PAYOUT CHANNELS IN THE MALI

Offer your customers remittance payouts through the biggest mobile money networks in Mali.

Launch your Mali corridor effortlessly. DigiPay.Guru connects your platform to Mali’s most reliable payout partners, while ensuring quick and secure fund disbursements.

Moov

Orange

PAYOUT CHANNELS IN MALI

Mali: A Rapidly Growing Remittance and Mobile-Money Market

Mali’s growing mobile money adoption and strong remittance inflows make it a strategic corridor for remittance businesses, fintechs, MTOs looking to expand across West Africa.

$1045 million

annual remittance

inflows

237 million+

active mobile money

accounts

5.06%

remittances received as a

share of GDP

BENEFITS

Why Leading Remittance Providers Choose DigiPay.Guru for Mali

Ready to enable remittances to Mali for your customers?

Book a Demo Now

WHITEPAPER

Get Strategic Insights on the Future of Cross-Border Remittances

Download our exclusive whitepaper to understand how fintechs, remittance providers, MTOs, and FX operators can capture new opportunities in the Mali corridor and beyond.

Frequently asked questions

Most clients go live within 2–4 weeks, depending on their existing setup and preferred payout channels.

Our ready-to-integrate API makes onboarding fast, smooth, and fully supported from day one.

Our ready-to-integrate API makes onboarding fast, smooth, and fully supported from day one.

Yes. We only partner with fully licensed and regulated mobile money operators in Mali including Orange Money and Moov Africa while ensuring complete local compliance.

Absolutely. DigiPay.Guru supports a broad West African network, including Ivory Coast, Senegal, Ghana, and Nigeria, thereby allowing you to expand corridors seamlessly through one integration.

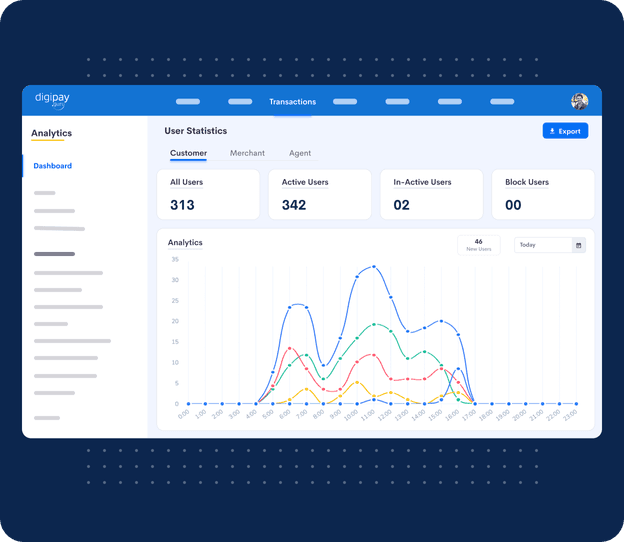

Yes. Our platform offers real-time transaction tracking with a unified dashboard to monitor payouts, reconcile data, and gain full visibility across all Mali payout channels.

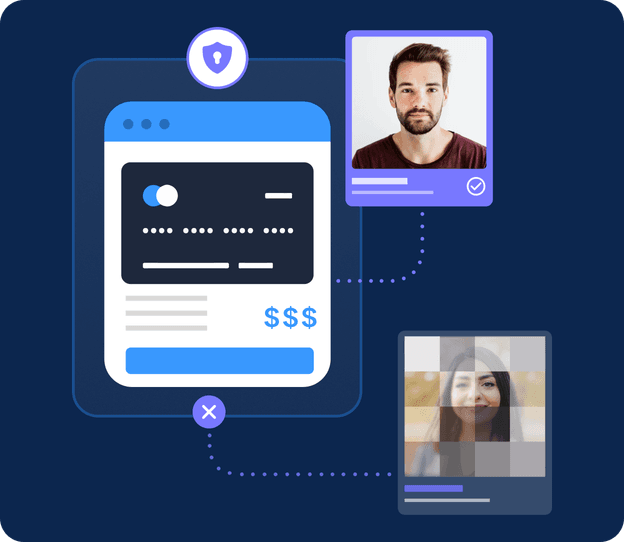

We follow strict KYC and AML protocols aligned with Mali’s financial regulations.

Our platform supports customer verification, transaction monitoring, and compliance reporting to ensure every payout is secure and transparent.

Our platform supports customer verification, transaction monitoring, and compliance reporting to ensure every payout is secure and transparent.

Read our insightful blogs!

Stay updated with the latest trends and innovations in finTech with our insightful blogs.