There is a very thin line between an eWallet solution and a digital wallet solution. However, it can make a big difference for your business strategy. So choosing between which one to launch for your business is no joke.

When choosing between an eWallet and a digital wallet, you’re not just picking a solution; you’re laying the foundation for how your customers will experience digital payments.

From mobile apps to contactless payments, wallet technology has transformed how money moves. But what works for one business might not work for another. It means that your decision should match your audience, your business model, and your long-term strategy.

In this blog post, you will learn:

-

What is an eWallet and a digital wallet

-

The key difference between the two solutions: eWallet vs Digital Wallet

-

When to choose which solution for your business

-

The strategic considerations when making the decision and more

Let’s break it all down so you can confidently choose the right path.

What is an eWallet?

Understanding the meaning of an eWallet clearly is important:

Meaning

An eWallet is a digital payment app/system that allows your customers to store funds in the wallet. It’s like a physical wallet, but it stays in the user’s mobile phone. It facilitates instant digital payments from wallet to wallet and more.

How it Works

The working of eWallet is quite simple:

Step 1: Users download the eWallet app on their mobile devices.

Step 2: They register and complete KYC verification if required.

Step 3: Users add money to their wallet via bank transfer, credit card, debit card, or cash top-up.

Step 4: The funds are stored as digital value inside the wallet.

Step 5: Users can now make payments, transfer funds, or pay merchants directly from their wallet balance.

Examples of eWallets

You’ve probably heard of:

GCash – A popular eWallet in the Philippines that allows users to store money, pay bills, and send funds easily.

M-Pesa – Widely used in Africa, it offers mobile-based money storage and transfer without the need for a traditional bank account.

Paytm – Allows users in India to top up their wallet and pay for services like bills, shopping, or peer-to-peer transfers.

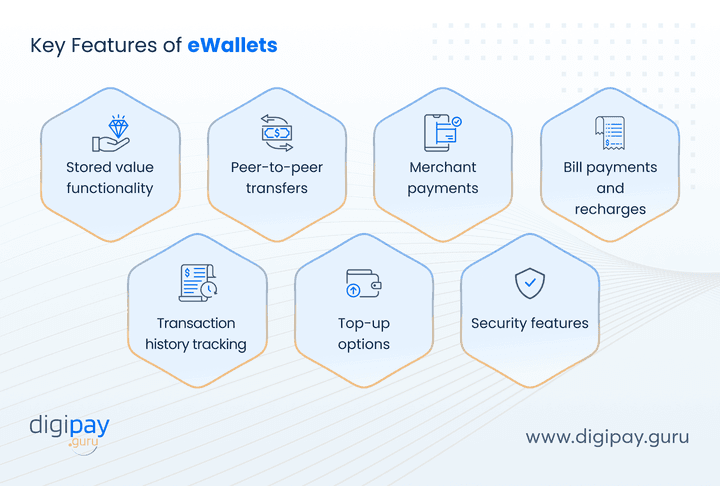

Key Features of eWallets

Stored value functionality: Lets users preload money into the wallet, which enables instant access to funds anytime.

Peer-to-peer transfers: Enables users to send money to friends, family, or other wallet users instantly.

Merchant payments: Users can pay for goods or services at physical stores and online merchants directly through the wallet.

Bill payments and recharges: Offers utilities to pay bills, recharge mobile phones, or pay subscriptions seamlessly.

Transaction history tracking: Users can view their complete payment history, while enhancing financial visibility and control.

Top-up options: Supports adding funds via debit cards, credit cards, bank transfers, or cash agents.

Security features: Includes PINs, biometrics like Face ID, and two-factor authentication to safeguard user transactions.

What is a Digital Wallet?

It’s essential to know the right meaning of digital wallet:

Meaning

A digital wallet is software that allows users to make digital payments by directly accessing their bank accounts or linked cards. Your customers do not have to store funds in the wallet.

How Digital Wallets Works

Digital wallet payments can be done in 6 easy steps:

Step 1: Users download the digital wallet app on their smartphone.

Step 2: They register and link their preferred bank account, credit card, or debit card to the wallet.

Step 3: The wallet securely tokenizes the linked card or account information for added security.

Step 4: At the time of payment, users simply tap their phone (NFC), scan a QR code, or pay online using the wallet.

Step 5: The wallet communicates with the bank/card issuer in real time and processes the payment instantly.

Step 6: A confirmation is shown, and the transaction is complete — no need to preload funds.

Digital Wallet Examples

Apple Pay: Enables secure, contactless payments using Apple devices linked to users’ bank accounts or cards.

Samsung Pay: Offers tap-to-pay convenience and supports both NFC and MST technologies for wider acceptance.

Google Pay: Allows users to pay directly from their bank accounts or cards for online and in-store purchases.

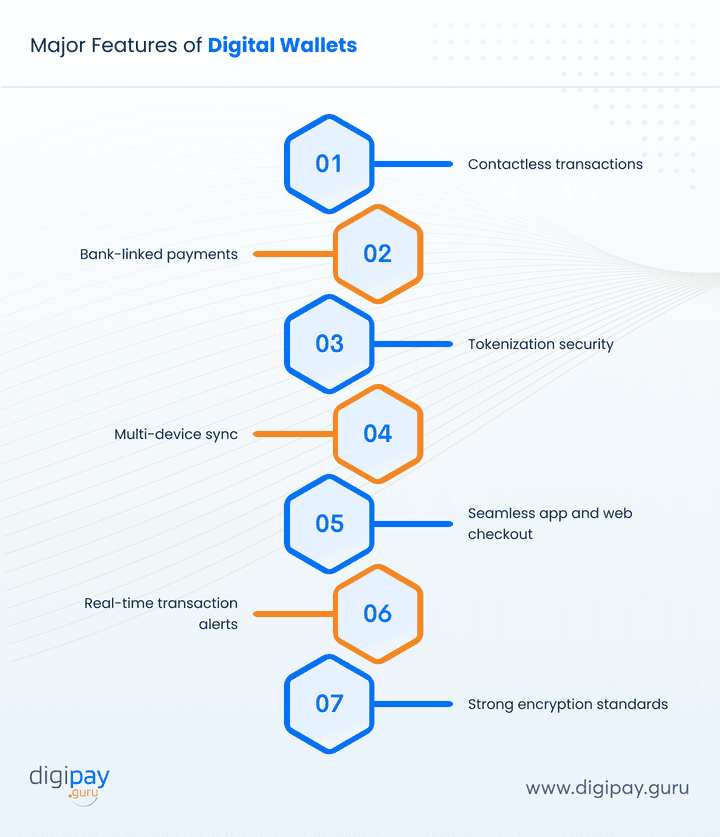

Key Features of Digital Wallet

Bank-linked payments: Lets users make real-time payments directly from their bank or card accounts.

No top-ups required: Users don’t need to preload funds; payments are processed instantly.

Contactless transactions: Enables secure tap-to-pay using NFC at physical stores and terminals.

Tokenization security: Hides actual card or bank details by using encrypted tokens during transactions.

Biometric authentication: Adds an extra layer of security with fingerprint, face ID, or iris scan.

Multi-device sync: Automatically syncs data across smartphones, tablets, and wearables.

Loyalty and pass storage: Stores digital loyalty cards, boarding passes, tickets, and coupons.

Seamless app and web checkout: Integrates smoothly with websites and apps for faster, one-click payments.

Real-time transaction alerts: Sends instant notifications after each payment for better control and visibility.

Strong encryption standards: Uses bank-grade encryption to protect every transaction from fraud.

Key Differences: eWallet vs Digital Wallet

This section will clarify all your confusion about the usage of the terms ‘eWallet’ and ‘digital wallet’ interchangeably. Because no, they are not the same.

The key differences include:

| Aspect | eWallet | Digital Wallet |

|---|---|---|

| Stores Funds | Yes, users preload money into the wallet | No, payments happen directly from bank or card |

| Top-Up Needed | Yes, users must add money in advance | No, transactions are processed in real time |

| Bank Account Needed | Not always; works even for unbanked users | Yes, must link to a bank account or card |

| Offline Capability | Yes, works in low or no internet zones using stored value | No, needs internet and live bank access |

| P2P Transfers | Yes, allows user-to-user money transfers | Yes, if supported by the bank or platform |

| Security Features | PIN, OTP, sometimes biometrics | Biometric login, tokenization, face ID, two-factor authentication |

| Best For | Budget control, closed ecosystems, loyalty rewards | Fast, direct, secure payments in open environments |

| Monetization Model | Earn from float, merchant deals, user engagement | Earn from transaction fees, integrations, value-added services |

| Operational Needs | Requires wallet management, KYC, compliance handling | Easier to operate, relies on existing bank/payment infrastructure |

When to Choose an eWallet Solution

An e wallet payment system is a great choice if:

-

You want to build your own payment ecosystem.

-

You prefer users to pre-load funds and use them within your app.

-

You’re targeting users in areas with inconsistent bank access.

-

You want to offer rewards, cashback, and budget management tools.

-

You plan to control the flow of funds and increase user engagement.

-

You want to offer offline mobile payments for transit, retail, or kiosks.

-

eWallets give you tighter control and allow for greater user retention with loyalty programs and gamified offers.

When to Choose a Digital Wallet Solution

A digital wallet solution is ideal if:

-

You want real-time payments with no top-up friction.

-

Your audience is digitally active and banked.

-

You aim for a faster time-to-market.

-

You want a low operational burden with no stored value liability.

-

You’re integrating with third-party payment gateways.

-

You need strong security features like tokenization and biometric access.

-

Digital wallet platforms are best suited for fast-moving, scalable fintech use cases.

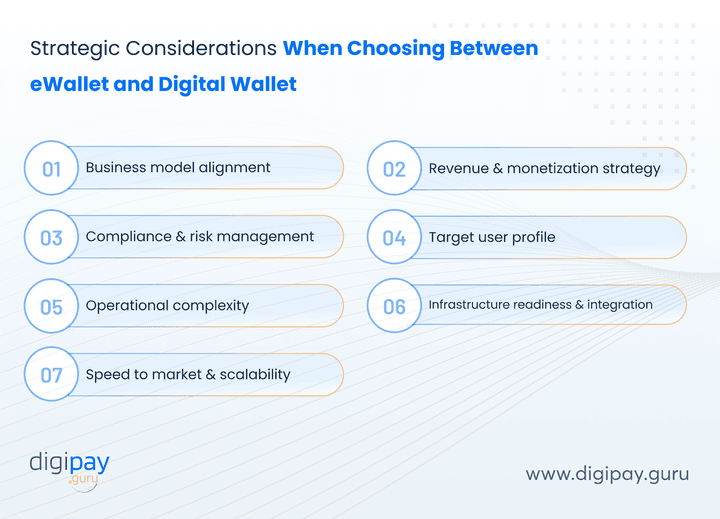

Strategic Considerations for Your Business When Choosing Between eWallet and Digital Wallet

Choosing between an eWallet and a digital wallet isn’t just about features. It’s about what aligns best with your business goals, users, and infrastructure.

Let’s explore the key strategic points you should evaluate before making that decision.

Business Model Alignment

The right wallet solution should naturally fit into your current and future business model.

If your financial offering revolves around wallet balances, loyalty rewards, or peer-to-peer money storage, an e-wallet solution makes sense.

If your focus is enabling seamless account-based payments or streamlining direct bank transfers, then a digital wallet platform is likely a better match.

Ask yourself: Does your model rely more on stored value or account-to-account movement?

Revenue & Monetization Strategy

Think about how you plan to earn from your payment solution.

With an eWallet, revenue can come from float income, merchant tie-ups, or promotional offers. You control the funds, so monetization is easier through:

-

Commission on partner services

-

Cashback-driven engagement

-

Tiered wallet models

In contrast, a digital wallet relies more on usage volume. Your income may come from:

-

Transaction processing fees

-

API service charges

-

Value-added services (like credit scoring or insurance sales)

Compliance & Risk Management

eWallets often involve holding user funds, which means regulatory compliance becomes heavier. You may need licenses for stored-value instruments, full KYC processes, and strong AML systems.

Digital wallets have a lower compliance burden as they don't store funds. However, they still need to comply with PCI DSS, authentication norms, and ensure safe integrations.

What to do: Evaluate what licenses, audits, and partnerships you’ll need to stay compliant and secure.

Target User Profile

Your user base should guide your choice.

-

If your users are unbanked, semi-banked, or operate mostly in cash economies, eWallets provide accessibility.

-

If your audience is urban, digitally mature, and already banked, digital wallets offer better convenience and trust.

Understanding user pain points and financial behavior is crucial.

Operational Complexity

Behind every wallet is a layer of operations you must manage.

eWallets involve fund flow management, balance reconciliation, wallet top-up partners, and internal ledgering systems.

Digital wallets demand integrations with banking APIs, third-party processors, and strong identity verification systems.

Infrastructure Readiness & Integration

If you already have API-based infrastructure, such as core banking systems, ID verification services, and a mobile tech stack, you’re well-positioned for either model.

However, if you lack backend capabilities or want to launch fast, a digital wallet platform can be simpler and quicker to roll out.

Speed to Market & Scalability

Digital wallets usually have a faster time to market because they don’t require stored-value management. Their cloud-native infrastructure also makes it easier to scale across regions and user bases.

eWallets take more time to launch due to wallet balance management, KYC, compliance, and float handling. But once live, they offer more flexibility to customize and add features that deepen user engagement and scale with your ecosystem.

How Can DigiPay.Guru Help?

At DigiPay.Guru, we understand that one wallet doesn't fit all.

So, we offer both advanced eWallet payment system solutions and cutting-edge digital wallet software.

With our eWallet solution, you can offer exceptional digital payment experience to your customers like P2P payments, contactless payments, airtime top-ups, etc.

With the eWallet solution, you get:

-

Multiple transaction options

-

Varied modes of payments

-

Agent network management

-

Multi-currency & multi-tenant

-

Seamless onboarding & KYC

-

Easy configurations and customization

-

Advanced security & compliance adherence

Plus, it's available in both license and SaaS versions.

With our digital wallet solution, you can offer secure and reliable digital payment services to your customers. And your customers do not have to store funds in the wallet.

The digital wallet offers:

-

P2P & P2M payments

-

Utility bills & airtime top-up

-

Referrals and rewards

-

Easy configurations and customization

-

Advanced security & compliance and much more…

It comes with

-

Lesser risks

-

Lesser licensing requirements

-

And there’s no need to pre-load funds

Plus, it can also be deployed in both license and SaaS versions.

Conclusion

Choosing between eWallet and digital wallet for your business can be complex and painstaking. But this blog will make it all easy, simple, and fast. The major difference between an eWallet and a digital wallet is its funds storage.

This unique distinction highlights a few other distinguishing features, like that a bank account is mandatory in making digital wallet payments but is not necessarily needed for eWallet payments.

With the key considerations in mind, such as business model, revenue, compliance, security, scalability, and more, you can make an informed decision between the two. In the end, it depends on your business needs.

The good news is: DigiPay.Guru offers both solutions. So once you are clear on what to launch, you don't have to worry about searching for the right solution frantically. It’s right in front of you.

FAQ's

No, they’re different. eWallets store preloaded funds, digital wallets link directly to bank cards/accounts for instant payments and mobile wallets are digital wallets designed specifically for smartphones.

Some examples of e-wallets include Paytm, GCash, M-Pesa, and Apple Pay Cash, all of which allow users to store funds and make payments directly from their digital wallet.

eWallets store funds within the app for offline use and can be preloaded, while digital wallets link directly to a bank account or card, which enables real-time payments without storing money in the app.

An online wallet typically refers to a web-based wallet that stores payment information for online transactions, while an e-wallet (electronic wallet) stores funds digitally, which allows both online and offline payments.

Yes, many advanced platforms allow hybrid models where users can both store funds and link bank accounts, offering flexibility for different user needs.

Both are secure if properly implemented. Digital wallets typically use advanced security like biometrics and tokenization, while eWallets rely on PINs and two-factor authentication.