Launch Future-Ready Financial Services in Kenya With DigiPay.Guru

Kenya stands as Africa’s fintech pioneer of groundbreaking innovations like M-Pesa and a vibrant digital finance ecosystem. DigiPay.Guru helps you lead this transformation with secure, compliant, and modular fintech solutions designed for Kenya’s regulatory and market realities.

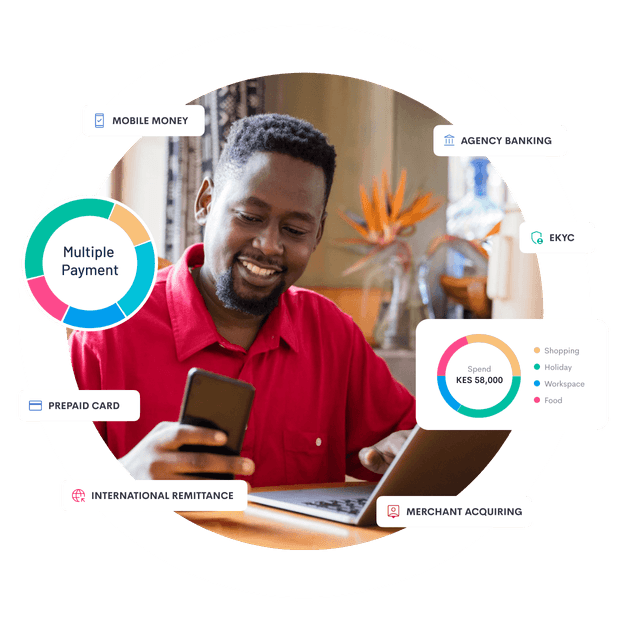

Our API-first, white-label platform enables banks, fintechs, and MFIs to launch digital wallets, prepaid cards, cross-border remittances, and eKYC systems in record time without the heavy cost or delay of building in-house. At every stage of your business, we help you deliver trusted digital financial services and advance Kenya’s cashless economy vision.

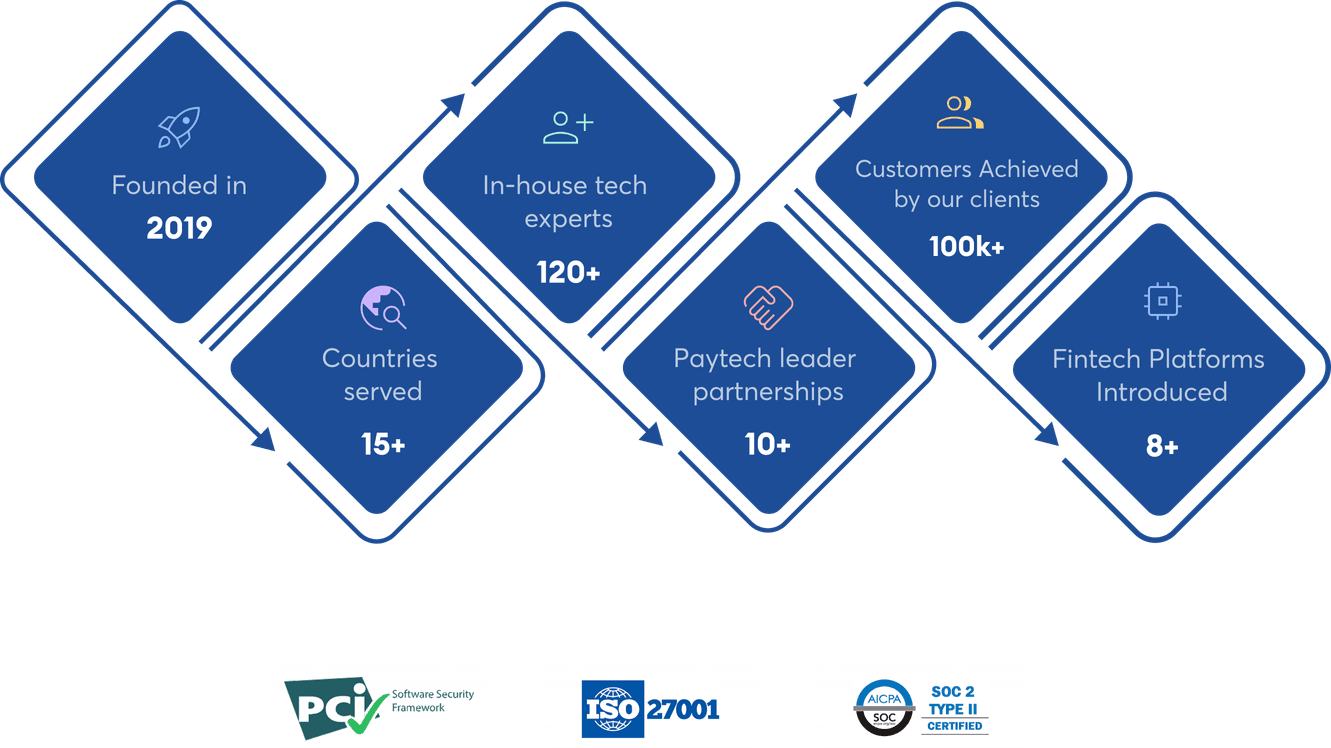

Our foundation and growth

Kenya: Africa’s Pioneer in Digital Payments and Financial Inclusion

Kenya’s mobile-first ecosystem and agent network power digital finance growth, which makes it a hotspot for scalable fintech solutions and payment innovation.

digital payments market by 2028

Average monthly mobile money transaction value

Mobile money’s share of Kenya’s GDP via agent transactions

Launch Digital Payment Solutions in Kenya That Empower Financial Innovation

DigiPay.Guru empowers Kenya’s banks, fintechs, and telcos with compliant, modular payment solutions that simplify operations, accelerate innovation, and scale financial services efficiently.

eWallet Solutions in Kenya

Launch branded eWallets that let users send, receive, and store funds quickly & securely while integrating with Kenya’s leading mobile money operators and banking APIs.

- Interoperable with reliable mobile operators

- CBK-compliant with AML/CFT safeguards

- Supports P2P, bill pay, merchant payments & loyalty programs

International Remittance Solutions in Kenya

Facilitate cross-border remittances from Kenyan diaspora communities to local wallets and bank accounts with secure transfers, competitive FX, smart routing, and compliant handling.

- Seamless integrations with global remittance partners

- Multi-currency transactions and smart FX routing

- Real-time settlement and AML compliance

Prepaid Card Solutions in Kenya

Launch virtual and physical prepaid cards linked to eWallets, thereby enabling cashless payments, instant issuance, and compliant financial inclusion for consumers in Kenya.

- Contactless, secure, and seamless payments

- Instant issuance & card lifecycle management

- Enables salary, rewards, and gig worker payouts

Merchant Acquiring Solution in Kenya

Empower Kenyan merchants to accept seamless POS, QR, and tap-to-phone payments with real-time settlements, analytics, and reconciliation tools for Kenya’s growing digital economy.

- Enables POS, QR-code & tap-to-phone transactions

- Real-time settlements & automated reconciliation

- Ideal for formal & informal businesses

eKYC Solution in Kenya

Simplify customer onboarding through AI-driven identity verification, biometric checks, and AML/KYC compliance to ensure faster, paperless, and fully compliant digital onboarding across Kenya.

- Face, document, and biometric verification

- Fully compliant with CBK and Data Protection Act (2019)

- Paperless registration and instant account activation

Agency Banking Solution in Kenya

Expand reach across Kenya’s unbanked and rural regions through agent-led banking that supports deposits, withdrawals, transfers, and bill payments with real-time monitoring and compliance.

- Supports deposits, withdrawals, and bill payments

- Secure agent management and real-time reporting

- Enhances access and boosts customer loyalty

Your Trusted Technology Partner for Kenya’s Digital Payment Future

DigiPay.Guru combines global fintech expertise with Kenya’s regulatory landscape, while helping financial institutions launch compliant, scalable, and future-ready digital payment solutions that accelerate innovation and financial inclusion.

Launch Secure and Scalable Digital Payments Solutions Across Kenya

Schedule Your Strategy Call

Frequently asked questions

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.