According to the World Bank (2024), global remittance flows reached $905 billion — a record high. Yet, while volumes grow, so do customer frustrations with bank-led remittances

This shows that the global remittances are climbing every year. But so is customer frustration.

Sending money across borders through banks should be fast, secure, and seamless. Instead, it's never without complexity and friction. Your customers face long delays, unexpected fees, confusing forms, and poor visibility into where their money actually is.

What is Bank Remittance? Its Meaning & Definition:

Bank remittance means sending money via formal banking channels. That includes everything from SWIFT transfers and compliance checks to dealing with multiple correspondent banks. But for your customers, it's about one thing: getting money to their loved ones quickly and safely.

And when you and your platform fall short in delivering it, they leave.

In this blog, you'll learn:

-

What matters most to remittance users

-

The top 5 bank remittance challenges

-

Why banks struggle to fix them

-

How the right remittance solutions for banks can turn things around…

Let's begin by understanding what matters the most for remittance users.

The Real Reasons People Send Remittances and Why Every Minute Matters

Cross-border payments are transactions across borders, yes. But, that's not it. They are the acts of trust, urgency, and emotional connection as well.

That’s why every second counts and why delays can cost more than just time. Let’s unpack what truly drives remittances today.

Emotionally Driven, Time-Sensitive Transfers

Your customers are not here just making casual transfers. They’re sending money to cover essentials like medical care, school fees, or basic utilities. And a single delay can mean missed treatment, lost learning, or lights going out at home. This means that these transfers are urgent and deeply personal. You need to treat them that way. When you keep this emotional value in mind and make your remittance services accessible in that manner, your customers stay loyal.

Fintechs Have Raised the Bar

Modern users expect the same experience they get from top money transfer apps:

-

Real-time transfers

-

Full transparency on remittance costs

-

Instant notifications and tracking

-

Mobile-first design

If you can’t offer that? They'll find someone who can.

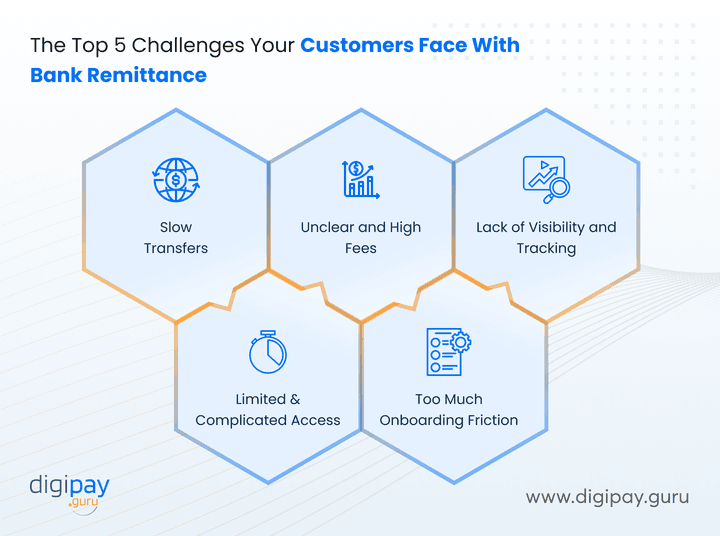

The Top 5 Challenges Your Customers Face With Bank Remittance

Now that you understand why speed and experience matter, let’s break down the pain points your customers face every single day.

1. Transfers Are Too Slow

The biggest complaint customers have in remittances? Payment delays.

Your customers expect money to arrive instantly but bank remittance systems can’t keep up. These slowdowns happen due to legacy infrastructure, long SWIFT chains, and manual compliance checks.

Many customers wait days and sometimes longer for their transfers to clear.

That’s unacceptable in an age of instant everything. Plus waiting this long feels frustrating. Risky, and completely avoidable.

2. Fees Are Unclear and Feel Excessive

Bank remittance fees often include:

-

Flat service charges

-

Hidden charges like FX rate markups

-

Unexpected third-party intermediary costs

-

Unclear service fees

Without a clear breakdown, your users feel cheated and can’t trust your remittance platform.

Customers begin to question whether their money is being spent wisely or simply eaten up by vague transaction fees.

3. There’s No Way to Track the Transaction

Customers want visibility. Instead, they’re left wondering:

-

Did the money arrive?"

-

"Why is it delayed?"

-

"Where’s my bank remittance receipt?"

This is because most traditional bank systems don’t provide real-time tracking or proactive status updates.

No tracking means anxious calls, poor remittance customer experience, and added pressure on your support team.

And when users can’t confirm whether the money arrived or where it’s stuck, they start looking for better & more transparent digital remittance services (your competitors).

4. Access Is Limited or Too Complicated

Many bank-led remittance services still rely on branch visits or outdated web portals. For a mobile-first generation, this is a deal-breaker. They want quick and easy access to services.

However, outdated apps, broken UX flows, or unclear bank remittance form processes push your users away. They’d rather choose apps that work the first time, every time.

5. Onboarding Is Full of Friction

Traditional lengthy Know Your Customer (KYC) procedures, paper-based forms, and repeated verifications kill momentum and lead to user drop-offs.

Even if your compliance checks are necessary, the process feels outdated. Plus, fintechs offer the same service in a few clicks without the pain. That’s where you risk losing users for good.

Why Banks Are Struggling to Fix This

If the problems are clear and the demand is obvious, why are banks still lagging behind?

Infrastructure Limitations Are Real

Most banks still operate on legacy infrastructure. These systems were never built for real-time remittance. On top of that, manual compliance workflows, outdated core banking modules, rigid SWIFT-only rails, and siloed operations slow everything down.

Due to this, changing even a small piece often feels like rewiring the entire engine and that’s why many banks stay stuck.

You Don’t Need to Rebuild. You Need the Right Partner

Tearing down your systems isn’t the solution and it’s not necessary. The right remittance solutions for banks integrate with your existing tech stack. Additionally, plug-and-play APIs, embedded AML/KYC, and modular flows reduce banking operational challenges.

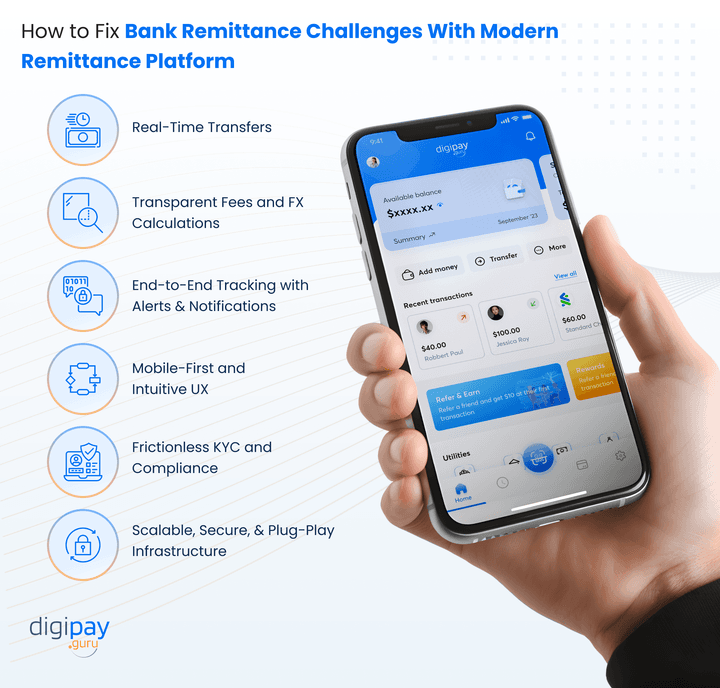

How to Fix It and What a Modern Remittance Platform Should Deliver

Solving these challenges doesn’t need a miracle. It just needs alignment between user expectations and tech capabilities. Here’s how the bank remittance problems can be solved:

1. Real-Time Transfers That Actually Arrive On Time

Legacy rails can't keep up with the speed needed today. A modern remittance platform connects directly with regional payout partners which bypasses the delays. This enables same-day or instant money transfers.

This, in turn, solves the most pressing bank remittance challenge: getting money where it needs to be, without the wait.

2. Transparent Fees and FX Calculators for Trust

Let users see exactly what they’re paying:

-

Real-time foreign exchange rates

-

Breakdown of bank remittance fees

-

Final received amount before sending

This builds trust, lowers support inquiries, and improves the remittance customer experience from the very first interaction.

3. End-to-End Tracking With Alerts and Notifications

From send to settle, let customers follow every step of their transaction smoothly.

A robust digital remittance service offers real-time updates via push notifications, SMS, or email. Whether it’s pending, approved, or received, users stay informed. This lowers anxiety, builds trust, and eliminates guesswork around the bank remittance receipt journey.

4. Mobile-First UX That Works for Everyone, Everywhere

Whether it's a farmer in Kenya or a student in Canada, your users expect convenience.

A modern remittance platform with a clean & intuitive mobile-first interface ensures fast access, easy form entry, and smooth navigation. From rural agents to urban expats, a platform that works for everyone improves adoption and reduces friction with every tap.

5. Frictionless eKYC and Compliance You Don’t Have to Keep Checking

Digital onboarding should be fast and compliant. Modern platforms streamline KYC and anti-money laundering (AML) processes using biometric scans, auto-ID verification, and real-time AML screening.

That means faster activations and fewer drop-offs without compromising on Know Your Customer (KYC) or anti-money laundering (AML) compliance requirements.

6. Scalable, Secure, & Plug-and-Play Infrastructure for Banks

The right solution plugs into your existing core banking stack without having to build it from scratch again. It supports:

-

SWIFT and non-SWIFT transfers

-

Regional corridors

-

Role-based access

-

ISO 20022 compatibility

This makes your infrastructure secure, scalable, fast, and future-ready without technical complexities.

How DigiPay.Guru Solves These Challenges

DigiPay.Guru offers a white-label, feature-rich remittance solution designed for banks, fintechs, financial institutions, and other remittance businesses. Here’s what you get:

-

Real-time transfers with smart routing

-

Global corridor support with local partners

-

Multi-currency FX engines with competitive rates

-

End-to-end tracking with branded receipts

-

Frictionless onboarding with digital eKYC and AML support

-

Agent network management for hybrid models

-

Mobile-first apps for both senders and receivers

It’s everything you need to upgrade your remittance experience, without reengineering your stack.

Whether you’re expanding corridors, reducing support costs, or increasing customer stickiness, DigiPay.Guru delivers measurable outcomes.

Clients using our platform have seen:

-

40% faster onboarding

-

3X increase in transaction volume

-

60% drop in remittance-related support queries

So choose wisely. Choose DigiPay.Guru.

Conclusion

Remittance is a promise to deliver money safely, quickly, and transparently. When that promise breaks, customers don’t wait to complain. They just leave. (For your competitors)

If transfers take too long, costs feel hidden, or there’s no way to track progress, users lose confidence. Frustrated by outdated systems, they turn to providers offering a faster and more transparent experience. And once they switch, it’s hard to win them back.

This shift doesn’t mean banks are falling behind because of poor intent. It often comes down to limited flexibility, old infrastructure, and missing the right tools. (which fintechs have already overcame)

The right platform changes that.

With DigiPay.Guru, you can improve speed, simplify compliance, increase visibility, and offer a mobile-first experience without changing your core banking system. It’s built to work around your structure, not against it.

That’s how you retain trust, increase adoption, and strengthen your remittance business in a digital-first world.

Schedule your demo today to explore how DigiPay.Guru can help you close the gap and stay ahead of the curve.

FAQ's

Bank remittances are often delayed due to legacy infrastructure, SWIFT dependency, manual compliance checks, and involvement of multiple correspondent banks. These outdated processes make it hard to move money in real-time. Without direct integrations or automation, even simple transfers can take days to complete.

High remittance fees stem from layered costs: bank service charges, FX rate markups, and third-party fees from intermediary banks. Many traditional systems don’t offer fee transparency, which makes it harder for customers to understand what they’re actually paying for and easy for trust to break down.

Use a platform that clearly displays all remittance costs upfront, including foreign exchange rates, service charges, and any additional third-party fees. Real-time FX calculators and transaction previews before sending reduced surprises and improving the user’s trust in your system.

A bank remittance form collects details required to send money abroad, such as sender and receiver information, transfer amount, account details, and reason for transfer. Poorly designed or unclear forms often create friction and user confusion, especially on legacy or non-digital platforms.

Banks can integrate modular remittance platforms using APIs that plug into their existing systems. These platforms provide features like smart routing, instant transfers, and embedded KYC/AML without the need for full infrastructure changes. It’s a faster, cost-effective path to modernization.