Almost every bank and fintech today faces the same challenge: how do you reduce fraud risk while giving merchants and customers faster & smoother payment experiences? One answer lies in a payment type you may not give much thought to: the Merchant-Initiated Transaction (MIT).

Though invisible to most cardholders, MITs play a major role in recurring payments and subscription billing. It powers subscriptions, hotel bookings, and ride-sharing apps. More importantly, they are treated by payment networks as low-risk payments.

In this article, you’ll see exactly what MITs are, how they differ from Customer-Initiated Transactions (CITs), and why they matter for banks and fintechs like yours. You’ll also learn how compliance frameworks like PSD2 and SCA exemptions for MIT reduce friction without adding fraud risk.

Let's begin by understanding its meaning!

What is a Merchant-Initiated Transaction (MIT)?

A merchant-initiated transaction (MIT) is a payment initiated by the merchant, not by the buyer, after the customer has already given consent.

In simple terms:

- The customer makes an initial cardholder-initiated transaction (CIT), where strong authentication applies.

- The merchant then stores the credentials securely (often tokenized).

- Later, when a scheduled or event-based payment arises, the merchant charges the card without requiring the customer to re-enter details.

This flow reduces friction for customers while still satisfying compliance rules. Networks like Visa and Mastercard recognize MITs as a separate category from buyer initiated payments because the authentication flow and risk handling differ.

How Do Merchant-Initiated Transactions Work?

The process follows a clear sequence:

- Customer Setup: The customer makes the first CIT. They authenticate with PIN, OTP, biometrics, or any Strong Customer Authentication (SCA) method.

- Consent Recording: The merchant receives authorization to store credentials for future payments.

- Stored Card Transactions: These details are held securely (tokenized, per PCI DSS standards).

- Merchant Trigger: At renewal, completion, or usage, the merchant initiates the charge.

- Authorization: The payment goes through without the customer repeating authentication.

That’s why MITs are often called card-on-file payments. Where the cardholder approves once, and the merchant continues within the agreed terms.

Cardholder-Initiated Transactions (CIT) vs Merchant-Initiated Transactions (MIT): A Direct Comparison

Understanding the difference between CIT and MIT is critical for banks and fintechs like yours. It shapes how you evaluate fraud risk, chargebacks, and compliance.

Here’s a clear comparison between the two:

| Aspect | Cardholder-Initiated Transaction (CIT) | Merchant-Initiated Transaction (MIT) |

|---|---|---|

| Initiator | Customer initiates each payment | Merchant initiates after prior consent |

| Authentication | Strong authentication for every payment | Authentication is only required at the first merchant transaction |

| Use Cases | Online checkout, POS transactions | Subscriptions, recurring billing, and hotel charges |

| Risk Level | Higher fraud &; chargeback risk | Lower risk, more predictable |

| Customer Experience | Requires repeated input of credentials | Seamless and no repeated card entry |

Merchant-Initiated Transaction Examples

Let’s put the theory of merchant-initiated transactions into context with a simple example. MITs appear in several industries that banks and fintechs like yours support daily:

- Subscriptions: Music streaming, SaaS platforms, cloud storage.

- Hospitality and Travel: Hotels charging for no-shows, minibar, or late checkout.

- Mobility and Transport: Ride-hailing or delivery apps billing automatically after a trip.

- E-commerce: Installment plans or repeat orders with stored credentials.

These examples show why MITs are embedded in today’s commerce. Plus, they make recurring payments possible and help merchants deliver a better customer experience.

What Makes CIT Higher Risk and MIT Lower Risk?

When you offer seamless payments to merchants, the difference between customer-initiated transactions (CITs) and merchant initiated transactions (MITs) matters.

Both CIT and MIT flow through the same card networks, but their risk profiles are very different.

Here’s why issuers and regulators see CITs as higher risk, while MITs fall into the low-risk category:

1. Prior Consent vs. Real-Time Authorization

With CITs, the cardholder must enter details and authenticate each time. This creates more opportunities for fraudsters to use stolen credentials.

In contrast, MITs rely on prior consent given during a strongly authenticated transaction. And once consent is secured, merchants charge the card within agreed terms.

For acquirers, this upfront approval reduces the likelihood of disputes and makes the transaction safer to process downstream.

2. Exposure of Payment Data

CITs expose payment details more frequently. And every checkout requires customers to retype or transmit sensitive card information, often across unsecured networks or devices. So, each touchpoint becomes a potential entry point for fraud.

With MITs, payment credentials are captured once, stored securely, and often tokenized. This reduces repeated exposure and minimizes both the attack surface and compliance burden for banks and fintechs like yours.

3. Predictability of Transaction Patterns

CITs can appear irregular, with varying amounts, locations, and merchants. This makes fraud detection harder and increases false declines.

However, MITs are inherently predictable with monthly subscriptions, installment payments, or post-service charges. Plus, its predictable frequency and amount ranges align with issuer fraud models, which leads to higher approval rates and fewer false positives.

For businesses like yours, this means more reliable processing volumes.

4. Chargeback and Dispute Risk

Because CITs require manual entry each time, disputes are more common: customers may claim they never made the payment, or that credentials were compromised.

But MITs have an audit trail tied to the original consent. This makes disputes easier to resolve and lowers chargeback ratios for merchants. In turn, lower chargeback exposure benefits your banks and fintechs too, since fewer disputes mean reduced operational overhead.

5. Regulatory Treatment

Under frameworks like PSD2, CITs require Strong Customer Authentication (SCA) for every payment. This adds friction for the user and introduces more points of failure.

MITs only require SCA at the initial setup, after which exemptions apply. This regulatory distinction directly explains why MITs are viewed as lower risk: they combine secure onboarding with smoother subsequent flows.

And for your business, supporting MITs means staying compliant while giving merchants a competitive advantage.

Read more: DigiPay.Guru Launches Dispute Module for Merchant Protection

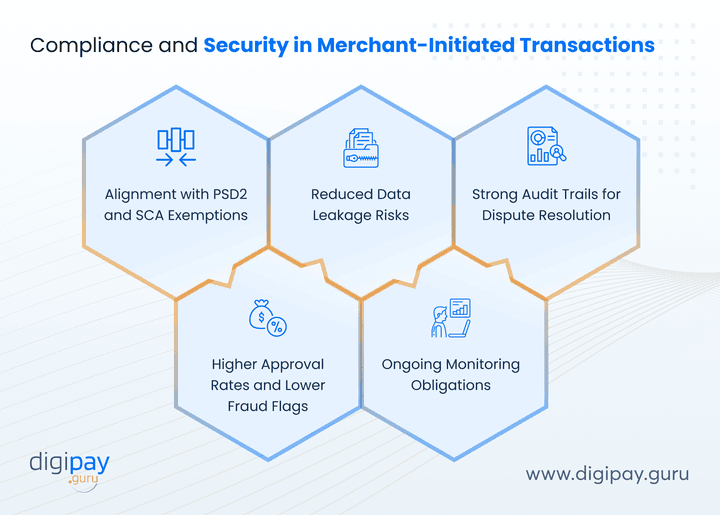

Compliance and Security in MITs

For businesses like yours, it isn’t enough to classify MITs as “lower risk.” You also need to understand why they’re treated differently and how this impacts your compliance and security frameworks.

Let’s understand this:

1. Alignment with PSD2 and SCA Exemptions

Under PSD2 in Europe, Strong Customer Authentication (SCA) is mandatory for most electronic payments.

However, MITs qualify for merchant-initiated transactions SCA exemptions because cardholders already gave explicit consent during the initial setup.

For banks and fintechs like yours, this reduces friction in recurring transactions while ensuring regulatory requirements are still met.

2. Reduced Data Leakage Risks

CITs repeatedly expose card numbers and CVVs, often across different networks and devices.

On the contrary, MITs minimize this by storing payment credentials securely (often via tokenization or network vaulting).

For you, this means:

- Fewer chances for cardholder data breaches

- Lower PCI DSS compliance costs, and

- A stronger security posture overall

3. Strong Audit Trails for Dispute Resolution

Each MIT is linked back to an original transaction that was fully authenticated. This creates a verifiable chain of consent, which is powerful evidence when handling disputes or chargebacks.

For acquirers like you, having this audit trail simplifies compliance investigations and reduces the financial risk of representments.

4. Higher Approval Rates and Lower Fraud Flags

Because MITs follow predictable schedules and are supported by stored consent, issuer fraud systems tend to treat them as trustworthy. This typically results in higher approval rates and fewer unnecessary declines.

For banks like yours, that means stronger merchant satisfaction and increased transaction volumes without compromising security.

5. Ongoing Monitoring Obligations

Even with lower inherent risk, MITs are not risk-free. You must maintain strong monitoring tools to detect anomalies such as sudden changes in transaction amounts or unusual frequency.

This kind of proactive oversight:

- Ensures compliance with card scheme rules

- Protects your reputation, and

- Reduces downstream losses

Benefits of MITs for Banks and Fintechs

Understanding the value of merchant-initiated transactions (MITs) is about the business upside for your business, other than just fraud reduction.

By enabling MITs, you can unlock more predictable revenue streams, strengthen merchant relationships, and reduce back-office friction.

1. Stable and Recurring Revenue

From streaming services to SaaS providers, subscription-based merchants rely heavily on MITs. By supporting these models, you can secure a steady flow of transactions each month.

This stability improves revenue forecasting and creates a reliable foundation for long-term growth.

2. Higher Approval Rates, Less Revenue Leakage

Because MITs are pre-authorized, issuers’ fraud systems are more likely to approve them. This results in fewer false declines at the point of transaction.

For your business, this means:

- Less revenue left on the table

- Stronger authorization rates, and

- A more consistent volume of settled transactions

3. Lower Operational Costs from Fewer Chargebacks

CITs often generate higher chargeback ratios due to disputed or fraudulent transactions, which increase compliance workload and costs.

However, MITs are tied to a clear audit trail of initial customer consent. This lowers dispute rates and saves you the significant expense of managing chargeback claims.

4. Stronger Merchant Value Proposition

Your merchant clients want to reduce churn and maintain predictable cash flows. By offering reliable MIT support, you enable them to run subscription models, recurring billing, and post-paid services more smoothly.

This strengthens your position as a payments partner and increases merchant loyalty.

5. Compliance-Friendly Revenue Growth

Supporting MITs demonstrates to regulators and partners that your business prioritizes secure & compliant payment flows.

With SCA exemptions built into regulations like PSD2, you can deliver a balance of security and convenience.

This reduces regulatory risk and creates a competitive edge when attracting new merchants.

Why MIT Capability Should Be Part of Your Strategy

By now, you’ve seen how merchant-initiated transactions (MITs) reduce risk and make recurring payments seamless.

Now, let's see why adding MIT support should be a core part of your acquiring strategy:

1. Win High-Value Merchants

Subscription platforms, ride-hailing apps, and hotels all need MITs. By supporting these models, you can secure a steady flow of transactions each month.

This stability improves revenue forecasting and creates a reliable foundation for long-term growth.

2. Boost Transaction Volumes

MITs create steady, predictable payment flows. That means more processed transactions and stronger revenue for your acquiring business. Because MITs are pre-authorized, issuers’ fraud systems are more likely to approve them. This leads to fewer false declines at the point of transaction.

For you, this means more processed transactions and stronger revenue for your acquiring business.

3. Lower Risk Exposure

With prior customer consent and SCA exemptions, MITs lead to fewer chargebacks and less fraud, which reduces compliance pressure on your institution.

4. Improve Merchant Satisfaction

Merchants value seamless & low-friction payments along with predictable cash flows. By enabling stored card transactions, you make their customers’ checkout effortless and encourage repeat spending.

This strengthens your position as a payments partner and increases merchant loyalty.

5. Future-Proof Your Offerings

As subscription billing and recurring payments grow worldwide, businesses that support MITs will stay competitive. With DigiPay.Guru’s merchant acquiring solution, you can deliver secure, compliant, and scalable MIT support from day one.

Conclusion

As a bank or fintech, the way you manage transaction flows directly shapes your risk profile and growth potential. With recurring payments and subscription billing becoming the backbone of digital commerce, you can’t afford to overlook merchant-initiated transactions (MITs). They combine the convenience of stored card transactions with the protection of prior customer consent, which makes them both seamless and low risk.

When you support MITs, you give your business exactly what it needs: stability, predictability, and compliance.

- You lower fraud risk because every transaction builds on prior consent.

- You see higher approval rates thanks to predictable billing patterns.

- You reduce disputes by keeping a clear audit trail that’s easy to defend.

And because networks and regulators classify MITs as low risk, you face less operational pressure while still scaling transaction volumes.

With DigiPay.Guru, you can deliver all of this through our merchant acquiring solutions. We help you support MITs securely, onboard high-value merchants, and future-proof your acquiring strategy so that recurring payments keep growing.

FAQs

A merchant-initiated transaction (MIT) is a payment you process on behalf of your merchant after the customer has already given consent. Unlike customer-initiated payments, MITs let the merchant trigger the charge without the cardholder being present.

This setup is critical for recurring billing, subscriptions, and post-service charges, and it gives you more predictable, low-risk transaction flows as an acquirer.

Yes, MITs are fully recognized under PSD2. Strong Customer Authentication (SCA) applies only at the first customer-initiated transaction, where consent and credentials are captured.

Every subsequent MIT benefits from SCA exemptions, which allow merchants to process payments seamlessly while staying compliant as the acquiring bank or fintech partner.

MITs are low risk because they rely on prior customer consent and use stored credentials secured during an authenticated transaction. The transaction patterns are predictable, like monthly subscription charges, which fraud systems treat as safe. For you, this means fewer disputes, fewer chargebacks, and higher approval rates across your merchant portfolio.

MITs don’t usually fail due to fraud. Instead, they fail because of expired cards, insufficient funds, or customers revoking consent. As a business, you can reduce these declines by supporting merchants with account updater services, tokenization, and clear communication practices.

Merchants can improve MIT authorization rates by:

- Keeping stored card data updated through network tokenization or account updaters.

- Using clear descriptors so customers recognize the charges.

- Setting up retry logic for declined transactions.

When you enable these features in your acquiring solution, you help merchants keep recurring revenue streams healthy and reduce churn.

A CIT is triggered by the cardholder, with SCA applied at every transaction. An MIT is triggered by the merchant after customer consent is recorded, and SCA applies only at the initial setup.

For you, this difference is critical: CITs carry higher fraud and chargeback risks, while MITs are treated as low-risk, stable transactions.

Industries built on recurring or post-service payments benefit most:

- Subscriptions (media, SaaS, utilities).

- Hospitality and travel (no-shows, minibar, late check-out).

- Mobility and transport (ride-hailing, food delivery).

- E-commerce installments.

As a business, supporting MITs means you can onboard and retain these high-growth, high-volume merchants more easily.

Yes. DigiPay.Guru’s merchant acquiring solution is designed to support MITs end-to-end. That means you can process recurring and stored-card payments securely, stay compliant with PSD2 and SCA exemptions, and give your merchants the seamless billing experience their customers expect.