Statista states that global inward remittances are expected to reach $1.42tn by 2030!

And global inward remittance flows have never been higher. As economies grow more connected and families more global, banks and remittance providers are handling billions in cross-border remittances every year.

But there's a catch.

With this boom comes a new standard. Customers don't just want their money to arrive. They want to track it in real time and with full visibility.

That means traditional, unclear systems no longer fall under the reliable one. If your remittance system can’t offer end-to-end payment tracking, you're already falling behind.

In this blog, let’s break down what this means, why it matters, and what you need to stay competitive in a landscape driven by speed, compliance, and money transfer transparency.

Let’s begin with the meaning of inward remittances!

What Are Inward Remittances and Why Are They So Important?

In simple terms, inward remittance means money sent from someone abroad to a recipient in their home country. It usually lands in a bank account or a mobile wallet. That's the core of the meaning of inward remittance.

Example:

A Bangladeshi migrant working in the UAE sends part of his salary home to his wife every month through a remittance app. She receives the money directly in her mobile wallet, which she uses to pay school fees and utility bills. That's an inward remittance in action and it's fast, digital, and essential.

Forms of Inward Remittance

There are various forms of inward remittances. Some of the most common ones are:

P2P Transfers: Funds sent by individuals working abroad directly to their families back home for daily use.

Business Payments: Money transferred between international partners to settle invoices or supplier obligations.

Aid & NGO Transfers: Donations or grant-based funds sent to nonprofit organizations in developing countries.

Digital Wallet Transfers: Money moved between digital wallets, often app-to-app, across international borders instantly.

Why It Matters

In many developing regions, inward remittances are essential for survival and economic growth.

And people rely on these funds to:

-

Pay school fees and secure children's futures

-

Cover urgent and ongoing healthcare expenses

-

Launch or sustain small businesses and local trade

For banks and fintechs, it goes beyond facilitating transfers, it's a gateway to deeper financial inclusion. Because a smooth and reliable inward remittance process can turn a one-time transaction into a long-term customer relationship.

In fact: According to the World Bank, remittances are a major contributor to GDP in countries like Nigeria, India, the Philippines, and Kenya.

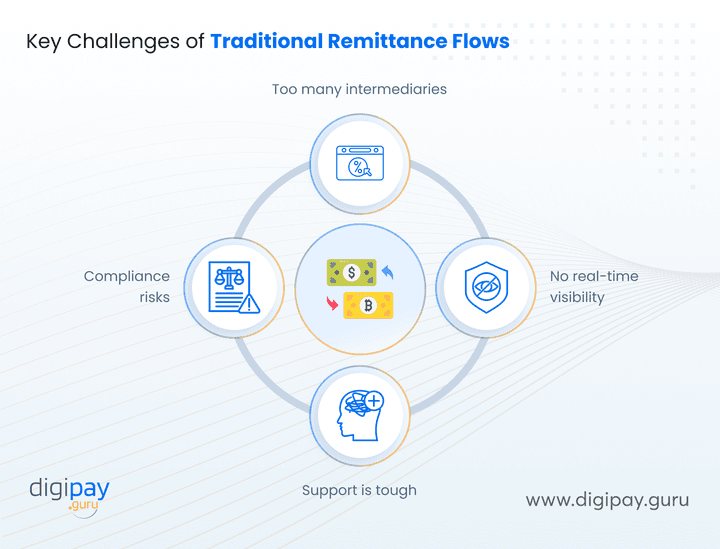

The Challenges of Traditional Remittance Flows

Despite technological advances, traditional remittance systems still create friction, especially when transparency and traceability are missing. Let’s explore the key challenges in this space:

What's Going Wrong?

Too many intermediaries: With traditional remittances, each payment often passes through several banks, switches, and partners. And every extra intermediary increases cost, delay, and risk.

No real-time visibility: Once the money is sent, the trail of payment status often disappears. And your customers have no way to check progress. This is frustrating as well trust losing.

Support is tough: Without the right tracking tools, your team spends hours chasing payout status from external partners. And hence they become incapable of supporting customers.

Compliance risks: Delayed or unclear transactions raise red flags and are prone to fraud risks. That exposes your business to regulatory scrutiny and fines.

All in all, without end-to-end visibility, you're flying blind. And your customers feel it.

That’s where end-to-end payment tracking comes to your rescue. Let’s understand what it is and how it helps.

What Is End-to-End Payment Tracking?

End-to-end payment tracking means the ability to trace a transaction from the moment it leaves the sender until it's delivered to the receiver. It is tracked at every step.

This type of end-to-end payment processing makes remittance flow predictable, secure, and visible.

It Includes:

-

Timestamps at each stage: Initiation → Processing → Settlement → Payout

-

Visibility across banks, fintechs, wallets, and MTOs

-

And real-time alerts and dashboards

It transforms your system from reactive to proactive and aligns with international standards like SWIFT GPI and ISO 20022.

Why End-to-End Payment Tracking Matters for Your Remittance Business

Modern users expect to track everything, from food deliveries to airport rides. And remittances are no different for them. They want to know where their money is at every step.

At the same time, financial and remittance regulators and governments are pushing hard for greater transparency.

And for your internal teams, real-time visibility can mean faster resolution, lower costs, and fewer escalations.

Let’s break it down by sector:

For Banks

Your customers trust you with their money, but now they expect speed and clarity too. If your system doesn’t show real-time updates, people will start looking elsewhere. So, offering tracking is how you stay relevant in a digital-first world.

For Fintechs

Your system may be fast, but your users still need assurance. And when a transfer is delayed, support teams can get flooded with queries. And offering end-to-end tracking features reduces those complaints and builds user confidence. That means fewer drop-offs and better retention.

For Money Transfer Operators (MTOs)

As an MTO, you’re handling dozens of payout corridors. So if there’s a delay, you need to know that immediately. And end-to-end tracking gives you control, helps protect your brand, and keeps partners accountable.

Bottom Line: No matter your role in the financial space, transparency in international payments is no longer a bonus, it's a basic necessity.

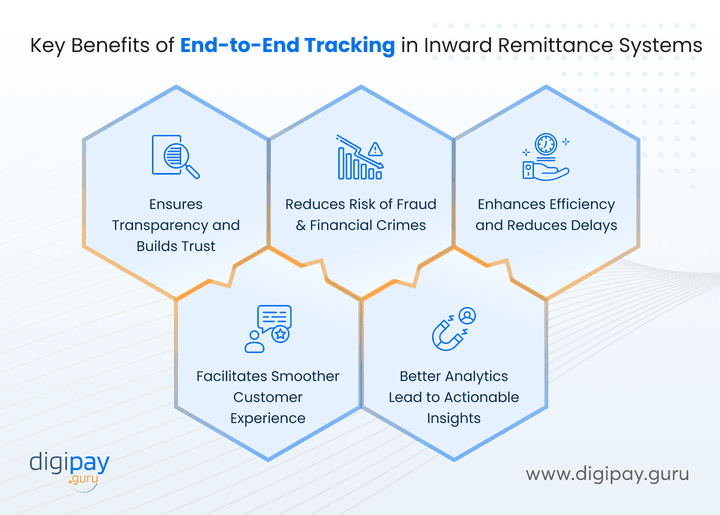

Key Benefits of End-to-End Tracking in Inward Remittance Systems

When you adopt end-to-end tracking, you’re unlocking measurable business value while upgrading your system.

Here's how it directly impacts your customer experience, compliance efforts, and operational efficiency:

Ensures Transparency and Builds Trust

Customers expect updates on their remittance status at every step. When they can track their money in real time, they feel more confident and are able to trust your business and system. Plus, they don’t have to feel helpless when they can track it easily and clearly from start to finish.

This builds a better relationship between you and your end users. Here’s what you get:

-

Real-time visibility reduces customer anxiety

-

Fewer support tickets around “Where is my money?”

-

Builds long-term user trust and retention

Reduces Risk of Fraud and Financial Crimes

End-to-end tracking helps you know where the money is and where it isn’t. This helps your customers flag suspicious activity quickly. And makes your system more secure and audit-ready.

This, in turn:

-

Supports AML compliance and traceability

-

Detects anomalies in transfer paths instantly

-

And strengthens your internal risk controls

Enhances Efficiency and Reduces Delays

Your operations and support team no longer have to waste time in manually checking with partners or chasing missing payouts.

Because end-to-end tracking keeps your customers updated and transparent on what's going on with their money. And this creates accountability.

This results in:

-

Faster resolution of stuck or delayed transfers

-

Fewer manual escalations to partner networks

-

And improved SLA performance across corridors

Facilitates Smoother Customer Experience

Yes speed does matter for a smoother customer experience, but predictability goes a long way for your customers. When they know when the money will arrive or reach, they feel in control and peace.

This is possible because end-to-end tracking offers:

-

Real-time notifications and status updates

-

Better ratings, reviews, and word-of-mouth

-

And higher NPS and app engagement

Better Analytics Lead to Actionable Insights

With clean and transparent tracking data, your customers won’t feel like everything is in air and that they are helpless in the process. Plus, you can optimize corridors, resolve bottlenecks, and hold payout partners accountable.

It also helps you:

-

Track partner and corridor performance with ease

-

Improve payout timing based on historical trends

-

Use data to reduce costs and boost delivery accuracy

Why End-to-End Tracking Is Especially Critical in High-Remittance Regions

Africa

Africa relies heavily on inward remittances through mobile money and agent networks. But many areas still lack reliable digital infrastructure. Plus, without tracking, delays or drop-offs go unnoticed which creates support complexities for your team.

On the contrary, real-time tracking ensures better control, faster payouts, and trust in corridors where cash is king.

Asia

Asia is home to some of the world’s busiest remittance corridors. From the Gulf to India or Malaysia to the Philippines, users expect speed and precision. Additionally, bank-wallet integrations are common, but complexity in it increases the risks.

End-to-end visibility helps remittance businesses like yours ensure smooth delivery and reduce failure rates.

MENA

MENA serves as both a sender and transit region in global remittance flows. But with fragmented networks and strict compliance rules, even small issues can create big reputational damage.

End-to-end tracking helps you stay compliant, trace transactions instantly, and build reliability across diverse partner systems.

What to Look for in a Good Remittance Tracking Solution

When evaluating a remittance tracking system, features are important. But it's also about solving real business problems.

Here’s what to prioritize to ensure your inward remittance process is reliable, scalable, and customer-friendly:

Real-time, Multi-party Tracking

The right remittance system should track every stage of the transaction from initiation to final payout across all involved parties. This includes sender banks, switches, MTOs, wallets, and payout partners and more. This level of visibility reduces need for guess work and improves customer confidence.

APIs for Bank, Wallet, and MTO integration

A good tracking solution in remittance should offer robust APIs that allow seamless integration with your existing banking systems, mobile wallets, and remittance partners. This ensures that data flows consistently and updates are always in sync across the ecosystem.

Customer-facing Notifications

The remittance platform must offer automatic updates via SMS, email, or in-app alerts. These notifications keep your customers informed at key moments like money sent, in transit, and credited, which reduces support calls and boosts trust in your service.

Ops Dashboards with Corridor Performance Metrics

Your operations team should have access to a real-time dashboard that highlights corridor performance, delays, and partner reliability. This helps in:

-

Proactive issue resolution

-

Better SLA tracking, and

-

Enhanced operational decision-making based on live data

Compliance-ready Audit Trails (ISO 20022, SWIFT GPI Support)

Choose a solution that supports compliance standards like SWIFT GPI and ISO 20022. It should log every event with time stamps and IDs, so your teams are always ready for audits, investigations, or AML inquiries without scrambling.

Inward Remittance Charges Transparency

Look for systems that allow you to display and track total charges clearly to the end user. The charges include FX spreads, service fees, and partner charges. This kind of transparency reduces disputes and increases your credibility in competitive corridors.

How DigiPay.Guru Enables Seamless End-to-End Remittance Tracking

At DigiPay.Guru, we understand that managing remittances isn’t just about moving money. It’s about ensuring every transaction is tracked, trusted, and transparent from start to finish.

Our platform is designed specifically for remittance businesses who want full control over their remittance flows.

Here’s what you get with DigiPay.Guru:

Real-Time End-to-End Visibility: Track every transaction across the full journey, from the sender’s initiation to the recipient’s wallet or bank account.

Operational Dashboards for Teams: Your support and compliance teams get real-time access to payout statuses, partner performance, and alerts, so they can act fast and stay ahead.

Easy Integration with Core Systems: Plug into your existing ecosystem using our ready APIs. Whether it’s core banking, wallets, or payout networks, we make connections seamless.

Built-In Support for SWIFT GPI, ISO 20022, and AML Checks: Our platform is audit-ready and regulator-friendly, which helps you stay compliant in high-stakes corridors and across borders.

Measurable Impact for Our Clients

Remittance businesses using DigiPay.Guru report:

-

45% drop in “Where’s my money?” queries

-

Faster dispute resolution

-

Stronger corridor reliability and reputation

If you're ready to offer a better remittance experience: one that’s transparent, trackable, and built for today’s expectations, DigiPay.Guru is here to help.

Conclusion

Let’s face it. Inward remittance isn’t just about “Did the money arrive?” anymore. It’s about how fast, where exactly, and who handled it along the way.

This means that customers expect clear updates, regulators demand traceability, and your support team needs answers, not assumptions.

And if your customers can't track the full journey from initiation till settlement, they feel frustrated.

Whether you’re a bank upgrading your infrastructure, a fintech scaling cross-border payments, or an MTO managing high-volume corridors, real-time tracking is no longer optional. It’s essential to delivering trust, speed, and control.

DigiPay.Guru helps you do just that with full end-to-end visibility, real-time insights, and seamless integration across systems.

Ready to take control of your inward remittance process? Let’s get started.

FAQ's

To facilitate inward remittances, you need to integrate with a remittance technology provider or correspondent partners that support multi-currency settlement, local disbursement options, and compliance with cross-border regulations. A platform like DigiPay.Guru enables you to manage corridors, partners, KYC, and transaction flows from a unified dashboard.

You’ll need the appropriate regulatory license (e.g., EMI, PI, or MTO certification), a remittance system that supports incoming settlement flows, robust AML checks, and payout integrations with local banks or wallets. Most importantly, you’ll need to ensure your systems are built to handle volume, reconciliation, and compliance from day one.

At a minimum, you should collect full KYC documents in line with your jurisdiction’s compliance rules. This includes government-issued ID, proof of address, and for larger amounts you need a source of funds. DigiPay.Guru’s platform can be configured to trigger KYC tiers and hold payouts until documents are verified.

End-to-end tracking is supported across most digital and API-integrated remittance channels. However, its availability depends on the transparency provided by upstream and downstream partners. Our platform enables visibility across integrated channels, and flags any hops where visibility is limited due to third-party constraints.

Several factors impact delivery time: currency conversion delays, partner settlement cycles, time zone differences, and compliance reviews. With real-time tracking, you can identify where delays occur and take action sooner.

Fees may include correspondent banking charges, processing fees from aggregators, FX spreads, and payout network fees. Your business can choose to absorb or pass these costs to the sender or receiver. A transparent tracking system helps you monitor these charges per corridor and partner.

To offer real-time tracking, your system must capture status updates at each step of the transaction, from initiation to payout. DigiPay.Guru’s platform provides both internal dashboards and customer-facing notifications (via SMS, email, or app), which gives users live updates on their funds.

A secure remittance setup includes end-to-end encryption, tokenized APIs, fraud detection layers, audit trails, and real-time reconciliation. DigiPay.Guru supports AML-compliant workflows, full transaction logs, and ISO 20022/SWIFT GPI compatibility. This ensures your transactions are safe, monitored, and traceable at all times.