PAYOUT CHANNELS IN THE GUINEA

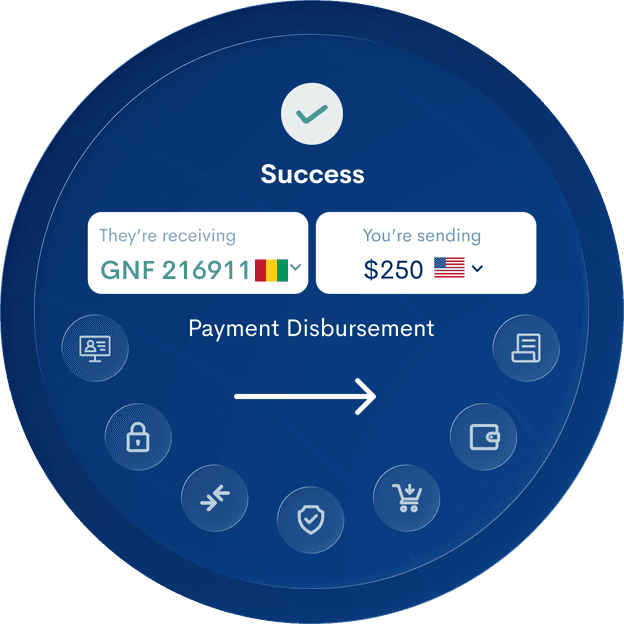

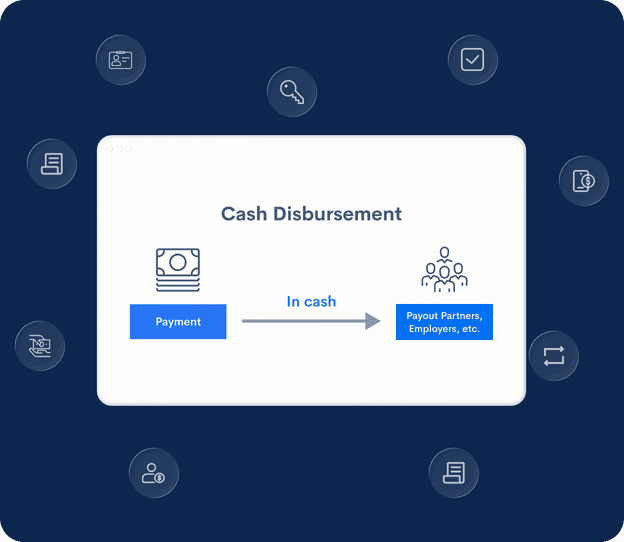

Launch payouts to Guinea with direct access to the country’s leading payout channels.

Expand into Guinea’s remittance market with DigiPay.Guru as it connects you to leading partners: MTN and Orange. This ensures fast & trusted disbursements for your customers.

MTN

Orange

PAYOUT CHANNELS IN GUINEA

Guinea: A Growing Remittance Opportunity

From mobile wallet penetration to steady inflows, Guinea offers a high-growth opportunity for banks, fintechs, and MTOs.

$557.81 million

annual remittance

inflows

$2.04 billion

Remittance transaction value

(2025)

~ 2.36 %

Remittance contribution to

GDP

BENIFITS

Top Benefits That Prove Expanding Your Remittance Reach to Guinea is a Smart Choice

Expand your remittance business by enabling customers to send money seamlessly to Guinea with DigiPay.Guru.

Book a Demo Now

WHITEPAPER

Get Strategic Insights on the Future of Cross-Border Remittances

Download our whitepaper to understand how banks, fintechs, and MTOs can capture new opportunities in Guinea and other West African corridors.

Frequently asked questions

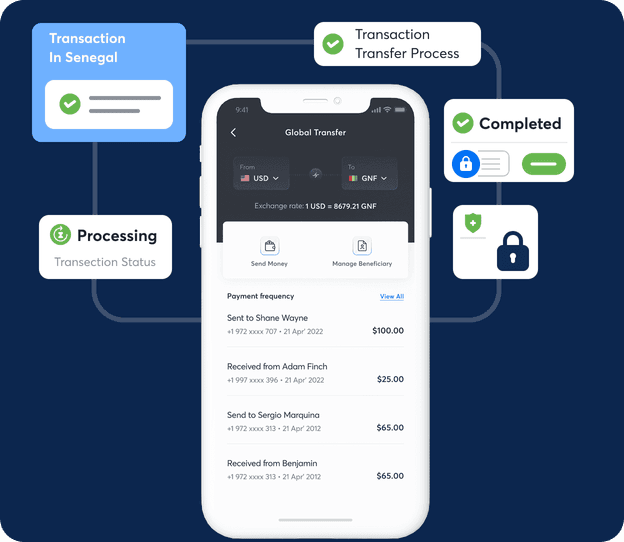

Most clients launch Guinea payouts within 2–4 weeks, depending on their existing setup and integration needs. Our ready APIs, sandbox environment, and dedicated support team ensure a fast and smooth go-live process.

Yes. DigiPay.Guru connects you only with licensed and regulated payout providers in Guinea, including MTN and Orange. This ensures all transfers remain secure, legal, and fully compliant with local requirements.

Absolutely. Guinea is one of several West African and pan-African corridors supported by DigiPay.Guru. Our network also covers high-volume destinations such as Nigeria, Ivory Coast, Ghana, Senegal, Kenya, and beyond while enabling you to scale regionally.

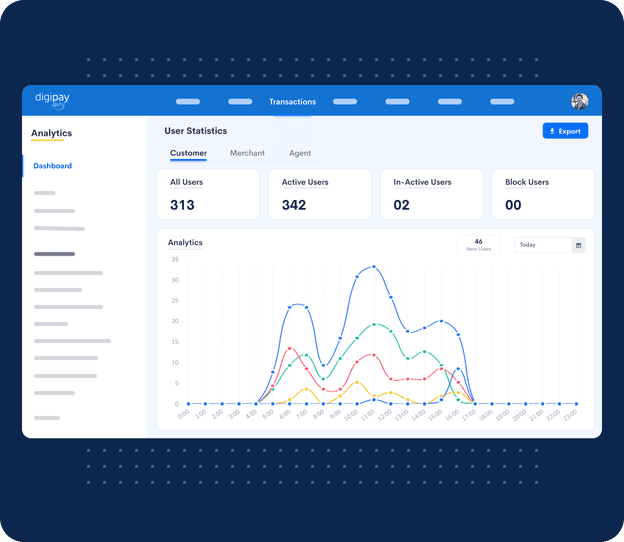

Yes. Our platform provides real-time transaction tracking, reporting, and reconciliation tools. This gives you full visibility into each transfer, improves customer trust, and simplifies operational management.

We follow global and local compliance standards. Our solution supports KYC verification, AML screening, transaction monitoring, and reporting tools, helping your institution meet all regulatory requirements in Guinea while reducing operational risks.

Read our insightful blogs!

Stay updated with the latest trends and innovations in finTech with our insightful blogs.