Every business wants to get paid. Every customer wants to pay their way. And in between sits the biggest opportunity for banks and fintechs: merchant payment acceptance.

It’s not just about POS machines or QR codes. It’s about giving businesses—your clients—the power to grow through seamless, secure, and flexible payment solutions. Yet, 65% of small and mid-sized businesses say their current setup is either outdated or fragmented.

That’s your opening.

Today’s businesses need more than a bank account. They need a partner who can help them accept all major payment types. Whether that’s credit cards, contactless payments, wallets, or Apple Pay.

You are giving them both a technical upgrade and a business advantage. An advantage that improves cash flow, boosts customer experience, and builds long-term loyalty.

In this blog, we’ll break down exactly how you can deliver merchant services for business that win trust, increase revenues, and set your business apart, powered by DigiPay.Guru.

Let’s dive in.

Introduction to Merchant Payment Acceptance

Before we jump into strategies and solutions, let’s get clear on the basics. Because to lead in this space, you need to speak the language of both business and technology.

What Is a Merchant in Payments?

A merchant is any individual or business that sells goods or services and wants to accept payments from customers.

This could be:

-

A small cafe accepting card payments

-

A boutique using a QR code for checkouts

-

An online seller with a payment gateway on their website

They all have one thing in common: they need to accept payments reliably, quickly, and across multiple channels.

And that’s where merchant payment acceptance activities come in. It’s the full stack of tools and infrastructure that helps these businesses get paid.

From the payment gateway to the settlement in their bank account, it’s everything that powers a smooth transaction experience. And as their banking or fintech partner, you’re in the perfect position to provide it.

Why Merchant Payment Acceptance Is the Lifeline of Business Growth

If you want your business clients to thrive, you need to help them get paid quickly, smoothly, and in any way their customers prefer.

Sounds simple, right?

But here’s the truth: payment expectations have changed. Shoppers now expect to pay with cards, wallets, QR codes, or even a tap from their phone.

And if your merchants can’t offer those options, they’re not just losing convenience; they’re losing customers.

Think about this:

-

42% of U.S. consumers would abandon a purchase if their favorite payment method isn't available. (PPRO)

-

Merchants who accept multiple payment types see 30–40% higher conversion rates. (Merchant Advisory)

That’s the real impact of merchant payment acceptance. By giving them the right merchant services, you help them earn more, and you grow too.

And when you provide better payment experiences to merchants, you become more than their payment partner. You become part of their growth story.

That’s what positions you, not just as a bank or fintech, but as their trusted business partner.

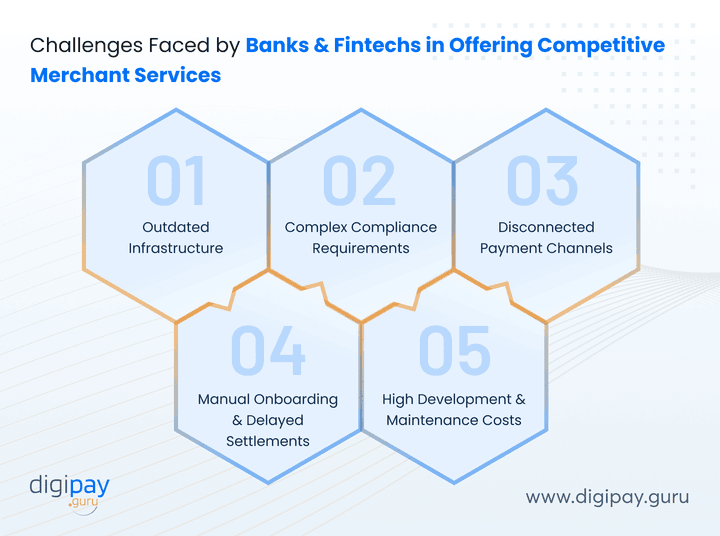

Challenges Faced by Banks & Fintechs in Offering Competitive Merchant Services

Delivering seamless, scalable merchant services for business isn’t as straightforward as flipping a switch.

Let's break down the key challenges you might face:

Outdated Infrastructure

Many banks and fintechs like yours still rely on fragmented systems or legacy tech stacks. These make it tough to integrate new features or scale quickly across channels like POS, QR, and ecommerce. That slows down your growth and your merchants' too.

Complex Compliance Requirements

Keeping up with PCI-DSS, KYC, AML, and local data laws is draining. And every regulation adds layers of complexity. Without built-in compliance tools, the burden grows and so does the risk.

Disconnected Payment Channels

Your merchants want to see their payments in one place. But many platforms keep online, in-store, QR, and mobile payments in separate silos. That creates confusion and poor user experiences.

Manual Onboarding and Delayed Settlements

Slow merchant onboarding kills momentum. And if funds don’t settle fast, merchants get frustrated. That’s a risk to your brand and their business.

High Development & Maintenance Costs

Building and managing your own merchant payment processing system can be very costly and unfriendly to your budget. Plus, keeping it updated is time- and resource-consuming from other priorities.

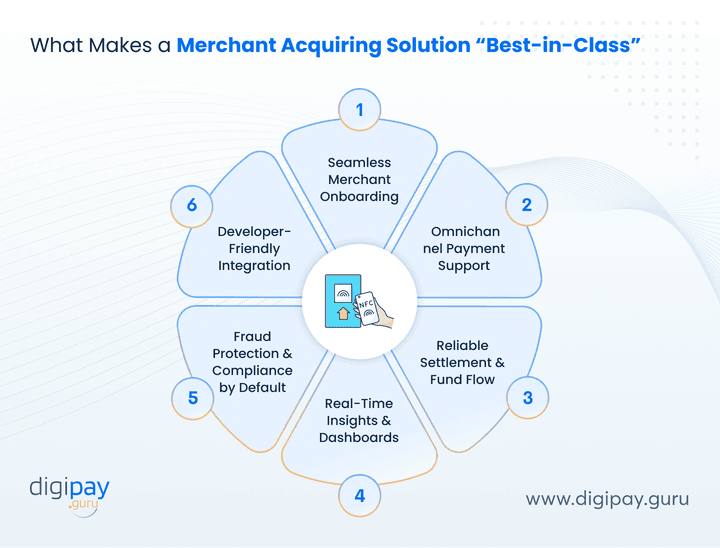

What Makes a Merchant Acquiring Solution “Best-in-Class”

Not all merchant acquiring solutions are created equal. If you're looking to serve modern businesses with real impact, you need more than just basic payment rails. You need a system that's smart, scalable, and built around the needs of your merchants and yours.

Here’s what a best-in-class solution should include:

Seamless Merchant Onboarding

Your platform should make it fast and easy for merchants to sign up, verify documents, and get started. Look for digital eKYC, automated approvals, and low-friction workflows.

Omnichannel Payment Support

The solution should support every relevant channel like POS, QR codes, e-commerce, mobile apps, and even contactless options like Apple Pay. Meaning one system, all major payment types.

Reliable Settlement & Fund Flow

Merchants care about cash flow. So a great platform ensures timely, transparent settlement options such as same-day, next-day, or custom cycles.

Real-Time Insights and Dashboards

Merchants want data and visibility. Hence, dashboards should offer real-time data on transactions, refunds, settlements, and disputes, all in one place.

Fraud Protection & Compliance by Default

AI-based monitoring, alerts, and dispute resolution tools should be built in. And yes, your solution should always stay ahead of PCI-DSS and AML rules.

Developer-Friendly Integration

Look for open APIs, quick plug-ins, and solid documentation. The easier it integrates, the faster you go to market.

All in all, a truly great merchant acquiring platform doesn’t just power transactions. It builds trust with your business clients.

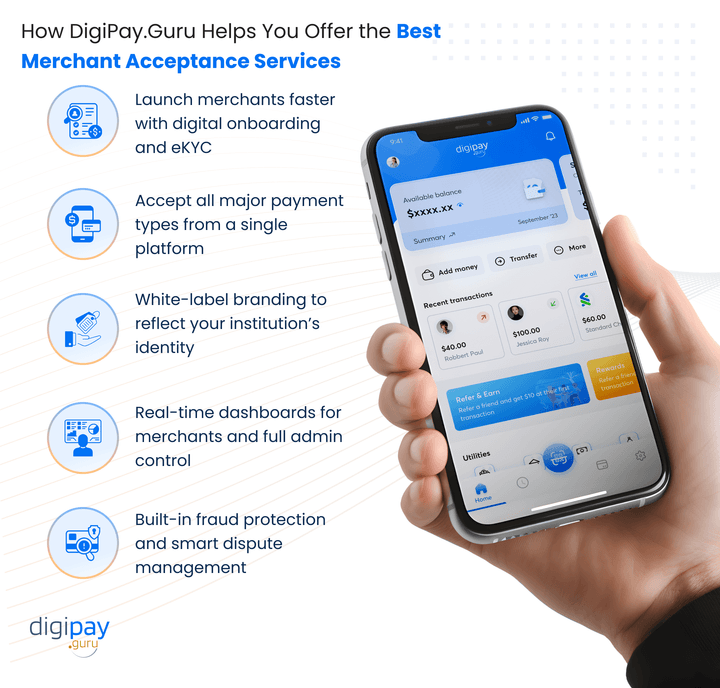

How DigiPay.Guru Helps You Offer the Best Merchant Acceptance Services

As a bank or fintech, you don’t have years to build, test, and scale a payment solution. You need something that works now, works well, and keeps your merchants happy. That’s where DigiPay.Guru makes a difference.

Our merchant acquiring solution is purpose-built for banks and fintechs like yours that want to launch fast, operate smart, and scale confidently.

Top features of DigiPay.Guru's merchant acquiring solution

DigiPay.Guru’s merchant acquiring solution is built for speed, scale, and simplicity. Here are the top features of DigiPay.Guru's merchant acquiring solution, you get:

1. Launch merchants faster with digital onboarding and eKYC

DigiPay.Guru enables frictionless onboarding with digital forms, instant eKYC, and automated verification. Merchants can start accepting payments within minutes. No paper, no back-and-forth, no bottlenecks.

2. Accept all major payment types from a single platform

Our platform lets your merchants accept all major payment types credit and debit cards, UPI, QR payments, wallets, net banking, Apple Pay, and contactless payments instantly. They offer more ways to pay, and you increase transaction volume.

3. White-label branding to reflect your institution’s identity

Our solution is white-labeled, which makes your platform fully customizable with your branding - logo, colors, and even messaging. It looks and feels like your product while running on our technology.

4. Real-time dashboards for merchants and full admin control

Merchants get detailed dashboards to monitor transactions, refunds, disputes, and settlements. And you get admin tools to monitor operations, performance, and system health anytime, in real time.

5. Built-in fraud protection and smart dispute management

DigiPay.Guru uses AI-powered risk detection to prevent fraud before it happens. Plus, automated alerts, dispute handling, and compliance tools reduce exposure and build merchant trust.

How This Empowers Merchants (Your Clients)

Whether it’s small retailers or growing e-commerce brands, your business clients want control, clarity, and confidence. They’re not looking for complicated dashboards or manual processes. They want tools that help them sell more, manage less, and get paid on time. That’s what DigiPay.Guru delivers.

Here’s what your merchants gain when you power them with our merchant acquiring solution:

Your business clients don’t want complexity. They want fast settlements, easy reconciliation, and payment types your customers prefer.

-

A unified dashboard that shows online, in-store, and QR payments in one place. So merchants know exactly what’s happening.

-

Faster settlement cycles—same-day, next-day, or custom options that improve their cash flow.

-

Dispute and refund tools built right in, which gives them autonomy and peace of mind.

-

Value-added features like loyalty offers and EMI options boost customer retention.

In short, you’re not just offering a payment tool. You’re helping merchants run smoother operations and grow their businesses with less stress and more clarity.

Benefits of Using DigiPay.Guru’s Merchant Acquiring Solution

You’re not just launching a payment service. You’re building a long-term growth engine.

Here’s how DigiPay.Guru helps you win:

-

Go live in weeks, not quarters, with a ready-to-deploy solution that cuts development time and cost.

-

Unlock new revenue streams from onboarding fees, premium features, and transaction commissions.

-

Gain full visibility through real-time admin dashboards that track merchant activity, disputes, and performance.

-

Stay compliant automatically with built-in PCI-DSS, AML, and tax tools with no manual chasing.

-

Retain merchants longer with modern features, faster settlements, and seamless experiences.

It’s everything you need to compete and lead in today’s dynamic payments landscape

The Strategic Opportunity For Your Business

The market is moving fast, and merchants are moving even faster.

They’re looking for partners who can help them accept payments easily, get settled quickly, and grow confidently. If your system doesn’t deliver that, they won’t wait around.

You have two choices:

-

Keep patching old tech while competitors run ahead.

-

Partner with a future-ready platform like DigiPay.Guru and leap ahead.

Delivering reliable, scalable merchant payment acceptance can transform how your business is perceived in the market.

DigiPay.Guru helps you launch fast, scale smart, and stay ahead of the curve.

Conclusion

Merchant expectations are changing fast. They want speed, simplicity, and payment flexibility. If you can’t offer it, they’ll find someone who can (your competitors).

With DigiPay.Guru’s merchant acquiring solution, you don’t just meet expectations; you exceed them. From seamless onboarding to multi-channel payment support, real-time insights, and affordable merchant services, you’re giving merchants the tools they need to grow.

And here’s the real win: when your merchants grow, you grow.

Whether you’re a bank looking to modernize your offering or a fintech ready to scale quickly, our platform helps you launch fast, stay compliant, and deliver real value.

Bonus? You don’t have to build it all from scratch. We’ve already done it for you. It’s white-labeled.

Now’s the time to lead and not play catch-up with the competitors.

FAQ's

Merchant payment acceptance refers to a business's ability to receive payments from its customers using various methods, such as cards, QR codes, wallets, UPI, net banking, or contactless options. It’s the core of how businesses get paid. As a financial institution, enabling this means you’re directly powering your merchants’ revenue streams.

A merchant is any individual, shop, or business that sells products or services and needs to accept customer payments. Whether it’s a retail store, a food truck, or an online seller, they all rely on merchant services to process transactions securely and efficiently.

Merchant services provide the tools and infrastructure a business needs to accept, process, and settle payments. Plus, they are the best payment solutions for small businesses. This includes payment gateways, point-of-sale systems, eKYC onboarding, fraud protection, reporting, and fast settlement into their bank account. With DigiPay.Guru, you offer all of this under one unified platform.

That depends on how you structure it. DigiPay.Guru offers a flexible, white-label solution that lets you control pricing, contracts, and terms. You can offer monthly plans, transaction-based models, or volume pricing, whatever suits your strategy and your merchants’ needs. No hidden penalties from our end.

The best service is the one that’s easy to onboard, accepts all major payment types, settles funds fast, and scales with the merchant’s growth. DigiPay.Guru checks all these boxes. It’s built to help your business clients accept payments confidently—online, in-store, or on the go.

Any business that accepts payments can benefit. That includes:

-

Hospitality

-

Healthcare

-

Retail stores

-

Restaurants & cafes

-

Travel & transportation

-

Entertainment & events

Whether they’re small shops or high-volume enterprises, our platform helps you serve every segment with ease.