Here’s a fact that should keep you up at night: Over 64 million adults in Nigeria are still unbanked.

Now imagine what happens when you put a mobile phone in their hands and give them a way to send, save, borrow, and pay — without stepping into a bank. That’s the power of mobile money in Nigeria.

As a bank/fintech, you’re not just competing with each other anymore. You're competing with the speed of mobile-first expectations, the reach of agent networks, and the simplicity of a tap-to-pay lifestyle.

From informal markets in Kano to corporate offices in Lagos, users are ditching cash and embracing mobile wallets. So, there’s no better time to act.

Now is the time to do your homework on the Nigerian market and jump right on the opportunities.

You either adapt and lead or watch others capture your future customers.

In this blog, you’ll uncover :

-

The current landscape of mobile money in Nigeria

-

The major drivers and key opportunities

-

How you can build future-proof infrastructure that delivers results.

Whether you’re a bank ready to digitize or a fintech preparing to scale, this blog is your strategic roadmap.

Let’s get into it.

Understanding the Mobile Money Market Landscape in Nigeria

Let’s zoom out a bit. Not long ago, mobile money was seen as a side project, and everyone feared using it. Today, it’s at the heart of how Nigerians pay, save, and access financial services.

They love it, they need it, and they can't live without it. (at least the ones who have smartphones and access to the internet)

Let’s look at what’s happening:

-

Over 200 licensed mobile money operators are active across the country.

-

The Central Bank of Nigeria (CBN) has approved 13 Payment Service Banks (PSBs) to help more people go digital.

-

In 2023 alone, mobile transactions hit N19.4 trillion, almost double the previous year.

-

Agent banking networks now reach nearly every local government area (LGA) in Nigeria.

These numbers are more than statistics. They show that people are ready to switch from cash to digital — and they already are.

Why is this happening?

-

Clear support from the CBN mobile money regulations

-

Growth in USSD banking in Nigeria, which works even without internet

-

More Nigerian fintech companies are solving real-world problems

-

Improved systems that allow different apps to talk to each other

From markets in Aba to farms in Makurdi, people are using a mobile wallet in Nigeria because they work. And they’re fast, safe, and simple.

It would be correct to say that mobile money is no longer something to test. It’s something to build on. If you're part of Nigeria's financial sector, this is your cue to offer mobile payments in Nigeria and lead the market.

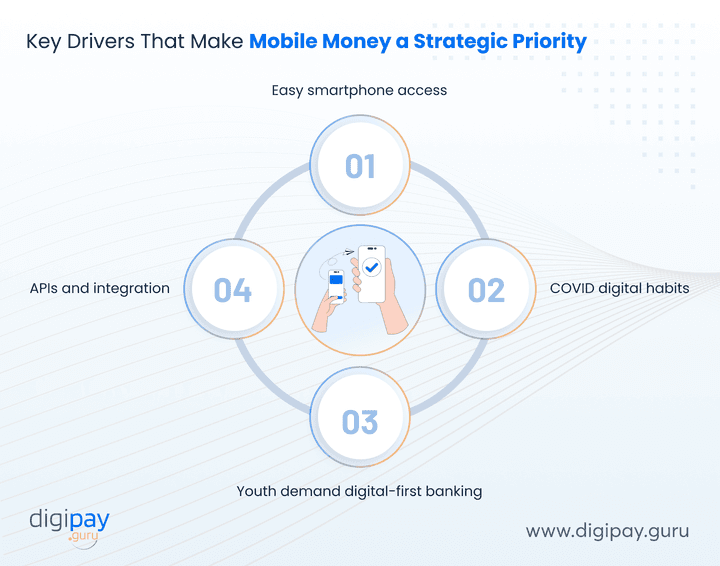

Why Now? Key Drivers Making Mobile Money a Strategic Priority

Mobile money isn’t just growing — it’s accelerating. Here’s why now is the right time for your business to lean in, invest, and lead the mobile money market in Nigeria.

Smartphone access is growing fast

More Nigerians now own smartphones than ever before. These devices are getting cheaper, and mobile internet is reaching even remote areas. What used to be a barrier is now a bridge.

And a smartphone isn’t just a phone anymore — it’s a digital bank branch in your user’s pocket. This shift means your customers expect mobile-first services that are fast, secure, and easy to use.

COVID made digital habits permanent

During the pandemic, many Nigerians had no choice but to go digital. Whether it was paying for goods online or sending money to loved ones through USSD, mobile money became the default. That was also a time when contactless or touchless became the norm.

That behavior of mobile money usage didn’t go away. It became the new normal. If your business isn’t meeting users where they are — on their phones — you risk losing them to faster and digital-first alternatives (your competitors).

Nigeria’s youth demand digital-first banking

More than half of Nigeria’s population is under 30. This is a generation raised on mobile phones, apps, and instant access. They’re not interested in waiting in line at a bank. They want to open an account, pay for services, and get loans — all from their phone. If your digital experience isn’t built for them, someone else’s is.

This young, tech-savvy population is not just the future. They’re your current and most active customer base.

APIs and integration make things smoother

One of the biggest changes in the financial ecosystem is how easily platforms now connect with each other.

Thanks to open banking, APIs, and better infrastructure, your bank or fintech can launch and scale mobile money services faster. No more siloed systems or slow rollouts.

This level of interoperability in mobile money means your service can work seamlessly with telcos, merchants, government portals, and more. This creates value for users and efficiency for your business.

Opportunities for Banks, Fintechs, and Financial Institutions

Mobile money isn’t about replacing banks. It’s about helping you grow, reach new markets, serve new customers, and future-proof your offerings.

Here’s how different players in the financial space can tap into this opportunity:

Strategic opportunities for banks to expand reach and stay relevant

If you are a bank, you have plenty of opportunities to grow your business. You can:

-

Reach more customers in remote areas without opening new branches

-

Launch mobile-first services like digital savings, loans, and bill payments

-

Use mobile wallets to reduce service costs and increase convenience

This way, banks can go beyond brick-and-mortar.

By offering seamless digital experiences through mobile wallet platforms in Nigeria, you can compete where customers spend their time — on their phones.

Strategic opportunities for fintechs to scale smarter

Strategic opportunities for fintechs to scale smarter

-

Build flexible solutions for underserved segments: gig workers, students, and SMEs

-

Offer new services like digital lending, buy-now-pay-later, and savings groups

-

Plug into telcos, banks, and agent networks through open APIs

Fintech in Nigeria is crowded — but there's still room for players who solve real problems. Mobile money gives you a way to stand out by being fast, focused, and frictionless.

Strategic opportunities for financial institutions to simplify and innovate

Financial institutions also do not stay too far from getting benefitted with mobile money. You can:

-

Digitize cash-heavy processes like disbursements and collections

-

Use analytics from mobile money to design better financial products

-

Offer faster, safer, and more transparent transactions for clients

Whether you're a microfinance bank, credit union, or large institution — you can use mobile money wallets in Nigeria to move faster, reach further, and reduce risk.

Bottom line: No matter your role in the financial ecosystem, mobile money is your chance to build deeper relationships, unlock new income streams, and be part of a growing digital economy.

Challenges in the Mobile Money Ecosystem

Every opportunity comes with its set of challenges. Mobile money is no exception. But the good news? Each challenge is solvable. And those who solve them first lead the market.

Systems still don’t always work together

Interoperability is improving, but not every platform easily connects to another. This creates friction for users and limits the reach of your services.

Hence, financial players who invest in integration — APIs, shared infrastructure, and open standards — will create smoother experiences and gain more loyal customers.

Not everyone trusts digital systems

Trust is still an issue, especially among older or less digitally savvy users. Concerns about fraud, scams, and lost funds keep many people from switching to mobile money.

This is your opportunity to lead with clear communication, reliable service, and strong support. Because trust builds adoption.

Cybersecurity is a growing concern

As more transactions move online, the risks grow too. Data breaches, identity theft, and mobile fraud can damage both users and brands.

Staying ahead of these threats with strong cybersecurity protocols and fraud detection isn’t optional — it’s essential.

Regulations can be unclear

Navigating fintech regulation in Nigeria isn't always straightforward. Multiple authorities, shifting policies, and overlapping requirements can slow you down.

That is why financial businesses that build compliance-ready systems and stay close to regulatory updates will have the upper hand in the Nigerian market.

Many users still need digital education

You can’t assume everyone knows how to use a mobile wallet. For many first-time users, mobile money is their first interaction with a financial tool.

That’s where smart onboarding, agent training, and simplified user interfaces come in. Make it easy, and adoption will follow.

Solving these challenges won’t just help you succeed — it will put your brand at the center of digital banking in Nigeria and its future.

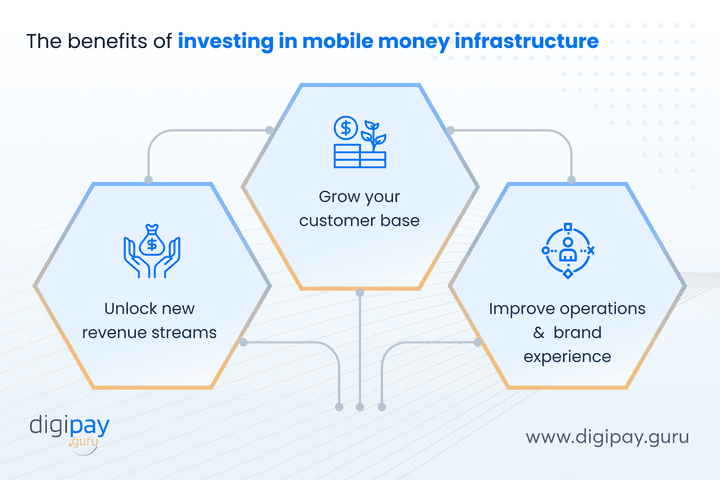

The ROI of Investing in Mobile Money Infrastructure

Digital transformation isn’t just about keeping up. It’s about gaining real returns fast. Mobile money can unlock growth across revenue, reach, and efficiency for your business. Here's how:

Unlock new revenue streams

Offering mobile money services in Nigeria opens the door to monetizing everyday transactions — from P2P transfers and bill payments to agent commissions and merchant fees. You’re not just offering a service. You’re creating new income channels that grow with user activity.

Banks can introduce tiered services. Fintechs can bundle credit, savings, and micro-insurance. Every tap brings value.

Grow your customer base

Digital-first platforms lower acquisition costs and scale faster than physical channels. With mobile money, you can:

-

Reach remote and unbanked population in Nigeria with low onboarding friction

-

Serve informal workers, youth, and underbanked SMEs

-

Convert one-time users into loyal customers through everyday touchpoints

The result? Broader reach, stronger engagement, and deeper market presence.

Improve operations and brand experience

Manual systems slow you down. That’s where mobile money comes to your rescue. Mobile money solutions automate key workflows, reduce service costs, and enable real-time insights. With mobile money, you can gain:

-

Faster KYC and onboarding

-

Simpler collections and disbursements

-

And smarter decision-making from data

That’s not just efficiency; it’s brand elevation. It means with mobile money, you become the digital-first bank or fintech that users trust and return to.

In short: Mobile money drives revenue, reach, and relevance. The sooner you invest, the sooner you gain.

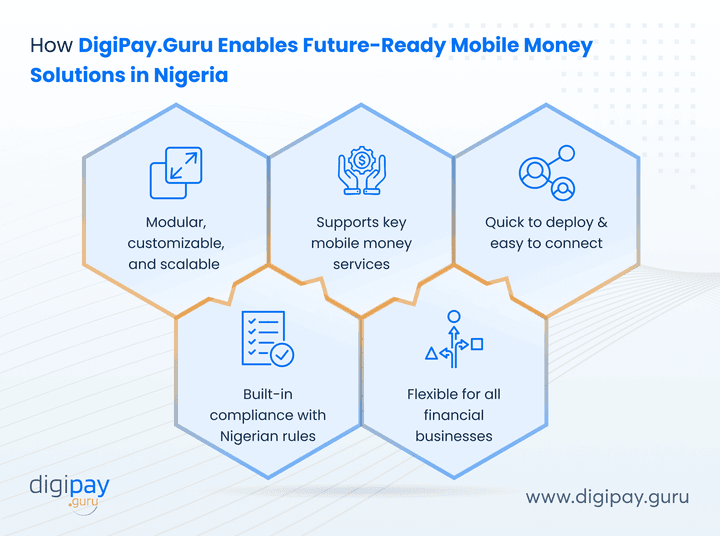

How DigiPay.Guru Enables Future-Ready Mobile Money Solutions

At DigiPay.Guru, we understand the Nigerian financial landscape. And we’ve built our solutions to help you succeed in it. Whether you’re a bank or a fintech, our platform is designed to support growth, scale, and compliance.

Here’s how:

Built to fit your model

Our mobile money solution is modular, customizable, and scalable. You can launch quickly, expand over time, or tailor services to meet the specific needs of your market.

Supports key mobile money services

From agent networks to merchant QR, P2P transfers to eKYC, we’ve covered the core functionalities. Everything works out of the box, ready for your rollout.

Quick to deploy, easy to connect

Go live faster with a system that plugs into your existing infrastructure. Our open APIs let you integrate with core banking systems, CRMs, and third-party apps smoothly.

Built-in compliance with Nigerian rules

Stay aligned with CBN regulations, PSB standards, and NDPR data policies. Our platform is designed to help you meet legal requirements without added effort.

Flexible for all businesses

Whether you're launching a wallet, expanding through agents, or embedding payments — our platform adapts to your strategy. It's ready for growth, no matter your starting point.

You bring the vision. We bring the tech that powers it.

Conclusion

The momentum behind mobile money in Nigeria isn’t slowing down. With millions still unbanked and mobile-first users growing by the day, the opportunity is clear and urgent.

For Nigerian banks and fintechs, this is more than a technology shift. It’s a chance to lead the next chapter of financial inclusion in Nigeria, drive new revenue, and deliver services where they matter most.

You don’t have to build everything from scratch. But you do need to act with clarity and speed.

Partner with a solution that understands the local market, meets regulatory demands, and helps you go to market faster.

That’s where DigiPay.Guru comes in. Our mobile money solution is designed to help you launch fast, scale smart, and stay compliant. Whether you're creating a new wallet or expanding your financial ecosystem, we bring the tech, tools, and local understanding to help you succeed.

The businesses that step forward now won’t just stay relevant. They’ll shape the way Nigeria transacts, saves, and grows.

Let’s build the future of finance together.

FAQ's

Mobile money is a digital wallet service that lets users store, send, and receive money using their mobile phones, even without a traditional bank account. In Nigeria, it operates through apps, USSD codes, and agent networks. Users can perform financial transactions like paying bills, sending money, or buying airtime directly from their phones.

Mobile money platforms are backed by Mobile Money Operators (MMOs) licensed by the Central Bank of Nigeria (CBN). These platforms often work with Payment Service Banks (PSBs), fintechs, and mobile network operators to deliver financial access across the country.

Some of the leading mobile money providers in Nigeria include:

-

OPay: Known for its wide agent network and multi-service super app.

-

PalmPay: Offers cashback rewards and a growing merchant network.

-

Moniepoint: Focused on SMEs with one of the largest POS and agency footprints.

-

Paga: A pioneer in the space, enabling wallet and agent-based services.

-

Kuda: A digital-only bank offering mobile-first account features.

-

MTN MoMo: Operates under a PSB license, expanding rapidly through telecom reach.

Each provider has a unique model, but they all aim to simplify financial services for Nigerians.

While they sound similar, the two serve different needs:

-

Mobile money works through wallets that are not tied to traditional bank accounts. It's designed for quick access, basic financial functions, and ease of use — even without internet or smartphones (via USSD).

-

Mobile banking is a digital extension of a bank account, allowing customers to check balances, transfer funds, or access other banking services through a bank’s app or USSD.

In short, mobile money focuses on accessibility and reach, especially for the unbanked, while mobile banking extends the services of formal financial institutions.

It is very popular and growing fast. In 2023, mobile money transactions in Nigeria crossed ₦19.4 trillion, a nearly 90% increase from the previous year. Millions of Nigerians now rely on mobile wallets for daily transactions, and agent networks cover nearly every Local Government Area (LGA).

The push by the CBN, the expansion of agent banking, and the rise of fintechs have all made mobile money a go-to financial tool for both rural and urban populations.

Mobile money platforms in Nigeria offer a wide range of services, including:

-

Peer-to-peer (P2P) money transfers

-

Airtime and data purchases

-

Bill payments (electricity, water, TV, etc.)

-

Merchant and QR code payments

-

Salary and government disbursements

-

Micro-loans and savings features

-

Agent cash-in and cash-out services

-

eKYC & onboarding for financial access and much more…

Advanced platforms also offer APIs, integrations with banks, and support for compliance with CBN regulations.