SACCOs were first introduced in Germany in the 1870s for poor people to avoid control and exploitation from money lenders. In the 1900s, the idea moved toward North America eventually. Then it reached Canada, the United States, Australia, and Ireland. And as of now, SACCOS has spread across 60+ countries with a member pool of around 100 million people.

According to the latest study by Global Findex Report 2021, there are almost 1.4 billion unbanked people in the world who don’t have access to proper banking services in their locations.

The major reason for this astounding number is a lack of awareness, access, convenience, steady income, and trust. But, trust is a huge factor as it keeps people unbanked even if they have access to banking facilities.

These stats and points above reveal the need for a system that can provide access to banking services in every location and to all classes of people. That’s where SACCOs came into the picture.

In this blog, we will discuss what SACCOs are, their basic difference from banks, their top benefits, reasons why they should be digitized, and the major use case of African countries in this field.

What is SACCOs?

SACCO is an abbreviation for Savings and Credit Co-Operative Society. It’s a member-based financial institution owned and controlled by its members, who are also the customers using its services. This organization operates on co-operative values, identity, and principles, which include social responsibility, openness, honesty, and caring for each other.

SACCOs provide financial services, such as savings and credit, to members who share a common interest, such as living in the same geographic area, or labor union, working for the same employer, belonging to the same church or a social fraternity, or living in the same community.

In simple words, it’s a self-help organization where a group of people stock their savings and offer loans to their members. The main objective behind setting up SACCOs was to combat poverty by providing affordable financial services to its members and promoting economic development within the community.

Through SACCOs, members can save money and borrow at competitive rates, with the organization being managed democratically by elected members from the community. These organizations offer a simple, accessible, and reliable option for people to invest, save, and raise capital for their needs.

SACCOs VS Banks: the basic difference!

SACCOs offer similar financial services as traditional banks. Even the experience of using those services is quite the same. However, there are a few key differences between the two. Let’s have a look at these differences.

Ownership

One of the main differences between traditional banks and SACCOs is ownership. Banks are generally owned by investors who may or may not be account holders. However, in a SACCO, you become a partial owner of the organization the moment you open an account there.

Profitability

Unlike traditional banks, SACCOs are not-for-profit organizations. They work in the best interest of their members. They are free from the stress of corporate investors and stock price fluctuations.

However, one must not think of SACCOs as a charity organization. SACCOs collect revenue, make financial decisions, pay salaries, and compete with other financial institutions.

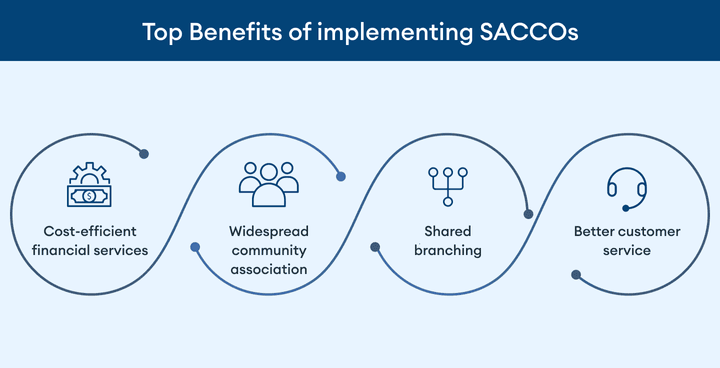

Top Benefits of implementing SACCOs

Apart from building trust and loyalty among the members, there are some essential benefits of implementing SACCOs. They are:

Cost-efficient financial services

Since SACCOs are not-for-profit and member-owned organizations, they pass on their success to their members by offering higher interest rates for savings, lower interest rates on loans compared to banks, and relatively lower fees.

Widespread community association

SACCOs play a crucial role in supporting the local economies by providing financial education & awareness. They also reach out to support small businesses. SACCOs are also known for supporting the local charitable organizations in the community. Shared branching

Shared branching is a unique feature of SACCO. It is unique because SACCOs are often local institutions and lack a widespread network of ATMs and branches. However, in many cases, users can utilize the branches and ATMs of SACCOs for free via a shared branching network.

Users can also make withdrawals, and deposits, pay loans, and access many other financial services. However, it’s essential to know that to leverage shared branching both your SACCO and the branch you want to use should be part of a shared branching network.

Better customer service

SACCO offers excellent customer service as compared to traditional banks. A customer who values building relationships and rapport with loan officers and tellers will only prefer SACCOs over any traditional bank.

Why should SACCOs be digitized?

Digitalization is at its peak! And after COVID has impacted the world, the need for digitalization towards mobile money solutions and banking services has also increased. So, SACCO must also get digital. But why? Let's understand why it is necessary to digitize a SACCO. Here are some reasons why:

Changing customer needs and preferences

Nowadays, the world has become fast-paced and after the COVID-19 impact, the needs and preferences of customers have become very dynamic. Customers today do not have time to waste and believe in as much convenience as they can get, especially in financial services.

With the increased penetration of mobile device users and mobile money services, it is now necessary to allow the members of SACCO to be able to access financial services through their mobile devices.

In addition, the majority of the members of these SACCOs are small business owners away from banking facilities. So, they need the best financial partner that can provide smooth functioning and quality services to grow their business.

And after the drastic impact that COVID-19 had on the payment industry, the digitization of SACCOs has come out to be a boon and has reached a wider customer base, including those who do not have access to traditional banking services.

Read More: COVID -19 impact on payment sector

Enhanced efficiency

Digitization is revolutionizing the way SACCOs operate by providing enhanced efficiency and cost savings. By utilizing digital technologies such as cloud computing, mobile banking, and artificial intelligence (AI), SACCOs can streamline their operations and increase their productivity by eliminating the need for manual processing and paper transactions.

Also, digital technologies enable SACCOs to offer improved customer service and provide real-time access to account information.

The minimized costs

When SACCO becomes efficient, it automatically minimizes unnecessary costs for them. From automated payments to digital banking services, digitization has enabled SACCOs to reduce their operational costs and focus on providing better services to their members.

With the help of digital tools, SACCOs can now track transactions in real-time and reduce paperwork which ultimately contributes to reducing extra costs. Thus, by digitizing operations, SACCOs can minimize costs while still offering quality services to their members.

Data Analytics

Digitizing SACCOs is a great way to leverage data analytics and insights. By digitizing their operations, SACCOs can gain access to real-time data and analytics that they can use to make informed decisions. This helps them in understanding their customers better, managing their finances more efficiently, and improving customer service.

Moreover, it also provides access to a wealth of data that can be used to identify trends and make predictions about the future. This information can then be used to develop strategies that will help the organization meet its goals. Additionally, it can also help in identifying potential areas of improvement or areas where further investment may be needed.

Improved security

Digitizing SACCOs can improve security by implementing various measures to protect sensitive data and transactions from unauthorized access and detect and prevent fraud and suspicious activities.

SACCOs do it in the following ways:

- Data encryption to members' personal information and account details is encrypted to protect them from unauthorized access and potential breaches.

- SACCOs can limit access to sensitive information and transactions to authorized personnel only.

- SACCOs can implement two-factor authentication, like passwords and fingerprints for accessing account information.

- AI-based security software can be used to detect and prevent fraud and suspicious activities

Transparency

With digital systems, records are easily accessible and updated in real-time. This allows every member of SACCO to view their account balances and transaction history at any time. Hence, it creates a sense of transparency among the members.

Furthermore, it can provide a clear and complete audit track, making it easier to track transactions. This assures that the information is accurate, up-to-date, and available to all members.

Competitive advantage

Digitizing SACCOs can allow for more efficient customer service, as customers can access services quickly and conveniently. It also allows SACCOs to access and analyze customer data to better understand customer needs and respond with tailored solutions.

In addition, it allows SACCOs to take advantage of new technologies and tools, which can help them to stay ahead of the competition.

African countries leading in the SACCOs world!

One of the biggest reasons behind SACCO’s success is that it takes the advantage of the strength and trust of the local community. SACCOs have seen immense success in the African continent because of two reasons. First, the convenience that it provides to its members. Second, its business model is built on the foundation of local communities.

According to a 2021 World Council Statistical Report, Kenya recorded a total asset value for SACCOs to be around USD 20 billion. And it even leads the number of members with around 9.9 million members.

Moreover, other African countries also had a large number of SACCO members. Ethiopia with 5.3 million members, Rwanda with 4.1 million, Uganda with 1.2 million, and Zambia with 1.04 million are leading the African SACCO markets.

The same study highlights Africa's SACCO membership which amounts to nearly 40.36 million people as of 2021. This figure shows that the African continent has the maximum usage and scope of financial services provided by the SACCOs.

Conclusion

SACCOs have been a symbol of trust and confidence when it comes to financing for many millions of people around the globe. With the latest digital technology disrupting the banking sector and the history of the pandemic forcing people to stay indoors and maintain social distancing, it was just a matter of time that SACCOs would hit the digital transformation.

In the coming years, we might see giant steps being taken in the direction of digitizing SACCOs. This digitization may expand the horizon of FinTech in a way we never imagined.