PAYOUT CHANNELS IN TOGO

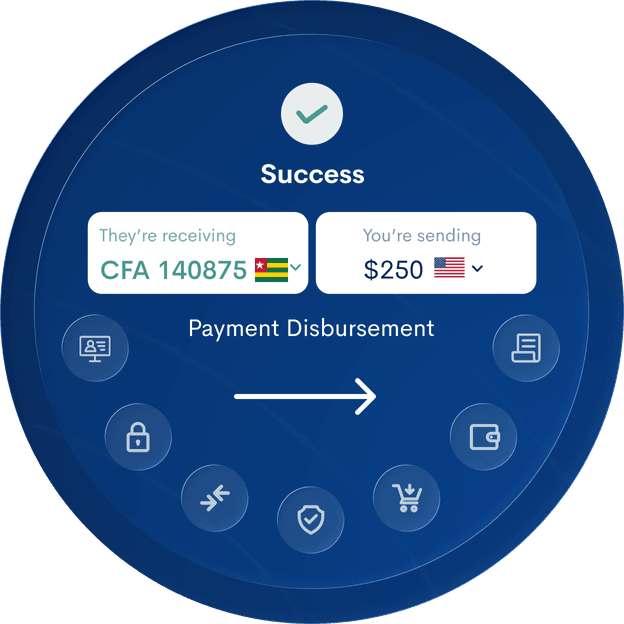

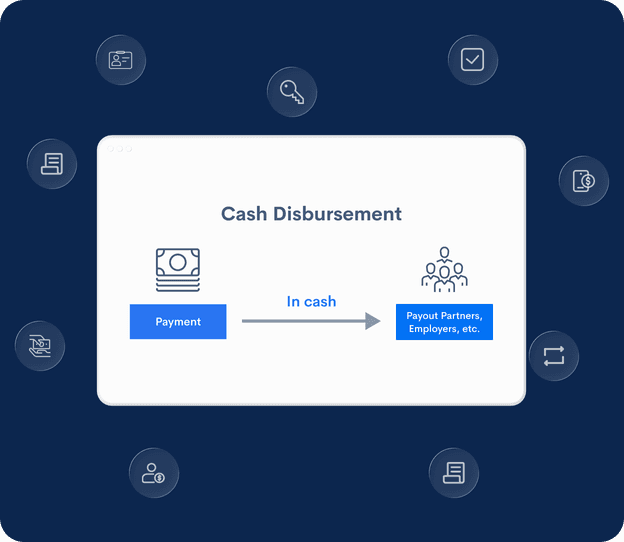

Deliver Payouts Across Togo Through Trusted Mobile Money Channels

Togo’s remittance ecosystem is driven by mobile money. DigiPay.Guru gives you ready access to these channels, while ensuring fast, secure, and widely accepted payouts for your customers.

Tmoney

Moov

PAYOUT CHANNELS IN THE TOGO

Togo’s Digital Payments Growth Is Opening Major Remittance Opportunities

Togo’s expanding digital ecosystem and increasing reliance on mobile money create strong demand for seamless remittance payouts, while making it an essential corridor for growth-focused providers.

$560million

annual remittance

inflows

58%

mobile money

penetration

6.10%

remittances received as a

share of GDP

BENEFITS

Why Leading Remittance Providers Choose DigiPay.Guru for Togo Payouts

Expand Your Global Remittance Network With Togo, Quickly and Securely

Book a Demo Now

WHITEPAPER

Get Strategic Insights on the Future of Cross-Border Remittances

Discover the key drivers shaping remittance innovation and how your business can benefit from the rise of digital payouts.

Frequently asked questions

Most businesses go live within 2–4 weeks, depending on their current system setup. Our unified API significantly reduces integration work and partner onboarding time. We guide you through testing, configuration, and corridor activation to ensure a smooth and fast launch.

Yes. DigiPay.Guru connects only with licensed and regulated mobile money operators in Togo, including T-Money and Moov. All payout channels follow the regulatory requirements set by Togolese financial authorities. We continuously track updates to keep your corridor fully compliant.

Absolutely. DigiPay.Guru supports a broad and expanding network across West Africa, including Benin, Côte d’Ivoire, Senegal, Mali, Benin, and Cameroon. You can activate these corridors using the same unified API, without additional technical integrations.

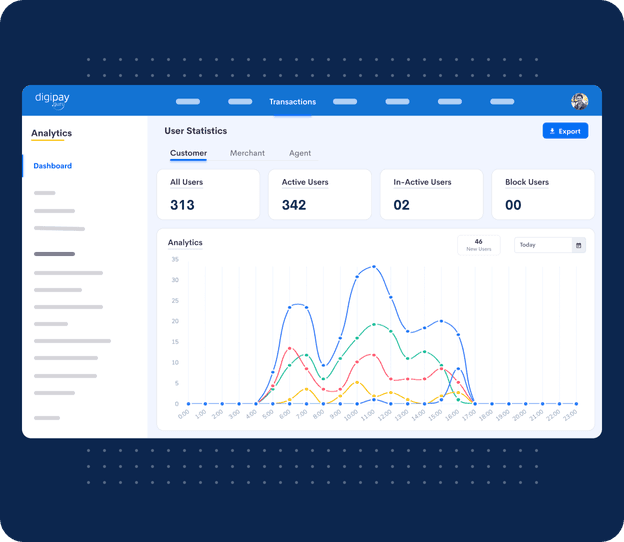

Yes. Our platform provides real-time visibility into each transaction: from initiation to payout. You can monitor partner status, confirmation times, and corridor performance instantly. This helps your operations and support teams resolve issues quickly and deliver a better customer experience.

DigiPay.Guru includes built-in KYC, AML screening, transaction monitoring, and risk scoring aligned with Togo’s regulations and global standards. Every payout is processed through automated compliance workflows to reduce fraud, ensure accuracy, and support audit readiness.

Read our insightful blogs!

Stay updated with the latest trends and innovations in finTech with our insightful blogs.