FinTech

Ivory Coast

eWallet solution

Challenges

DigiPay.Africa had a clear vision: to build a powerful, region-wide eWallet that delivers speed, flexibility, and control. But to get there, they had to overcome three major roadblocks:

1. Complex Multi-Language Compatibility

DigiPay.Africa needed their e-wallet platform to serve a multilingual audience across West Africa. They wanted users to switch languages effortlessly inside the app.

They also needed the ability to add new languages quickly, without having to rely on developers or make code changes each time. This would help them scale faster and localize their app experience in every market.

2. Rigid Top-Up and Bill Payment Vendor Management

The team wanted users to pay for mobile top-ups, utility bills, and digital services directly through the eWallet. But the real challenge was building a flexible system that didn’t require developer effort every time a new vendor or service provider had to be added.

They needed a way to quickly and independently manage all these vendor integrations in one place.

3. Inefficient Payment Gateway Management

To facilitate smooth transactions, especially across borders and currencies, DigiPay.Africa wanted to work with multiple payment gateways. But every new integration required technical changes, developer hours, and testing cycles. This slowed them down.

What they really needed was the power to connect, disconnect, or update payment gateways without going back to the development team each time.

Solutions

DigiPay.Guru delivered a tailored eWallet solution that gave DigiPay.Africa complete control, unmatched flexibility, and a foundation to scale seamlessly.

1. Multilingual Support

We developed an intuitive admin panel feature that enables the client to manage language support internally. Here’s how it works:

- The admin team can export all app content, translate or update it offline in any language, and then re-upload it.

- The app instantly reflects the changes. There’s no need for developer support, code changes, or downtime.

As DigiPay.Africa expands into new regions, they can launch localized versions of their app in days, not weeks. This solution gave them full independence in offering a localized user experience across different countries.

2. Top-Up and Bill Payment Integration

We built a middleware layer that centralizes all vendor integrations for top-ups and bill payments. The admin panel now allows DigiPay.Africa to connect to any third-party API on their own. They can add a new electricity provider, a mobile operator, or a streaming service directly from the dashboard. This puts them in control of their ecosystem and removes the bottlenecks or downtime.

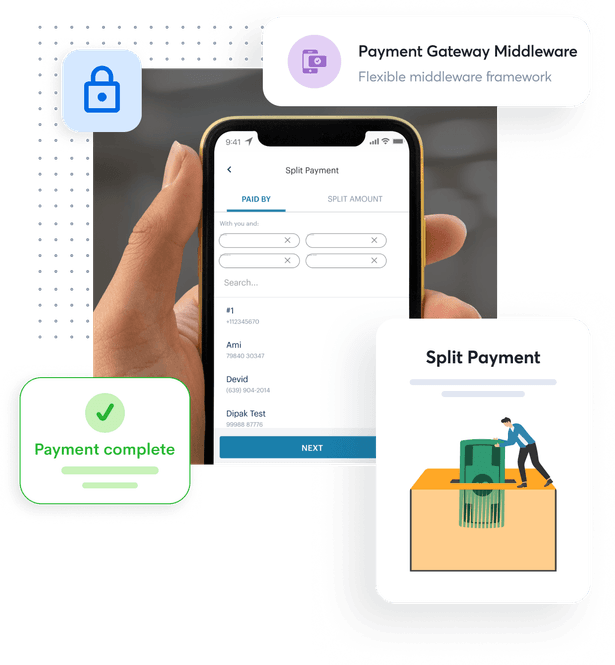

3. Payment Gateway Middleware

We implemented a flexible middleware framework for managing payment gateways. From their admin dashboard, the DigiPay.Africa team can now integrate new gateways, remove old ones, or switch between providers based on business needs. No additional development time is needed. This allows them to adapt to market changes, negotiate better rates, and stay agile.

How did it help DigiPay.Africa?

- Gave the team full control over language support and content updates.

- Enabled the business to onboard new billers and top-up partners on the fly.

- Empowered them to manage multiple payment gateways without relying on developers.

- Improved customer experience with wider service offerings and multilingual access.

Reduced time-to-market for new features and service updates.

Cut long-term development costs by removing technical bottlenecks. - Positioned the brand as a flexible, fast-moving, and reliable fintech leader in the region.

Conclusion

DigiPay.Africa’s journey with DigiPay.Guru is a strong example of what happens when technology meets vision.

By giving their team the tools to manage and expand their platform independently, we helped them scale faster, reduce operational barriers, and create a superior user experience.

If you are a bank, fintech, or financial institution looking to future-proof your digital offerings, DigiPay.Guru is your trusted partner.

Let’s build your success story next.