When it comes to the matter of money, transactions, and finance, security is always paramount. There has been an extensive adoption of security measures to ensure that no fraudulent activity takes place. For example, bank representatives ask us for biographical data and passcodes. Similarly, a user has to confirm their identity with signatures and PINs.

However, evolving technologies and the impact of fintech in banking have rapidly digitized and innovated the banking and commerce sector. They are making banking services faster and more convenient than ever.

However, many people are still skeptical about the security aspect of it as we have seen many cases of fraud taking place in digital payments.

Biometric authentication technology has emerged as a potential solution to this issue. In this article, we will see what biometric payment technology is and how it can transform the landscape of digital payments. But first, let’s understand biometric technology.

What is biometric technology?

Biometric authentication is a security measure which uses biometric features of a user to verify the identity of a person trying to access an authorized device. Biometric features are nothing but unique biological and physical characteristics of an individual that can be compared against the authorized features stored in the database.

If the biometric features like fingerprint or face scan of a user match with the biometric database, the user is granted access to the device.

Biometric authentication can also be set up in the physical environment. For example, in gates and doors for controlling access points.

The usage of biometric authentication has rapidly increased over the years as it has made its way to the smartphones, consumer devices, and computers. Governments and private organisations are also using biometric authentication in secure areas such as airports, military bases, and at entry ports of national borders.

With increase in the usage of smartphones for the purpose of shopping and utilizing banking services, the companies have now started to leverage biometric technology for payments and money transfers.

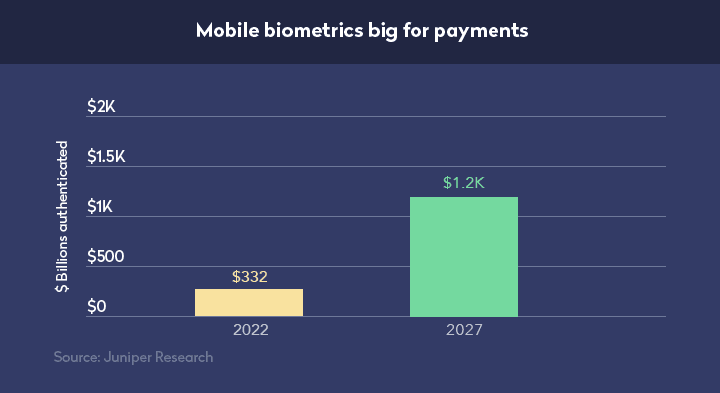

According to Juniper’s study, mobile biometrics will authenticate remote mobile payments worth $1.2 trillion by the year 2027, up from $332 billion in 2022. The research also highlights that the volume of biometrically authenticated remote mobile payments will grow by 383% over the next 5 years.

Moreover, Juniper also found that facial recognition is paving the way for greater adoption of biometrics in mobile payments, with OEM-Pay solutions leveraging the near omnipresence of facial recognition capabilities to provide seamless checkout experiences for customers.

The story of biometrics in mobile payments

After digital banking, digital shopping was the next frontier. Apple played a significant role here with the launch of Apple Pay in 2014. Many thought that it was far-fetched; however, the idea was quite sound. If people are getting comfortable accessing banking services from their phone then they would love to make purchases as well.

The secure and convenient mobile banking experience can also be translated into a secure and convenient mobile shopping experience. Soon big names like Samsung and Google came up with Samsung Pay and Android Pay respectively.

Samsung incorporated and established iris scanning as the central component of its mobile payment platform. It offered top-notch convenience as the customers could authorize payments by simply staring at their phones.

On the other hand, Android Pay didn’t require biometric authentication but many android smartphones supported this feature.

Types of biometric authentication

Fingerprint Scanners

Fingerprinting is one of the most common types of biometric authentication used in smartphones and many other devices. Fingerprint scanners record the swirls and ridges of an individual’s fingerprints.

Also, the fingerprint is an individual’s most unique form of identity. Even twin siblings have different fingerprints on their hands, making fingerprinting highly reliable.

The latest versions of fingerprint scanners are now assessing the vascular patterns of an individual’s fingers. Fingerprinting is not a fool-proof technology and has its own shortcomings. Despite that, it’s the most popular technology and is being utilized by several enterprises and customers.

Facial recognition

As the name suggests, facial recognition technology depends on matching different measurements of an authorized face to the face of the individual trying to gain access. These measurements are known as faceprints. If a sufficient number of faceprints is matched, then the user is granted access.

The facial recognition technology is already operational in many smartphones. However, it does struggle in comparing faces when it views them from different angles or differentiating between people with similar looks.

Voice identification

Voice identification technologies take vocal characteristics under consideration for distinguishing among various individuals. It creates a voice profile of a person by combining a number of data points and compares it with the data present in the database.

The voice identification technology focuses on speaker’s throat and mouth for the formation of particular sound quality and shape.

This methodology eliminates the security threats posed by voice imitation or with common conditions of sickness that might change the voice quality of the user.

Eye scanners

There are mainly two types of eye scanners available which are retina scanners and iris recognition scanners. In retina scanners, a bright light is projected toward the eye which forms visible blood vessel patterns. These patterns are then read by the scanner and are compared against the approved pattern saved in the database.

The process followed in iris scanners is also quite similar. The iris scanner looks for unique patterns in the coloured ring that is present around the pupil of the eye.

Both the eye scanning techniques are prone to inaccuracies if the individual is wearing eye glasses or contact lenses. A photograph can also trick these techniques.

Big names adopting biometric technology

With increasing cases of fraud, customers feel less secure with just PINs and passwords. That’s the reason why big names like Intel and Microsoft are adopting biometric authentication systems for their latest products and services.

Also, biometric single sign-on (SSO) is an advanced password management technology. It protects data from all unauthorized users. Companies like Microsoft and Intel are encouraging and facilitating banks to enter the biometric space for all mobile banking services.

Adoption of multi-factor authentication

Customers with only Passwords and PINs are highly susceptible to fraud. That's the reason why you must take steps to secure your online payment system. So, many organizations have started using multi-factor authentication (MFA) by combining fingerprint technology with facial recognition, retina, or voice.

MFA is highly secure as it makes it difficult for hackers to compromise the customer account. This unique security method combines something that a user knows and what a user is.

Banks will also start pairing PINs & passwords with biometric recognition in mobile banking for two-factor authentication before the manual logins become outdated.

Online banking made secure and simple

Apple created a huge buzz when it came with the fingerprint sensors on its smartphones. Later many other companies adopted this technology. Financial service providers also jumped in to leverage this technology and came up with biometric login for their banking apps.

Almost all the major banks adopted the fingerprint login and supported the additional modalities. Samsung’s iris scanning is another technology that got incorporated for user login by financial service providers.

Face ID is another technology which was introduced by Apple. It’s an infrared facial recognition system which has been adopted by banks like Singapore’s OCBC and HSBC.

Not only banks but many other smartphone companies are also simulating Apple’s Face ID feature. So, it’s fair to say that in the coming years, a huge number of users will log into their bank accounts by just looking at their phones.

Future of card payments with biometrics

Biometric technology also has something to offer for card payments. Currently the card payment methods involves swiping of a card at a terminal which is slowly becoming obsolete in many parts of the world.

Chip-enabled cards are widely used in Canada and Europe; however, they consume a lot of time as it requires the user to enter the PIN in many purchases.

There’s also chip cards that support NFC transactions, in which the customers have to tap their card on the terminal. This method is quite convenient and fast as compared to the other card payments methods mentioned above. However, it does come with its share of security risks as there’s no need for a PIN or signature.

This is where the biometric payment cards come into the picture. These cards support tap-and-go payments and are infused with biometric security. All a cardholder needs to do is register his fingerprint on the card’s sensor while making payments.

Big players like Mastercard and Visa are already working on this technology with their financial service partners for large-scale rollouts. It means that in a short time, consumers from all over the world will be able to make payments from their smartphones in most secure, fast, and convenient manner.

Conclusion

Biometric technologies have redefined the way we look at security. With fintech solutions transforming the banking industry, users will continue to enjoy the benefits of top-notch security.

Moreover, biometric technology is being continuously worked on to provide even more secure solutions. Only time will tell how successful biometrics will prove to be for digital payments.

If you liked this article and are looking to read more such insightful content then stay tuned to this space.