Branchless banking solution made simple

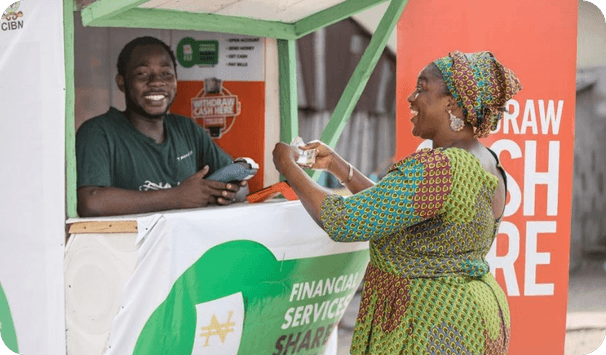

Expanding traditional banking infrastructure is costly and slow. With DigiPay.Guru’s agency banking solution, scale efficiently by turning local shops into banking agents. Offer seamless transactions, customer onboarding, and financial services via a secure and cost-effective solution.

- Lower acquisition costs compared to physical branches

- Drive cross-selling of banking & financial products

- Higher transaction volumes and repeat usage

- Boost customer retention and loyalty

TAP INTO THE UNBANKED MARKET

Your market is bigger than you think, and still untapped

These numbers expose a massive service gap and a business opportunity your bank can’t afford to ignore any longer.

1.4 bn

global adults remain unbanked

350 mn

African adults remain unbanked

Only 33%

Adults in Sub-Saharan Africa have a mobile money account

Drive growth, inclusion, and profitability — all at once

Boost financial inclusion

DigiPay.Guru’s agency banking solution rapidly extends your reach into underserved communities and remote rural areas without traditional branches. By empowering local agents, you turn unbanked populations into new customers. This drives financial inclusion and strengthens your brand’s presence.

- Expand your reach without building branches

- Turn unbanked populations into new customers

- Meet financial inclusion targets & regulatory needs

Enhance customer experience

Our solution brings your services to remote areas through local agents. This eliminates wait times and adds a human touch. Plus, it boosts satisfaction, trust, and retention while deepening customer relationships and increasing engagement.

- Easy access to banking services anywhere

- Faster, more personal service via local agents

- Higher customer satisfaction and loyalty

Reduce operational costs & boost revenues

DigiPay.Guru’s agency banking model cuts costs by replacing branches with local agents. No infrastructure or staffing needed. Plus, it boosts profit margins, reduces expenses, and improves your cost-to-income ratio while accelerating revenue growth.

- Lower infrastructure and overhead costs

- Performance-based agent commissions

- Lean operations boost profit margins

Increase revenue streams for your bank & agents

DigiPay.Guru’s agency banking multiplies revenue for you and your agents. It means with every transaction, agents earn commission, you charge fees, expand your market, and boost agent income. This creates a win-win model that drives sustainable and scalable growth.

- Yield new fee and interest income

- Offer additional products via agents

- Commission incentives to keep agents motivated

All your banking services—delivered through agents

Best standard we follow

We follow only the best practices to cater to the biggest tier 1 and tier 2 banks with our reliable agency banking solution.

Why top banks and fintechs trust DigiPay.Guru

Explore the latest features of our agency banking solution

Customizable agent commission

Set flexible, performance-based commission structures for your agents. Motivate performance, control costs, reduce payout inefficiencies, and ensure your incentives align perfectly with your strategic goals.

Learn more

Agent cash in/cash out

Enable secure, real-time deposit and withdrawal services through agents. And make everyday banking accessible anywhere, anytime to your customers in underserved or remote areas.

Learn moreReady to reach the unbanked and unlock new revenue streams?

Launch your agent network faster, at lower cost, and scale profitably without the burden of setting up branches.

Schedule a Strategy Call

Frequently asked questions

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.