Quick Summary

If you found this article, you are probably running a fintech business or a neobank and would love to stay updated with the neobanking market trend and the opportunities it holds. By the way, DigiPay.Guru is a digital fintech solution provider that helps businesses like yours to stay ahead of the market trends and competitors with next-gen, ready-made software solutions. Let’s get you a run-through of the latest neobanking market trends for 2025 in this blog.

Did you know that the global neo-banking market is expected to reach nearly $3.4 trillion by 2032?

This stat is enough to say that the future of the neobanking market is bright, and we can anticipate that its growth trajectory will be amazing.

Neobanking can become a goldmine opportunity soon. And to grab the benefits of it, you need to stay updated with the emerging trends and opportunities it can offer in 2025.

Then you can innovate and upgrade your business with the needed digital fintech solution.

This blog post will guide you through the future of neobanking with the emerging trends and neo banking opportunities that will make a big difference in 2025.

So without waiting any longer, let’s dive right into the blog.

What are Neobanks?

Neobanks are like traditional banking but without physical branches. It's all done online through apps or websites. Neobanks offer better rates and perks. And they're super convenient since you can manage money from anywhere. It's banking for the digital age!

How Neobanks Differ From Traditional Banks

So, how do they differ from traditional banks?

No physical infrastructure: Lower overhead, faster scalability

Tech-first design: Seamless UI/UX, real-time services

Focused offerings: Often specialize in specific segments (like freelancers, SMEs, or youth banking)

Speed of innovation: Quick to launch new features based on data and feedback

While traditional banks are adapting, neobanks are setting the pace for digital innovation.

The Growing Landscape of Neobanks

Neobanks are no longer fringe players. They’re mainstream challengers. As of 2024, global neobanks serve over 1.4 billion customers, with hundreds of licensed and unlicensed entities across North America, Europe, Latin America, and Africa.

In regions with large unbanked populations, neobanks fill gaps that traditional banks can’t reach. It offers financial access via smartphones where branches are scarce. Their lean models and embedded finance capabilities position them as frontrunners in the next era of digital banking.

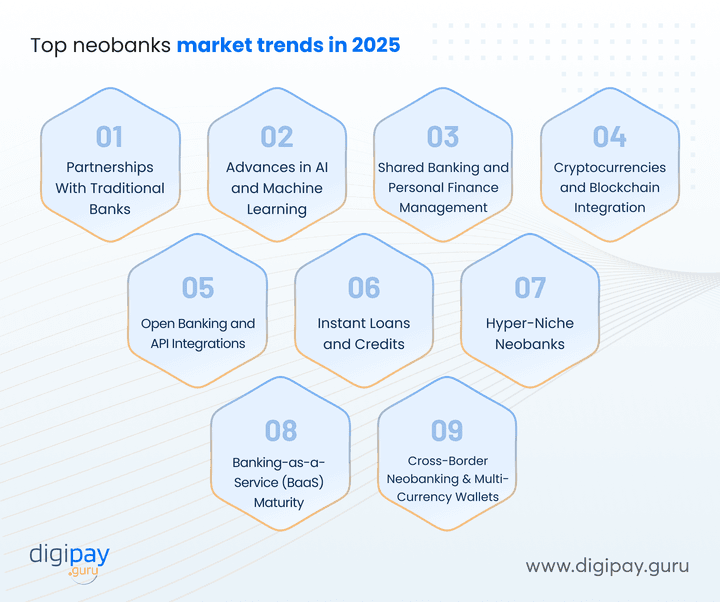

Emerging Trends in Neobanking Market For 2025

The neobanking market is growing and evolving continuously. There are some top trends in neobanking that the top neobanks are looking forward to adopting this year. So, why should you be left behind?

The latest neobank trends include:

Partnerships With Traditional Banks

One of the biggest trends emerging in neobanking is the “increased partnerships between neobanks and traditional banks.” While they were once competitors, many are realizing the synergies of working together.

Neo-banks can benefit from the large customer base, trust, regulatory compliance, and capital of incumbent banks. Whereas, traditional banks can leverage the agile innovation of banking fintechs to offer digital banking services.

Collaborative models like white-label digital banking solutions and banking-as-a-service platforms have already emerged from such partnerships.

Now, we will see a jump in these bank-neobank synergies this year.

Advances in AI and Machine Learning

The neobanking market will see a major shift due to advanced AI and ML. It will continue to transform neo-banking offerings.

Right from customer onboarding to personalized recommendations and predictive analytics, AI is making banking seamless. McKinsey says that the majority of the world’s top neobanks that have achieved scale or profitability have leveraged AI effectively.

Also:

Neo banks have started leveraging data science to

-

Provide hyper-personalized neo banking services

-

Improve financial performance

-

Lower costs through automation

-

Detect fraud faster, and

-

Manage risks better

This will help neobanks differentiate themselves as the best fintech bank through a superior user experience

Shared Banking and Personal Finance Management

The concept of shared banking and personal finance management is gaining traction in the neobanking market. This is because it allows customers to seamlessly partner & manage their finances.

Shared banking services like shared bank accounts, peer-to-peer payments, and expense splitting are gaining popularity, especially among millennials.

Integrated personal finance management tools are also allowing users to aggregate financial data, track budgets, and analyze spending habits in one place.

Neo banks that can make shared digital banking and money management easier for customers will gain an edge and become the best neobank in the space.

Cryptocurrencies and Blockchain Integration

Cryptocurrency & blockchain will continue to disrupt the banking fintechs while offering neobanks new avenues for innovation and growth.

This year, the neobanks will be seen adopting cryptocurrency as a legitimate asset class. This means that customers can buy, sell, and store digital currencies directly in their neo banking apps.

With cryptocurrency adoption growing, integration with decentralized finance and blockchain will rise. Plus, we will see more services like yield farming, crypto-backed lending, and tokenized assets, along with automated smart contracts.

Blockchain integration will also transform identity verification, transaction processing, and cross-border payments.

Open Banking and API Integrations

Open banking is enabling fintech innovation by allowing businesses like yours to leverage bank APIs. These APIs help to create seamless data sharing with third-party providers and offer enhanced services to their customers.

Moreover, neobanks can now easily integrate with other financial products like investment platforms, insurance providers, and accounting software. This neobanking market trend will lead to seamless money management and innovative embedded finance offerings.

Instant Loans and Credits

The demand for quick and easy access to loans is growing among millennials and Gen Z. Neo banks are catering to this demand by providing fintech bank services like instant microloans and short-term credits through user-friendly apps.

Additionally, data-driven algorithms quickly assess the creditworthiness and risk of the customers to provide real-time approvals. And the customers can get funds in their accounts instantly without paperwork.

Hyper-Niche Neobanks

Neobanks are shifting from broad audiences to hyper-focused niches. By targeting specific user groups like gig workers, teens, immigrants, or small business owners, they deliver tailored solutions that traditional banks overlook. These specialized offerings include custom onboarding flows, relevant financial tools, and community-centric engagement.

In 2025, this approach will gain traction as customers seek financial services that understand their unique lifestyles, needs, and challenges. It's not about being the biggest; it's about being the most relevant to a specific tribe.

Banking-as-a-Service (BaaS) Maturity

BaaS is evolving from a buzzword to a powerful business model. Neobanks are increasingly licensing their infrastructure to fintechs, startups, and even non-financial platforms to embed services like payments, lending, and accounts. This shift creates new revenue streams while expanding reach beyond direct users.

As API maturity and regulatory clarity improve in 2025, BaaS will unlock scalable growth and cross-industry collaboration. This positions neobanks not just as service providers but as foundational enablers in the digital finance ecosystem.

Cross-Border Neobanking and Multi-Currency Wallets

As digital nomads, remote workers, and global merchants increase, the demand for seamless international banking grows. Neobanks are responding with multi-currency wallets, real-time FX, and global bill payment tools.

In 2025, cross-border capabilities will be a major differentiator, which will enable users to manage finances across regions without friction or excessive fees. These features support global freelancers, diaspora communities, and SMEs with international supply chains.

It’s more than convenience. It’s the next stage of financial inclusion at a global scale.

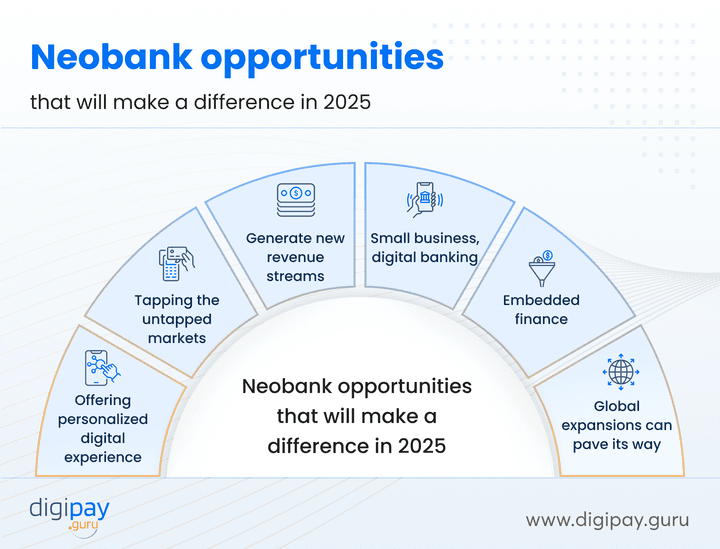

Neobank Opportunities That Will Make a Difference in 2025

The above trends in the neobanking market can happen any time soon. So, grabbing the opportunities emerging out of them is necessary for long-term success. The best neobank opportunities that will make a difference in 2025 include:

Offering a Personalized Digital Experience

Customers today expect banking services to be real-time, omnichannel, and personalized. Neo banks that leverage data analytics to provide tailored recommendations and predictive services will delight their users with such an experience.

Things like two-way in-app messaging with bankers, personalized budget alerts, and location-based offers will drive engagement. So, the neo-bank that masters digital user experience will win market share.

Tapping The Unbanked and Underbanked Markets

A large segment (1.4 billion) of the population worldwide still does not have access to formal financial services. These unbanked and underbanked markets are untapped pools of growth and carry great opportunities to increase your customer base as well as profits.

Neo banks can leverage the reach of mobile and their lean structures to profitably serve these customers. With customized products and micro-targeted marketing, they can gain a first-mover advantage here.

Generate New Revenue Streams

Neobanks have the potential to generate revenues beyond brick-and-mortar banking services.

They can diversify their revenue streams with various opportunities such as

-

Premium subscription models

-

Value-added services

-

Affiliate partnerships

-

Data monetization and more…

It's all about well-framed strategies to utilize customer data and unlock new sources of growth and profitability.

Provide Banking Services to Small Businesses

Small businesses are underserved by traditional banks today. Nearly 63% of small business owners feel their bank does not appreciate or value their business, which highlights a significant service gap. Neo banks can carve a niche by building robust SME banking services on digital neo banking platforms.

With options for easy online business account opening, digital invoicing, payment acceptance, and automated accounting, they can add tremendous value. This segment offers a steady source of low-cost deposits and fee income.

Explore Embedded Finance Offerings

Embedded finance, or contextual banking, is an exciting opportunity today. Neo banks can integrate their services into non-financial platforms. The services include

-

Payments

-

Lending

-

Subscription management

-

Insurance

-

Investments

-

Bill payments, and

-

Identity verification into non-financial platforms

Imagine paying for your cab ride via your neobank account without leaving the taxi app. Or getting a micro EMI loan as you check out your shopping cart. These embedded services will drive growth in the neobanking market.

Global Expansions Can Pave The Way

Many neobanks are going international to find new markets and scale up. This is because expanding into underpenetrated markets with youthful demographics is a major opportunity. With their technology-first approach, neobanks can easily adapt products and marketing to local needs. Plus, partnerships with local fintechs and distributors will power rapid geographic expansion.

Conclusion

The neobanking market revolution has just started, and 2025 promises to be a year of stellar growth and innovation. So, you must leverage the emerging trends like digital partnerships, AI adoption, open banking APIs, personal finance, shared banking, and instant loans.

Plus, focusing on unbanked segments, personalization, small businesses, and embedded finance, neobanks can unlock invaluable opportunities.

All in all, the future belongs to those who can make banking seamless, embedded, and highly personalized. So start building your hyper-local and customer-centric neobank today!

At DigiPay.Guru, our next-gen digital payment solutions help you launch your digital-first banking fast and securely, as we offer a secure payment infrastructure and seamless omnichannel digital payment services.

FAQ's

A neobank is a digital-only financial institution that delivers banking services through mobile apps or web platforms, without any physical branches. These banks are built on modern technology stacks and focus on providing fast, user-centric, and cost-efficient experiences.

Neobanks often specialize in services like digital wallets, instant payments, expense tracking, and even business banking—all designed for today’s mobile-first users.

Neobanks differ from traditional banks in several fundamental ways:

-

No physical branches: Everything is digital, reducing overhead and improving access

-

Faster innovation: Neobanks iterate quickly and launch new features based on data and user behavior

-

Focused services: Many neobanks target specific user groups like freelancers, startups, or underbanked populations

-

Lean and API-driven infrastructure: Ideal for embedded finance and partner integrations

For financial institutions, this means an opportunity to partner, white-label, or build faster digital offerings using neobank models.

Neobanks generate revenue through multiple streams:

-

Interchange fees on card transactions

-

Subscription models for premium features

-

Lending and credit products (e.g., instant loans, BNPL)

-

Commission from third-party services (insurance, investments, etc.)

-

Business banking tools (payroll, invoicing, working capital, etc.)

If you're building or partnering with a neobank, these models provide diverse monetization paths beyond interest income. This is ideal for scale and sustainability.

Some of the most recognized neobanks globally include:

-

Revolut (UK): Multi-currency banking, crypto, and travel

-

Nubank (Brazil): Serving Latin America's unbanked

-

Chime (USA): Fee-free digital banking

-

Monzo (UK): Transparent personal finance features

-

TymeBank (South Africa): Hybrid digital-branch model

However, the “best” neobank depends on the market segment you're targeting. For B2B or SME-focused banking, look for models like Moniepoint or Oxygen that prioritize business workflows and infrastructure.

In 2025, neobanking will shift from disruption to infrastructure. Here’s what to expect: -Deeper collaborations with traditional banks

-

Rise of AI-driven personalization and automation

-

Expansion of embedded finance across industries

-

Increased focus on SME banking and underserved markets

-

Growth of modular Banking-as-a-Service platforms

If you're in banking or fintech, this is your moment to either build, partner, or adapt before customer expectations evolve beyond legacy systems.

Yes—if regulated properly. Many neobanks operate under full banking licenses or partner with licensed institutions. Security protocols, encryption, multi-factor authentication, and real-time fraud detection have significantly matured.

For businesses like yours, this means you can build or white-label a neobank with full compliance and robust infrastructure. Just ensure your provider aligns with local and international regulatory standards (e.g., PCI-DSS, GDPR, ISO 27001)

Absolutely. In 2025, neobanks will play a crucial role in streamlining financial operations for businesses. Here’s how:

-

Faster onboarding and KYC for SMEs

-

Automated invoicing, payroll, and expense management

-

Access to real-time lending and credit tools

-

Easy API integrations with accounting and ERP systems

-

Localized financial services for cross border trade