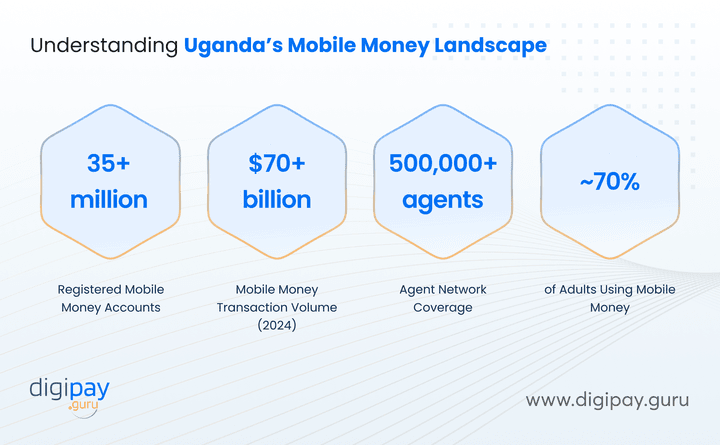

Uganda has quietly become a global success story in digital finance. With over 35 million registered mobile money accounts, mobile wallets in Uganda now serve more people than traditional banks. In fact, mobile money transactions account for over 50% of total financial activity, according to the Bank of Uganda.

For financial businesses like yours, it's a wake-up call.

Your future customers won’t wait in lines at branches. They’re using USSD menus, mobile wallets, and agent networks, often in rural areas that traditional banking couldn’t reach. Mobile money in Uganda has removed long-standing barriers to access and empowered individuals with savings, credit, and digital payments at their fingertips.

In this blog, you’ll discover

-

How mobile money is transforming financial access,

-

What does it mean for formal financial businesses like yours, and

-

How you can lead Uganda’s next wave of financial inclusion and growth

Let’s begin with an understanding of the mobile money landscape!

Understanding Uganda’s Mobile Money Landscape

Mobile money has become the de facto financial infrastructure in Uganda. This section helps you understand its rapid evolution and the players leading the charge.

The Rise of Mobile Money in Uganda

Uganda's mobile money boom began in the late 2000s. Today, it’s grown into a $70B+ annual transaction ecosystem. According to the Bank of Uganda, mobile transactions now outpace traditional bank transfers.

What makes it work?

-

High mobile phone penetration (even in rural areas)

-

Massive agent networks

-

Demand for simple, accessible financial services

More than convenience, mobile money has become a core financial gateway for individuals who never had formal access to the financial system. It has turned basic mobile phones into financial tools, proving that innovation can leapfrog legacy barriers.

Key Players Shaping the Ecosystem

-

MTN Mobile Money Uganda: Dominates with broad agent coverage and strong brand trust

-

Airtel Money Uganda: Gaining fast with competitive mobile money charges in Uganda

-

Fintechs and aggregators: Offer mobile wallet integrations, credit scoring, and bill payments

These providers enable millions to send, receive, and store money securely, even without a bank account. Their platforms act as the foundation for digital payments, financial engagement, and even savings and credit access.

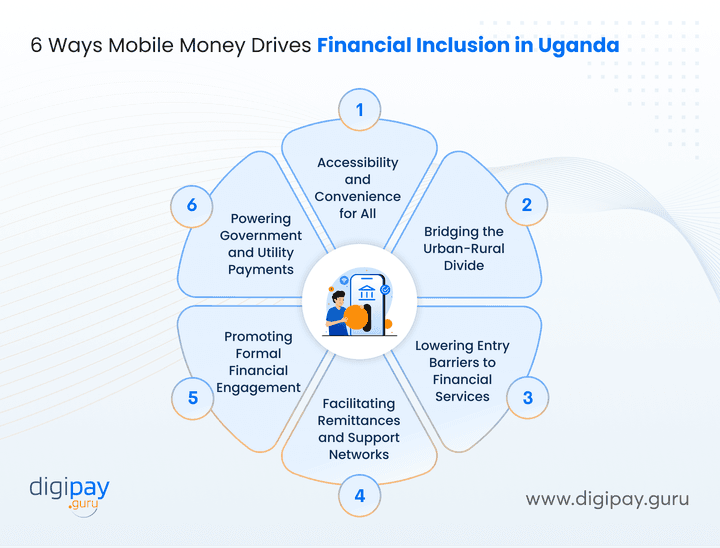

6 Ways Mobile Money Drives Financial Inclusion in Uganda

Financial inclusion goes beyond access. It's about usability, trust, and everyday value. Here’s how mobile money makes a difference.

Accessibility and Convenience for All

Anyone with a mobile phone, even the simplest one, can open a mobile money account. There’s no need for paperwork, formal employment, or physical travel to a bank.

Plus, the process is fast, accessible, and built for people with limited resources. It’s financial access without the friction, which then leads to boosted financial inclusion in Uganda.

Here’s what makes mobile money truly inclusive, even for low-income and rural users:

-

Use of USSD and SMS for non-smartphone users

-

24/7 access to funds

-

Easy bill payments and airtime top-ups

-

Simple user interfaces that support low literacy levels

Bridging the Urban-Rural Divide

Mobile money reaches remote districts that commercial banks simply can’t serve affordably. It brings financial access to places where infrastructure, transport, or costs previously created hard barriers. With just a phone and a local agent, users can transact securely, no matter where they live.

Here’s how mobile money bridges the urban-rural divide in Uganda:

-

Over 500,000 agents countrywide

-

Cash-in/cash-out in even the most remote villages

-

Helps farmers, traders, and informal workers transact securely

-

Supports seasonal financial needs through access to quick transfers

Lowering Entry Barriers to Financial Services

Traditional banking has always come with paperwork, hidden costs, and access hurdles. You needed formal employment, verified income, and a trip to the nearest branch, which often wasn't near at all. That model simply doesn’t work for Uganda’s youth, gig workers, or rural households.

Here’s how mobile money removes those entry barriers and levels the playing field:

-

Quick onboarding with national ID or phone registration

-

Zero or low minimum deposits

-

Inclusive for youth, women, refugees, and gig workers

-

Builds financial identity over time

Facilitating Remittances and Support Networks

Sending money should be simple, fast, and secure, whether it's across districts or continents. Mobile wallets in Uganda have transformed remittance by enabling frictionless movement of money for families, businesses, and communities. People no longer rely on risky & cash-based systems or lengthy queues.

Here’s how mobile money makes remittances and support networks easier:

-

Real-time domestic transfers

-

Diaspora remittances via integrated platforms

-

Reduces dependency on physical travel or cash couriers

-

Secure and traceable transactions that strengthen family support networks

Promoting Formal Financial Engagement

Mobile money does more than move funds. It builds a financial footprint. For many Ugandans, mobile transactions are the first step into the formal economy. As people save, borrow, and pay digitally, they generate data that your business can use to offer more personalized and impactful services.

Here’s how mobile money fosters formal financial engagement:

-

Transaction data used for credit scoring

-

Gateway to digital loans, insurance, and savings

-

Boosts financial literacy and trust in digital finance

-

Encourages savings and budget management

Powering Government and Utility Payments

Public services and essential utilities are going digital, and mobile money is the go-to platform. From school fees to taxes, government agencies and NGOs alike are tapping into wallets to improve efficiency and transparency. It reduces cash handling, leakage, and bureaucracy at every level.

Here’s how mobile money is being used to power government and utility payments:

-

Tax payments, license renewals, tuition, and fines

-

NGOs distribute aid via mobile wallets in Uganda

-

Transparent and trackable, and

-

Helps formalize the economy and reduce leakages

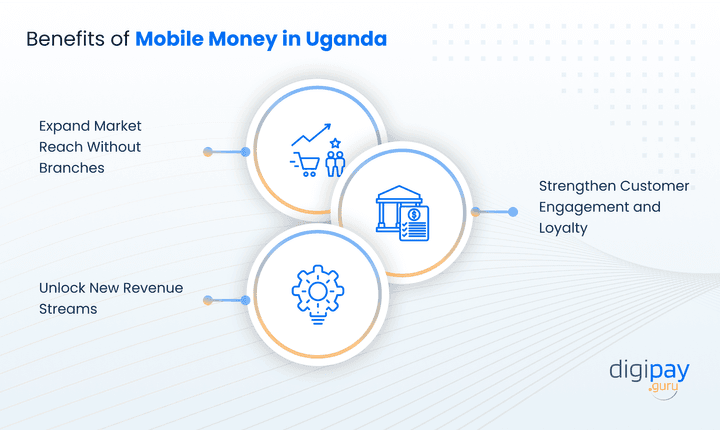

Benefits of Mobile Money in Uganda (For Banks, Fintechs & Financial Institutions)

Mobile money gives your business a direct line to new customers, new data, and new value. Let’s explore the benefits it unlocks for your business:

Expand Market Reach Without Branches

You don’t need branches to serve new markets anymore. Mobile money lets you meet customers where they are, in rural towns, urban slums, and growing digital hubs. Plus, it removes the infrastructure barrier and opens up acquisition channels at scale.

Here’s how you can expand your reach without physical investment:

-

Partner with mobile money agents

-

Offer services via mobile apps for finance in Uganda

-

Enable onboarding through USSD, QR, or agents

-

Reach new customer segments at a low acquisition cost

Unlock New Revenue Streams

Beyond holding deposits, mobile money opens up a wide range of monetization possibilities. You can turn everyday digital transactions into consistent revenue streams and deliver services customers actually use.

Here’s how to unlock new sources of revenue:

-

Offer nano-loans, micro-savings, and insurance

-

Leverage transaction fees, commissions, and float interest

-

Cross-sell financial products based on wallet activity

-

Earn through digital merchant payments and value-added services

Strengthen Customer Engagement and Loyalty

Mobile money platforms aren't just functional. But more than that, they are habit-forming. When people use a mobile money platform to send money, buy airtime, or pay bills daily, they build loyalty faster than they would with a branch. For businesses like yours, this opens the door to deeper engagement and higher lifetime value.

Here’s how mobile money helps strengthen customer loyalty and retention:

-

Daily use = high engagement

-

Easy to build behavioral insights

-

Personalized offers via mobile channels, and

-

Enable gamification and reward programs for savings and spending behavior

Enabling Uganda’s Digital Transformation through Mobile Money

Uganda's mobile money ecosystem is more than just financial infrastructure. It's driving national progress in how people pay, save, and interact with the economy.

Let’s look at how it powers broader digital transformation:

Building Blocks for a Cash-Lite Economy

Every mobile transaction moves Uganda one step away from cash dependency. It reshapes how people spend, save, and manage money, especially in remote and informal markets. This shift is behavioral as well as structural, with long-term economic benefits.

Here’s how mobile money supports Uganda’s journey toward a cash-lite economy:

-

Safer than cash

-

Reduces the informal shadow economy

-

Supports e-commerce and digital retail, and

-

Reduces theft, corruption, and fraud in financial transactions

Digital Identity and Interoperability

Interoperability is now at the core of Uganda’s mobile money ecosystem. Backed by national ID systems and proactive regulation from the Bank of Uganda, the system supports fluid movement across platforms and providers.

Here’s how digital identity and policy enable seamless financial access:

-

Easier KYC across platforms

-

Wallet-to-bank and wallet-to-wallet transfers

-

Seamless movement across the financial system

-

Enables aggregation of services on a single platform

Challenges and Limitations That Still Need Solving

Even the most transformative technologies come with real-world hurdles. Mobile money in Uganda is no exception. Its growth reveals both potential and pressure points.

Here are the key limitations you need to plan for:

Network Reliability and Agent Liquidity

Reliable infrastructure is essential to keep digital money flowing smoothly. But in Uganda, mobile money still faces hurdles like unstable networks and cash-strapped agents in rural zones. These pain points slow adoption and dent user confidence.

Here are the key challenges related to network and liquidity reliability:

-

Unstable connections can delay transactions

-

Agents may lack cash or float, especially in rural areas

-

Interrupts trust and usage patterns

-

Requires better agent liquidity forecasting tools

Fraud and Consumer Protection

As mobile money adoption grows, so do risks around user safety and digital fraud. From phishing scams to SIM swap attacks, the threats are evolving, and not all users are equipped to spot them.

Here’s where mobile money needs stronger protections:

-

Phishing, SIM swap, and social engineering attacks are rising

-

Some users lack digital literacy

-

There's a need for better complaint resolution and safety education

-

Stronger in-app fraud detection and user alerts needed

Regulatory and Cost Pressures

Regulatory uncertainty and inconsistent cost structures remain major barriers. And taxes, fluctuating tariffs, and shifting compliance expectations slow innovation and reduce user adoption, especially in low-income and rural areas.

Here are the most pressing regulatory and cost-related challenges:

-

Unpredictable mobile money tariffs in Uganda

-

Taxation on withdrawals has discouraged usage

-

Financial institutions face compliance challenges in innovation

-

Requires more transparent fee structures and regulatory clarity

How DigiPay.Guru Powers Mobile Money Solutions in Uganda

You need more than a software vendor. You need a strategic partner who understands the ground reality of launching and scaling mobile money in Uganda. That’s exactly what DigiPay.Guru brings to the table.

We build end-to-end digital wallet infrastructure for banks, fintechs, financial institutions, and other financial businesses tailored to Uganda’s regulatory, network, and user realities.

Whether it’s USSD-based onboarding, agent management, or wallet-to-bank interoperability, we deliver tools that simplify scale and ensure compliance.

At DigiPay.Guru, we help you build robust mobile money ecosystems fast:

-

Our mobile wallet Uganda platform supports USSD, QR, NFC, and agent workflows

-

Built-in KYC, transaction tracking, role-based permissions, and reporting tools

-

Modular and scalable from a mobile money business in Uganda to a cross-border remittance

-

Rapid go-live: launch in weeks, not months

-

Compliant with Bank of Uganda regulations and mobile money interoperability standards

Whether you're building from scratch or modernizing legacy systems, we help you go live faster, safer, and smarter with real-time visibility and secure digital rails.

Conclusion

Uganda has proven that mobile-first innovation can solve deep-rooted financial access challenges. From street vendors in Kampala to farmers in rural districts, mobile wallets have become a trusted tool for storing, sending, and managing money. This is no longer a temporary shift. It’s the foundation of Uganda’s future financial system.

For businesses like yours, this is your window to innovate, grow market share, and offer services that resonate with everyday Ugandans. Whether you want to reach rural customers, digitize payments, or offer embedded finance, mobile money is the shortest route.

But success here requires more than good tech. It calls for local context, smart compliance, fast rollout, and the ability to adapt.

That’s where DigiPay.Guru comes in.

At DigiPay.Guru, we don’t just build mobile wallets; we co-create solutions with you that meet Uganda’s market realities. From agent-driven onboarding to interoperable e-wallets and reporting built for regulators, we help you launch fast, scale confidently, and serve better.

Let’s unlock Uganda’s mobile money opportunity together.

FAQ's

As of the latest data from the Bank of Uganda, over 60% of Uganda’s adult population actively uses mobile money services. That translates to 35+ million registered mobile money accounts, a figure that continues to grow, especially in underserved and rural regions.

The two dominant players are

-

MTN Mobile Money Uganda – largest market share, extensive agent network, strong trust factor.

-

Airtel Money Uganda – fast-growing with competitive Airtel Money charges in Uganda and a wide rural outreach.

Other fintechs offer value-added services like digital lending, bill pay, and mobile wallets in Uganda that integrate with these platforms.

It solves a fundamental challenge: access to formal banking services. In rural Uganda:

Users can cash in/out via agents without traveling to urban centers.

It enables mobile money transfers to Uganda from family or aid organizations.

Farmers and traders transact securely, build financial identities, and access digital financial tools, often for the first time.

Yes. Mobile money reduces the risk of theft, fraud, and loss tied to carrying physical cash. Platforms offer PIN protection, SMS confirmations, and agent authentication. With features like transaction logs and MTN mobile money statement Uganda, users can track and verify every transfer.

Costs vary by provider and transaction type:

Mobile money charges in Uganda typically include withdrawal fees, P2P transfer costs, and transaction taxes.

MTN Mobile Money Uganda and Airtel Money Uganda publish transparent tariff tables.

Most platforms offer low cost or free services for small-value transactions to keep usage inclusive, especially in rural areas.