Accelerating the UAE’s Fintech Revolution With API-Driven Digital Payment Solutions

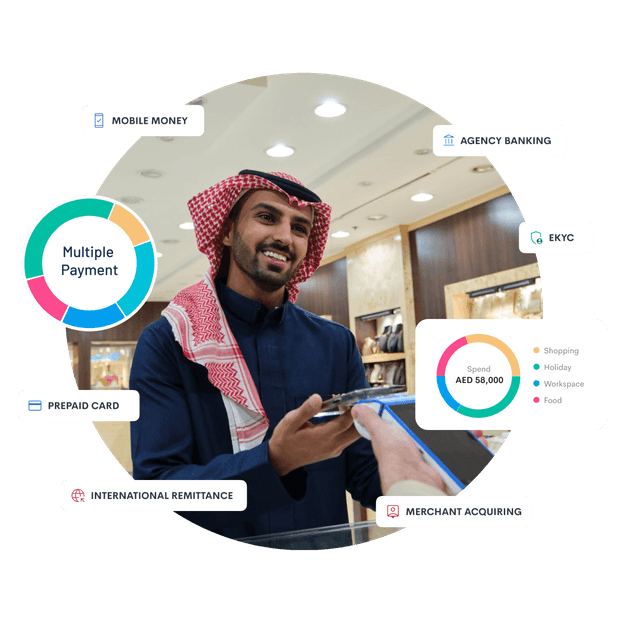

With DigiPay.Guru, you can launch faster, scale smarter, and stay fully compliant across Dubai, UAE. Our API-first, white-label platform gives you mobile wallets, prepaid cards, cross-border remittances, merchant acquiring, and eKYC without the high costs or delays of building in-house.

Your customers expect speed, convenience, and trust in every transaction. DigiPay.Guru empowers you to deliver that with modular, compliance-ready solutions that integrate seamlessly with local banks, telcos, and payment rails. By partnering with us, you future-proof your digital banking strategy and strengthen your position in Dubai’s fast-growing fintech hub.

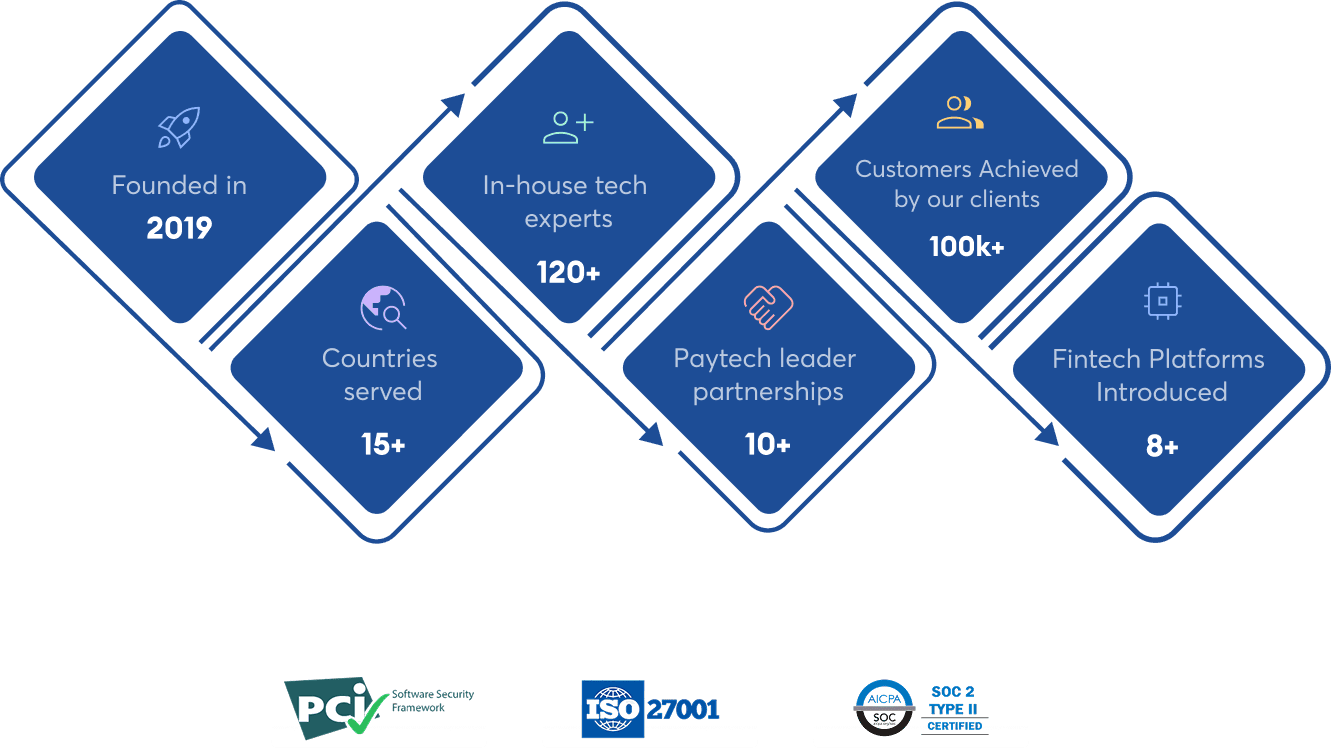

Our foundation and growth

Leverage Dubai’s Fintech Ecosystem to Expand Across MENA and Beyond

Dubai combines innovation, regulation, and cross-border connectivity, positioning your business to thrive in one of MENA’s fastest-growing digital payment markets.

No. of transactions across digital channels in Dubai, UAE

UAE consumers now use digital payment methods

banked consumers use digital wallets in Dubai

Launch Digital Payment Solutions in Dubai, UAE, That Scale With Your Business Growth

You can scale confidently across the UAE with modular platforms that reduce time-to-market, ensure CBUAE compliance, and deliver trusted digital services.

Mobile Money Solution in Dubai, UAE

You can launch secure wallets in Dubai that support P2P transfers, utility payments, and merchant transactions while ensuring compliance, fast adoption, and trusted customer experiences across the UAE.

- Seamless P2P and merchant transactions

- Compliant with UAE financial regulations

- Drives customer loyalty and engagement

International Remittance Solution in Dubai, UAE

Enable compliant international money transfers from Dubai with competitive FX, automated routing, and AML safeguards. This helps your business strengthen corridor access and serve global diaspora communities securely.

- Competitive exchange rates with routing

- AML/CFT safeguards for compliance

- Supports global remittance corridors

Prepaid Card Solution in Dubai, UAE

Offer physical and virtual prepaid cards tailored for UAE customers and enable cashless payments, inclusion, and convenience while reducing reliance on cash and supporting regulatory compliance.

- Secure card issuance and management

- Expands cashless adoption in the UAE

- Supports corporate and retail payments

Merchant Acquiring Solution in Dubai, UAE

Empower SMEs and enterprises (your merchants) with POS, QR, and tap-to-phone acceptance in Dubai, thereby giving your merchants secure, real-time processing and reconciliation that builds trust and growth opportunities.

- POS, QR, and contactless payments

- Real-time reporting and reconciliation

- Scales with SMEs and enterprises

eKYC Solution in Dubai, UAE

Streamline customer onboarding with biometric checks, document verification, and AML compliance tools that give your business faster, more secure identity verification across all digital channels.

- Biometric and document verification tools

- Compliant with CBUAE KYC rules

- Faster and more secure onboarding

Agency Banking Solution in Dubai, UAE

Expand access for underserved customers in the UAE through agent-led services that enable deposits, withdrawals, transfers, and bill payments, thereby increasing inclusion and extending financial reach.

- Agent-led financial service expansion

- Supports cash-in and withdrawals

- Enhances inclusion across the UAE

Why DigiPay.Guru Helps You Lead the UAE’s Digital Payment Future

By choosing DigiPay.Guru, you gain a trusted partner focused on accelerating your growth, strengthening customer trust, and positioning your business at the center of Dubai’s fintech future.

Accelerate Your Growth in Dubai’s Fintech Market With DigiPay.Guru

Schedule Your Strategy Call

Frequently asked questions

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.