According to GSMA, mobile money processed around 108 billion transactions worth over $1.68 trillion in 2024.

This scale matters because in many African markets, mobile money has become a primary rail for everyday financial activity like payments, collections, transfers, bill pay, and disbursements.

If you’re a bank, fintech, or other financial business, choosing the right mobile money platform is no longer just a product decision. It has become an infrastructure decision.

Your platform needs to support secure onboarding, wallet operations, transaction controls, interoperability with telcos and banking rails, and the ability to launch new use cases without rebuilding your stack each time.

In this blog, you’ll learn:

-

Why mobile money platforms in Africa shape marketplace growth,

-

What capabilities truly matter,

-

The top platform types in the ecosystem,

-

And how to choose the top mobile money platforms for African marketplaces based on real operational needs.

Let’s get into it.

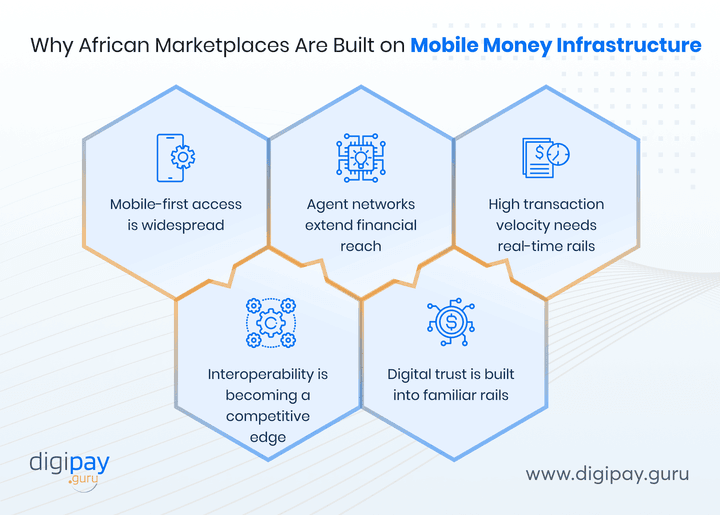

Why African Marketplaces Are Built on Mobile Money Infrastructure

In many African markets, mobile money is the core transaction rail that powers day-to-day financial movement.

When you look at how money flows in the region: collections, transfers, disbursements, bill pay, agent cash-in/cash-out, mobile money sits right in the middle of that ecosystem.

That’s why modern financial marketplaces in Africa naturally evolve around mobile money infrastructure. It supports scale, accessibility, and distribution in a way traditional rails struggle to match.

Here’s why this happens:

[

-

Mobile-first access is widespread: People don’t need a branch visit or card issuance to start transacting.

-

Agent networks extend financial reach: Cash-in/cash-out bridges the gap between cash economies and digital finance.

-

High transaction velocity needs real-time rails: Everyday payment behaviour depends on speed and reliability.

-

Interoperability is becoming a competitive edge: The ability to connect telcos, banks, and payment providers reduces friction.

-

Digital trust is built into familiar rails: Users adopt faster when systems align with existing transaction habits.

So if you’re enabling financial services at scale, mobile money infrastructure is not optional. It’s the foundation.

Why Mobile Money Infrastructure Is Required

Money has to move between multiple parties, across different rails, with the right controls in place. If that foundation is weak, everything built on top becomes risky: growth, compliance, trust, and even day-to-day operations.

That’s why a basic mobile money integration is not enough. What you need is mobile money infrastructure: a setup designed to support scale, governance, and multi-rail execution.

Below are the core reasons it becomes essential.

[

Multi-Party Money Movement Needs Rules, Not Manual Work

Financial marketplaces often involve multiple participants and role-based flows. That requires programmable money movement, not ad-hoc transfers.

-

So, you need the ability to define:

-

Who can receive funds and under what conditions

-

Transaction limits and thresholds

-

Approval and control workflows

-

Scheduled or conditional disbursements

This creates consistency and reduces operational risk.

Interoperability Becomes Non-Negotiable

Africa is not one payment ecosystem. Financial marketplaces may have to connect:

-

Bank transfers,

-

Agents,

-

PSPs and local switches.

So infrastructure must support interoperable payment platforms, where you can route transactions across rails without rebuilding integrations for every market.

Settlement and Reconciliation Must Be Built-In

If your settlement reporting is weak, your marketplace gets slower and riskier. Manual reconciliation is also one of the fastest ways to lose control over scaling operations.

Infrastructure should support:

End-to-end transaction traceability

Automated settlement files and reporting

Reconciliation across multiple rails/providers

Exception handling and failure tracking

Compliance Is Not a Layer You Add Later

As transaction volumes grow, regulatory expectations rise too. A financial marketplace needs compliance embedded into the transaction lifecycle, not treated as a separate project.

That includes:

-

KYC and identity verification

-

AML screening and watchlist checks

-

Transaction monitoring and rule-based alerts

-

Audit trails and reporting readiness

This is what enables marketplace compliance payments at scale.

Expansion Requires an API-First Foundation

Financial marketplaces evolve. Today, it could be wallet transfers. Tomorrow it could be:

-

Bulk disbursements,

-

Bill payments,

-

Agent services,

-

Cross-border flows,

-

Loyalty or rewards.

If your platform isn’t API-first, every new use case becomes a rebuild. And with the right infrastructure, your teams can launch new capabilities without destabilizing the core.

In short, mobile money infrastructure is required because it gives you what financial marketplaces truly need: control, interoperability, compliance, and scalability, all in one foundation.

Top Mobile Money Platforms for African Marketplaces

If you’re a business offering mobile money services, choosing a platform is not about popularity. It’s about control, compliance, scalability, and interoperability.

Here’s a clear breakdown of the leading options:

1. DigiPay.Guru (White-Label Mobile Money Platform for Institutions)

DigiPay.Guru is an advanced mobile money (eWallet) platform built specifically for banks, fintechs, NBFCs, and financial institutions. It enables you to launch mobile money services under your brand using a white-label + API-first infrastructure approach.

Key Features

-

White-label wallet app + admin platform (your branding, your customer experience)

-

API-first integrations for faster rollouts and partner connectivity

-

Multi-rail interoperability: connect with telcos, bank rails, and PSPs

-

Compliance-first framework: KYC, AML screening, monitoring rules, audit trails

-

Bulk payments + disbursements with control and reporting

-

Multi-currency + remittance readiness for corridor-based expansion

-

Operational dashboards for settlement visibility, reconciliation support, and exception handling

Best for:

Build their own mobile money product, not resell a third-party wallet

Launch fast without compromising regulatory readiness

Scale reliably across markets, corridors, and rails

In short: DigiPay.Guru helps you move from “wallet launch” to institution-grade digital finance infrastructure.

2. M-Pesa (Telco-Led Mobile Money Ecosystem)

M-Pesa is a widely adopted telco-led mobile money service, known for deep penetration and agent networks in East Africa.

Key Features

-

Strong wallet adoption for everyday transfers and payments

-

Extensive cash-in/cash-out agent network

-

High familiarity and trust in dominant markets

Best for:

-

Institutions operating in M-Pesa-heavy regions

-

Use cases that depend on agent-led access and consumer wallet behaviour

Limitation: product customization and branding control are typically constrained.

3. MTN Mobile Money (MoMo) (Multi-Country Telco Wallet Rail)

MTN MoMo is a telco-led wallet ecosystem with broad reach across multiple African countries.

Key Features

-

Strong consumer adoption across MTN markets

-

Supports transfers, bill payments, and wallet usage

-

Business integration capabilities through APIs in some markets

Best for:

-

Institutions seeking quick wallet rail reach across MTN corridors

-

Mobile money services anchored in domestic transactions

Limitation: ecosystem dependency may restrict deep institutional control.

4. Orange Money (Strong Francophone Presence)

Orange Money is a telco-led mobile money ecosystem with strong footprint across francophone Africa.

Key Features

-

Strong adoption in French-speaking markets

-

Agent reach and everyday transaction coverage

-

Partner-led cross-border capabilities in selected corridors

Best for:

-

Institutions focused on francophone Africa

-

Agent-enabled financial access models

Limitation: telco ecosystem design may limit your brand ownership and flexibility.

5. Airtel Money (Regional Wallet Reach Across Airtel Markets)

Airtel Money is a telco-led wallet ecosystem across many Airtel operating regions.

Key Features

-

Wallet transfers and utility payments

-

Agent reach depending on market maturity

-

Strong domestic usage in Airtel-heavy countries

Best for:

-

Institutions targeting wallet services in Airtel corridors

-

Basic transaction enablement and utility payment flows

Limitation: scaling into multi-rail, multi-provider models becomes complex.

6. VodaPay / Vodacom Wallet Ecosystem (South Africa-Led Expansion)

VodaPay is positioned as a digital wallet ecosystem focused strongly on South Africa, expanding into broader service categories.

Key Features

-

App-led adoption approach

-

Integrated service ecosystem

-

Expansion model tied to Vodacom footprint

Best for:

-

Institutions and partners focusing on South Africa

-

App-driven digital finance extensions

Limitation: expansion outside core markets depends heavily on ecosystem growth.

Here’s the quick comparison:

| Feature | DigiPay.Guru | M-Pesa | MTN Mobile Money (MoMo) | Orange Money | Airtel Money | VodaPay |

|---|---|---|---|---|---|---|

| Type | White-label fintech platform / mobile wallet + remittance solution for businesses (B2B) | Telecom-led mobile money service | Telecom-led mobile money service | Telecom-led mobile money service | Telecom-led mobile money service | Telecom fintech & super-app wallet |

| Primary Use Case | Launch branded wallets, remittance & payments for banks/fintechs with APIs & compliance tools | Peer-to-peer payments & merchant mobile money | Consumer & merchant mobile money with business APIs | Consumer & merchant mobile money (strong in francophone Africa) | Mobile wallet for transfers, bills & payments | Wallet & financial services integrated with Vodacom network in South Africa |

| Geographic Coverage | Deployable across markets where clients operate (API/white-label) | East Africa (e.g., Kenya, Tanzania, others) | ~16 African countries | ~17 African countries | ~14+ African countries | South Africa (expanding) |

| Institution Integration | API + flexible integration options for regulated financial use cases | Limited APIs (mostly push/USSD, ecosystem-dependent) | APIs for transaction and business integration | Moderate API support | Moderate API support | API integrations for super-app functions |

| Cross-Border Support | Built-in multi-currency & remittance modules | Available via partners/extended services | Cross-border options & interoperability improving | Known for strong cross-border features | Limited; domestic focus | Limited; primarily domestic + expanding services |

| Agent Network Strength | Depends on deployment/partners | Extensive agent network supporting cash in/out | Extensive telecom-based agent reach | Strong agent network across francophone markets | Good agent network | Growing ecosystems of services |

| APIs & Developer Support | Strong API-first architecture for wallet & payments | Basic/limited APIs | Good APIs for business integration | Moderate API support | Moderate API support | API integrations for ecosystem functions |

| Compliance & Security | Built-in KYC/AML, PCI/GDPR readiness | Regulated; basic compliance frameworks | Regulated; strong telco-compliance | Regulated; strong frameworks | Regulated; telco frameworks | Regulated; secure app ecosystem |

| Advanced Financial Services | Remittance, multi-currency, merchant acquiring, loyalty, bulk payments | Savings & credit optional services (via partners) | Some lending & ecosystem services | Value added services vary by market | Value added services vary by market | Wallet + lifestyle services, offers |

Other Major Mobile Money Platforms in Africa

If you’re a financial business planning to launch mobile money services, you’ll quickly realize one thing: Africa’s mobile money ecosystem is not dominated by one type of player. It’s a mix of telcos, fintech aggregators, and bank-led switching infrastructure.

Understanding these platform types helps you make a more informed build-or-partner decision and, more importantly, enables you to design a mobile money proposition that scales across various rails, regions, and compliance requirements.

Plus, it helps you build the best mobile money platform for marketplaces. Below are the three most common platform categories you’ll encounter.

Telco Wallets

Telco-led wallets are among the most established mobile money ecosystems in many African markets. Their biggest strength is distribution.

Where telco wallets work well

-

Fast adoption due to existing subscriber base

-

Deep agent networks supporting cash-in/cash-out

-

Strong everyday transaction familiarity (P2P, bill pay, airtime top-ups)

Where can they limit your institution

-

Limited control over customer experience and branding

-

Restricted customization for institution-specific workflows

-

Harder to scale across multiple telcos and countries without complex partnerships

If you’re a financial business, telco wallets can be a powerful channel, but they may not offer the flexibility you need for a long-term, multi-market digital finance strategy.

Fintech Payment Providers

Fintech payment providers typically sit between multiple payment rails and offer faster integrations. Many banks and fintechs use them to accelerate launches.

Where fintech payment providers work well

-

Faster go-to-market compared to direct telco integrations

-

Access to multiple payment methods through a single integration

-

Useful for launching basic wallet-to-bank and wallet-to-wallet flows

Where gaps appear

-

Limited depth in wallet-native operations (role-based wallets, advanced controls)

-

Reconciliation and settlement reporting may vary across providers

-

Compliance tooling often depends on third-party stacks rather than built-in workflows

These providers are strong when your priority is speed. But if you want full control over mobile money capabilities, you’ll need to evaluate whether their platform depth matches your product roadmap.

Banking & Switching Platforms

Banking and switching platforms form the regulated backbone of many financial ecosystems. They focus heavily on settlement, interoperability, and control.

Where banking & switching platforms work well

-

Strong compliance alignment and regulatory credibility

-

Structured settlement and reporting mechanisms

-

Better support for bank-grade controls and governance frameworks

Where limitations can show up

-

Implementation timelines can be longer

-

Product flexibility may be constrained

-

Innovation cycles are slower due to rigid infrastructure layers

For many institutions, banking and switching platforms provide stability. The key question is whether they can support the speed and modularity required for mobile money innovation.

Why Marketplaces Struggle with Standalone Mobile Money Providers

Standalone providers usually struggle not because they’re “bad,” but because they are built for a limited scope.

Below are the most common friction points.

Too Many Integrations as You Expand

Most standalone providers cover only a subset of rails. As soon as you want to expand: new telcos, new banking rails, new corridors, you start stacking integrations.

That leads to:

-

Fragmented customer experience

-

Inconsistent transaction handling, and

-

Longer change cycles every time you add a new rail

And instead of building a mobile money ecosystem, you end up building an integration maze.

Manual Reconciliation Becomes an Operational Burden

Standalone setups often push reconciliation responsibility back to your internal teams.

You deal with:

-

Different settlement cycles per provider

-

Inconsistent reporting formats

-

Mismatched transaction references

-

Disputes that require manual tracing

This becomes a hidden cost. And finance and operations teams end up doing work that infrastructure should automate.

Limited Control Over Wallet Logic and Customer Journeys

Banks and financial institutions don’t just need a wallet. You need a wallet that matches your product rules.

For example:

-

Tiered limits based on KYC level

-

Role-based permissions (agent, customer, partner)

-

Configurable fees and commissions

-

Approval workflows for sensitive transactions

Standalone providers typically offer fixed flows. That makes innovation slow and customization difficult.

Compliance Tooling Is Often Incomplete

As transaction volumes increase, regulators and internal risk teams expect stronger controls.

If compliance tooling is weak, your institution gets exposed to:

-

AML gaps

-

Poor audit trails

-

Limited transaction monitoring capability

-

Slow investigation workflows during disputes or suspicious activity reviews

You shouldn’t have to bolt compliance onto mobile money later. It must be built into the system from day one.

Scalability Breaks When Reliability Becomes Mission-Critical

In mobile money, reliability is not just uptime. It’s transaction traceability, retry logic, and clear failure handling.

Standalone providers can create issues like:

-

High failure rates when rails fluctuate

-

Weak monitoring visibility for your teams

-

Limited fallback options when one rail goes down

When customers can’t transact, they don’t blame the provider. They blame your institution.

Build vs Buy Mobile Money Infrastructure for Marketplaces

The challenges don't end here.

If you’re a financial business planning to offer mobile money services, you’ll hit this decision early:

Do you build mobile money infrastructure in-house, or do you buy a proven platform?

Both approaches can work. But they lead to very different outcomes in speed, risk, cost, and long-term flexibility.

Let’s break this down clearly.

When building in-house makes sense

Building can be a fit when:

-

You have a mature engineering organization dedicated to payments

-

You can invest 12–24 months without immediate revenue pressure

-

You already have strong compliance and risk tooling that can integrate tightly

-

You need highly specialized workflows not supported by available platforms

But building is not a “wallet project.” You’re building:

-

Wallet ledger logic

-

Multi-rail integrations

-

Settlement and reconciliation engines

-

Transaction monitoring

-

KYC/AML controls

-

Admin dashboards and audit trails

-

Operational tooling for failures, retries, and dispute flows

When buying becomes the better business decision

Buying a mobile money platform becomes a fit when:

-

Time-to-market is critical

-

You want predictable rollout timelines

-

You need a mobile wallet infrastructure in Africa that is already designed for scale

-

You want to focus internal teams on customer acquisition and product differentiation

-

You want compliance controls embedded into the workflow from day one

In short, buying helps you launch faster while reducing implementation risk.

The good news is: DigiPay.Guru can help: Here’s a quick comparison of build vs Buy(DigiPay.Guru’s whitelabel platform)

| Area | Build In-House | Digipay.guru |

|---|---|---|

| Time to market | 12–24 months | Weeks |

| Regulatory burden | Very high | Embedded |

| Scalability | Hard | Native |

| Cost predictability | Low | High |

| Product focus | Engineering | Growth |

And in most financial institutions today, the strategic advantage comes from launching early, learning faster, and iterating with market feedback. And not from spending years rebuilding infrastructure that already exists in mature, white-label platforms.

Marketplace-Critical Capabilities

Before you choose any platform, you need a checklist of the key capabilities you should have in your platform. Below are the capabilities that actually matter when you run African marketplace payment solutions:

| Capability | How Digipay.guru Enables It |

|---|---|

| White-label wallets | Buyers, sellers, agents |

| Split payments | Commission & escrow flows |

| Bulk payouts | Vendor & driver settlements |

| Compliance stack | KYC, AML, transaction monitoring |

| API orchestration | Faster expansion |

| Interoperability | Telcos, banks, PSPs |

DigiPay.Guru: The Leading Mobile Money Platform for African Marketplaces

If you’re a financial business planning to offer mobile money services, you need more than a wallet app. You need a secure, scalable foundation that supports real-world financial flows across customers, agents, partners, and service providers.

That’s where DigiPay.Guru fits in.

DigiPay.Guru helps you launch white-label mobile money services faster, with the control and flexibility institutions need. Instead of stitching together multiple providers, you get one platform designed for regulated, high-volume environments.

With DigiPay.Guru, you can offer:

-

White-label wallets tailored to your customer journeys

-

API-first integrations for faster rollout and expansion

-

Interoperability across telco wallets, banks, and PSPs

-

Built-in compliance controls like KYC and AML screening

-

Operational visibility through monitoring, reporting, and audit trails

The result: you can scale digital finance services confidently, without adding operational friction or compromising compliance.

Comparison: DigiPay.Guru vs Other Mobile Money Platform Types

Once you know what matters, comparisons become simple.

Here’s a practical, buyer-friendly view of DigiPay.Guru vs. Other mobile money platforms:

| Feature | DigiPay.Guru | Telco Wallets | PSPs | Bank Platforms |

|---|---|---|---|---|

| Marketplace wallet system | ✅ Native | ❌ | ⚠️ Limited | ❌ |

| Split & escrow flows | ✅ Built-in | ❌ | ⚠️ Partial | ⚠️ |

| Multi-rail orchestration | ✅ Yes | ❌ | ⚠️ | ⚠️ |

| Compliance automation | ✔️ | Limited | Limited | ❌ |

| Wallet Module | ✅ Yes | ⚠️ | ⚠️ | ✅ |

| White-label control | ✅ Full | ❌ | ⚠️ | ❌ |

| Cross-border readiness | ✅Yes | ❌ | ⚠️ | ⚠️ |

| Scalability | ✅ Africa-first | ⚠️ Country-based | ⚠️ | ⚠️ |

Notice the pattern.

-

Telco wallets are strong for adoption.

-

PSPs are strong for fast onboarding.

-

Bank platforms are strong in structure.

But marketplaces need a combination of flexible workflows, orchestration, and compliance-ready automation.

That combination is what infrastructure platforms solve.

Why African Marketplaces Choose DigiPay.Guru

Banks, fintechs, and financial institutions choose DigiPay.Guru because it helps them launch and scale mobile money services without turning payments into an operational headache.

In fast-moving African financial ecosystems, speed matters, but control matters even more. So, you need infrastructure that supports growth, compliance, and multi-rail connectivity from day one.

DigiPay.Guru stands out because it gives you:

-

Faster go-to-market with a ready, white-label mobile money platform for Africa

-

Full ownership of customer experience without relying on third-party wallet branding

-

Interoperability across rails, including telco wallets, banks, and PSPs

-

Built-in compliance tooling for KYC, AML screening, and monitoring workflows

-

Automation for settlement and reconciliation, reducing manual back-office work

-

Scalable architecture designed for high transaction volumes and regional expansion

In short, it’s the difference between offering mobile money as a feature and running it as a dependable financial infrastructure.

Conclusion

Mobile money in Africa has moved far beyond basic transfers. Today, it supports everyday payments, agent-led access, bill pay, and large-scale disbursements often across multiple rails.

For you, this creates a clear opportunity: you can offer digital payment services that fit how customers already transact. But the platform you choose directly shapes how fast you can launch, how reliably you can operate, and how confidently you can meet compliance expectations as volumes grow.

If you want to deliver this capability under your own brand, DigiPay.Guru advanced mobile money solution gives you a proven, white-label platform with API-first scalability, multi-rail interoperability, and built-in compliance controls to support secure, high-volume mobile money services across African financial ecosystems.

FAQs

The best platform is one that lets you launch white-label mobile money services under your brand with strong control and scalability. It should support multi-rail interoperability (telcos, banks, PSPs), built-in compliance, and operational visibility. For institutions, the best platform is the one that reduces risk while accelerating go-to-market.

A single wallet provider may work for limited use cases, but financial ecosystems rely on multiple rails and participants. Infrastructure ensures interoperability, consistent controls, reliable reporting, and scalable operations across providers. It also reduces dependency on manual reconciliation and fragmented customer journeys.

DigiPay.Guru helps banks and fintechs launch secure, white-label mobile money services using an API-first fintech platform. It supports multi-rail connectivity, wallet operations, and operational reporting in one system. You also get embedded compliance tools like KYC, AML screening, and monitoring, which helps you scale with confidence.

Look for a platform with white-label wallets, API-first integrations, and interoperability across telco and banking rails. It should include compliance controls, real-time monitoring, automated settlement reporting, and strong failure handling. These capabilities help institutions operate mobile money reliably at scale.

Traditional platforms are telco-led ecosystems with strong adoption and distribution. DigiPay.Guru is built for institutions that want to run mobile money under their own brand with deeper control. It provides a platform layer for interoperability, compliance automation, and scalable operations beyond a single provider network.

Yes. DigiPay.Guru supports scaling across markets by enabling multi-rail connectivity and configurable transaction controls. Cross-border readiness depends on corridor and compliance needs, and the platform helps institutions manage these requirements with better visibility and orchestration. This reduces complexity compared to building corridor capabilities from scratch.

Building gives full control but takes time and requires deep investment in compliance, monitoring, and integrations. Using DigiPay.Guru lets you launch faster with predictable rollout and embedded governance. Most institutions prefer to differentiate with customer experience while relying on proven infrastructure for core mobile money operations.

DigiPay.Guru fits financial ecosystems where multiple participants transact through digital rails. This includes institutions offering customer wallets, agent-enabled services, and bulk disbursement programs. It also supports interoperability-driven models where telcos, banks, and PSPs need to connect under one operational framework.

DigiPay.Guru includes built-in compliance capabilities like KYC workflows, AML screening, and transaction monitoring. It supports configurable controls such as limits and rules-based alerts. With audit trails and operational reporting, institutions can investigate exceptions faster and reduce fraud exposure as transaction volumes grow.

Because it combines what institutions need most: white-label control, API-first scalability, multi-rail interoperability, and embedded compliance tooling. It supports operational visibility and automation that reduces back-office burden. This makes it easier for banks and fintechs to launch reliable mobile money services and expand across African financial ecosystems.