FinTech

Bahamas

eWallet solution

Challenges

Alliance Cash had big ambitions, but their system was holding them back.

1. Manual Vendor Management

The team at Alliance Cash struggled with the manual integration of external vendors and products for mobile top-ups and bill payments. Each vendor had to be added one at a time, which required a labor-intensive process that consumed operational time and delayed service rollouts.

2. Scalability Constraints

Due to the manual nature of vendor onboarding, scaling the platform, especially with a vision to go regional or global, seemed daunting. Every new market demanded significant manual configuration, which can be very challenging and act as a major bottleneck.

3. Operational Inefficiencies

Manual vendor onboarding also led to frequent errors, delays, and strained operational resources, which directly affected service uptime and customer satisfaction. These issues limited the team’s ability to focus on innovation and strategic growth.

Solutions

DigiPay.Guru stepped in with a tailored, feature-rich e-wallet solution designed to resolve Alliance Cash’s specific operational hurdles and scale their business faster.

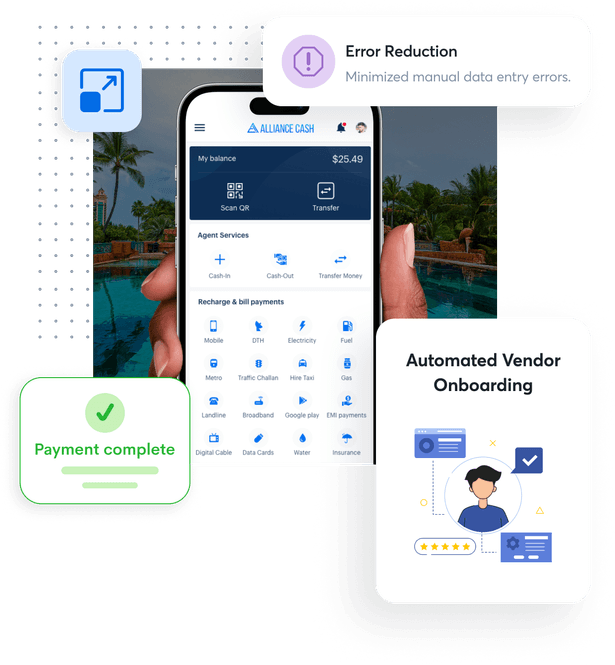

1. Automated Vendor Onboarding

- We developed a dedicated vendor setup module that automated the onboarding of vendors and top-up products. Admins could now complete the setup in just two to three simple steps. This dramatically reduced the effort and time required.

2. Scalable Infrastructure

- Our solution is architected with scalability at its core, which makes it easy to expand services into new markets without rebuilding systems from scratch. Hence, onboarding more services or vendors doesn’t add operational load.

3. Error Reduction and Performance Optimization

- By automating the vendor onboarding process, we significantly minimized manual data entry errors. This led to improved accuracy in service configurations and faster issue resolution. This way, the platform’s overall performance became more stable, which enhanced user trust & operational reliability.

How did it help Alliance Cash?

- Streamlined external vendor onboarding, saving significant time and internal resources

- Improved scalability, making it easier to expand services across new markets

- Reduced manual errors in vendor and product setup, ensuring smoother operations

- Boosted overall efficiency in top-up and bill payment workflows

Conclusion

With DigiPay.Guru’s advanced eWallet solution, Alliance Cash was able to transform its eWallet platform into a high-performing fintech engine. From automation and scalability to efficiency and speed, every improvement brought them closer to their vision.

By eliminating manual bottlenecks, enhancing scalability, and improving system efficiency, DigiPay.Guru helped Alliance Cash evolve from a promising startup into a high-performing, scalable wallet brand.

If you’re among fintech businesses in the Bahamas facing similar challenges, DigiPay.Guru can help you unlock the same results.

Let’s build the future of digital finance together.