The United States is not only the world’s largest economy. It’s also the global hub for international remittances. In 2024 alone, individuals and businesses in the U.S. sent over $80 billion abroad, according to the World Bank.

For financial businesses like yours, this represents one of the most valuable opportunities in the modern fintech landscape.

Why? Because every transfer is more than a transaction: it’s a relationship. Each remittance opens a path to long-term customers who will eventually need accounts, cards, savings, or credit.

And by 2026, the demand for faster, cheaper, and more reliable international money transfers from the USA is at an all-time high.

Whether you’re a fintech startup, payment service provider, or financial institution, this guide will help you understand how to build a licensed, compliant, and scalable money transfer business in USA.

Let’s dive in.

Why Start a Money Transfer Business in the USA (2026)?

The United States is not just a participant in global remittance. It’s the largest sender of global money transfers worldwide.

So, if you’re in the business of cross-border payments or planning to enter it, this is a market you simply cannot afford to overlook.

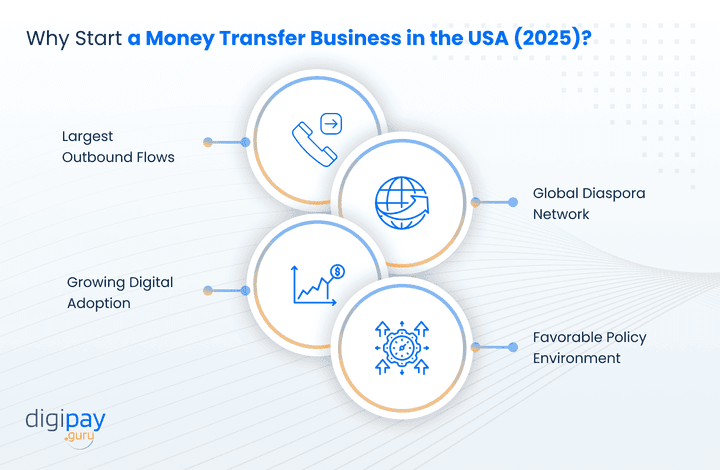

Key reasons to start a remittance business in the USA:

- Largest Outbound Flows: According to the World Bank, the U.S. sent over $80 billion in remittances globally in 2024, more than any other country.

- Global Diaspora Network: Millions of migrants living in the U.S. regularly send money to their families in countries like Mexico, India, and the Philippines.

- Growing Digital Adoption: Americans increasingly prefer digital remittance apps that offer instant, low-cost, and transparent transfers.

- Favorable Policy Environment: U.S. regulators like FinCEN and state-level authorities support innovation through clear licensing and compliance frameworks.

For businesses like yours, this is not just about capturing transfers. It is about owning a piece of the financial journey of millions of households.

How Remittance Works in Practice

On the surface, remittance looks simple. But behind the scenes, it is a multi-step process with compliance, settlement, and technology layers. Here’s how it works:

- Sender in the U.S.: The customer initiates a transfer using a digital app, a bank, or a licensed money transfer operator.

- Processing and Compliance: The funds are routed through regulated intermediaries who perform Anti Money Laundering (AML)/KYC checks, currency conversion, and settlement.

- Payout Abroad: The receiver collects funds via a local bank, mobile wallet, or cash pick-up outlet in their home country.

Each stage presents a chance to enhance trust and speed or lose it. Success depends on how seamless, transparent, and compliant your system is.

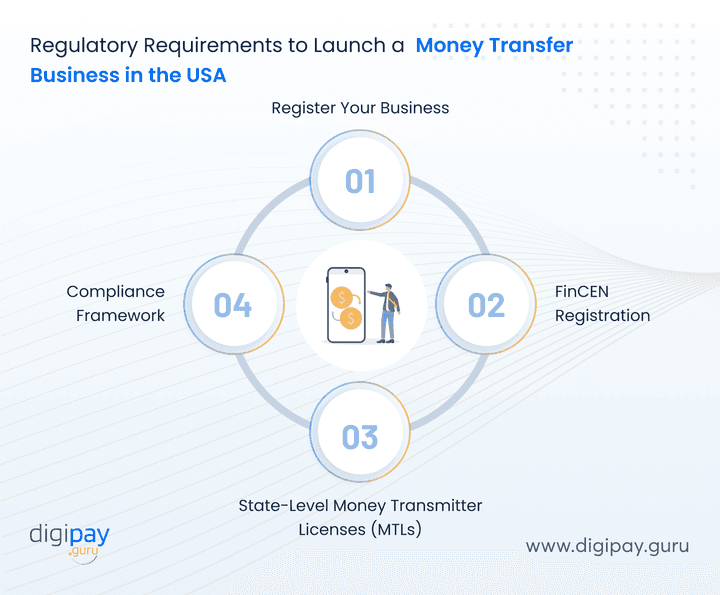

Regulatory Framework: Legal and Licensing Requirements

No matter how advanced your technology is, you cannot operate in the U.S. without the necessary federal and state-level licenses.

Understanding the regulatory structure is the first step toward launching a legitimate money transfer business.

The key regulatory requirements include:

1. Registering Your Business

You must first establish a legal entity in the U.S. (LLC or Corporation). This provides the foundation for applying for USA remittance licenses and partnering with financial institutions.

2. FinCEN Registration

All money transfer businesses must register as Money Services Businesses (MSBs) with the Financial Crimes Enforcement Network (FinCEN).

This registration confirms your business complies with the Bank Secrecy Act (BSA) and anti-money laundering (AML) regulations.

3. State-Level Money Transmitter Licenses (MTLs)

In addition to FinCEN, each U.S. state has its own licensing rules. You’ll need to apply for an MTL in every state where you plan to operate or serve customers.

Licenses are often managed through the NMLS (Nationwide Multistate Licensing System).

Typical requirements include:

- Proof of incorporation

- AML compliance policy

- Surety bond (state-dependent, often $10,000–$500,000)

- Background checks for directors and owners

- Audited financial statements

4. Compliance Framework

Maintaining compliance is an ongoing obligation. Your system should support:

- AML/CFT monitoring under FinCEN rules

- KYC verification for senders and receivers

- OFAC screening to prevent sanctioned transactions

- Data protection under state and federal laws

Failure to comply with these regulatory needs can result in heavy fines or license suspension, which makes compliance the backbone of your operations.

Choosing the Right Business Model

Once you have your regulatory path clear, the next step is defining how you will operate in the USA. Broadly, you can choose from three models:

| Business Model | Description | Advantages | Ideal For |

|---|---|---|---|

| Bank Partnership | Partner with a licensed U.S. bank or MSB to operate under their Money Transmitter License (MTL). | Easier regulatory entry, built-in compliance oversight, and trusted financial network access. | Startups entering the U.S. remittance space or foreign fintechs seeking local partnerships. |

| Digital-Only | Offer 100% online international money transfer through an app or web platform using licensed processors and API-based payment rails. | Low operating costs, instant scalability, modern UX/UI, and better integration with FinCEN-compliant systems. | Fintech startups, neobanks, and SaaS-based payment platforms targeting tech-savvy users. |

| Hybrid Model | Combine digital remittance channels with cash payout or agent networks abroad for greater customer accessibility. | Broader reach, supports unbanked and underbanked users, and enables corridor expansion. | Established money transfer operators & global fintechs expanding from the U.S. to emerging markets. |

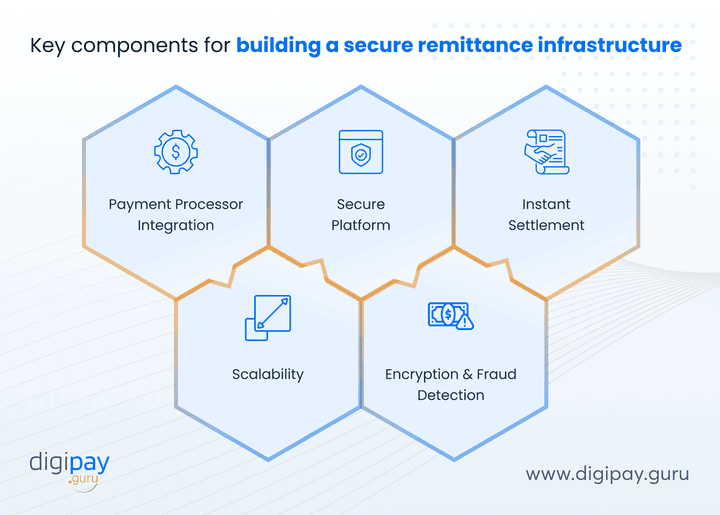

Building Secure Remittance Infrastructure

Infrastructure is the backbone of any remittance business. If it fails, your entire customer experience collapses. So, you must consider a remittance solution that helps you build a secure remittance infrastructure.

Key components for building a secure remittance infrastructure include:

- Payment processor integration: To move funds smoothly across corridors.

- Secure platform: It should be capable of handling high volumes with built-in AML/KYC automation and compliance checks.

- Instant settlement: Americans expect instant money transfer in the USA. If delays occur, your customer trust can be affected.

- Scalability: It should have the capability to expand into new corridors and payout networks without re-engineering your system.

- Encryption and fraud detection: It protects your business as well as your customers’ payment and personal data.

For banks and fintechs like yours, the decision often comes down to whether to build from scratch or adopt a proven secure money transfer solution.

Pro Tip: Instead of building from scratch, adopt a white-label remittance platform like DigiPay.Guru that reduces time-to-market and ensures compliance readiness.

Challenges in International Remittance (and How to Solve Them)

While the U.S. remittance market offers vast potential, it also brings unique challenges. These hurdles often stop new entrants from moving fast.

The good news is: each challenge has a solution if approached with the right strategy and infrastructure.

1. Licensing Complexity Across States

Getting a Money Transmitter License (MTL) in the U.S. can be time-consuming. Each state has its own requirements, fees, and review timelines, which makes nationwide compliance challenging.

Why it matters:

Without the required state licenses, you cannot legally provide or advertise cross-border money transfer services in those jurisdictions.

How to solve it:

-

Partner with already licensed Money Services Businesses (MSBs) to operate under shared coverage while your applications are in progress.

-

Use compliance management platforms that automate MTL tracking, renewal, and reporting.

-

Hire legal advisors who specialize in FinCEN and state-level remittance regulation.

2. Fierce Competition from Established Players

The U.S. market is dominated by major brands like Western Union, Remitly, Wise, and MoneyGram, along with dozens of new fintech entrants.

Why it matters:

Standing out in a market where customers already trust existing players requires differentiation on speed, transparency, and user experience.

How to solve it:

-

Focus on niche corridors (e.g., USA to Philippines, USA to Kenya) where service quality gaps exist.

-

Offer transparent, real-time pricing with zero hidden fees.

-

Enhance user experience with instant payouts, multi-channel access, and 24/7 customer support.

3. Regulatory Oversight and Compliance Burden

In the U.S., remittance companies must comply with federal rules (FinCEN, OFAC, BSA) and state-specific AML/CFT requirements. Managing this dual-layer framework can overwhelm new entrants.

Why it matters:

Regulatory missteps can result in heavy fines, license suspension, or criminal liability: all of which can destroy customer trust.

How to solve it:

-

Implement a robust AML/KYC system from day one, aligned with FinCEN’s BSA expectations.

-

Use automated tools for transaction monitoring and suspicious activity reporting (SARs).

-

Maintain detailed audit trails and regular compliance training for staff.

4. Fraud Risks and Cybersecurity Threats

Digital remittance channels are increasingly targeted by fraudsters and hackers. Plus, phishing, account takeovers, and synthetic identities pose serious threats.

Why it matters:

A single security breach can lead to customer loss, regulatory penalties, and irreversible brand damage.

How to solve it:

-

Integrate AI-driven fraud detection and behavior-based transaction scoring.

-

Adopt end-to-end encryption and multi-factor authentication for all users.

-

Conduct quarterly security audits and comply with AML KYC, PCI DSS, and ISO 27001 standards.

5. Exchange Rate Transparency and Settlement Delays

Exchange rate margins and delayed settlements are among the biggest pain points for senders. And your customers expect instant transfers and clear FX rates.

Why it matters:

Unclear pricing or delayed payouts quickly erode trust, especially in competitive corridors like Mexico or India.

How to solve it:

-

Display real-time FX rates and lock them before transaction confirmation.

-

Partner with payment processors offering fast, API-driven settlements.

-

Maintain transparent transaction timelines to set accurate expectations.

6. High Operational Costs

Running a remittance business in the U.S. involves licensing fees, surety bonds, AML compliance costs, and technology investments.

Why it matters:

Without efficiency, overheads can eat into profit margins, especially for smaller fintech entrants.

How to solve it:

-

Use a white-label remittance platform instead of building from scratch.

-

Automate onboarding, KYC, and settlements to minimize manual labor.

-

Scale gradually, while focusing on the highest-volume remittance corridors first.

On a positive note, these challenges are not reasons to avoid the USA market. They are barriers that can work in your favor if you overcome them better than your competitors. And you’ll build long-term market trust.

Strategic Considerations for Growth of Your Money Transfer Business

Launching a money transfer software in the USA is only the first milestone. But the real success comes when you scale your remittance business sustainably.

And growth here depends on trust, partnerships, and the ability to adapt to market shifts.

Here are a few strategic considerations that can help you grow:

1. Build Trust-Led Customer Acquisition

In remittance, trust outweighs every form of marketing. In the U.S., immigrants and diaspora communities rely heavily on word-of-mouth, cultural networks, and personal recommendations when choosing money transfer providers.

Here’s how to grow in such a scenario:

-

Deliver consistently on instant, secure money transfers to top outbound corridors like Mexico, India, and the Philippines.

-

Provide transparent fees and real-time FX rates to eliminate surprises.

-

Invest in multilingual customer support that operates across time zones to build global reliability.

2. Expand Through Strategic Partnerships

No single remittance business can cover every corridor on its own. In the U.S., strategic partnerships help you expand reach, reduce costs, and ensure faster compliance.

Here’s how to expand smartly:

-

Partner with correspondent banks, global payment processors, and licensed MSBs for multi-corridor coverage.

-

Collaborate with fintech aggregators to integrate new payout countries without rebuilding your system.

-

Form alliances with digital wallet operators abroad to offer instant, low-cost disbursements.

3. Leverage Cross-Selling Opportunities

Once you’ve earned customer trust, your money transfer service becomes a gateway to broader financial engagement. And cross-selling enhances both retention and revenue.

Here’s how to diversify offerings:

-

Offer prepaid or virtual cards to senders or receivers abroad.

-

Introduce bill payments, merchant payments, or mobile top-ups as value-added features.

-

Bundle services like micro-savings or investment wallets for long-term engagement.

4. Time Your Growth for 2026 and Beyond

The U.S. remittance landscape is becoming more tech-driven and compliance-centric. Entering now allows your business to build early market trust and adapt before competition intensifies.

Here’s how to future-proof your growth:

-

Invest in AI-driven compliance and transaction monitoring to stay audit-ready.

-

Focus on corridors with growing U.S. diaspora populations, such as Latin America and Southeast Asia.

-

Use a scalable, API-based infrastructure that can expand seamlessly as you add new corridors or services.

How DigiPay.Guru Can Help Your Remittance Business?

At DigiPay.Guru, we specialize in powering international remittance solutions for banks, fintechs, and remittance businesses like yours.

And we understand the complexity of entering a market like the USA. So, we’ve built solutions to make it easier to enter, grow, survive, and outshine.

Our platform offers:

-

White-label money transfer apps: So you can launch your own branded app to send money to the USA.

-

Compliance-ready modules: AML, KYC, and reporting tools aligned with CBN license requirements. Plus, we are also PCI-SFF, SOC type 1 & 2, and ISO27001 compliant.

-

Mobile-first design: Our solution is built for markets where smartphone adoption is high.

-

API-driven integration: Connect seamlessly with your existing systems, banks, mobile wallets, and processors.

-

Scalability: Expand from the USA to other corridors without re-architecting your system.

-

Advanced security features: End-to-end encryption, fraud detection, and transaction monitoring built into the platform, so every transfer is protected, and customers can trust your service.

All in all, with DigiPay.Guru, you can move from idea to launch in a fraction of the time it would take to build from scratch. And you can do it with the confidence that your service meets international standards for secure money transfer solutions at all times.

And when compared with the traditional (build from scratch) model, here’s how DigiPay,Guru outperforms:

| Feature | DigiPay.Guru White-Label Remittance Platform | Traditional Setup (Build from Scratch) |

|---|---|---|

| Development Time | 4-6 weeks: launch-ready with pre-built remittance modules | 6-12 months of development and testing before market entry |

| Cost | Affordable subscription or license-based model | High upfront investment in tech, licensing, and integrations |

| Compliance Readiness | Pre-integrated with FinCEN, OFAC, and AML/KYC modules | Requires custom compliance development and third-party tools |

| Licensing Support | Guidance for MTL registration & MSB operations | No licensing assistance and handled entirely by your legal team |

| Scalability | High. It's modular, API-driven, multi-corridor expansion-ready | Limited. It depends on the custom architecture and maintenance budget |

| Multi-Currency & Corridor Support | Yes: supports USD and key global payout currencies | Requires separate integrations and FX engine setup |

| Maintenance & Updates | Fully managed by DigiPay.Guru’s technical and compliance teams | Requires in-house tech, compliance, and security management |

| Security Certifications | SOC 2, PCI-DSS, and ISO 27001 ready | Must be independently audited and certified |

| Time-to-Market | 3-4x faster launch with lower regulatory friction | Slower due to licensing, testing, and API dependencies |

| Best Suited For | Banks, fintechs, and licensed MSBs expanding into the U.S. remittance market | Large enterprises with in-house compliance and development teams |

Conclusion

If you’re a remittance business, you can’t afford to overlook the U.S. market, the world’s largest source of outbound remittances. Every year, Americans send over $80 billion to countries like Mexico, India, and the Philippines, which makes the U.S. the global hub of cross-border money transfers.

By 2026, the demand for faster, cheaper, and more transparent international transfers from the U.S. will continue to rise as senders seek digital-first, secure, and compliant solutions.

So, entering this market is more than a growth move. It’s your chance to build credibility, expand corridors, and position your brand as a trusted cross-border payments leader.

However, success in the U.S. remittance space demands more than just technology. You must navigate FinCEN registration, state-level Money Transmitter Licenses (MTLs), AML/KYC compliance, and high customer expectations for speed and reliability. These hurdles are real, but overcoming them gives your business a lasting competitive edge.

That’s where DigiPay.Guru helps. Our white-label remittance platform offers compliance-ready modules, advanced security features, and scalable integrations that let you launch confidently.

Start now, and establish a strong global presence built on trust, speed, and compliance

FAQs

To start a remittance business in the USA, you need to register with FinCEN as a Money Services Business (MSB), obtain state-level Money Transmitter Licenses (MTLs), and build a secure, compliant technology platform.

You’ll also need to:

-

Implement AML/KYC systems

-

Partner with payment processors or correspondent banks, and

-

Maintain strong reporting and data security practices under Bank Secrecy Act (BSA) and OFAC guidelines.

In short, it takes a blend of regulatory approval, reliable infrastructure, and customer trust to operate successfully.

To obtain an MTL, you must:

-

Register your business as an MSB with FinCEN.

-

Apply for MTLs in each U.S. state where you plan to operate (via the NMLS portal).

-

Submit business incorporation documents, AML policies, audited financials, and background checks.

-

Secure a surety bond that meets state-specific requirements (typically $10,000–$500,000).

MTL approval can take several months, so many new entrants partner with already licensed MSBs while building their own regulatory footprint.

Yes. Foreign entities can operate in the U.S. remittance market by forming a U.S. legal entity (LLC or corporation) and registering it with FinCEN.

However, to send or process remittances, you’ll need either:

-

Your own Money Transmitter Licenses (MTLs) in the states you operate, or

-

A partnership with a licensed U.S.-based MSB that can handle compliance and settlement.

This approach allows you to enter the U.S. market quickly and legally while building long-term operations.

Documentation requirements vary by state, but generally include:

-

Articles of Incorporation or Organization

-

AML/CFT compliance policies

-

Ownership and management details

-

Audited financial statements or proof of net worth

-

Surety bond and background checks for directors

-

Compliance officer appointment and risk management plan

These documents demonstrate your financial stability, governance, and readiness to comply with U.S. remittance regulations.

The fastest and most compliant way is to partner with a licensed MSB or adopt a white-label remittance platform built for U.S. regulations.

Using a platform like DigiPay.Guru’s remittance solution, you get:

-

Pre-built compliance modules (AML, KYC, and reporting)

-

API integrations with U.S. banks and global payment processors

-

Scalable architecture to add corridors easily

-

End-to-end security aligned with FinCEN and OFAC standards

This lets you move from idea to live operations faster, with reduced risk and complete compliance.

The cost of starting a money transfer business in the USA varies based on your licensing needs, compliance setup, and technology approach.

Expenses typically include state licensing, surety bonds, legal and AML frameworks, and platform development.

Using a white-label remittance solution significantly reduces setup time and costs while ensuring full regulatory compliance and faster market entry.

You must comply with:

-

FinCEN’s Bank Secrecy Act (BSA) for AML reporting and recordkeeping

-

OFAC sanctions screening for restricted transactions

-

State-level AML/CFT programs and consumer protection laws

-

Transaction monitoring and Suspicious Activity Reports (SARs) submission

-

Data privacy standards under GLBA and applicable state laws (e.g., CCPA)

Maintaining an in-house or outsourced compliance officer is strongly recommended for ongoing supervision.

FinCEN registration is a federal requirement. It identifies your business as an MSB under the U.S. Department of Treasury.

Money Transmitter Licenses (MTLs) are state-specific permissions that allow you to legally operate and serve customers in those jurisdictions.

In short, FinCEN registration is mandatory nationwide, while MTLs define where you can transact.

The best approach is to combine a secure money transfer platform with trusted payout partners in target countries.

A compliance-ready platform ensures:

-

Instant settlements via integrated processors

-

Fraud detection & AML monitoring

-

Scalable corridor expansion

-

Transparent FX management

With DigiPay.Guru, you can centralize all of this under one unified, white-label solution optimized for U.S. remittance operations.

Yes. Most U.S. states require their own Money Transmitter License (MTL). Some, like Montana and South Carolina, have fewer restrictions, but states like California, New York, and Texas have stricter rules.

If you plan to operate nationally, consider:

-

Partnering with a multi-state licensed MSB, or

-

Applying progressively, starting with high-volume corridors (e.g., California–Mexico, Texas–Central America).

This will help you stay well-prepared without any unnecessary hurdles.

The first step is to register your business as a Money Services Business (MSB) with FinCEN, the Financial Crimes Enforcement Network. This establishes your legal foundation and allows you to operate under U.S. financial regulations.

After registration, you’ll need to apply for state-level Money Transmitter Licenses (MTLs), create a robust AML/KYC compliance program, and select a reliable technology partner to power your remittance operations.

Market research helps you identify profitable corridors, understand customer preferences, and comply with state-specific regulations. The U.S. remittance landscape is highly competitive, with different states having unique licensing rules and consumer expectations.

Thorough research ensures you choose the right business model (digital-only, hybrid, or partnership), set competitive fees, and position your service to meet both regulatory and customer needs effectively.

DigiPay.Guru provides a compliance-ready, white-label remittance platform that helps you launch faster and operate confidently in the U.S.

Our solution is built with FinCEN and OFAC compliance modules, multi-currency support, and scalable API integrations, ideal for banks, fintechs, and licensed MSBs. With DigiPay.Guru, you minimize development time, reduce compliance friction, and gain a trusted technology partner to support long-term growth.