Over the past few years, financial services have moved from branches to browsers and now to mobile apps. Customers no longer wait in line to transfer money or open accounts; they expect everything to happen in seconds, from anywhere.

This shift has made FinTech mobile applications the backbone of modern banking and digital finance.

For banks, fintechs, and financial institutions like yours, that means one thing: adapt fast or fall behind. It’s not enough to have an app; it must be secure, scalable, and built to comply with regulations.

And finding the right FinTech app solution provider is where success really begins.

The leaders in this space combine in-depth industry knowledge with advanced technology. They don’t just build apps; they build ecosystems that connect payments, wallets, compliance, and customer experience into one seamless flow.

In this blog, we explore the top 10 FinTech mobile app solution providers for 2026: the ones shaping how the world experiences digital finance today and tomorrow.

Let’s begin with understanding what makes a great fintech app solution provider.

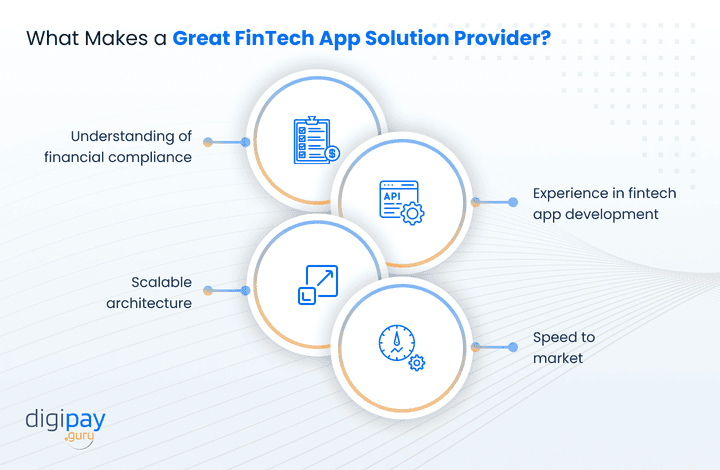

What Makes a Great FinTech App Solution Provider?

Every fintech mobile application company claims to be “innovative” or “cutting-edge.” But only a few truly deliver.

A FinTech App Solution Provider is more than just a developer. It’s your strategic technology partner. It’s the one who helps you go from concept to launch, while ensuring your app is compliant, scalable, and secure.

So, what sets the best apart from the rest? Let’s decode it.

- Understanding of financial compliance: Providers must know PCI DSS, PSD2, and AML like the back of their hand.

- Experience in fintech app development: They should’ve already delivered successful banking, remittance, or wallet apps.

- Scalable architecture: Cloud-native and API-first frameworks ensure your platform grows with you.

- Speed to market: In fintech, being first isn’t everything, but being fast is.

A great partner won’t just help you build a fintech app; they’ll help you build trust in a world where security is the new currency.

Key Evaluation Criteria

When evaluating FinTech mobile app solution companies, focus on these five core pillars. Each one directly impacts your user experience, compliance, and long-term ROI.

They are:

| Criteria | Description | Why It Matters |

|---|---|---|

| Compliance Expertise | Familiarity with PCI DSS, PSD2, GDPR, AML | Builds trust and prevents regulatory risks |

| Scalability & Architecture | Modular, API-first, and cloud-native | Future-proofs your app for new markets |

| Security Layers | Encryption, biometrics, fraud prevention | Keeps transactions safe and data protected |

| Industry Experience | Proven fintech and banking projects | Reduces development risk |

| Time-to-Market | White-label or low-code frameworks | Enables faster app deployment |

Each factor plays a role in determining not just how fast your app launches, but how long it thrives.

Because in fintech, speed gets you users, but compliance keeps them.

Global Market Outlook: FinTech App Growth in 2026

The global fintech app development landscape is booming. 2026 is expected to be the most transformative year yet, driven by new regulatory frameworks, embedded finance, and digital inclusion across emerging markets.

Here’s how the FinTech app market looks globally:

| Region | Market Share (2026) | CAGR (2024–26) | Key Growth Drivers |

|---|---|---|---|

| APAC | 40% | 32% | Super apps, QR payments, digital wallets |

| MENA | 25% | 27% | Cross-border remittance, neobanks |

| Africa | 18% | 35% | Mobile money, agent networks |

| Europe | 12% | 20% | Open banking, regtech innovation |

| North America | 5% | 15% | BNPL, embedded finance, data security |

The takeaway: The next fintech revolution won’t be driven by giants. It’ll be powered by mobile-first, API-led FinTech app development companies that can localize, scale, and integrate fast.

Top 10 FinTech Mobile App Solution Providers in 2026

Choosing the right fintech app solution provider can define your digital transformation journey.

Here’s a curated list of the top 10 global fintech mobile app solution providers leading the charge in 2026.

1. DigiPay.Guru

Core Offering: White-label eWallet, digital wallet, remittance, eKYC, prepaid card issuance & management, and merchant acquiring.

Ideal For: Banks, fintechs, financial institutions, NBFCs, telcos, MTOs, and more.

Headquarters: India / Global

DigiPay.Guru has emerged as one of the most comprehensive FinTech app solution providers of 2026. Its white-label ecosystem enables businesses to launch eWallet, digital wallet, remittance, eKYC, prepaid card issuance & management, and merchant acquiring systems faster than ever, all without starting from scratch.

The platform’s modular, API-first architecture gives financial institutions the flexibility to scale effortlessly across borders. With built-in eKYC and AML compliance modules, DigiPay.Guru helps clients stay ahead of regulations while ensuring smooth onboarding and transaction safety.

What sets DigiPay.Guru apart is its real-world adaptability: it supports mobile, web, and even USSD channels, which makes it ideal for both developed and emerging markets. Its proven presence in 20+ countries and experience across diverse financial ecosystems make it a reliable partner for institutions aiming to innovate confidently and expand globally.

2. Mobifin

Core Offering: Digital banking, wallet, and payment infrastructure

Ideal For: Microfinance institutions, cooperative banks, and financial enterprises

Headquarters: India

Mobifin specializes in helping traditional banking systems transition to digital-first models. It focuses on mobile and agent-led financial ecosystems, empowering organizations in regions with limited connectivity.

Its robust backend and simple UI help financial institutions roll out mobile banking and wallet solutions that work seamlessly both online and offline.

3. Velmie

Core Offering: Core banking platform, investment, and savings app development

Ideal For: Neobanks, challenger banks, and fintech startups

Headquarters: USA

Velmie provides banking infrastructure-as-a-service that accelerates fintech innovation. With a strong focus on core banking APIs, investment platforms, and compliance-ready architecture, Velmie helps startups and neobanks build scalable fintech apps quickly.

Its open-banking approach ensures easy integration with third-party services and accelerates product deployment.

4. Appinventiv

Core Offering: Custom fintech app development and UX/UI design

Ideal For: BFSI enterprises and digital-first financial brands

Headquarters: India

Appinventiv stands out for its custom app development capabilities across the BFSI sector. The company delivers high-performance fintech mobile applications focused on user experience, security, and scalability.

From neobank apps to wealth management platforms, Appinventiv’s team combines technical precision with creative design, thereby helping brands launch customer-centric financial products that drive engagement.

5️. Tmob

Core Offering: Omnichannel fintech and telco app platforms

Ideal For: Telecom operators and financial service providers

Headquarters: Turkey

Tmob bridges the worlds of telecom and fintech through its omnichannel digital platforms. It enables telcos to diversify into digital banking, micro-lending, and wallet services using pre-built, customizable frameworks.

With a focus on speed, reliability, and user engagement, Tmob helps telecom-led fintech ecosystems grow faster in competitive markets.

6️. Mambu

Core Offering: Cloud-native core banking platform

Ideal For: Banks, digital lenders, and neobanks

Headquarters: Germany

Mambu is recognized globally for its composable core banking systems. It offers a modular platform where institutions can add, remove, or modify financial services without disrupting operations.

This makes it ideal for organizations that want to digitize legacy systems while staying flexible for future innovations. Mambu’s cloud-first approach reduces maintenance costs and enhances operational agility.

7️. Fintelics

Core Offering: Blockchain and AI-driven fintech platforms

Ideal For: DeFi, crypto startups, and AI-led fintech projects

Headquarters: Canada

Fintelics brings innovation through AI, blockchain, and smart contract-based fintech development. Its expertise lies in building decentralized finance (DeFi) and crypto platforms that prioritize transparency and automation.

The company’s AI-enabled analytics tools help fintechs make smarter lending, risk, and investment decisions.

8️. VeriPark

Core Offering: CRM and digital banking front-office solutions

Ideal For: Traditional banks and insurance providers

Headquarters: United Kingdom

VeriPark focuses on enhancing customer engagement for banks and insurers through intelligent CRM solutions and digital front-office systems. Its platforms are designed to improve relationship management, streamline onboarding, and personalize financial experiences across web and mobile.

VeriPark is a go-to choice for institutions looking to modernize without overhauling their core systems.

9️. Netsmartz

Core Offering: Outsourced fintech development services

Ideal For: Fintech startups and scaling enterprises

Headquarters: USA

Netsmartz offers flexible, outsourced fintech app development for organizations that need expert teams on demand. It’s particularly popular among startups and mid-sized fintech companies looking to accelerate time-to-market while keeping costs manageable.

Netsmartz’s focus on agile development and global delivery models ensures smooth execution from prototype to launch.

10. Konsentus

Core Offering: Open banking compliance and API data security

Ideal For: Banks, payment gateways, and fintech aggregators

Headquarters: United Kingdom

Konsentus provides specialized solutions for open banking compliance and secure API management. Its products enable banks and fintechs to protect consumer data and meet evolving regulatory frameworks like PSD2 and GDPR.

With a strong reputation for reliability and precision, Konsentus is trusted by financial institutions navigating the complexities of data sharing and regulatory compliance in Europe and beyond.

TL;DR?

| Rank | Company | Core Offering | Ideal For | Headquarters |

|---|---|---|---|---|

| 1 | DigiPay.Guru | White-label wallet, remittance, eKYC, card issuance, and merchant management | Banks, fintechs, remittance providers | India / Global |

| 2 | Mobifin | Digital banking, mobile wallet, and payments infrastructure | Banks & microfinance | India |

| 3 | Velmie | Core banking platform, investment & savings app development | Neobanks & fintech startups | USA |

| 4 | Appinventiv | Custom fintech app development & UX design | BFSI & financial enterprises | India |

| 5 | Tmob | Omnichannel fintech & telco apps | Telecom-led financial services | Turkey |

| 6 | Mambu | Cloud core banking backend | Banks & digital lenders | Germany |

| 7 | Fintlecs | Blockchain & AI fintech platforms | Crypto & DeFi startups | Canada |

| 8 | VeriPark | CRM and digital banking front-office | Traditional banks & insurers | UK |

| 9 | Netsmartz | Outsourced fintech development | Fintech scale-ups | USA |

| 10 | Konsentus | Open banking compliance & data security | Banks & API providers | UK |

Comparative Analysis: Choosing the Right FinTech Partner

Now that we’ve met the top players, how do you decide who’s the right fit for your business goals?

Here’s a quick comparison highlighting the core strengths of leading FinTech app development companies.

| Feature / Provider | DigiPay.Guru | Mobifin | Velmie | Mambu |

|---|---|---|---|---|

| White-label Wallet | ✅ | ✅ | ✅ | ❌ |

| Cross-border Remittance | ✅ | ✅ | ✅ | ❌ |

| Core Banking Backend | ✅ | ✅ | ✅ | ✅ |

| AI/Analytics | ✅ | ✅ | ✅ | ✅ |

| Time-to-Market | ⚡ Fast | ⚡ Fast | 🕒 Moderate | ⚡ Fast |

| Regulatory Compliance (AML/KYC) | ✅ | ✅ | ✅ | ✅ |

| Ideal For | Banks, Fintechs | MFIs | Startups | Banks |

Quick Insight

Why DigiPay.Guru Leads the FinTech App Space in 2026

Here’s where DigiPay.Guru truly shines as a FinTech app solution provider.

In an industry where innovation meets regulation, DigiPay.Guru bridges both worlds with precision.

Its white-label platform offers more than just a product. It’s a ready-to-launch fintech ecosystem.

Key Strengths

| Feature | Description | Business Benefit |

|---|---|---|

| White-Label Platform | Customizable wallet & remittance suite | Rapid market entry |

| Omnichannel Ecosystem | Supports mobile, web, and USSD | Scalable reach in developing markets |

| eKYC & AML Module | Built-in verification engine | Compliant user onboarding |

| API-First Architecture | Open integrations with banks & fintechs | Seamless scalability |

| Real-Time Analytics | Data-driven insights | Improve revenue & compliance |

| Global Expertise | Deployments in 20+ countries | Trusted by leading fintech brands |

When you’re building fintech applications in banking, speed and compliance define success.

That’s exactly where DigiPay.Guru stands tall by combining innovation, interoperability, and trust in one unified platform.

💡 In fintech, innovation without compliance is like a car without brakes: fast but risky. DigiPay.Guru gives you both speed and safety.

Conclusion

The FinTech app race in 2026 is more competitive than ever. And the fintech industry is in the middle of its most transformative phase.

Mobile apps have become the bridge between people and their money, while offering convenience, accessibility, and speed like never before.

For banks, fintechs, and financial institutions like yours, this evolution means one thing: the need for a trusted technology partner who understands both finance and innovation.

Choosing the right FinTech app solution provider goes beyond app development. It’s about finding a partner who brings together compliance, scalability, and a deep understanding of digital finance.

Each company on this list has carved its space, but your ideal partner should align with your long-term growth goals.

That’s where DigiPay.Guru stands out. With its proven white-label platforms, regulatory expertise, and deployment across 20+ countries, DigiPay.Guru helps financial institutions launch faster, scale smarter, and deliver seamless mobile experiences that customers trust.

It’s not just about building fintech apps; it’s about building the future of digital finance.

FAQs

A FinTech mobile app is a digital platform that allows users to perform financial activities like payments, money transfers, investments, or banking through their smartphones, securely and in real time.

Some of the best FinTech app solution providers in 2026 include DigiPay.Guru, Mobifin, Velmie, Appinventiv, and Mambu, all known for innovation, scalability, and strong compliance expertise.

Choose a provider with proven industry experience, robust security, regulatory compliance, and an API-first architecture that allows your business to scale and integrate new financial services easily.

A modern FinTech app should have biometric login, multi-layer security, eKYC, real-time payments, analytics, and a smooth user interface that enhances trust and customer engagement.

The cost varies by app type, features, and region, but typically ranges between $80,000–$300,000. White-label platforms like DigiPay.Guru can significantly reduce cost and time to market.

DigiPay.Guru stands out for its white-label platform, rapid deployment, global reach, and built-in compliance tools like AML and eKYC, thereby helping financial institutions launch faster with confidence.

Unlike custom developers, DigiPay.Guru offers a ready, modular fintech ecosystem that covers wallets, remittance, merchant acquiring, and compliance, all under one scalable, integration-friendly platform.

A typical custom app may take 6–12 months, depending on complexity. However, DigiPay.Guru’s white-label fintech solutions allow institutions to launch secure, compliant apps in just a few weeks.