Offering the best cross-border remittance services to your customers can be challenging. Especially when your competitors are implementing advanced technology to create a faster, more secure, and compliant cross-border payment experience.

The good news is, you can also offer them, and even better than your competitors. Not just that, you can offer the best-in-class global payment services to your customers. But how?

The answer is a modern, advanced, and robust cross-border payment solution!

In this blog, you’ll learn the exact best practices modern remittance businesses like yours use to simplify global payouts for remittances, reduce costs, and expand faster with a system that works behind the scenes so you can focus on growth.

Let’s get started with the understanding of a modern cross-border payment solution.

Understanding the Modern Cross-Border Payment Landscape

The demand for cross border payouts has never been higher. And your customers expect fast, reliable, and transparent international transfers.

But many businesses are still operating with outdated infrastructure. Traditional cross-border systems rely on multiple intermediaries, manual processes, and delayed settlements. Every extra step means more time, more cost, and more room for error.

This makes it difficult to compete, especially when fintech challengers are offering real-time transfers and better customer experiences.

To stay ahead, you need a system that’s built for modern remittance needs. One that offers:

-

Real-time transaction capabilities

-

Built-in compliance automation

-

Multi-currency support, and

-

API-based integrations

In short, you need a purpose-built cross-border payment system and not a patched-together process. If you want to deliver fast, secure, and compliant international money transfers at scale, this is the foundation you start with.

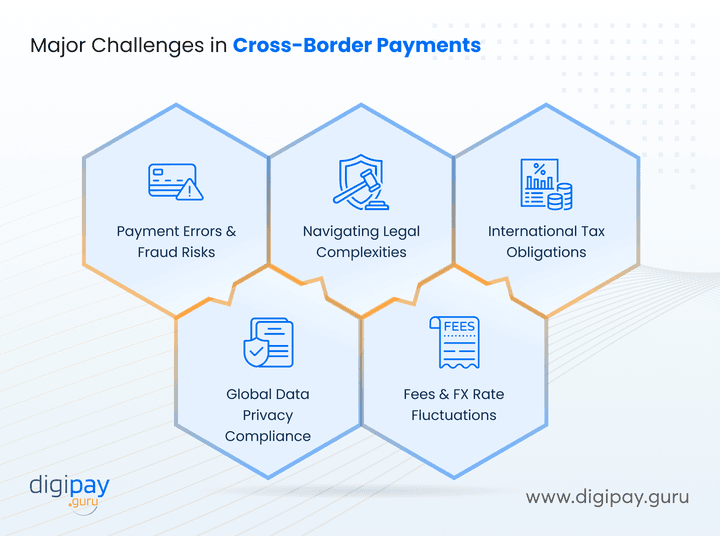

Major Challenges in Cross-Border Payments

Before implementing best practices, it's important to understand the common pain points that slow down or complicate international remittance services. Remittance businesses like yours often face multiple operational and regulatory hurdles when managing international payments at scale.

Below are some of the most critical challenges of global payouts:

Payment Errors & Fraud Risks

Mistyped beneficiary details, invalid account numbers, or system mismatches can lead to failed cross border transactions. These errors not only disrupt operations but also open the door to fraud. Without real-time validation and fraud monitoring, you may expose your business to unnecessary risk.

Navigating Legal Complexities

Cross-border remittance payments must comply with all the complex financial regulations that may vary for each country. From licensing to capital controls, you must stay aligned with local and international laws, along with cross border payments regulations, to avoid penalties or disruptions.

Managing International Tax Obligations

Handling cross-border disbursements means navigating tax rules across different jurisdictions. Reporting obligations, withholding taxes, and documentation requirements can add an administrative burden and compliance risk.

Ensuring Global Data Privacy Compliance

International transactions involve sensitive personal and financial data. So meeting data protection laws like GDPR and local equivalents is essential for maintaining trust and avoiding regulatory issues.

Handling Fees and Exchange Rate Fluctuations

Hidden fees and volatile foreign exchange rates reduce transparency and impact user trust. Without clear pricing and smart FX management, businesses like yours may struggle to stay competitive and profitable.

Understanding these challenges is the first step. The next step is implementing best practices to address these cross-border payment challenges effectively.

Read more - How do exchange rates work and how do you choose the right rate providers?

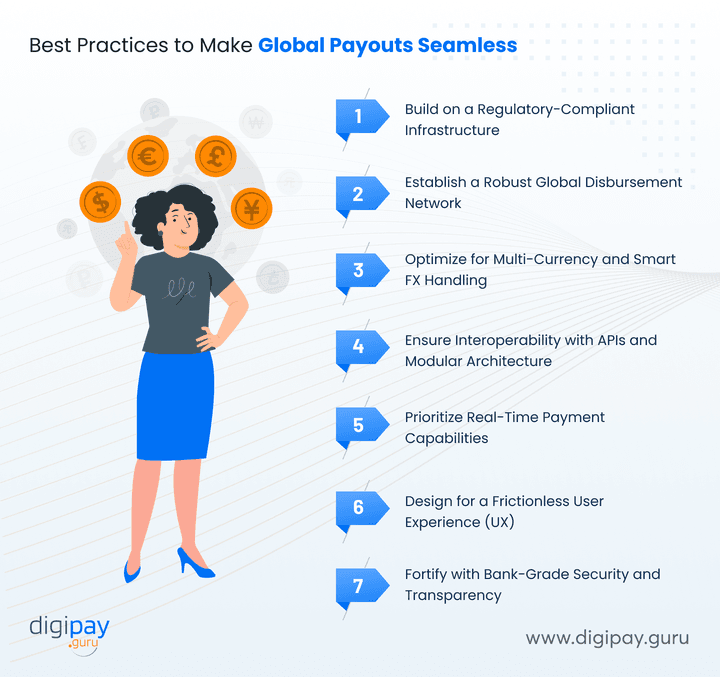

Best Practices to Make Global Payouts Seamless

Offering cross-border remittance services is no longer a competitive edge. It’s a standard expectation. But doing it well? That’s where real differentiation happens.

If you want to scale, retain customers, and stay compliant without adding operational complexity, the approach matters just as much as the technology.

Below are seven proven best practices that can help you build, streamline, and scale your cross-border payment operations with confidence.

Build on a Regulatory-Compliant Infrastructure

When it comes to cross-border payouts, regulatory compliance is even more important. Every jurisdiction has its own set of requirements: eKYC, AML, sanctions screening, data privacy laws, and more. And trying to manage all of it manually increases risk and slows down transactions.

Modern cross-border global payment systems should embed compliance directly into its workflows. Choose a solution that supports multi-jurisdictional compliance through automated eKYC, AML screening, and dynamic risk rules.

This not only reduces manual errors but also ensures every transaction meets local and international regulatory standards.

Plus, with built-in compliance, you can onboard users faster, minimize delays, and reduce audit stress, all while maintaining trust with regulators and customers.

Establish a Robust Global Disbursement Network

A powerful cross-border payment system is only as strong as its disbursement reach. Your customers want funds delivered quickly and reliably, regardless of location.

To make that possible, you need deep integrations with local payout channels: banks, mobile wallets, cash-out agents, and regional payment service providers (PSPs). These relationships enable fast delivery, lower transaction costs, and better currency management.

Robust cross border payment solutions offer multi-channel disbursement capabilities, including bank accounts, wallets, and over-the-counter cash across various geographies.

And you gain the power to serve diverse customer preferences while ensuring consistency and speed.

Optimize for Multi-Currency and Smart FX Handling

Foreign exchange is a critical component of cross-border transactions and a common point of friction. Unpredictable conversion rates and hidden charges frustrate users and eat into margins.

Leading global payment platforms offer smart FX engines that deliver real-time rates, guaranteed spreads, and full visibility into conversion costs.

With a cross-border payment solution, you can enable rate locking, apply custom margins, and automate conversions based on predefined rules.

This creates a more transparent and trustworthy experience for your users and gives your business better control over profitability.

Ensure Interoperability with APIs and Modular Architecture

Modern global payment solutions should offer developer-friendly APIs, sandbox environments, and plug-and-play modules that integrate with your existing tech stack, from banking cores to CRM tools.

And if it's white-label, it's a plus point. A white-label platform gives you the flexibility to customize features, add new corridors, and manage integrations at your own pace.

This means faster time to market, fewer development headaches, and a smoother experience for both your team and your users.

Prioritize Real-Time Payment Capabilities

Cross-border payments are evolving fast. And your customers now expect real-time transactions, not next-day transfers. If your system doesn’t support instant payments, you risk falling behind.

With support for ISO 20022, RTP rails, and intelligent routing, a modern international remittance system ensures that payments reach their destination quickly and securely. You can also get:

-

Real-time transaction updates

-

Status tracking, and

-

Instant confirmation notifications.

This not only improves transparency but also significantly boosts user confidence in your service.

Design for a Frictionless User Experience (UX)

Operational efficiency is critical in remittances. But the kind of user experience is what keeps your customers coming back to use your remittance platform.

Whether it's your internal operations team or end users sending money, your interface should be clean, intuitive, and informative.

Look for systems that offer:

-

Self-service portals for managing transactions

-

Bulk upload features for high-volume disbursements, and

-

Real-time payout tracking and multilingual support

A reliable and trusted global payment solution can provide a fully white-labeled interface designed to make sending and managing cross-border payments easy for every stakeholder involved.

Fortify with Bank-Grade Security and Transparency

Your cross-border payment platform should offer end-to-end encryption, PCI DSS compliance, real-time fraud detection, and strict access controls.

Get a solution that is built with a security-first architecture. From transaction monitoring to two-factor authentication, it should help you protect sensitive data, prevent fraud, and meet international security standards.

With trust built into every transaction, your customers stay confident, and your operations stay safe.

Choosing the Right Cross-Border Payment Technology Partner

The success of your cross-border payment services depends heavily on the cross border payment providers you choose to power them. With dozens of options in the market, it's essential to focus on the factors that truly impact performance, compliance, and long-term scalability.

As a bank, fintech, or financial institution, here are five non-negotiables you should look for:

-

Regulatory support: The platform should automate KYC, AML, and reporting to meet global and local requirements.

-

Technical integration ease: Developer-friendly APIs, sandbox environments, and smooth onboarding are critical.

-

Scalability and flexibility: You need a system that grows with your business, which enables adding corridors, features, and partners easily.

-

Real-time reporting: Instant visibility into transactions, compliance checks, and reconciliation saves time and improves transparency.

-

Customizable UX: A white-label interface that reflects your brand and simplifies user workflows matters more than ever.

DigiPay.Guru delivers on all of these. Our cross-border payment solution is designed to help financial institutions scale faster, reduce operational risk, and deliver exceptional experiences to both internal teams and customers.

Choosing the right partner isn't just about features; it's about future-proofing your cross-border payment business.

Conclusion

Cross-border payments have become a strategic priority for businesses like yours offering international remittance services. Operational inefficiencies, regulatory complexities, and rising customer expectations demand a more sophisticated and scalable approach.

So, implementing best practices for seamless cross border payouts is no longer optional. It’s very important to deliver fast, compliant, and cost-efficient cross-border money transfers. And that’s only possible with the right technology partner.

By leveraging a purpose-built cross-border payment solution, you can simplify operations, reduce risk, and enhance the user experience across every payout corridor.

DigiPay.Guru empowers remittance businesses like yours with a modern, API-driven platform designed to support seamless, secure, and scalable cross-border payments. From real-time FX and multi-channel disbursement to compliance automation and transaction transparency, our solution is engineered to meet the demands of modern remittance services.

FAQ's

Cross-border payments refer to the process of sending money from one country to another. For remittance businesses, this typically involves transferring funds to end users, such as individuals, freelancers, gig workers, or vendors, across different geographies.

The process usually includes initiating a transfer, converting currency, meeting local compliance checks, and settling the payment through local banks, wallets, or cash-out partners. A cross-border payment solution like DigiPay.Guru simplifies this by handling compliance, FX, routing, and disbursement from a unified system.

You should evaluate providers based on five key criteria:

-

Regulatory readiness (built-in eKYC, AML, and compliance workflows)

-

Integration flexibility (well-documented APIs and modular architecture)

-

Scalability (ability to expand into new corridors and volumes quickly)

-

Real-time visibility (live reporting, transaction tracking)

-

Customizable user experience (white-label portals, multilingual support)

A partner like DigiPay.Guru offers all of the above, purpose-built for modern remittance businesses.

FX rates impact the final amount your recipient receives and the margins you earn. Without transparency and real-time rate locking, fluctuating rates can lead to user dissatisfaction and financial loss. A smart cross-border payment platform provides real-time FX engines, rate guarantees, and margin controls, which give you predictability and protect both you and your customers from surprises.

Yes. With the right platform, you can automate disbursements across dozens of countries simultaneously. DigiPay.Guru enables bulk uploads, real-time validation, multi currency payments handling, and smart routing—all within a single interface. This is especially useful for fintechs managing gig economy payouts, banks disbursing payroll, or MTOs sending P2P remittances at scale.

Processing times depend on the payment rails, currency pair, and local banking infrastructure. Traditional methods can take 2–5 business days. However, with a modern cross-border payment solution, many transactions can be completed in real time or within a few hours, especially when integrated with local payment systems or wallets. DigiPay.Guru supports real-time and same-day settlements in many corridors, which gives you the speed and predictability your business needs.