“Why Mobile Money Is the Fastest Adoption Channel in Emerging Markets?” For African fintech CEOs and CTOs, this is not a theoretical question. It shows up in your transaction data.

If you are focusing on fintech inclusion in an emerging market, chances are your customers are already using mobile money, whether you design for it or not.

Across Africa and other emerging economies, for most people mobile is their first point of contact. Whether it is bill payment or salary or air time top up, people use mobile wallets or agent networks for transactions. For startups, aiming to start their fintech business this means mobile money is not optional. It is the default.

The uncomfortable truth is - if your product does not fit naturally into the mobile money ecosystem, adoption will stall no matter how strong your funding, branding, or roadmap looks.

Payment failures, settlement delays, or limited interoperability erode trust quickly in markets where word travels fast.

This guide breaks down practical mobile money adoption strategies for startups operating in emerging markets. It focuses on what founders and leadership teams need to consider across infrastructure, regulation, partnerships, and scale, so adoption holds up beyond the pilot stage.

What Mobile Money Adoption Really Means for Startups?

Mobile money adoption is often misunderstood.

For startups, adoption does not mean users downloading an app or completing a first transaction. True adoption shows up when customers trust the system enough to use it repeatedly for real needs. That trust depends on reliability, liquidity, and predictable outcomes.

What is mobile money adoption for startups?

Mobile money adoption means achieving consistent, repeat usage of mobile wallets and payment services, supported by reliable cash-in and cash-out, clear settlement, and visible customer support.

Many fintech startups integrate mobile money APIs and assume adoption will follow. In practice, adoption only happens when payments work every day, agents have liquidity, reversals are handled cleanly, and users feel confident their money is safe.

Top 5 major benefits on mobile money adoption strategies are -

-

Financial inclusion in emerging markets

-

Improved cash flow

-

Reduced transaction risks

-

Data driven insights about transactions and history

-

Improved support and trust from customers

Fintech startup owners can use these to benefit and position their business.

Understanding Mobile Money Ecosystems in Emerging Markets

Once you know the benefits, you need a detailed understanding of how mobile money in emerging markets work and the important players involved in it.

Mobile Money Ecosystem Components

| Key Components | Impact |

|---|---|

| Layer | Role in Adoption |

| MNOs | Distribution + trust |

| Agents | Last-mile access |

| Banks | Float & settlement |

| Fintech APIs | Product layer |

| Regulators | Compliance & consumer protection |

How Mobile Money Works in Practice?

Mobile money differs fundamentally from traditional bank-based payments. Digital wallets are typically issued by mobile network operators or licensed providers. Funds are stored digitally, but cash-in and cash-out happen through agent networks rather than branches.

This model supports financial inclusion by allowing users to transact without formal bank accounts. It also supports cashless economy goals by digitizing everyday payments while keeping access local.

Key Ecosystem Players and Their Role

Mobile Network Operators (MNOs)

MNOs provide distribution, brand trust, and agent networks. In many markets, they remain the primary wallet providers.

Agents and the Agent Banking Model

Agents handle last-mile access. They enable cash-in, cash-out, and user assistance. Agent liquidity directly affects transaction success.

Banks often hold float accounts and manage settlement. Regulators define consumer protection, reporting, and licensing requirements.

Fintech Platforms and APIs

Fintech infrastructure providers sit above these layers, enabling startups to integrate, orchestrate, and scale across multiple wallets and rails.

Understanding how these players interact is essential for designing adoption strategies that work in real conditions.

Core Mobile Money Adoption Challenges Startups Face

When working towards growth, fintech startups in emerging markets need to know – “Which are the obstacles they should find a solution to?”

1. Trust and Digital Literacy

Users are cautious with new financial services. Fear of funds getting stuck, language barriers, and limited digital literacy can slow adoption. Startups must design onboarding and support with education, local languages, and clear recourse paths.

2. Fragmented Payment Rails and Interoperability Gaps

Emerging markets often have multiple wallets, banks, and schemes that do not fully interoperate. Without early planning, startups end up locked into single providers, limiting reach and increasing failure rates.

3. Liquidity, Settlement, and Unit Economics

Agent float shortages, delayed settlements, and complex fee structures directly affect adoption. If users cannot cash out reliably or merchants experience delays, trust erodes quickly.

4. Compliance and Regulatory Complexity

KYC, AML, and licensing requirements vary by market. Many startups underestimate how quickly compliance obligations grow with volume, leading to operational strain later.

5. Low Digital/Financial Literacy

Due to high illiteracy users are unable to use mobile money features. Then another reason is unfamiliarity with digital technologies. Old age users who are not so tech savvy have problems adopting newer technologies.

6. Agent Network Limitations

Transactions are challenging when there is a shortage of agents in rural locations. Problems arise when agents do not have enough cash or e-float. This becomes an infrastructural problem making things worse.

7. High Transaction Costs

With convenience, there comes charges. Users get convenience but for smaller amounts the convenience costs them more. And they become less interested using mobile money.

When you intend to build a great payment infrastructure for startups, these are some obstacles, for which they need to find a solution to.

But with right strategies and solutions you can easily establish cashless economy in developing countries.

Mobile Money Adoption Strategies That Actually Work

You understood what does not work but now this section talks about which strategies work the best for mobile wallet adoption.

Strategy 1: Start with High-Frequency Use Cases

Mobile money for startups will breed the highest success when it works around daily needs. Utilities like airtime top up or bills, transport, merchant payments, and remittances create habitual usage that builds trust.

Strategy 2: Design for Cash-In and Cash-Out First

No matter how polished the app is, adoption fails if users cannot easily move between cash and digital value. Agent density, liquidity management, and clear instructions matter more than advanced features early on.

Strategy 3: Localize by Behavior, Not Just Geography

Even within the same country, payment behavior differs. Pricing sensitivity, transaction timing, and preferred channels vary. Successful startups adapt workflows to local patterns rather than applying a single model everywhere.

Strategy 4: Build Trust into Every Transaction

Instant confirmations, transparent fees, visible receipts, and predictable reversals reassure users. Trust is reinforced through consistent outcomes, not marketing messages.

Strategy 5: Plan Interoperability from Day One

Wallet-to-wallet and wallet-to-bank interoperability become critical as volumes grow. Planning early avoids costly rework and unlocks broader adoption.

Product and UX Design for Last-Mile Adoption

| UX Strategy | Adoption Impact |

|---|---|

| 1-tap payments | High |

| Local language | Medium |

| Offline flows | High |

| Simplified KYC | High |

| QR payments | Medium |

Mobile-first financial services must account for device diversity and connectivity constraints. Many users rely on basic phones or intermittent data.

Effective design approaches include:

-

USSD and IVR for feature phones

-

App and QR flows for smartphones

-

Offline-friendly interactions

-

Tiered onboarding aligned with KYC requirements

Reducing friction in onboarding, top-ups, bill payments, and refunds has a direct impact on adoption and retention.

Regulation and Compliance: Getting It Right Without Slowing Growth

Compliance is not a launch checkbox. It is an operating condition.

Startups must align with KYC tiers, AML monitoring, reporting obligations, and data protection rules from the start. Regulatory sandbox fintech programs can help validate models, but they do not replace full compliance.

Many startups reduce risk by partnering with licensed banks, MNOs, or platform providers that already support compliant workflows. This approach accelerates time to market while preserving regulatory confidence.

Also read - Here is a complete guide on “build vs buy” for your next project.

Build vs Buy: Choosing the Right Mobile Money Infrastructure

| Factor | Build In-House | White-Label Platform |

|---|---|---|

| Time to launch | 9-18 months | 4-8 weeks |

| Compliance risk | High | Low |

| Engineering cost | Very high | Predictable |

| Scalability | Custom | Built-in |

| Multi-country expansion | Hard | Easy |

This comes when you are still considering whether to build a mobile money platform from scratch or buy a white label API first mobile money platform.

Evaluating Payment Infrastructure for Startups

Key decision factors include:

-

Speed to market

-

Compliance risk exposure

-

Engineering and operational cost

-

Ability to scale across markets

Building core rails can make sense for large, well-funded teams, but most startups underestimate the long-term cost of maintenance and compliance.

When White-Label and API-First Platforms Make Sense

Mobile money platforms for startups that offer white-label and API-first infrastructure provide faster launches, built-in interoperability, and compliance readiness. They allow startups to focus on differentiation rather than rebuilding payments foundations.

Partnerships That Accelerate Mobile Money Adoption

Strategic partnerships amplify adoption when structured correctly.

Startups commonly partner with:

-

MNOs and agent networks for distribution

-

Banks for float management and oversight

-

Marketplaces and super apps for user acquisition

-

Government and development programs for trust and scale

Clear revenue sharing, data boundaries, and customer support alignment are essential for sustainable partnerships.

Monetization Without Impacting Adoption

Transaction fees alone rarely sustain growth. Many successful startups layer multiple other services. There are different pricing models to cater to different kind of audiences. Pricing must balance affordability with unit economics. Over-incentivizing early users can distort behavior and reduce long-term viability. Whereas not offering additional benefits to long-term users can also impact the sustainability of the business.

These are some ways from where you can start monetizing without impacting your adoption process -

-

Transaction fees

-

FX margins

-

Subscriptions

-

Merchant services

-

Float income

-

Value-added services

Striking a balance between them is one metric that C-suite executives should ensure while delivering a solution. Let us jump to the next section to know more such metrics.

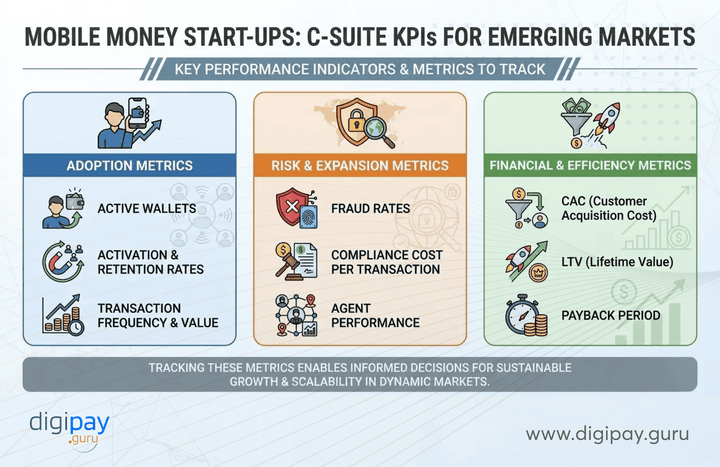

KPIs and Metrics C-Suite Teams Should Track

A list of key metrics that can help top executives keep track of things is -

These metrics reveal whether adoption strategies are working and where friction remains.

Future of Mobile Money in Emerging Markets

Mobile money will increasingly converge with instant payments, QR standards, and open banking frameworks. AI-driven personalization, fraud detection, and credit scoring will sit on top of wallet infrastructure.

Startups that invest in adaptable tech stacks, strong data capabilities, and regulatory resilience will be best positioned as mobile money becomes the backbone of broader cashless economies.

How DigiPay Guru Can Ease Your Mobile Money Adoption

For many fintech startups, mobile money adoption does not fail because of demand. It fails because the operational and regulatory layers underneath the product becomes difficult to manage as volumes grow.

DigiPay Guru is designed to address this gap by providing a unified, white-label payment infrastructure that simplifies how startups connect to mobile money ecosystems across emerging markets.

Instead of managing multiple integrations with MNOs, banks, and settlement partners, startups can use DigiPay Guru as a single infrastructure layer that supports collections, payouts, wallet operations, and reconciliation. This reduces fragmentation and helps teams focus on user experience and growth rather than payment plumbing.

From an adoption perspective, DigiPay Guru supports:

-

Multi-rail mobile money access, enabling broader reach without repeated integrations

-

Built-in compliance readiness, including KYC and transaction monitoring aligned with regulated environments

-

Reliable settlement and reconciliation, reducing failures that erode user trust

-

API-first, white-label deployment, allowing startups to preserve their brand while scaling faster

For startups operating in emerging markets, this approach lowers time-to-market, reduces operational risk, and creates a more stable foundation for long-term mobile money adoption. Rather than rebuilding infrastructure market by market, teams can adopt a platform that grows with them.

Key Takeaways for Startup Leaders

-

Mobile money adoption is operational, not cosmetic

-

Trust and liquidity matter more than features

-

Infrastructure decisions shape scalability

-

Compliance builds credibility

-

Interoperability unlocks growth

For fintech startups in emerging markets, mobile money success is decided behind the scenes. Adoption depends less on how the product looks and more on how reliably it works every day.

Users trust systems that settle on time, agents that have liquidity, and platforms that handle issues transparently. And without interoperability across wallets, banks, and rails, growth remains capped.

Leaders who treat mobile money as core infrastructure rather than a feature are better positioned to scale sustainably across markets.

FAQs

Mobile money is critical for understanding startups in emerging markets because it is how most people already store and move money. It enables startups to reach users without bank accounts and supports everyday payments through trusted mobile and agent networks.

The biggest risk is underestimating operational complexity, including liquidity management, settlement delays, interoperability challenges, and compliance requirements that directly affect trust and adoption.

A mobile money-enabled product can launch in a few weeks using API-based or white-label platforms, while building direct integrations and compliance processes from scratch can take several months.

Startups build trust by ensuring reliable transactions, clear confirmations, predictable reversals, visible customer support, and consistent cash-in and cash-out availability through agent networks.

Yes, startups can scale across countries by using interoperable, API-first infrastructure that supports local regulations, multiple mobile money providers, and country-specific payment workflows.