The payments landscape has changed, and your merchants are aware of it.

It’s not enough to just offer a payment gateway. Merchants expect more: multiple payment channels, faster processing, higher success rates, and total reliability. They want flexibility and control. And if they don’t get it from you, they’ll find it somewhere else.

If you offer merchant payment acceptance services, you are delivering more than processing transactions. You’re delivering customer experiences, reducing churn, and enabling your merchants to grow.

But here's the catch! The more you scale, the more complex it gets. And juggling multiple PSPs, payment methods, and compliance needs can quickly turn into a mess.

Good news? Payment orchestration solves that.

It streamlines the chaos. It helps you route smartly, scale faster, and serve better. And most importantly, it helps you offer the kind of payment experience that modern merchants expect & deserve.

Don't worry if you don't know what it is or if you have just heard but aren't clear about it. This blog is made with all your queries in mind.

Let’s walk through what payment orchestration means, how it works, and how it can make your acquiring services smarter and more competitive.

Here we go…

What is Payment Orchestration?

Payment orchestration refers to a centralized platform that manages the end-to-end payment flow across multiple gateways, processors, and methods. It acts like a conductor of your unified payment stack.

You get a layer between your merchant frontend and the backend PSPs, fraud systems, and compliance modules. It does the heavy lifting: from routing payments smartly to ensuring compliance across borders.

Unlike a traditional single-gateway model, a payment orchestration platform gives you flexibility. You can connect to multiple payment orchestration providers, route traffic based on success rates, and reduce dependencies.

In short, it gives you control. And that control turns into higher success rates, lower costs, and happier merchants.

Here’s a quick example:

A merchant in Africa using your acquiring platform wants to accept mobile money, card payments, and QR codes across multiple countries. Instead of building a custom integration for each provider in every country, your orchestration layer connects to multiple PSPs behind the scenes and automatically routes each transaction to the most suitable one based on geography, cost, and success rate.

How Does Payment Orchestration Work in Acquiring?

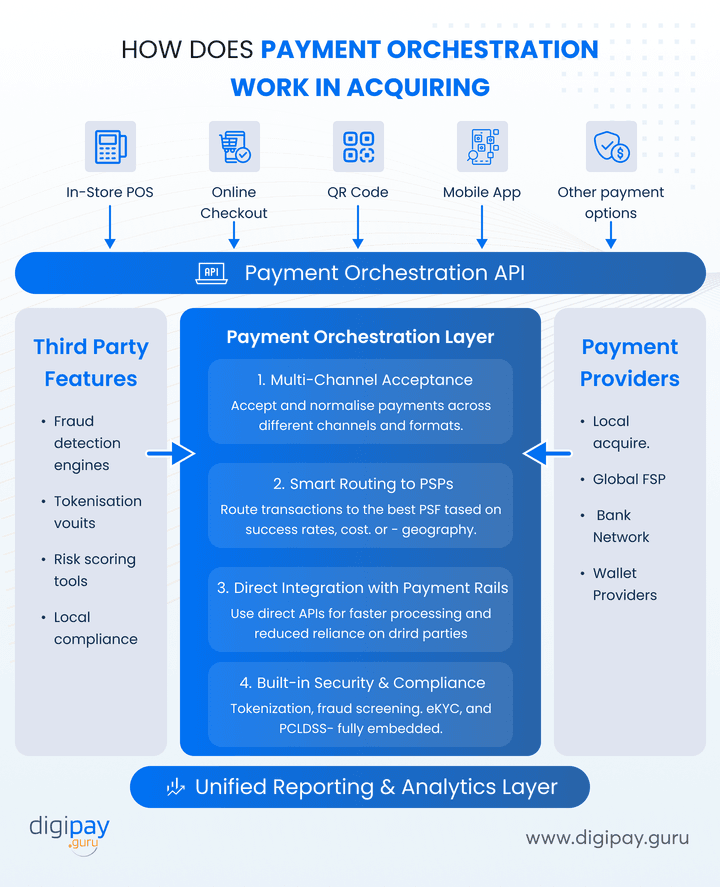

Let’s break it down. Here’s how a modern payment orchestration layer works:

Step 1: Accepting Payments Through Multiple Channels

Your merchants aren’t one-size-fits-all. Some want in-store QR payment acceptance. Others are scaling across borders with online checkouts. A payment orchestration platform enables multi-acquirer routing and consolidates all payment types in one dashboard.

Step 2: Routing Transactions Through Gateways and Providers

With orchestration, transactions are routed to the best gateway in real-time based on success rates, cost, or geography. This improves reliability and removes dependency on a single provider, which gives you more control and flexibility.

Step 3: Using Direct Integrations for Faster Processing

Orchestration uses direct APIs to connect with local and global payment rails. This eliminates delays, reduces third-party reliance, and accelerates time to market for new payment methods or merchant needs.

Step 4: Implementing Security Measures and Compliance

Security and compliance are built-in, not bolted on. Orchestration includes tokenization, fraud screening, eKYC, and PCI DSS tools to protect transactions and simplify regulatory checks across all regions.

Why Do Banks & Fintechs Need Payment Orchestration?

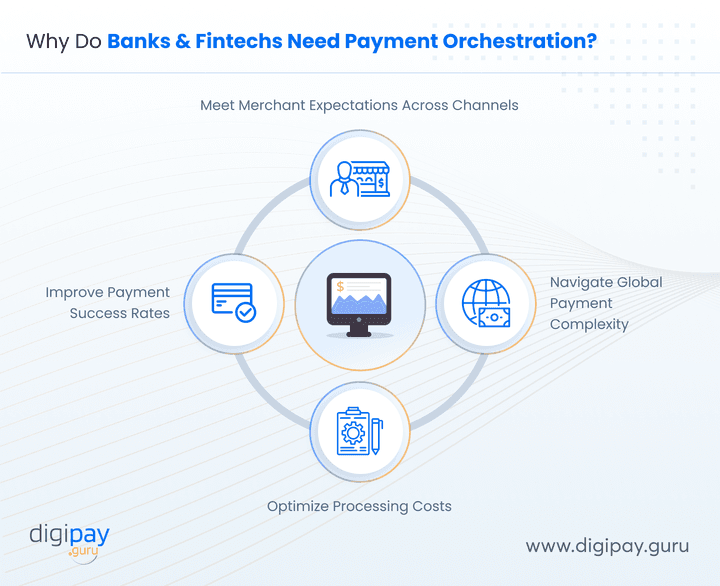

You’re in a competitive space. Merchants won’t wait for you to fix downtime or expand to new methods. Here’s why payment orchestration companies are essential enablers for banks & fintechs like you:

Meet Merchant Expectations Across Channels

Merchants expect a consistent payment experience, be it online, offline, or in-app. Orchestration helps you support all payment types, routes, and devices from a single platform, so your merchants get reliability and choice without operational headaches.

Navigate Global Payment Complexity

Each region has its own rules, rails, and risks. A payment orchestration platform abstracts that complexity and helps you offer local relevance with global reach. Plus, you can connect to local gateways, manage currency differences, and stay compliant in each region without separate builds or long development cycles.

Optimize Processing Costs

Different gateways mean different fees. So why pay more when you can route smartly?

Payment orchestration helps you route transactions based on cost-efficiency. This way, you avoid unnecessary fees, unlock volume-based discounts, and fine-tune your margins without sacrificing performance for savings.

Let’s break it down visually:

Scenario: A merchant in Nigeria accepts card payments from multiple African countries. You’re connected to 3 PSPs:

- PSP A: 2.9% per transaction

- PSP B: 2.5% per transaction

- PSP C: 2.2% for transactions above $100

Orchestration flow:

1 Transactions under $100 go to PSP B (cheapest at low volume)

2 Transactions above $100 go to PSP C (discount kicks in)

3 If PSP B is down, transactions auto-route to PSP A

Result: You reduce average transaction cost without lifting a finger. Your merchants get consistent uptime, and you maintain control over routing logic, fees, and provider mix, all in real time.

Improve Payment Success Rates

Failed payments lead to lost sales and frustrated merchants. But there's no need to worry with orchestration. Payment orchestration offers retry logic and automatic failover to alternate providers. That means fewer declines, smoother checkouts, and a stronger reputation as a reliable acquirer.

Key Benefits of Using a Payment Orchestration Platform

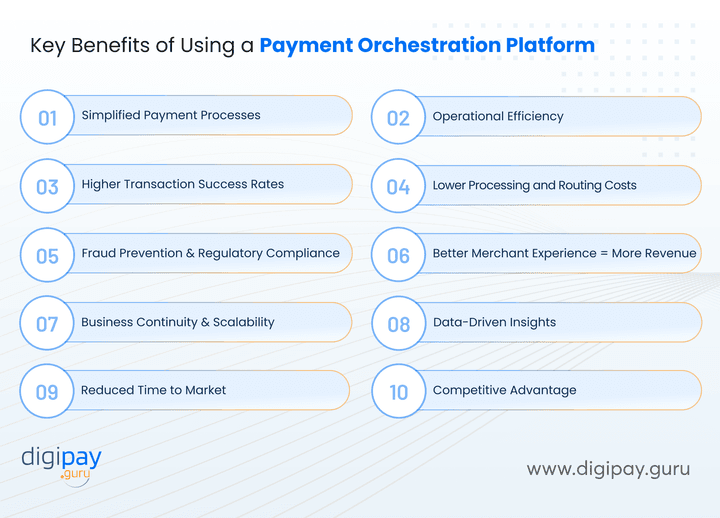

When you have orchestration built into your acquiring platform, everything just works better for your merchants, from payments and reporting to onboarding and performance. Here are the key benefits you get:

Simplified Payment Processes & Operational Efficiency

Instead of toggling between multiple dashboards or chasing reconciliation errors, you get one clean, unified view. Settlements, reporting, and routing all happen automatically. And your team spends less time on support and more time scaling operations.

Higher Transaction Success Rates

Every failed transaction costs trust and revenue. Orchestration helps you route payments to the best-performing gateway automatically. And if one fails? It retries instantly with another. This way, you deliver smoother checkouts, fewer declines, and a consistent merchant experience that builds long-term loyalty.

Lower Processing and Routing Costs

With orchestration, you don’t need to guess which route is cheapest. You set the logic, and the engine takes care of the rest. It picks the most cost-effective payment provider for every transaction, so you protect your margins and keep pricing sharp for your merchants.

Fraud Prevention & Regulatory Compliance

Security and compliance don’t have to slow you down. With fraud checks, tokenization, AML, and eKYC already in place, you stay compliant from day one. And you don’t need a patchwork of tools but just a single & orchestration-ready layer that handles risk without adding friction.

Better Merchant Experience = More Revenue

Merchants don’t want to chase down failed payments or wait days for onboarding. Merchants want fast onboarding, fewer issues, and full visibility into performance.

Orchestration helps you deliver that. With it, you can give them a plug-and-play experience that just works. And when they process more payments through your stack, your revenue goes up too.

Business Continuity & Scalability

Downtime kills trust for your merchants. If one PSP fails or goes offline, orchestration switches traffic instantly to another (backup). And when you're ready to expand into a new country or support a new method, you already have the integrations ready to go.

Data-Driven Insights & Competitive Advantage

You can’t optimize what you can’t see. With orchestration, you get real-time analytics on transaction flows, PSP performance, and customer behavior. You can:

-

Share insights with your merchants

-

Adjust routing logic, and

-

Spot trends before they become problems

That’s how you win in a competitive market.

Reduced Time to Market

Adding a new PSP or launching in a new region or new partner integration shouldn’t take months. With orchestration, you’re not starting from scratch. You can integrate once and scale endlessly. That means your roadmap moves faster, and your merchants get the speed they need to stay ahead.

Competitive Edge in Fintech and eCommerce Payments

When merchants compare providers, they look for speed, flexibility, and results. If your platform offers orchestration-level features like smart routing, real-time analytics, and built-in compliance, you don’t just compete. You stand out and win the deals that matter. And that’s how you stay one step ahead in fast-moving markets.

Financial Impacts of Payment Orchestration for Acquirers

When you think about orchestration, it's easy to focus on tech. But its real value is in its financial upside.

Below, let’s explore the key financial impacts of payment orchestration for you as an acquirer (bank or fintech):

Revenue Optimization

When more payments go through successfully, you earn more without changing your pricing. Payment orchestration lets you route every transaction to the PSP most likely to approve it.

That means:

-

Fewer failed attempts

-

Higher approval rates and

-

More volume moving through your platform

Improved Cash Flow

Waiting for settlements can be painstaking for your merchants. But with orchestration, it becomes a piece of cake.

Payment orchestration speeds up routing and processing so that funds move faster. It also helps reduce chargebacks and settlement delays, which makes your cash position more predictable and a whole lot healthier.

Better Financial Management

When you rely on multiple PSPs, your finance team ends up juggling spreadsheets, emails, and recon files. Orchestration changes that. You get a clean, real-time view across providers. Reconciliation gets easier. Audits get cleaner. And reporting becomes a strategic advantage, not a monthly scramble.

Customer Retention and Loyalty

Merchants stay where payments are smooth. If they trust your platform to deliver reliable uptime and clean performance, they have no reason to look elsewhere. Orchestration helps you build that trust by minimizing errors, improving reliability, and keeping your merchants processing happily through your rails.

Challenges Associated with Payment Orchestration

No system is without its challenges. And orchestration is no exception. But when you understand the hurdles, you can plan for them and move forward with clarity. Here are a few (solvable) challenges of payment orchestration:

Integration Complexity

Your legacy systems and existing PSPs might not play nicely together right away. Orchestration means stitching them into a unified flow, which takes time, effort, and clean APIs.

Compliance Is Not One-Size-Fits-All

If you are operating across different countries, you’re navigating different rules, licenses, and reporting standards. Orchestration simplifies the tech, but you still need sharp regulatory know-how and adherence.

Need for Team Upgradation

There’s more to orchestration than just plugging in tools. Your ops and support teams will need to understand how flows work, how to troubleshoot faster, and how to manage PSP relationships strategically.

But there’s good news! You can solve these challenges too!

You don’t have to build or learn all of it from scratch. When you use a platform that gets it right out of the box, like DigiPay.Guru, half the battle is already won.

DigiPay.Guru gives you an orchestration-ready acquiring solution that’s already built for scale. You get multi-PSP support, smart routing, security layers, and real-time visibility without months of dev work. It’s built so you can serve your merchants better, faster, and smarter.

How DigiPay.Guru Enables Orchestration-Ready Merchant Acquiring

We get it. You don’t want more complexity. You want something that works out of the box, flexes with your needs, and scales without slowing you down. That’s exactly what DigiPay.Guru is built for.

Our platform helps banks and fintechs offer orchestration-ready acquiring services (payment acceptance) without the mess of custom builds or siloed systems.

Here’s how:

-

Multi-PSP Infrastructure: Connect to multiple PSPs across online, POS, QR, and mobile channels, all through a single interface.

-

Smart Routing & Failover: Route transactions based on success rate, cost, or location. If one PSP goes down, we switch instantly. So that your merchants’ payment acceptance never stops.

-

Built-in Security & Compliance: From tokenization and 3DS to eKYC and AML, we handle the heavy security and regulatory lifting.

-

Real-Time Data & Analytics: Track everything. Understand what’s working. Share insights with your merchants with dashboards for easy and real-time data & insights.

-

Modular APIs: DigiPay.Guru’s solution comes with API-driven efficiency, which helps you go live faster. Plus, you can add new payment methods or geographies without rebuilding your stack.

All in all, whether you’re scaling into new markets, onboarding more merchants, or just trying to deliver more value, DigiPay.Guru gives you the control and confidence to do it right.

Conclusion

The more your merchants grow, the more they expect. They want faster onboarding, more payment options, & fewer failures.

As a bank or fintech, your ability to deliver on those expectations depends on how strong and flexible your infrastructure really is.

Payment orchestration can future-proof your acquiring business. It gives you the tools to respond faster, route smarter, and scale globally without breaking things.

If you're still running multiple PSPs without a central layer to manage them, you're holding back your team and your merchants. It will cost more than just downtime or complexity. It’s a lost opportunity.

But DigiPay.Guru helps you change that.

Our merchant acquiring solution is built with orchestration at the core. You get real-time control, faster time to market, and a platform that grows with your merchants.

If you're ready to simplify your stack and serve your merchants better, we’re here to help.

Let’s build something smarter, together.

FAQ's

Using one PSP locks you into their pricing, performance, and downtime. With payment orchestration, you can connect to multiple PSPs and route transactions based on success rate, cost, or geography. It gives you more control, flexibility, and business continuity.

Managing multiple PSPs manually creates complexity, different dashboards, settlement cycles, and compliance processes. Orchestration brings all of that into one unified layer, which streamlines everything from routing to reconciliation and frees up your ops and tech teams.

It automatically routes each transaction to the PSP most likely to approve it. If one fails, the system retries instantly through a backup. This way, you avoid declines, improve conversions, and deliver a smoother experience to your merchants and their customers.

It depends on your stack, but that’s where DigiPay.Guru helps. Our platform is modular and API-first, which means it can sit over your existing systems and unify them without starting from scratch. Integration is fast, and support is built in.

You get a real-time view across all PSPs about success rates, transaction volumes, routing paths, and failure trends. You can also share performance insights with merchants and use the data to optimize costs, spot risks early, and make smarter decisions.