Future-Ready Payment Solutions for Ethiopia’s Financial Landscape

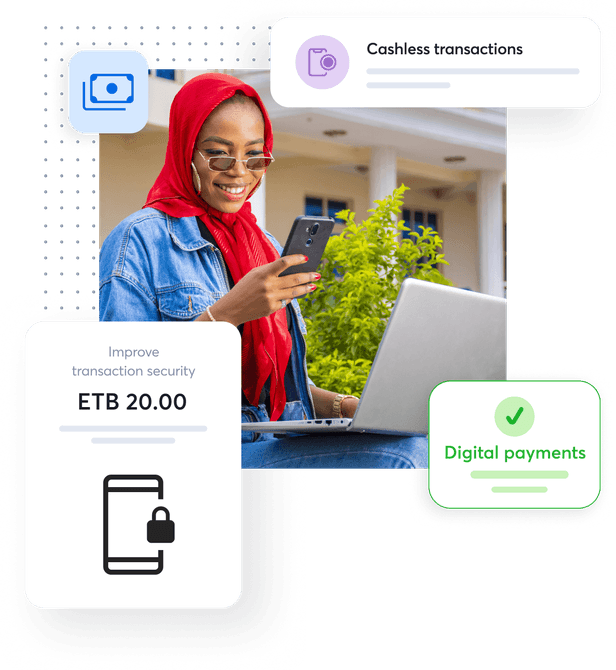

DigiPay.Guru helps you stay ahead of Ethiopia’s digital transformation with a secure, compliant, and scalable platform that’s ready for your institution. Whether you’re a bank expanding mobile money, a fintech launching new services, or a government-backed provider pushing inclusion, our platform meets you where you are.

With digital adoption on the rise, a national push toward cashless systems, and evolving regulations, now is the time to modernize your offerings. We deliver the infrastructure you need to move fast, serve better, and stay fully aligned with Ethiopia’s regulatory and market dynamics.

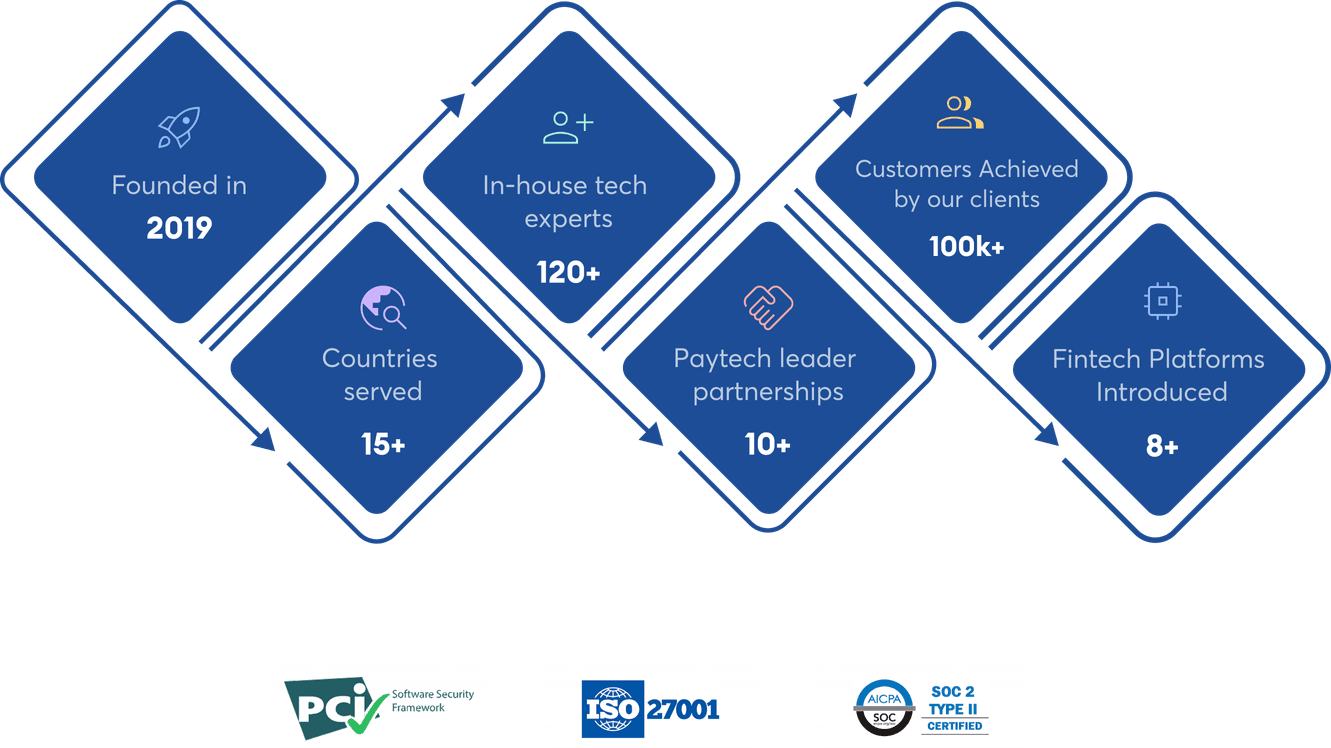

Our foundation and growth

Ethiopia’s Digital Payments Market: Rapid Growth and Innovation

Ethiopia’s digital payment sector is expanding rapidly, driven by mobile money adoption, regulatory support, and increasing transaction volumes.

mobile money accounts in Ethiopia in 2024

digital transactions in Ethiopia in 2024

total mobile money transactions processed in Ethiopia

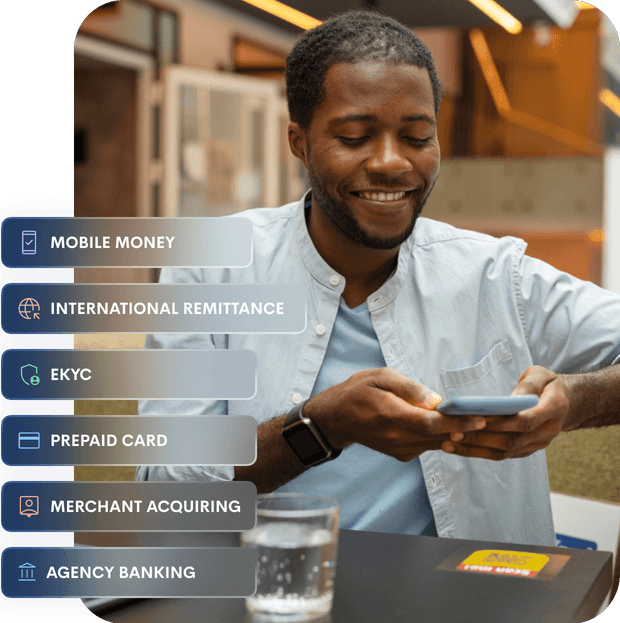

Digital Payment Solutions That Power Ethiopia’s Financial Transformation

Empower your institution with DigiPay.Guru’s secure, scalable, and compliant digital payment solutions, tailored to Ethiopia’s evolving financial landscape.

Mobile Money Solution in Ethiopia

Offer end-to-end mobile money services, from wallet creation to P2P, merchant, and utility payments, fully interoperable and compliant with local integrations like MTN MoMo, banks, and agents.

Learn moreInternational Remittance Solution in Ethiopia

Enable your customers in Ethiopia to send and receive international remittances seamlessly. Integrate with global partners and ensure compliance across corridors while driving diaspora engagement and cross-border financial inclusion.

Learn morePrepaid Card Solution in Ethiopia

Launch virtual or physical prepaid cards with robust management tools. Serve the underbanked and support digital payrolls, travel, e-commerce, and everyday domestic or international spending.

Learn moreAgency Banking Solution in Ethiopia

Expand your reach with branchless banking. Equip agents to offer cash deposits, withdrawals, transfers, and account services digitally while transforming rural and low-access areas across Ethiopia.

Learn moreeKYC Solution in Ethiopia

Simplify customer onboarding with biometric, document-based, address based, face based digital KYC verification. Plus, our platform meets Bank of Ethiopia’s compliance standards and enables fast, secure identity verification across channels.

Learn moreMerchant Acquiring Solution in Ethiopia

Support merchants with QR, POS, and mobile wallet acceptance. Enable seamless, real-time payments across informal vendors and enterprise retail with smart reconciliation and reporting tools.

Learn moreWhy Leading Ethiopian Institutions Trust DigiPay.Guru

Unlock Ethiopia’s digital payment potential with a platform trusted worldwide, yet customized for local compliance, user behavior, and institutional needs.

Start Delivering Scalable, Secure Digital Payments Across Ethiopia Today

Schedule Your Strategy Call

Frequently asked questions

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.