Strengthen Digital Payments Infrastructure in Burkina Faso With DigiPay.Guru’s Trusted Digital Fintech Solutions

Burkina Faso’s financial sector is steadily embracing digital transformation, driven by mobile penetration, expanding agent networks, and growing demand for accessible financial services. As banks, microfinance institutions, and fintechs modernize their offerings, the need for secure, interoperable, and regulation-aligned payment infrastructure continues to rise.

DigiPay.Guru partners with financial institutions in Burkina Faso to deliver modular, API-driven fintech solutions that enable digital wallets, mobile payments, agent-led services, and cross-border transactions, without the complexity of building systems from scratch. Our white-labeled platforms are designed to support operational efficiency, regulatory alignment, and sustainable growth in Burkina Faso’s digital economy.

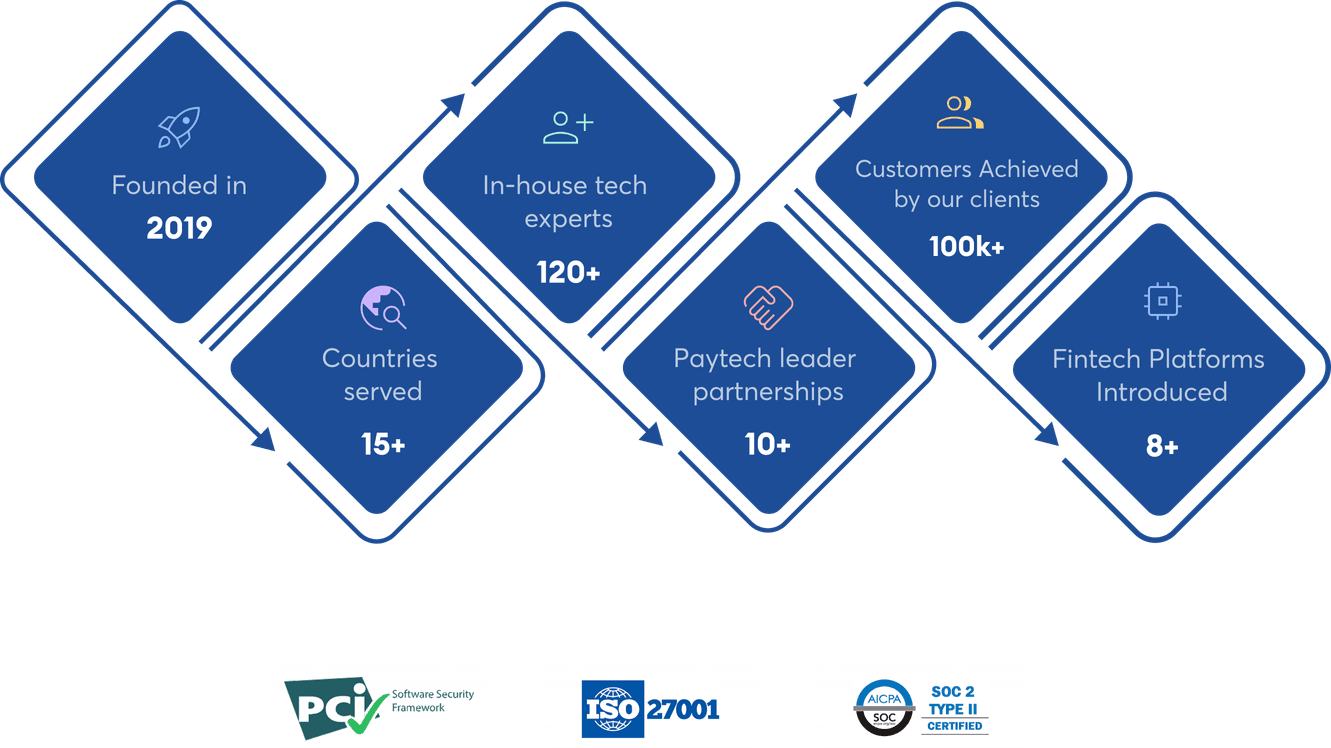

Our foundation and growth

Burkina Faso’s Digital Payments Landscape: Market Opportunities for Financial Institutions

With increasing demand for mobile-enabled financial services, Burkina Faso presents significant opportunities for banks and fintechs to modernize payments and reach underserved communities.

Mobile subscriptions in 2025

Average monthly mobile money transaction value

Mobile penetration in 2024

Launch Secure and Scalable Fintech Solutions in Burkina Faso With DigiPay.Guru’s Robust Digital Payment Solutions

DigiPay.Guru enables banks, fintechs, and MFIs in Burkina Faso to deploy compliant, modular digital payment solutions that simplify operations and support inclusive growth.

eWallet Solutions in Burkina Faso

Launch branded eWallets that allow customers to store, send, and receive funds securely, while supporting integration with banks, mobile money systems, and agent networks in Burkina Faso.

- Supports P2P transfers, bill payments, and merchant payments

- Interoperable with banking and mobile payment ecosystems

- Designed with regulatory and operational requirements in mind

International Remittance Solutions in Burkina Faso

Enable secure and efficient cross-border money transfers for inbound and outbound remittances, connecting Burkina Faso with regional and international payment corridors.

- Multi-currency transaction support

- Integration with global remittance partners

- AML and compliance-focused transaction handling

Prepaid Card Solutions in Burkina Faso

Offer virtual and physical prepaid cards linked to digital wallets, enabling cashless payments, controlled spending, and broader financial access for individuals and businesses.

- Supports contactless and online payments

- Card lifecycle and program management

- Suitable for payroll, disbursements, and aid programs

Merchant Acquiring Solutions in Burkina Faso

Help merchants accept digital payments through QR codes, POS, and mobile-based acceptance solutions, supporting both formal and informal businesses.

- Enables QR and POS-based transactions

- Settlement and reconciliation tools

- Designed for small merchants and SMEs

eKYC & Digital Onboarding in Burkina Faso

Digitize customer and agent onboarding with secure identity verification processes with AI-driven identity verification, biometric checks, and AML/KYC compliance that reduce manual effort and improve compliance.

- Document and biometric verification

- AML and risk checks

- Faster, paperless onboarding workflows

Agency Banking Solutions in Burkina Faso

Extend financial services beyond branches across Burkina Faso through agent banking solutions that support deposits, withdrawals, transfers, and bill payments with real-time monitoring & compliance.

- Secure agent management and monitoring

- Real-time reporting and controls

- Strengthens outreach in rural and underserved areas

Why Financial Institutions in Burkina Faso Partner With DigiPay.Guru

DigiPay.Guru combines global fintech expertise with a deep understanding of emerging-market financial ecosystems, enabling institutions in Burkina Faso to modernize payments with confidence.

Build Secure and Compliant Digital Payment Infrastructure With DigiPay.Guru

Schedule Your Strategy Call

Frequently asked questions

The most widely used digital payment methods in Burkina Faso include:

- Mobile money wallets offered by telecom operators

- Agent-led cash-in and cash-out services

- Bank-integrated electronic payments

- QR-based and merchant digital payments in select segments

These channels play a critical role in enabling everyday transactions for individuals and small businesses.

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.