Transforming Payments for Uganda’s Financial Ecosystem

DigiPay.Guru is a global fintech platform provider offering advanced digital payment solutions tailored to Uganda’s evolving economy. As Uganda embraces digital finance, we equip you to meet growing customer demand, comply with local regulations, and reduce reliance on cash.

From mobile money to remittances, our technology is built for Uganda’s shift toward a cashless economy. This makes financial services more inclusive, agile, and future-ready. Plus, DigiPay.Guru brings agility, innovation, and local relevance to your digital transformation journey.

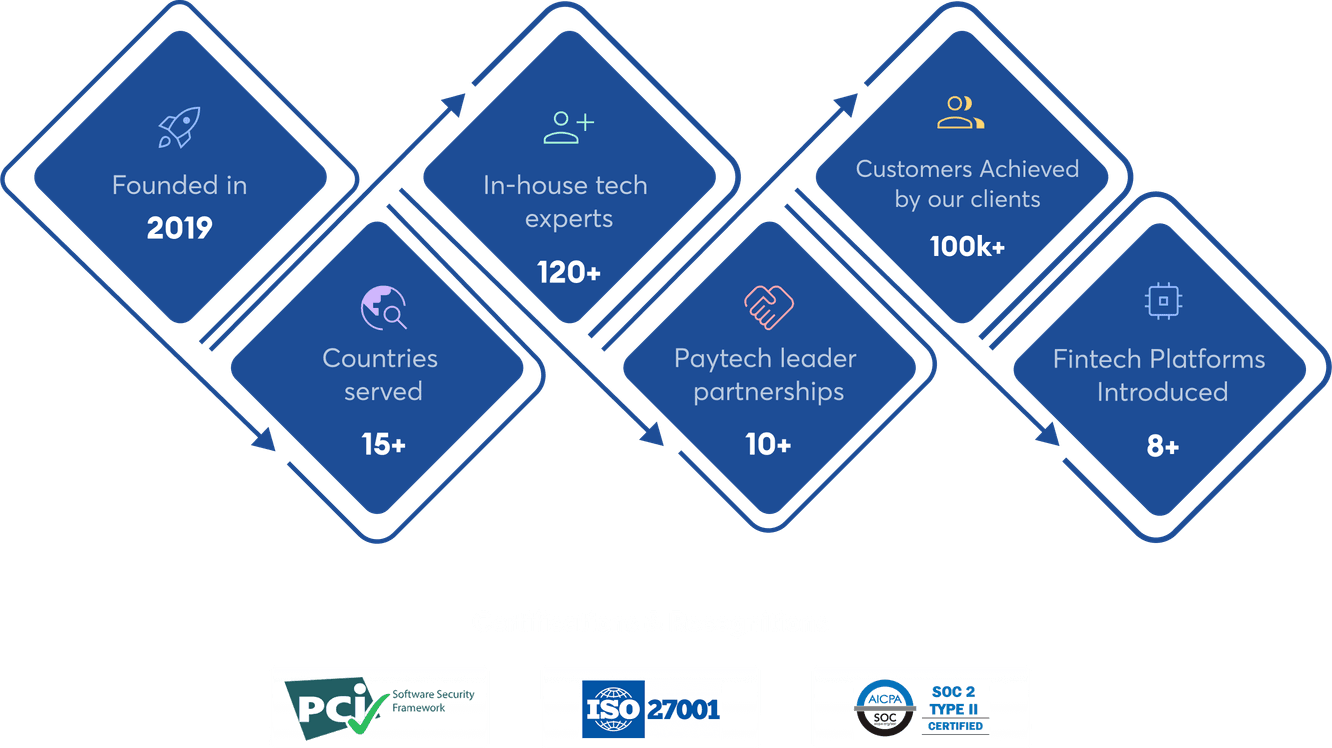

Our foundation and growth

Uganda’s Digital Payment Ecosystem Is Expanding Rapidly

Uganda’s digital finance space is booming, which offers massive potential for innovative, secure, and customer-centric payment solutions.

Total transaction value in 2025

Mobile money market size in 2024

Monthly active mobile money users

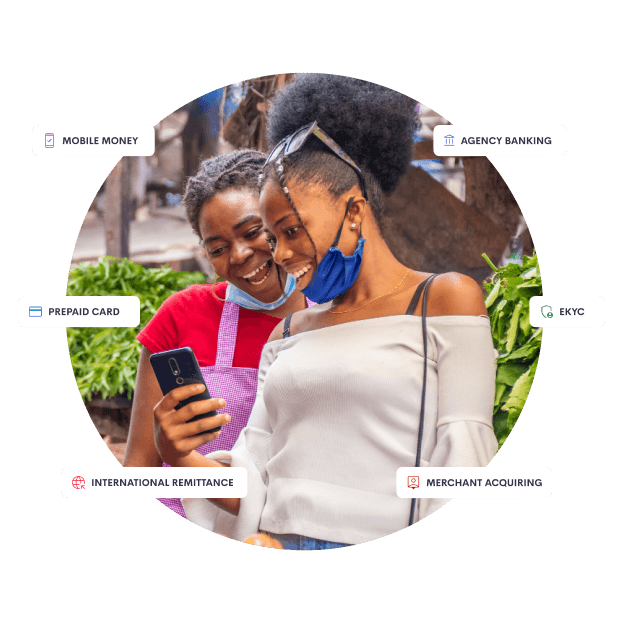

Smart Digital Payment Solutions for Uganda’s Banks, Fintechs, and Telcos

DigiPay.Guru offers secure, modular, and white label payment solutions in Uganda. From mobile money and remittance to eKYC, prepaid cards, merchant acquiring, and more.

Mobile money solution in Uganda

Launch your own branded mobile money service in Uganda with features like P2P transfers, utility payments, and agent networks to drive financial inclusion.

Learn moreInternational remittance solution in Uganda

Enable fast and secure cross-border money transfers in Uganda with multi-currency support, transparent rates, and reliable settlement through a compliant remittance infrastructure.

Learn morePrepaid card solution in Uganda

Offer physical or virtual prepaid cards with real-time control, transaction tracking, and spending limits tailored for banks, fintechs, and enterprises in Uganda.

Learn moreAgency banking solution in Uganda

Expand banking access across Uganda by empowering agents to offer services like cash deposits, withdrawals, account opening, and bill payments in rural areas.

Learn moreeKYC solution in Uganda

Digitize customer onboarding with AI-driven face verification, document capture, and real-time validation to ensure compliance with Uganda’s regulatory and data privacy requirements.

Learn moreMerchant acquiring solution in Uganda

Simplify merchant onboarding and enable seamless digital payments acceptance across Uganda with robust features like QR payments, invoicing, settlement, and real-time transaction tracking.

Learn moreWhy Leading Fintech Companies in Uganda Choose DigiPay.Guru?

DigiPay.Guru delivers secure, scalable, and fully localized digital payment solutions that help you grow fast and stay compliant in Uganda’s fintech ecosystem.

Let’s Build Uganda’s Next Big Fintech Success Story Together

Get Started Now

Frequently asked questions

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.