Privacy and security of information, specifically regarding financial data and payments, are essential for customer satisfaction. The first ever secured online payment was made in 1994 and it turned out to be successful. Internet Shopping Network and Net Market introduced it. The Payment industry is growing significantly with the use of new emerging products like E-wallets, QR codes, NFC, and many more.

With this, payment security concerns are also increasing. Security is not a product but a process. It is the accumulation of processes for keeping our customers safe and secure. According to a study by Globe Newswire, payment fraud via mobile devices was predicted to be more than 50% for the 2nd quarter of 2021. This suggests that even after so many advancements in the digital payment world, security concerns are still prevalent.

What is Payment Security?

Payment security is the process of the various steps taken by banks, financial institutes, or businesses. This process ensures their customers' data are protected from security breaches. Security breaches may include privacy, data leak, or stolen money. Generally, it’s important to adhere to the rules, regulations, and security aspects for your customers.

The security of payment comes with multiple layers and may have various requirements based on the kind of business. These multiple layers of security are required because if any breach occurs in the security, it’s you who will be held accountable. If these layers are implemented, you’ll be able to save yourself from lawsuits and unsatisfied transactions.

A foolproof platform with advanced security systems for digital payments.

Types of Payment Security

Tokenization

Remember, the token that you receive in return for money in the casinos or gaming zones? These tokens are valid in that particular casino or gaming zone only! It has no value outside its premises.

Similar is with online payment tokenization, but instead of money, here the token is created for a cardholder’s sensitive information such as name, card details, address, or bank account details.

For instance, if your card number is 12345678910, tokenization will convert the card number into a unique alphanumeric token number. This number can be used only once. These tokens have no meaning once they are utilized for transactions.

So, here there are no chances of stealing identity or data breaches. This helps you to keep transactions safe and secure. These transactions can be made through credit card information stored in e-wallets, POS, or any other e-commerce solutions.

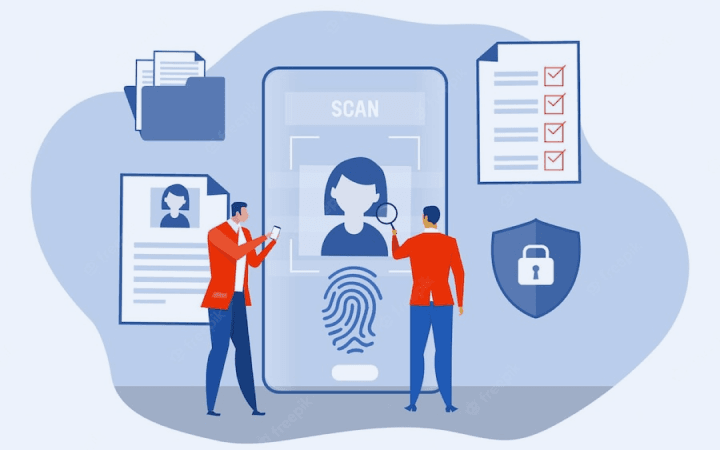

Biometric Payment System

Biometric payment is a Point-of-Sale Technology that uses authentication of biometrics based on the physical characteristics of users such as a finger, face, eye, vein, voice, etc. This biometric system helps in knowing the identity of the user and in deducting the payments from their bank account.

The most common secure payment method used for biometric authentication is the fingerprint scan. The system uses 2-factor biometric authentication. A finger scan is used instead of ‘cards to swipe’, and then the user has to type in the Personal ID Number (PIN) for payment deduction from the account.

The most used biometric payment methods other than fingerprint scans are Iris Scan, Retina Scan, Voice Scan, Facial Recognition, and Palm Geometry scan. Ear scans, signature matches, and DNA match options are available in rare cases.

Address Verification Service (AVS)

Address verification service (AVS) is a system specially made for fraud protection. It is an online payment security solution designed and provided by credit card processors and banks to detect any suspicious activities in credit card transactions and prevent payment fraud.

The address verification service system checks the address given by the cardholder with the address in the records of the bank. And then the secure payment processor sends a response to the system and the payment is accepted or rejected based on this response.

If the AVS system is used correctly, it can limit the digital payment fraud faced by so many customers. This will be beneficial to you, as your customers will stay retained.

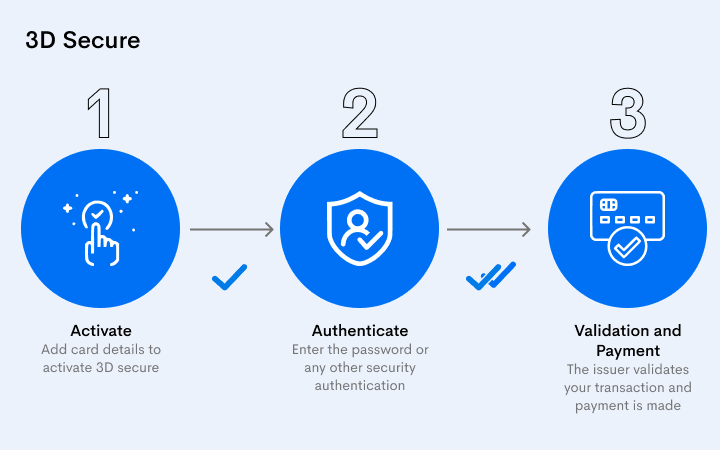

3D Secures

3D Secure (3DS) is an authentication tool designed to avoid the illegal or unauthorized use of cards in card-not-present transactions. 3DS helps in adding an extra protection layer to the payment experience. And there is a 2-step verification on every transaction making it extra secure.

No payments can be done without the authentication of the user. This authentication is done either through a personal ID number (PIN) or a one-time password (OTP).

There are three parties involved in this verification process: Banks, Issuing Banks, and processing technology. The essential point to note is that the liability of the payment security is shifted from you to the bank on the successful verification of the transaction.

How to protect online payments for your customers?

The types of payment security, as discussed above, can be useful for preventing security-related issues. However, certain standards and processes can help make secure online payments for your customers.

Maintain Security Standard - PCI DSS

To protect the online payment processes for your customers, your first step should be to maintain the required and necessary security standards. One of the major security standards which, if followed, can help you keep your customers' cards or transactions safe is the ‘Payment Card Industry Data Security Standard (PCI DSS).

PCI DSS was developed in 2004 by Visa, MasterCard, Discover Financial Services, American Express, and JCB. These standards are made for any entity that accepts, processes, transmits, and stores the details of cards. Its main motto is to make online payments via cards more secure and fraud less.

Find the Right Payment Gateway

Protecting your customers’ sensitive data is very important. And payment gateway has a huge contribution to online payment security. So, finding the right payment gateway provides you with the right security required to accept the payments.

For choosing the right payment gateway, you must give priority to how it keeps the transactions secured, the tools used, the security standards followed, and who can access the payment data. You can also consult with industry experts for the same.

Encrypt Data through SSL and TLS

Online payment security requires encryption to keep the data and access to sensitive information secured. For this, Secure Socket Layer (SSL) and Transport Layer Security (TLS) can be implemented.

SSL helps in encrypting the information, to protect the payment details and sensitive information. TLS helps protect the privacy and security of data for online payment communications.

Deploy online secure money transfer system with Secure Electronic Transaction

Secure Electronic Transaction (SET) is the online secure payment system introduced by VISA and MasterCard. This system aims at maintaining the security of all the parties involved in online payments for a secure online money transfer.

It works on vital functions such as authentication of merchants and cardholders, maintaining payment protocols, keeping a check on security procedures, and keeping the payment information confidential.

Read More: What do you need to know about Electronic Payment Systems?

Implement Strong Customer Authentication

SCA or Strong Customer Authentication is one of the safest ways to pay online. It aims to add extra security layers to online payments. It is used to limit domestic as well as cross-border frauds to increase payment security. To use this authentication process, all that is required is to input two-three elements. This includes knowledge (a password or a pin), possession (a smartphone or a card reader), and inherence (biometric authentication).

Want to enhance the payment security of your online payment solutions?

Why is Payment Security Important for Your Customers?

Payment security is a major concern for your customers. Quite often, there is news floating about hacked bank accounts, stolen identities, information breaches, and stolen money. The scenario of online payment after covid has changed. Still, it makes customers feel less secure about their payments. So, it is important to provide the best payment security to your customers.

Also, there are beneficial aspects associated with it, such as:

Improvement in their business transactions

The businesses of your customers work beautifully because of the trust and security their customers feel with them. Their customers won’t hook into any of their products or services if there is no security in their payments. So, with payment security, your customers can improve their business transactions.

Enhancement in Financial Stability

With the implementation of payment security, the customers will feel that they can use the online payment systems as and when required. And they don’t need to think twice if it's safe or not!

This will increase the flow of their online payment transactions and will make their daily activities easy and simple. So, they will now be able to make payments of exact amounts and will follow all the rules and regulations about it. This will give them a sense of financial stability.

Final Words

To summarize, the advent of digital payments has an online flow of transactions, so maintaining security could be quite tough. In addition, electronic payment security is needed for every transaction to keep your customers safe and satisfied.

Being aware of the necessary online payment security app and having a piece of complete knowledge about how to protect the payment data can help boost the security of payments, and avoid fraud and misuse of private data.