The rules of engagement in financial services are changing. Fast.

If you're building for scale, inclusion, or digital-first experiences, you’re likely weighing one big decision: mobile money vs. mobile banking.

And here’s the reality—it’s not just about tech anymore. It's about where your customers are, how they move money, and what infrastructure they trust. Whether you’re a traditional bank or a fintech company targeting emerging markets, this choice shapes everything from compliance strategy to go-to-market speed.

At DigiPay.Guru, we've helped businesses like yours all across the globe make this call. We've seen banks launch mobile money apps to reach rural populations. We've seen fintechs skip banking licenses altogether and scale through agent-based wallets. We've also seen those who waited too long and lost the market to more agile competitors.

This blog is here to show you the strategic role both mobile money and mobile banking can play. And to help you decide which to lead with, based on your audience, market, and growth priorities.

So let’s break it down with clarity, context, and your goals at the center.

What Is Mobile Money and What Is Mobile Banking?

Understanding the key difference between mobile money and mobile banking isn’t just about definitions. It’s about choosing the right foundation for your digital finance strategy.

Let’s break down the meaning of mobile money vs. mobile banking.

What Is Mobile Money

Mobile money is an eWallet that allows users to store, send, and receive money using a mobile phone without needing a traditional bank account.

It operates through a mobile money app, USSD code, or agent network. It’s lightweight, accessible, and built for scale in markets where formal banking hasn’t reached everyone. Your users can:

-

Transfer funds from their mobile money account to a bank account

-

Pay utility bills

-

Top up airtime and much more…

In markets like Africa, Southeast Asia, and Latin America, mobile money has become the default financial infrastructure. It works with or without the internet, which makes it ideal for low-connectivity regions.

And with strong agent networks, it delivers both convenience and trust in offline as well as online settings.

Mobile Banking

Mobile banking gives your customers digital access to their existing bank accounts. It’s an extension of your core banking system, delivered through a branded banking app. With mobile banking, users can:

-

Check balances

-

Transfer funds between accounts

-

Apply for loans or services

-

Access full-service financial tools and much more…

It’s built for the already banked population. In markets with high smartphone penetration, stable internet, and established financial systems, mobile banking deepens engagement and boosts retention. Think of it as your digital branch—available 24/7.

But here’s the key: mobile banking assumes your users already trust banks, have accounts, and are comfortable with digital services. That’s not always the case.

Mobile Money vs Mobile Banking: Key Differences

When choosing between mobile money and mobile banking, you’re not just choosing a technology; you’re choosing how your business shows up in the lives of your users.

This table highlights the operational and strategic differences between mobile money and mobile banking. It’s designed to help you evaluate each model based on what your customers need today and what your growth strategy demands tomorrow.

| Feature | Mobile Money | Mobile Banking |

|---|---|---|

| Account Requirement | No need for a traditional bank account | Requires a formal bank account |

| Internet Dependency | Works with or without internet (via USSD/SMS) | Internet connection is mandatory |

| Internet connection is mandatory | Peer-to-peer payments, bill pay, merchant payments | Full-service banking—balances, loans, transfers |

| Target Audience | Any digital transaction, including online and in-person payments | Banked customers with formal financial access |

| Platform Access | Via mobile money app, USSD, or physical agent network | Via smartphone-based mobile banking app |

| Agent Network Integration | Built-in support for cash-in/cash-out via local agents | Rarely used; relies on ATMs and branch infrastructure |

| Speed to Deploy | Faster to launch in new or underserved markets | Slower, requires core banking integration |

| Compliance Burden | Moderate—especially in emerging markets with fintech sandboxes | Higher—must meet full banking regulations |

| Best Fit Markets | Emerging economies, rural populations, digitally excluded users | Urban markets, tech-savvy users, stable financial ecosystems |

| Customer Onboarding | Flexible onboarding via KYC-lite or agent verification | Strict onboarding tied to regulatory and identity checks |

This comparison isn’t just technical; it’s strategic.

Mobile money helps you build presence in high-opportunity & low-infrastructure markets.

Mobile banking helps you deepen engagement with users already inside the financial system.

Strategic Market Trends Powering Mobile Money and Mobile Banking

The momentum behind mobile money and mobile banking isn’t accidental. It’s driven by clear market forces. Understanding these trends helps you align your investment with where the industry is headed, not where it’s been.

Let’s unpack what’s fueling each model.

Mobile Money: The Infrastructure of Inclusion

Global organizations like the GSMA, World Bank, and IMF agree: mobile money is at the heart of financial inclusion.

-

Over 1.4 billion people are still unbanked, many of them in cash-based economies.

-

Mobile phone penetration exceeds 80% in regions where formal banking penetration is below 20%.

-

Governments and humanitarian agencies are increasingly using mobile wallets for G2P disbursements, pensions, and subsidies.

The trend is clear—when people can’t reach banks, banks must reach them. Mobile money is the bridge.

Mobile Banking: Digitizing Existing Relationships

At the same time, digital banking adoption is surging in urban, banked populations.

-

Fintechs like Revolut, Chime, and Nubank are setting the benchmark for user experience and personalization.

-

Traditional banks are accelerating mobile-first transformations to reduce cost-to-serve and increase engagement.

-

Embedded finance is pushing mobile banking into new use cases—wealth, insurance, and lending.

Mobile banking is evolving from a digital alternative to the default channel for customer interaction.

Regulatory Shifts Are Opening Doors

Central banks are becoming more open to innovation, especially in emerging markets.

-

Regulatory sandboxes are enabling quicker pilots of mobile money systems.

-

Interoperability mandates are driving wallet-to-bank integrations.

-

Digital ID and eKYC frameworks are lowering onboarding barriers.

For businesses that move early, these shifts offer a unique first-mover advantage.

The takeaway?

Mobile money and mobile banking are both riding strong but different waves.

One is inclusion-driven. The other is engagement-driven.

Knowing when and where to ride each makes all the difference.

Who Should Choose What? Use Cases by Segment

There’s no one-size-fits-all solution. The right choice depends on who you are, who you serve, and where you’re operating.

Below are real-world use cases that align with your goals—whether you're a bank expanding reach, a fintech scaling fast, or a government financial institution delivering impact.

Banks: Build Reach + Revenue

If you're a traditional bank, mobile money opens doors that branches and apps can't.

-

Acquire new customers in unbanked regions using wallet-based onboarding.

-

Launch an agent network to offer cash-in, cash-out, and merchant services in areas without branches.

-

Create a product journey: bring users in through mobile money, then graduate them to mobile banking when ready.

-

Offer basic financial services at scale—with lower operational costs.

Best fit if: You’re in a market with limited banking penetration and want to extend your footprint without building physical infrastructure.

Note: Mobile banking can help you digitize your services to serve urban populations with banking, internet, and smartphone access.

Fintechs: Scale Smart and Fast

For fintechs, mobile money offers a fast track to market entry without the regulatory load of full-service banking.

-

Deploy a mobile money app quickly with lower tech and compliance friction.

-

Focus on high-volume use cases: P2P transfers, merchant payments, airtime, and bill pay.

-

Keep onboarding simple with eKYC, agent registration, or telco partnerships.

-

Integrate with APIs for cross-border, loyalty, or embedded finance use cases.

Best fit if: You want to launch quickly in emerging markets or offer focused digital services like remittances, microloans, or P2P payments.

Government & Development Institutions: Deliver Inclusion at Scale

Public and developmental organizations can use mobile money as a direct, auditable, and secure delivery channel.

-

Enable G2P payments like pensions, subsidies, and disaster relief.

-

Deploy mobile wallets in humanitarian zones where banks don’t exist.

-

Digitize grant disbursements and reporting with real-time dashboards.

-

Boost economic participation in rural or vulnerable communities.

Best fit if: You need a trusted way to deliver funds to people without requiring them to visit a bank or own a smartphone.

Why the Future Is Not Either/Or But Both

If you’re building for scale in digital finance, don’t fall into the trap of false choices. Mobile money and mobile banking aren’t competitors; they’re complements.

Each model solves a different problem:

-

Mobile money solves access.

-

Mobile banking deepens engagement.

Businesses that win in today’s markets know when to lead with one and how to layer the other.

Let’s look at what this looks like in the real world.

-

M-Pesa didn’t just launch a product; it created financial access where none existed.

-

bKash became a national payment infrastructure by solving for inclusion first and then layering more services.

-

One of our DigiPay.Guru clients onboarded over thousands of new users in a very short period with a mobile money-first strategy. And then added mobile banking features as their users grew more financially active.

Now that’s the compounding effect of sequencing.

Meanwhile, the best mobile banking apps, like Revolut, Chime, and Kotak 811 didn’t start by replacing cash. They built smart, full-stack digital experiences for users who already had accounts, cards, and comfort with digital finance.

But here’s the catch: Mobile banking assumes digital literacy. It assumes users are already inside the financial system.

Mobile money doesn’t make those assumptions. It builds the bridge.

So, you start where your market is today. Then you layer services based on where your users want to go next.

Hybrid Strategies That Work

Here's what smart businesses do:

-

Launch a mobile money product first to gain market entry

-

Introduce digital banking services to grow customer value

-

Build bridges (e.g., mobile money login to banking apps, wallet-to-bank transfers)

Think of mobile money as the gateway drug. Mobile banking is a long game.

Challenges in Adoption of Mobile Money or Mobile Banking System

Even with the right strategy, launching mobile money or mobile banking isn’t plug-and-play. Both models face common roadblocks that can slow down growth or derail impact.

Understanding these challenges early helps you plan for smoother execution and adoption.

They are:

Regulatory Issues

Whether you’re a fintech startup or a legacy bank, regulation is the gatekeeper.

Some markets lack clear frameworks for digital wallets, while others impose full banking-level scrutiny even on lightweight wallet providers. Cross-border features like remittances or wallet-to-bank transfers often trigger AML compliance and KYC compliance checks that slow down innovation.

For mobile banking, the bar is even higher. Full licensing, capital requirements, data localization, and audit trails come standard.

If you’re entering new markets, your legal team shouldn’t be an afterthought. It should be your launch partner.

Infrastructure Gaps

Great ideas fall flat without solid rails underneath.

Mobile banking relies heavily on internet connectivity, device compatibility, and backend system stability. In many regions, that’s still a work in progress.

Mobile money offers flexibility with USSD, SMS, and agent-led cash handling. But it still needs a backbone: telco partnerships, strong agent onboarding, and API integrations with other financial systems.

If your backend can’t scale or your agent network is weak, users won’t stick around.

Digital Literacy and Trust

You’re not just onboarding users. You’re asking them to trust a screen with their money. In low-literacy markets or regions where fraud is rampant, fear kills adoption.

If your app is clunky, the signup process is confusing, or your app doesn’t support local languages, people can likely give up before completing a purchase. This can lead to low conversion rates.

However, you can build this trust with clear UX, real-time support, and community-level presence.

Sometimes, the agent who answers questions at the corner shop builds more confidence than the most advanced interface.

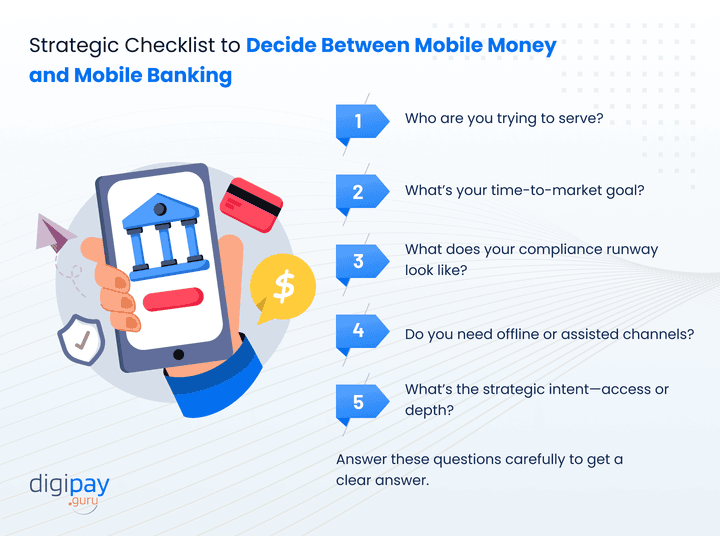

Key Decision Criteria: A Strategic Checklist For Your Business

Whether you're leading innovation at a traditional bank or building infrastructure at a fintech, the choice between mobile money and mobile banking carries long-term implications.

Use this checklist to align your decision with your business model, market maturity, and growth horizon.

Who are you trying to serve?

-

Unbanked or underbanked → Mobile Money

-

Banked and digitally fluent → Mobile Banking

What’s your time-to-market goal?

-

Need to launch fast with lean operations → Mobile Money

-

Prepared for phased deployment and full-stack banking → Mobile Banking

What does your compliance runway look like?

-

Limited regulatory capacity → Start with Mobile Money

-

Full compliance readiness → Mobile Banking is viable

Do you need offline or assisted channels?

Yes, we need agents, USSD, or hybrid flows → Mobile Money

No, our users are mobile-first and self-serve → Mobile Banking

What’s the strategic intent—access or depth?

-

Access and reach → Mobile Money is the front door

-

Depth and lifetime value → Mobile Banking expands the relationship

This isn’t about picking sides. It’s about sequencing decisions with intent.

Start with the model that fits your users today. Layer the one that grows with them tomorrow.

DigiPay.Guru’s Take: Start With Mobile Money

At DigiPay.Guru, we don’t just build products; we build entry points to financial ecosystems.

And from what we’ve seen in markets across the globe, starting with mobile money gives you speed, reach, and flexibility that traditional mobile banking alone can’t match.

Why? Because mobile money isn’t just a feature. It’s a strategy.

You're not just launching an eWallet. You’re:

-

Building a distribution network with agents, QR codes, and SMS rails

-

Reaching first-time users who don’t have a bank account

-

Unlocking market share where formal banking still hasn’t penetrated

And here’s what we bring to the table:

-

A white-label mobile money solution that’s built to scale

-

Full-stack modules for agent management, merchant payments, and bill pay

-

Real-time integrations for mobile money transfer to bank account flows

-

Secure, compliant onboarding with KYC, eKYC, and transaction monitoring

-

An architecture that’s ready for digital banking add-ons when you’re ready

We help you go live fast with advanced security, scalability, and reliability.

If you want to lead in underserved markets, if you’re serious about financial inclusion, and if you're building for long-term user lifetime value, mobile money is your launchpad.

We’re here to help you take that first step with confidence, speed, and clarity.

Closing Thoughts

If you’ve made it this far, you already know: this isn’t about choosing sides. It’s about choosing sequencing.

Mobile money is how you reach the unbanked (but today, everyone has access to it). Mobile banking is how you deepen relationships with the already banked. Both are essential. But they serve different moments in your customer journey.

Here’s what smart digital finance leaders are doing:

-

Starting lean with mobile money to drive reach and adoption

-

Layering mobile banking to build engagement, cross-sell, and long-term value

-

Designing products around real-world user behavior; not legacy assumptions

Whether you're launching in Sub-Saharan Africa or scaling in Southeast Asia or in any corner of the world, the winning strategy isn’t “mobile-first.” It’s customer-first.

At DigiPay.Guru, we help businesses like yours architect that journey—from eWallet to full-stack digital banking, at the right time and in the right order.

If you're ready to turn strategy into action, we’re here to help.

FAQ's

Mobile money operates independently of a traditional bank account and is designed for financial access—especially in underbanked regions. Mobile banking, on the other hand, is an extension of existing bank services delivered via a mobile app. It requires users to already have a bank account and is built to deepen engagement with existing customers.

Both systems can be secure if implemented correctly. Mobile banking benefits from built-in bank-grade security protocols. Mobile money, meanwhile, often includes layers like PIN-based access, agent verification, and USSD-based transactions that don’t require the internet, which reduces digital risk in low-tech environments. The key is how each solution handles KYC, fraud prevention, and transaction monitoring.

Yes. That’s one of its biggest advantages. Mobile money was designed to serve users without formal banking relationships. Users can store funds, make payments, and perform peer-to-peer transfers—all with just a mobile number and basic KYC. It’s ideal for onboarding the unbanked.

Mobile money is better suited for rural and underbanked populations. It works over USSD/SMS, doesn’t require a smartphone or internet, and is supported by agent networks that provide physical access points. It’s the fastest way to deliver financial services where banks can’t reach.

The push by the CBN, the expansion of agent banking, and the rise of fintechs have all made mobile money a go-to financial tool for both rural and urban populations.

Mobile banking apps offer a full-service banking experience—from balance checks and fund transfers to loan applications and investment options. They help financial institutions increase retention, upsell higher-value products, and improve customer satisfaction in well-banked, digitally mature markets.