Reserve bank of India (RBI), India’s central bank and regulatory body, has made a remarkable move for the Fintech industry in India. RBI has issued a new framework UPI123Pay that enables users for offline digital payments for featured phones.

This move will significantly boost the digital payment methods and people will be more aware of various modes of digital payments. So what are you waiting for! Let’s quickly peek into the details of guidelines and see how this move can help you in your business to prospect more.

Reserve bank of India issued a ‘Statement on Developmental and Regulatory Policies’ with three pilots in three different regions of India to test with small value-based transactions. With the proven results, the RBI has concluded it fit to issue and introduce the solution and framework for the public interest.

Fintech in India- Powering mobile payments

The fintech sector is witnessing massive shifts in favor of digital payments. Digital Payments services have been forefront for transforming a robust infrastructure, the continuous evolvement of customers’ experience, and progressive government initiatives.

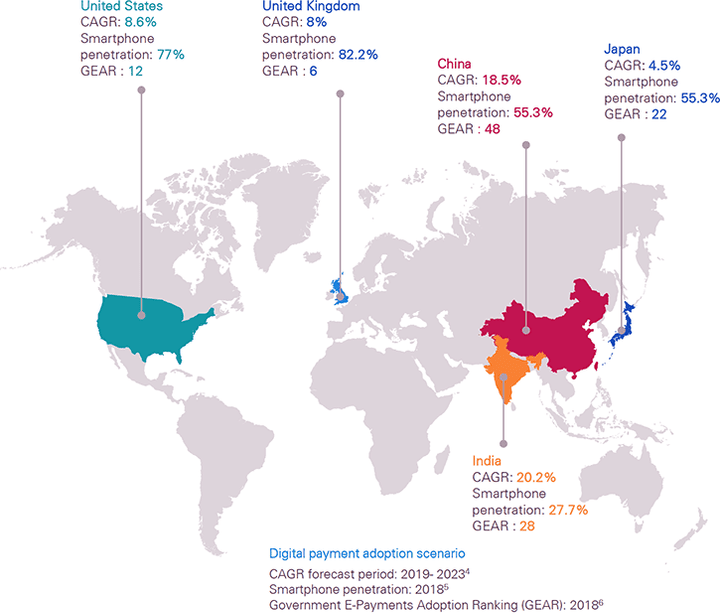

India is also revolutionizing its payment transformations and the evolution of online mobile payments and financial services, it has paved the way for digital transformations. The global landscape of digital payments is changing continuously. Digital payments methods are foreseeing thriving growth and gaining transactions worldwide.

According to Global Forecast Report to 2026 to 2026, the digital market size is projected to grow from $88.1 Billion in 2021 to $180.2 billion by 2026, at a CAGR of 15.4%.

India is the second leading smartphone penetration with 27.7% and digital payment is boosting at a CAGR of 20.2% followed by China. This could be a significant push to the innovative use of digital technologies.

According to the RBI report for FY 2020-21, there were 6 Billion card transactions with the amount of $174Billion out of which 5 billion transactions of amount $27 billion are for digital payments including e-wallet payment systems, gift cards, and others. This showed a significant scope for the digital marketers and hence, Indian regulators took advantage of this. Let’s explore what the framework is all about and how it is beneficial for public interest and merchants.

Highlights of the new offline Digital Payments framework:

The framework which the Indian Regulatory system, RBI, has introduced is the first of its kind which enables digital payment that too without internet! Sound strange. Yes, it is possible as this framework will conduct retail digital payments in offline mode throughout the country. Let’s see why they have planned to regulate this:

- This framework will give a push to digital transactions such as mobile money transfers, e-wallet payment systems, internet banking, bank cards, and mobile Point of Sale (mPOS), which creates awareness among people.

- Digital payment is weak in rural and semi-urban areas of the country because of poor internet connectivity, telecom connectivity, and usage of smartphones. This framework will give a boost in the digital transaction and India’s rural and semiurban areas could take a pick-up start from this move.

- This will promote contactless payment method, which is the hour of need in the COVID-19 pandemic era. Developing countries like India, need contactless payment solutions like Near Feild Communication (NFC) payments that engage more consumers and improve user experience too.

- The framework will promote digital payment methods which are more quick, convenient, and secure. As this doesn’t require immediate internet usage, this would be more user-friendly and a new introduction to an electronic payment solution.

How the Offline Digital Payment framework will work?

The framework issued by Indian regulators has certain conditions that have to be followed for its integration. They are as follows:

The framework will enable its users to make digital payments through feature phones in four ways:

IVR (Interactive Voice Response) calling: Calling in customer care number and selecting the preferred language and following the instruction to transfer the money securely.

Using App functionality: The featured phone will have inbuilt app functions that users can interact with during the payment process.

Proximity Sound-based payments: The framework will use sound waves to allow contactless, offline, and proximity of data on the featured device.

Give a Missed Call: This is most simple among all where the consumer gives a missed call on the merchant’s outlet display board to perform routine transactions and online bill payments and the customer will then receive an incoming call to enter the transaction UPI PIN for authentication.

The digital transactions are subject to a limit of Rs 200 for each transaction with an overall limit of Rs 2,000 for all offline transactions until the account balance is replenished.

The account balance can be replenished only in online mode.

The payment can be made face-to-face in proximity to the consumer using any mode of payment like bank cards, mobile wallet payment systems, mobile money transfers, digital payment apps, and any other.

The digital payment does not require any AFA(Additional Factor Authentication), since the transactions are offline. The payment requires the consumer’s consent. The notification alerts such as SMS, email, etc. will be received by consumers after a time lag.

Who all are the beneficiaries of the Offline digital payments framework?

The world of digitization is highly dominated by electronic payment methods and e-commerce solutions. Almost all the sectors have shifted towards online innovative methods and India Regulatory services have stepped forward towards this shift. The offline digital payment is going to help all local merchants and retailers the most but let’s find out who all can take advantage of this framework.

Digital banks and apps: The digital bank will have an advantage with the framework as it creates more awareness among people and they come to know about more digital payment solutions.

Digital payment apps developers: There is a great opportunity for online digital payment software development companies to create more user-friendly and robust software solutions which can integrate with this new framework.

Local Merchants, Vendors, and Retailers: Local merchants will be the winner of this framework as it will raise their footfall and promotes cashless payment methods. Their consumers can transact more conveniently for small purchases like households and groceries. Small recharges and toll payments can also be done through this method and hence affects many small businesses if a wide range.

Conclusion

Digitization has forced everyone to come out with new solutions whether you are a businessman, an entrepreneur, or a government regulatory to increase the financial inclusions. Indian Regulatory services, RBI, has introduced a new, innovative, and one of its type of payment method to cover the rural and semi-urban region with poor or no internet connectivity that can be worldwide accepted. This innovative framework is expected to make a huge difference in the India Fintech industry and tends to push digital payment methods.