Grab the digital payments opportunity with next-gen mobile wallet

Grow your customer base by making your services accessible to unbanked populations without investing in costly infrastructures as you employ our future-centric & customizable e-wallet payment system. By collaborating with us, you get the power to;

- Attract, retain, & increase customer satisfaction

- Multiply customer base

- Generate new revenue streams

- Minimize overall costs

- Boost financial inclusion

TAP INTO THE MARKET POTENTIAL

The boundless opportunities of e wallet solution

Tap into the limitless market potential by launching your eWallet at the right time!

$590 bn

Global ewallet market by 2032

$16tn

Transaction values in 2028

77%

Total growth, 2023 to 2028

DigiPay eWallet solution at a glance

DigiPay eWallet at a Glance

Redefine your eWallet experience

Transform your business with a white-label ewallet solution offering all the features you need.

Multiple transaction options

Let your customers perform multiple transactions with an eWallet solution ensuring flexibility and convenience.

- P2P (peer-to-peer) payments

- P2M (peer-to-merchant) transactions

- Utility bill payments & airtime top-ups

Varied modes of payments

Offer flexibility with varied payment methods tailored to suit your payment preferences.

- QR payments

- Tap & pay transactions

- Phone number & SMS links

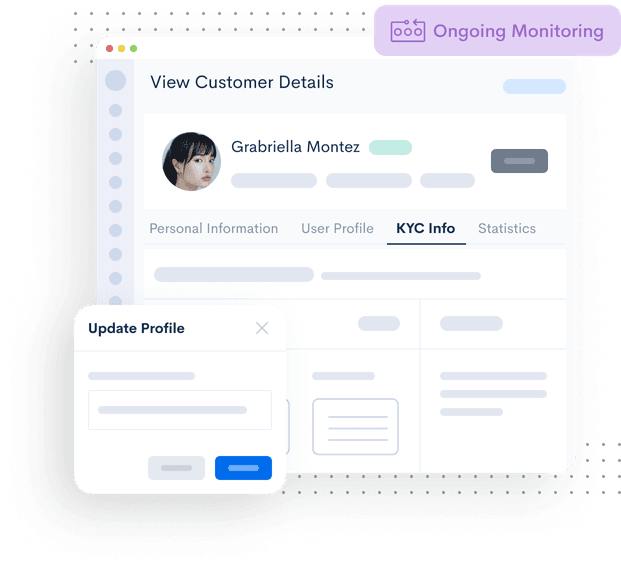

Seamless onboarding and KYC

Ensure effortless onboarding and KYC process ensuring a smooth start to the eWallet journey.

- Configurable onboarding process

- AML/CFT verifications

- Ongoing monitoring

Build your agent network

Strengthen your agent networks for seamless transactions & expand your financial services effortlessly in every corner.

- Facilitate cash transactions

- Setup agent hierarchy

- Flexible commission model

Advanced configuration

Enhance efficiency with flexible and easy configurations for a seamless eWallet experience.

- Flexible fee structure

- Access controls

- Thresholds & transaction limits

EXPERTISE

Build a next-gen mobile ewallet platform

DigiPay.Guru’s ewallet solution comes with a cluster of advanced features that will bring promising benefits to your business’s growth that it deserves.

SECURE AND SCALABLE

eWallet payment system that grows with you!

Your business doesn’t have to face even the slightest of problems when it comes to security and scalability. Our eWallet platform comes with advanced security features and seamless scalability capabilities to keep your business thriving, growing, and outshining your competition at all times!

Successful implementation of the CASHUP app in Gambia

Witness how DigiPay.Guru’s eWallet solution helped CASHUP to improve the payment system in Gambia, Africa. We have redefined the financial landscape for CASHUP which can drive financial inclusion and maximize eWallet penetration in the region.

Huge growth potential!

DigiPay.Guru's user-friendly solution holds tremendous growth potential for both customers and businesses in the Gambia, making CASHUP an impressive choice for financial transactions.

60%

Financially excluded Gambian people can now easily access formal financial services with mobile wallet penetration.

4.22 M

Cellular mobile connections show increasing mobile penetration in the Gambia.

1.29 M

Internet users can be directly tapped into for offering eWallet solutions in the Gambian market.

66%

Increase in mobile wallet transactions can play a vital role in raising awareness and fostering the adoption of eWallets.

*based on the stats of 2022

“DigiPay.Guru team helped my team improve mobile money payments in South Africa. They are great to work with and delivered the best solution. We are really happy with the solution and would hire them again for our next project.” —

Essa Tarawally

Operations Manager, Gambia

Flexible deployment models designed for you!

License model

Get complete control and flexibility! Easily deploy the eWallet solution within your own infrastructure. Enjoy the benefits of a one-time licensing fee and customize the solution to your specific needs.

SaaS model

Get the SaaS version of the solution with a cloud-based wallet-as-a-service. Experience rapid implementation, automatic updates, and cost-efficient scalability, all with no infrastructure maintenance on your end.

Frequently asked questions

Read our insightful blogs!

Stay updated with the latest trends and innovations in FinTech with our insightful blogs.