FinTech

South Africa

Digital Wallet Solution

Challenges

Sendalula’s team had a clear vision, but execution came with operational and technical roadblocks. From performance limitations to compliance complexity, they needed a robust digital wallet partner to overcome these hurdles.

1. Large App Size

Sendalula’s initial build was too heavy for many target users. In areas with poor connectivity or limited device storage, downloading the app became a barrier. This significantly affected early adoption and market penetration across underbanked zones.

2. Onboarding & KYC

The original onboarding journey was fragmented, complex, and time-consuming. And regulatory shifts in South Africa added pressure to build a flow that was not only intuitive for users but flexible enough for future compliance updates without frequent code changes.

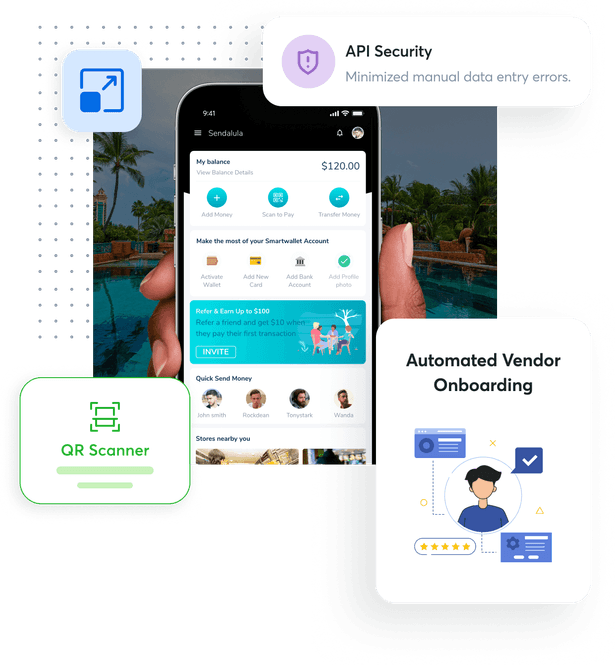

3. API Security

BNV required API security that went far beyond standard implementations. The default unencrypted endpoints left room for exploitation, which could compromise customer trust, data privacy, and overall credibility in high-stakes industries.

4. QR Scanner Performance

The in-app QR scanner was lagging and frequently failed to detect codes on the first try. For users making quick merchant payments, this led to frustration and drop-offs. This undermined one of the wallet’s core utility features.

Solutions

To bring Sendalula’s vision to life, DigiPay.Guru deployed strategic fixes across user experience, backend security, and mobile performance, tailored specifically for industrial use cases and unpredictable network conditions.

1. App Size Reduction

We implemented Android app bundles to streamline Sendalula’s build and shrink the download size by nearly 50%. This immediately improved install success rates, especially in rural or low-bandwidth areas with basic smartphone adoption.

2. Simplified Onboarding/KYC

We built a modular, guided onboarding flow with dynamic KYC configuration. This allowed admins to update document requirements or steps without app redeployment, which, in turn, ensured full compliance with evolving financial regulations in real time.

3. Enhanced REST API Security

To safeguard transactions, we encrypted all API payloads, added biometric verification, and enabled PIN-based two-factor authentication. This made Sendalula one of the most secure wallets in its category without adding user friction.

4. Optimized QR Scanner

We upgraded the scanning engine using a custom QR library with image recognition enhancements. This reduced scan errors, sped up detection, and gave users a frictionless experience while paying merchants or peers instantly.

How Did It Help Sendalula?

- Doubled download rate by reducing app size and optimizing for low-connectivity areas.

- Improved KYC completion time by 45% through a guided onboarding flow.

- Boosted trust with enterprise-grade API security and strong user authentication.

- Enabled faster in-store payments through a high-speed QR scanner.

- Made regulatory compliance effortless with admin-configurable KYC modules.

- Positioned Sendalula as a serious contender in South Africa’s digital wallet space.

Conclusion

Sendalula’s success is a result of vision backed by execution. BNV had a clear goal: launch a powerful yet simple mobile wallet for underserved industrial sectors. DigiPay.Guru translated that goal into a scalable, secure, and user-first digital wallet solution. By resolving their key pain points, from app size and KYC complexity to security and scanning speed, we enabled Sendalula to go to market with confidence and lead with innovation.

At DigiPay.Guru, we don’t just deliver technology; we create outcomes. If your business is aiming to launch a digital wallet that’s secure, scalable, and compliant, let’s make it real.