PAYOUT CHANNELS IN THE BENIN

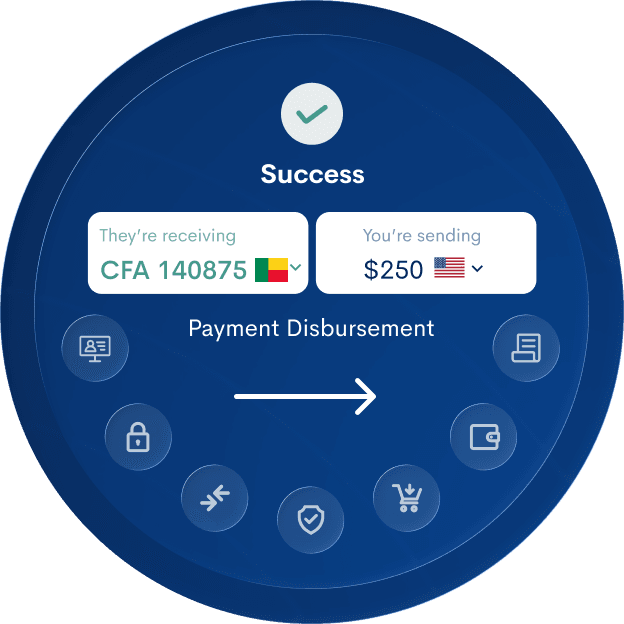

Deliver fast and reliable payouts through Benin’s leading local payment channels.

With DigiPay.Guru, your customers can send money to Benin through the country’s top mobile money networks, activated instantly via our unified API.

Moov

MTN

PAYOUT CHANNELS IN THE BENIN

Why Enabling Benin Payouts Strengthens Your Remittance Network

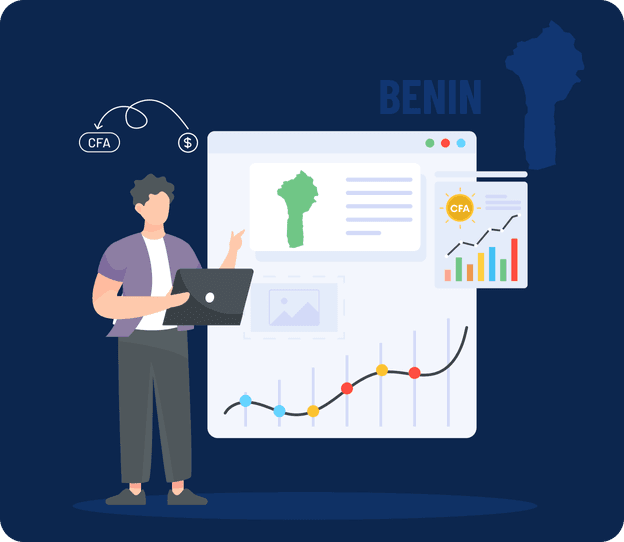

With rising remittance inflows and strong mobile wallet usage, Benin offers a powerful opportunity for businesses looking to grow their payout network in Francophone West Africa.

$338 million

annual remittance

inflows

11.2 million+

active mobile money

accounts

1.2%

remittances received as a

share of GDP

BENEFITS

Why Top Remittance Providers Choose DigiPay.Guru for Benin Payouts

Activate the Benin payout corridor in just weeks.

Book a Demo Now

WHITEPAPER

Get Strategic Insights on the Future of Cross-Border Remittances

Discover the key drivers shaping remittance innovation and how your business can benefit from the rise of digital payouts.

Frequently asked questions

Most businesses go live within 2–4 weeks, depending on their current system setup and integration readiness. Our single API is designed for quick onboarding, with dedicated technical support to streamline your corridor activation.

From testing to launch, we ensure the entire Benin payout flow is configured, validated, and ready for real-time operations.

Yes. DigiPay.Guru integrates only with fully licensed and regulated mobile money operators in Benin, such as MTN MoMo and Moov Money.

All payout channels adhere to the standards set by Benin’s financial authorities. We continuously monitor regulatory changes to maintain complete compliance for your corridor.

Absolutely. DigiPay.Guru supports a broad West African payout network, including Côte d’Ivoire, Senegal, Mali, Ghana, and Nigeria.

All these corridors can be activated through the same unified API. This allows you to scale your regional presence quickly without additional technical integrations.

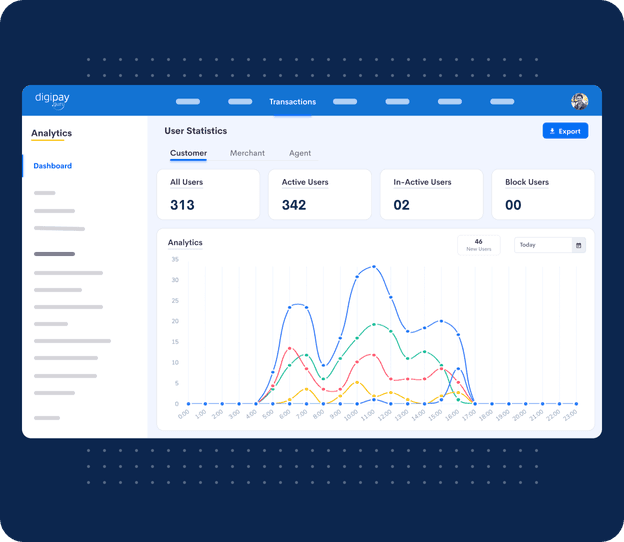

Yes. Our platform provides real-time transaction visibility, from initiation to final payout. You can monitor payout confirmation, partner status, and corridor performance instantly through your dashboard.

This ensures faster issue resolution, smoother operations, and a better customer experience.

DigiPay.Guru includes built-in KYC, AML screening, transaction monitoring, and risk checks aligned with Benin’s regulatory requirements.

Every payout is screened through automated compliance workflows to minimize fraud and maintain reporting accuracy. Our platform helps you meet both local and international compliance standards without additional overhead.

Read our insightful blogs!

Stay updated with the latest trends and innovations in finTech with our insightful blogs.