Quick Summary

If you’re expanding or scaling remittance payouts into African corridors, the real challenge is rarely sending money. It’s delivering it reliably, to the right beneficiary, through the right rail, on time, and with full compliance traceability.This blog breaks down payout methods, infrastructure requirements, and what “fast & secure” truly means. You’ll also see how DigiRemit helps you orchestrate bank, wallet, cash, and card disbursements through one unified payout layer.”

If you’re running a remittance business, you must know this truth: the remittance experience isn’t judged at the moment the sender pays. It’s judged when the beneficiary receives. That last mile is where trust is earned or lost.

And in Africa, payout expectations are not uniform. Some beneficiaries want funds in a bank account, others need mobile wallet credit, and in many places, cash pickup is still essential.

Add to that corridor-specific pressure, especially across African corridors, where payout delays, failed credits, or unclear confirmations immediately trigger escalations from agents, partners, and customers.

That’s why payout infrastructure matters more than ever. When you build the right payout layer, you don’t just improve delivery speed; you reduce operational overhead, strengthen compliance posture, and make your remittance business scalable across multiple African markets without rebuilding the stack every time.

In this blog, you’ll learn the payout challenges, compare payout options in Africa, and see how DigiRemit enables fast remittance payouts to Africa with security, compliance, and real-time operational control.

Let’s begin by understanding the common payout challenges.

Common Payout Challenges in African Remittance Markets

Remittance payouts in Africa don’t fail because of one big issue. They fail because of multiple small issues across compliance, infrastructure, and local delivery conditions.

The key challenges include:

Operational & Compliance Barriers

Even if your remittance product is strong, payouts can collapse under operational and compliance realities if you don’t plan the payout layer properly.

Here are the most common blockers you face:

KYC, beneficiary verification, and mismatch risks: Beneficiary name mismatches, inconsistent identity records, or account ownership ambiguity create payout holds and manual reviews. This slows down what should be instant delivery.

AML/KYC payout compliance at scale: You need reliable screening, configurable rules, and defensible audit trails, especially across African corridors where risk expectations can be higher. It’s not enough to check a box; you need operational proof.

Fraud and payout risk management: Fraud doesn’t only happen at the sender side. Payout fraud can include account takeovers, SIM swaps, repeated payout attempts, agent manipulation, or insider risk. If you’re using fragmented systems, fraud monitoring becomes reactive.

Audit readiness and traceability gaps: The bigger you scale, the more questions you will face: When did the payout happen? On which rail? What checks ran? What was the outcome? Who approved the exception? If these answers are not instantly available, compliance becomes a business bottleneck.

💡Expert Tip

Technical & Infrastructure Hurdles

African payout rails are improving, but they remain heterogeneous and fragmented. This creates technical challenges that show up as customer problems.

Common hurdles include:

Fragmented rail integration: Integrating separate endpoints for banks, wallets, and cash agents means your product becomes an integration-heavy patchwork. Each rail has unique formats, SLAs, and failure behaviors.

Unpredictable confirmations and settlement behavior: Some rails confirm fast but settle later. And others reverse unexpectedly. Without a unified orchestration layer, it becomes difficult to deliver reliable payout confirmations.

High failure rates during peak volumes: High-volume events, salary days, festive seasons, and corridor spikes can trigger downtime or timeouts. If your payout routing is static, you suffer avoidable failure rates.

Payout reconciliation complexity: Reconciliation is where many remittance operations break. If you lack structured payout references, status codes, and automated matching, you end up with delayed reporting and higher dispute rates.

Market-Specific Issues

Africa isn’t one payout environment. It’s many payout environments layered together.

Here’s what makes Africa unique:

Different beneficiary delivery options depending on market maturity: In some markets, mobile money dominates. In others, bank rails are strong. And in many, cash pickup remains the default.

Urban vs rural payout realities: Even where digital rails exist, last-mile access varies. A wallet payout may not be useful if the beneficiary can’t easily cash out or spend digitally.

Corridor-specific compliance and partner expectations: African corridors often require additional transparency and control, especially for regulated partners, banks, and larger institutional senders.

💡Expert Tip

Remittance Payout Options in Africa: A Comparison

When you’re planning payout operations, the first question isn’t “which payout method is best?”

It’s: which payout method is best for this beneficiary, in this market, at this time, for this transaction risk profile?

That’s why modern remittance payout infrastructure increasingly relies on multi-rail disbursement.

Here’s a comparison of payout options in Africa:

| Payout Option | Speed | Security | Compliance | Cost | Scalability | Best Use Case |

|---|---|---|---|---|---|---|

| Bank Transfer | Medium–High | High | High | Medium | Medium | Urban banked recipients |

| Mobile Money Wallet | Fast | Medium–High | Medium | Low–Medium | High | Mobile-first markets |

| Cash Pickup / Agent | Immediate | Medium | High | High | Low | Unbanked / rural payouts |

| Prepaid Card Disbursement | Fast | High | High | Medium | High | Universal spend + ATM |

| DigiRemit Multi-Rail Orchestration | Real-time | High | Embedded | Optimized | Very High | All beneficiary types |

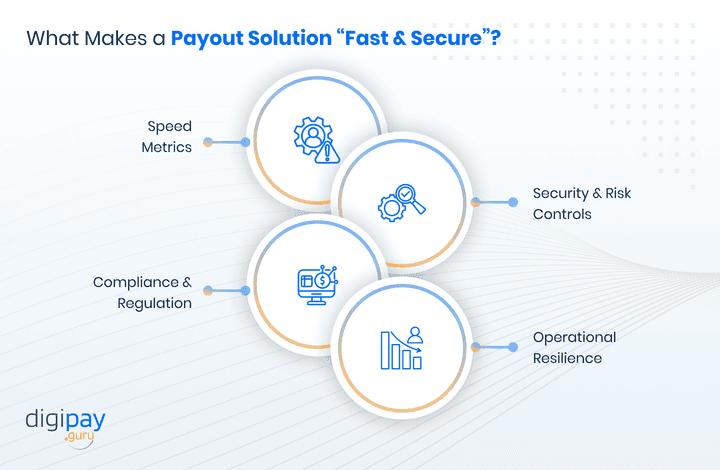

What Makes a Payout Solution “Fast & Secure”?

“Fast” and “secure” can’t be treated as marketing words. In remittance payouts, they must be measurable, operational, and defensible.

Here’s what makes a payout solution fast and secure:

Speed Metrics

Fast payouts aren’t just “instant.” You should measure speed using metrics like:

-

Average payout time (from payout request to completion)

-

Success rate (first-attempt delivery rate matters more than average time)

-

Exception resolution time (how quickly you recover when something fails)

-

Confirmation time (how quickly the sender/agent gets clarity)

If your payout system is fast but frequently fails or reverses, your real experience is not fast. It’s unreliable.

Security & Risk Controls

Security means you can confidently route high volumes without payout leakage or fraud.

You should expect:

-

Beneficiary validation and account verification, where applicable

-

Velocity limits and transaction monitoring

-

Real-time anomaly detection

-

Secure API access + authentication best practices

Read more - Transparency, Speed & Security in Cross-Border Payments

💡Expert Tip

Compliance & Regulation

A secure remittance payout solution must support:

-

AML/KYC payout compliance in Africa aligned to corridor standards

-

Configurable business rules

-

Audit trails by transaction and payout rail

-

Automated screening and exception logging

Compliance should not slow down payouts. It should be integrated into the workflow.

Operational Resilience

Operational resilience is what keeps your payout experience stable:

-

Automatic failover routes

-

Rail-level monitoring and uptime alerts

-

Contingency routing when a provider underperforms

-

Consistent dispute and reversal handling processes

Introducing DigiRemit: Fast & Secure Payouts for Africa

If you’re serious about scaling in African corridors, you need more than rail integrations. You need payout orchestration.

DigiRemit is an international remittance payout solution designed to enable fast remittance disbursements in Africa while keeping your compliance posture strong and your operations manageable.

Unified Multi-Rail Payout Engine

DigiRemit supports payout delivery across:

-

Bank transfers

-

Mobile wallets

-

Cash pickup networks

This allows you to offer the right beneficiary delivery options market-by-market, without reinventing the stack each time.

API-First Disbursement Platform

DigiRemit remittance payouts are built for speed-to-market:

-

Simplified MTO payout integration

-

Structured payout APIs

-

Operational visibility by rail and market

If your team is expanding across corridors, your platform should help you launch faster and not force you into another long integration cycle.

Compliance Automation

Instead of layering compliance as a manual ops step, DigiRemit supports:

-

Embedded compliance workflows

-

Standardized audit logs

-

Configurable rules

-

Better exception handling

This reduces payout friction while strengthening compliance defensibility.

Smart Settlement & Liquidity Routing

Settlement mechanisms in Africa vary widely across rails and partners. DigiRemit supports intelligent routing strategies that help you balance:

-

Speed vs cost

-

Availability vs reliability

-

Risk level vs payout route

💡Expert Tip

Payout Performance Metrics: What to Expect

If you’re assessing payout infrastructure, you should track KPIs that map to customer trust and operational readiness, such as:

| KPI | Typical Threshold | Business Impact |

|---|---|---|

| Average Payout Time | Seconds to minutes | Customer satisfaction |

| Settlement Latency | <24 hours | Cashflow predictability |

| Compliance Match Rate | 99.9% | Regulatory safety |

| Dispute Resolution | <48 hours | Operational trust |

| Cost per Transaction | Optimized | Competitive pricing |

What these KPIs really mean for you:

-

Faster payouts reduce abandonment and support tickets

-

Predictable settlement improves corridor profitability

-

Strong compliance match rate improves partner confidence

-

Dispute resolution SLAs protect your reputation

-

Optimized payout costs strengthen your unit economics

DigiRemit vs Other Remittance Payout Solutions

Many payout models work in the early stages. But once you scale across markets, they start breaking.

Here’s how DigiRemit compares against other remittance payout solutions:

| Feature | DigiRemit | Traditional Bank Rails | Mobile Wallet Only | Cash Pickup Systems |

|---|---|---|---|---|

| Multi-rail support | ✅ | ❌ | ⚠️ | ⚠️ |

| API-First | ✅ | ❌ | ❌ | ❌ |

| Built-in Compliance | ✅ | ⚠️ | ⚠️ | ⚠️ |

| Real-Time Settlement | ✅ | ⚠️ | ⚠️ | ❌ |

| Global integration | ⚠️ | ❌ | ❌ | ⚠️ |

| Cost Efficiency | Optimized | High | Medium | Very High |

| Scalability Across Africa | High | Low | Medium | Low |

Conclusion

If you’re building or scaling remittance corridors in Africa, your payout infrastructure becomes your competitive edge. Speed matters, but reliability matters more. And “secure” isn’t a slogan; it’s your ability to deliver payouts with compliance clarity, fraud controls, and real-time operational visibility.

The fastest-growing remittance players are those who can deliver consistently across multiple beneficiary types (banked, wallet-based, and cash-dependent), without rebuilding their system for every rail or market. That’s exactly why payout orchestration is no longer optional at scale.

If you’re planning to scale fast remittance disbursements across Africa, DigiRemit gives you a practical way to do it, through a single API-first, multi-rail payout orchestration platform with built-in compliance and reconciliation readiness.

Speak with our expert team today to explore how DigiRemit can fit your corridor strategy and payout goals.

FAQs

Remittance payouts to Africa are the final step of a cross-border remittance, where funds are delivered to the beneficiary through a local rail, such as a bank transfer, mobile wallet credit, cash pickup, or prepaid card. For you as a money transfer business, bank, or fintech, payout performance directly impacts customer trust, dispute rates, and corridor scalability.

DigiRemit enables fast remittance disbursements by using a multi-rail payout orchestration approach, where the platform routes each payout through the most suitable available rail (bank/wallet/cash/card) based on speed, availability, and risk rules. You also reduce delays through API-first automation, real-time payout tracking, and configurable exception handling.

Most African remittance beneficiaries receive funds via:

- Bank transfers (for banked recipients)

- Mobile money wallets (high adoption in many markets)

- Cash pickup/agent networks (common in unbanked and rural regions)

- Prepaid cards (useful where digital spending + ATM withdrawals are needed)

Your best strategy is typically multi-method payouts, because adoption and reliability vary by market.

DigiRemit is designed to support secure cross-border payouts through embedded risk controls and traceable transaction processing. Security is strengthened through configurable validations, fraud monitoring controls (where applicable), secure API authentication, and structured audit trails, thereby helping you reduce payout fraud, beneficiary mismatches, and operational leakages.

DigiRemit supports compliance workflows that help you operate confidently in regulated environments, including:

- AML/KYC rule enforcement

- Sanctions screening support

- Configurable risk thresholds per corridor

- Exception handling with reason codes

- Audit-ready transaction logs and reporting support

This makes compliance part of the payout flow and not a manual afterthought.

Yes. DigiRemit supports integrations for mobile wallet payouts in Africa, while allowing you to deliver funds directly into beneficiaries’ wallets where mobile money is the preferred payout method. This helps you increase payout reach, reduce cash dependency, and support fast disbursements, especially for low-to-mid value remittances.

DigiRemit supports multi-rail disbursement, including:

- Local bank and account payouts

- Mobile money wallets

- Cash pickup/agent networks

- Prepaid card disbursement

This gives you flexibility to offer the right delivery option per market and beneficiary type, without locking your corridor success to one rail.

DigiRemit reduces operational risk by lowering payout failures and manual workload through:

- Automated validations and compliance checks

- Smart routing with fallback logic (based on configuration)

- Real-time status tracking and confirmations

- Reconciliation-ready references and reporting

For your teams, this means fewer escalations, fewer disputes, faster investigation time, and stronger partner confidence.

Yes. Real-time payout is possible with DigiRemit, depending on the payout rail and market readiness. For example, wallet payouts can often be real-time, while certain bank rails may be near-real-time or same-day. DigiRemit helps you maximize real-time remittance delivery logistics by selecting the most reliable rail available and providing real-time payout status visibility.

As a money transfer business, DigiRemit helps you scale across African markets faster by enabling:

- Broader payout coverage (bank/wallet/cash/card)

- Faster payout delivery and higher success rates

- Simplified integration through payout APIs

- Reduced compliance and operational complexity

- Improved payout traceability and reconciliation

Ultimately, you can expand corridors confidently while keeping cost, risk, and operational workload under control.