education, and healthcare, often surpassing foreign direct investment and development assistance.

For many African economies, remittances act as a safety net during financial or political uncertainty.

In 2024, total remittance inflows to Africa surpassed $100 billion, according to World Bank data. This figure continues to grow each year, with sub-Saharan Africa contributing the largest share. As digital remittance adoption expands, the continent is on track to exceed $120 billion by the end of 2025.