The prepaid card market in the UAE is growing fast, and you must know why it matters for your business. Banks, fintechs, and financial institutions like yours are using prepaid cards to simplify payouts, control spending, and reach customers without full bank accounts.

In fact, the market for prepaid cards and digital wallets is projected to reach about US$12.43 billion by 2029, growing roughly 12.7% annually from 2025-29, which shows clear commercial momentum. (GlobeNewswire)

If you operate in Dubai’s financial ecosystem, choosing the right prepaid card in UAE directly impacts your customer experience, cost structure, compliance, and speed to market.

So, you must evaluate card type, FX support, reload options, security, and local regulatory fit. And, you also need a provider who handles BIN sponsorship, eKYC, AML checks, and smooth API integration.

This guide explains how prepaid cards work, lists the types available in Dubai, and shows the features that truly matter to pick a prepaid-card solution that fits your business goals.

Let’s begin by getting a glimpse of the rise if prepaid cards in the UAE.

Rise of Prepaid Cards in the UAE

Prepaid cards have become a major part of Dubai’s financial ecosystem. You see tourists using them, gig workers using them, and corporates using them for expenses.

You also see banks and fintechs like yours launching them to engage younger customers or to reduce operational friction.

This massive adoption is driven by three realities:

- The UAE hosts a large expat population that sends money home.

- Foreign currency usage is high due to constant travel and tourism.

- Digital wallets and online purchases are rising every day.

Prepaid cards solve real problems here:

- They offer control without a traditional bank account.

- They offer flexibility without credit checks.

- They support foreign exchange usage.

- They ensure secure payments without exposing primary debit cards.

If you plan to offer prepaid cards as a bank, fintech, or financial institution, you must consider implementing in the UAE for long-term growth.

What Is a Prepaid Card?

A prepaid card is a payment card that you can load with funds before use. That simple definition hides something bigger.

From a business viewpoint, a prepaid card is a controlled, compliant, flexible payment instrument that gives you direct influence over how, when, and where your customers spend money.

- A prepaid card is not a credit card. There are no interest charges.

- A prepaid card is not a linked debit card. There is no direct tie to a bank account.

- A prepaid card is not a stored-value coupon. It works at POS, ATMs, tap and pay stores, and online purchases globally.

If you offer financial services in Dubai, a prepaid card becomes a strategic extension of your product suite.

You can:

- Onboard customers faster

- Add spending limits

- Issue virtual/physical cards

- Improve user retention, and

- Attract new revenue streams

How Prepaid Cards Work: Step-by-Step Operational Flow

Understanding the internal flow of a prepaid card helps you compare providers and platforms clearly.

Every step below affects your compliance, speed, and customer experience:

-

Purchase or Issue the Card: Your customer either buys the card or receives it through your platform. As the issuer, you decide if the card should be physical, virtual, NFC-powered, or multi-currency.

-

Load Funds: Your customer loads funds through wallet balance, bank transfer, cash-in channels, salary disbursement, remittance payout, and corporate top-up. The smoother this step is, the higher the usage frequency becomes.

-

Use the Card: Your customer can use the card for POS transactions, ATM withdrawals, online purchases, subscription payments, foreign currency payments, and travel expenses. This is where a prepaid card competes directly with debit cards and credit cards.

-

Reload the Card: Reloading should be instant, and your customers expect speed. If you delay reloads, they choose a different financial provider.

-

Monitor Transactions & Limits: As a provider, you set spending limits, merchant category controls, and AML rules. Your customers monitor their balance through your app or wallet. A strong prepaid card platform makes this effortless.

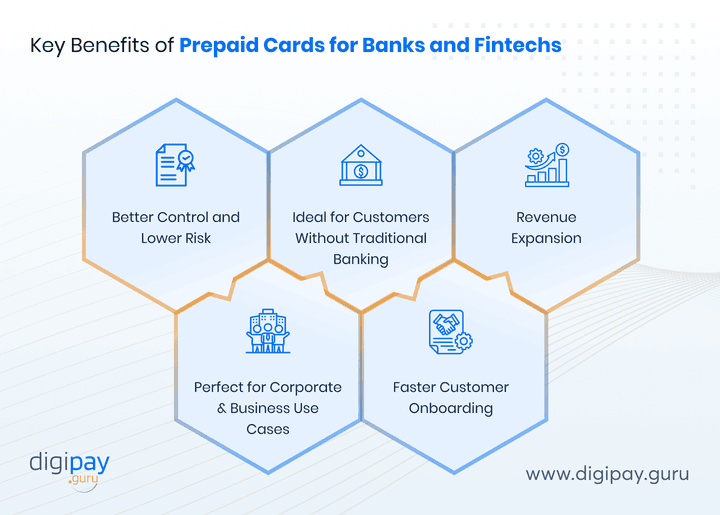

Key Benefits of Prepaid Cards for Banks and Fintechs

If you run a financial business in the UAE, a prepaid card is more than a card. It is an engine of opportunity. Let’s look at what it solves for you:

Better Control and Lower Risk

A prepaid card does not rely on a traditional bank account or credit line. Here, your customers only spend the amount they load, which gives you full control over exposure.

This reduces fraud, credit risk, and operational disputes, especially when serving new-to-bank or high-volume segments.

You also gain clearer visibility into spending patterns, which improves compliance and helps you design smarter card policies.

Ideal for Customers Without Traditional Banking

The UAE has a large expat and migrant workforce. Many of them prefer simple financial tools that do not require a long onboarding process or a full banking relationship.

A prepaid card bridges this gap by offering them safe payments, ATM withdrawals, and online purchases without a traditional bank account.

For you, this means access to a wider audience without the friction of high-cost KYC processes.

Revenue Expansion

Prepaid cards unlock multiple commercial opportunities. You earn from interchange revenue, FX markup, card usage fees, and value-added services.

These monetization channels create predictable income while keeping your costs stable.

For your business, this becomes a fast and scalable way to strengthen profitability.

Perfect for Corporate and Business Use Cases

Many UAE businesses rely on prepaid cards for travel, project expenses, allowances, and procurement. They want spending limits, real-time tracking, and controlled usage, all features that prepaid cards are built for.

When you offer prepaid cards for business, you become the go-to partner for companies seeking financial discipline and faster reconciliation. This deepens your enterprise relationships and increases long-term retention.

Faster Customer Onboarding

When you combine prepaid card programs with digital onboarding, you can onboard users in minutes instead of days. eKYC, automated AML checks, and instant activation reduce operational load while improving user experience.

For fintechs, this creates a competitive edge in customer acquisition. For banks, it speeds up digital migration and reduces branch dependency. Faster onboarding directly converts into higher activation and card usage.

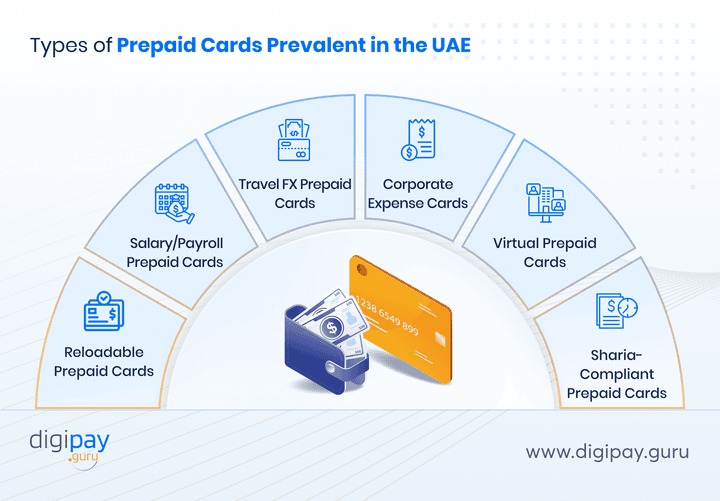

Types of Prepaid Cards in the UAE

The UAE market offers a wide range of prepaid card types. Each type exists because it solves a specific problem. The key types of prepaid cards in the UAE are:

Reloadable Prepaid Cards: Perfect for daily spending and budgeting.

Salary/Payroll Prepaid Cards: Ideal for gig workers, blue-collar workers, and employees without bank accounts.

Travel FX Prepaid Cards: These cards offer multi-currency support and reduce foreign currency fees.

Corporate Expense Cards: You can assign spending limits, track usage, and simplify accounting.

Virtual Prepaid Cards: Ideal for online purchases, digital subscriptions, and secure one-time payments.

Sharia-Compliant Prepaid Cards: Islamic banks issue these for customers seeking Sharia-aligned financial tools.

Feature Comparison of Top Bank-Issued Prepaid Cards in the UAE

Before choosing your own prepaid card program, you should understand what the market already offers. The key features against the top bank-issued prepaid cards in the UAE are:

| Bank/Provider | Card Type | Reload Options | Fees | Ideal Users |

|---|---|---|---|---|

| Emirates NBD Liv | Reloadable | Bank/wallet | Moderate | Digital-native residents |

| ADCB Hayyak | Reloadable | Transfer/cash | Low | General spending |

| FAB Al Hilal | Islamic Prepaid | Bank transfer | Low | Sharia-compliant users |

| Mashreq Neo | Virtual + Physical | Wallet | Low | Online shoppers & travelers |

Best White-Label Prepaid Card Platforms: Key Players & Capabilities

If you are a bank, fintech, or financial institution that wants to issue prepaid cards fast, you need a white-label platform. And a strong white-label prepaid card platform does the heavy lifting from technology, activation, KYC, AML, card issuance, compliance, to API integrations.

The best white-label prepaid card platforms include:

| Provider | Type | Capabilities | Ideal Clients | Go-to-Market Speed |

|---|---|---|---|---|

| DigiPay.Guru | White-label prepaid card platform | Card issuing, virtual cards, NFC, eKYC, AML, wallet integration, CMS, APIs | Banks, fintechs, exchangers, digital wallets | Very Fast (15–45 days) |

| Marqeta | Issuing platform | Tokenization, APIs | Global fintechs | Medium |

| M2P | Issuing + banking stack | Multi-issuer support | Asian fintechs | Fast |

| FOO | Issuing + wallet | Modular wallets | MENA banks | Medium |

Out of all, DigiPay.Guru stands out for one simple reason: You can issue, activate, and manage prepaid cards without friction or complexity. And your customers enjoy a fast, seamless, contactless payment experience.

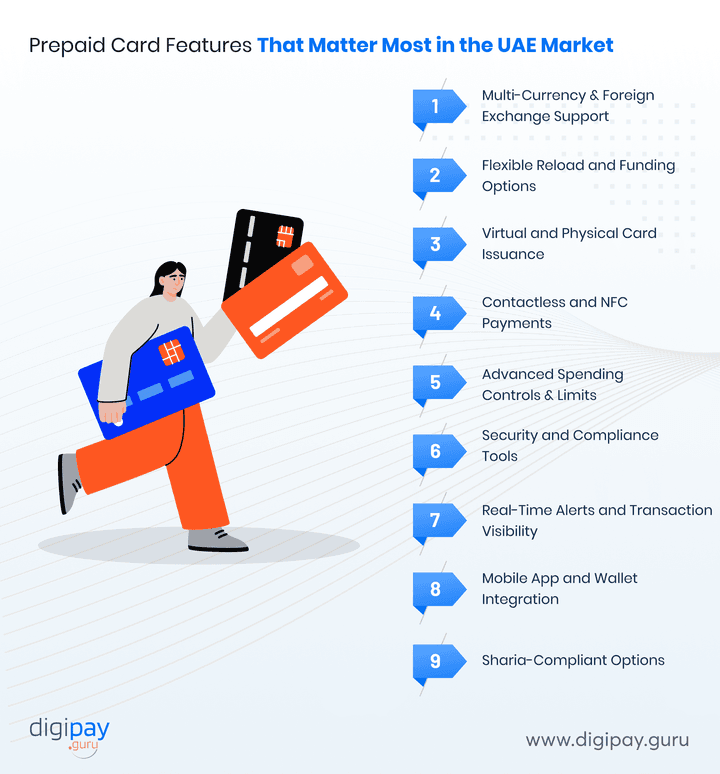

Prepaid Card Features That Matter Most in the UAE Market

Choosing the right prepaid card requires clarity. And not every card suits UAE customers. Plus, not every feature aligns with your business model.

Here are the features that matter most in the UAE market:

Multi-Currency and Foreign Exchange Support: Your customers want smooth foreign currency payments for travel and online shopping, so strong FX support helps you offer competitive rates and unlock steady FX-based revenue.

Flexible Reload and Funding Options: More reload options like wallet, bank transfer, salary, and cash-in lead to higher activation and usage, especially for expats and gig workers.

Virtual and Physical Card Issuance: Offering both virtual and physical card issuance options lets you serve digital-first users instantly while supporting everyday POS and ATM needs with physical cards.

Contactless and NFC Payments: Tap-and-pay is now standard in UAE retail, so NFC ensures faster transactions and a modern payment experience.

Advanced Spending Controls and Limits: Controls like spending caps and merchant restrictions reduce risk and make your card ideal for corporate expense programs.

Security and Compliance Tools: Built-in AML checks, tokenization, and fraud monitoring protect your institution and keep your card compliant with UAE regulations.

Real-Time Alerts and Transaction Visibility: Instant notifications improve user trust, reduce disputes, and give you stronger oversight for compliance monitoring.

Mobile App and Wallet Integration: Customers expect effortless card management inside your app, so smooth integration boosts engagement and retention.

Sharia-Compliant Options: Supporting Islamic finance principles helps you reach a large customer segment with products aligned to local expectations.

How DigiPay.Guru Enables Fast & Scalable Prepaid Card Launches

If you want to launch prepaid cards that stand out in Dubai, you need a platform that eliminates complexity. DigiPay.Guru helps you do exactly that.

Here is how we help you win this market:

- Issue prepaid cards in 15–45 days

- Offer virtual and physical cards

- Add NFC/contactless payments

- Integrate with wallets and apps through APIs

- Manage users through a full Card Management System

- Automate KYC through eKYC + AML screening

- Support BIN sponsorship

- Maintain UAE compliance standards

With DigiPay.Guru, your customers get instant activation. And you get a card program that scales.

How to Choose the Right Prepaid Card Provider in the UAE (Decision Checklist)

Here is the checklist your team should use before selecting any prepaid card provider in Dubai.

Licensing Requirements

Your provider must work with UAE-regulated issuers and meet all local compliance standards. Because a clear framework for issuing, settlement, and onboarding protects you from regulatory gaps.

Moreover, always confirm their licensing, certifications, and BIN network access upfront.

Technology Integration

Your prepaid card should plug into:

- wallets

- banking cores

- ERPs

- remittance systems

- mobile apps

API-first architecture reduces development time and keeps your operations flexible as your product grows.

BIN Sponsorship

Most fintechs cannot issue prepaid cards without a BIN sponsor, so your provider must offer a reliable sponsorship model. This includes managing issuer relationships, compliance documentation, and activation timelines.

Cost Structure

Request clarity on:

- setup fees

- per-card issuance

- card replacement

- interchange

- FX markup

- monthly platform fees

Transparent pricing helps you forecast revenue and avoid hidden operational expenses that impact your margins.

Scalability

Look for the provider with the ability to add:

- new card types

- corporate cards

- travel cards

- virtual cards

- multi-currency support

This is because the platform must scale without forcing you into expensive migrations or re-architecture as your customer base expands.

If your provider cannot scale, your growth will stall.

Compliance & Security

UAE regulators expect strict compliance. Your prepaid provider must offer:

- PCI security

- AML monitoring

- fraud prevention

- transaction screening

- eKYC onboarding, and more

This helps you stay audit-ready and minimize operational risks.

Support & SLA

When your customers face card issues, your provider’s support quality directly affects your brand reputation.

You need a provider that offers fast issue resolution, strong uptime SLAs, and responsive support teams for payment products.

Conclusion

The UAE has one of the fastest-growing digital payment markets in the region, and prepaid cards now play a central role in how customers manage daily spending, travel expenses, and online purchases.

With the market projected to reach US$12.43 billion by 2029, prepaid cards are no longer a secondary product. They are a strategic offering for any bank or fintech looking to stay relevant and competitive.

And choosing the right prepaid card provider becomes easier when you evaluate the fundamentals: licensing, technology, BIN sponsorship, compliance, scalability, and long-term cost structure.

A strong prepaid card program helps you improve customer trust, reduce operational risk, and expand into new revenue streams without reinventing your infrastructure.

If your goal is to launch a prepaid card program that is secure, compliant, and fast to market, DigiPay.Guru offers a complete prepaid card management and issuance solution.

You can issue, activate, and manage both virtual and physical cards with ease, while giving your customers a smooth, contactless, and reliable payment experience. Ready to build your prepaid card program? Take the next step towards a successful issuance!

FAQs

Prepaid cards from banks such as Emirates NBD, ADCB, FAB, and Mashreq Neo are widely used due to strong digital onboarding and flexible reload options. For businesses and fintechs, white-label prepaid cards are becoming more popular because they allow you to launch custom programs without building infrastructure from scratch.

Fintechs typically partner with a licensed card issuer and a white-label prepaid card platform that handles BIN sponsorship, compliance, card management, and API integrations. This approach shortens development time and ensures alignment with UAE regulations.

You must work with a UAE-regulated financial institution, meet KYC/AML requirements, ensure PCI compliance, and operate under an approved BIN. You also need transaction monitoring, fraud controls, and clear reporting structures to stay compliant with local authorities.

Prepaid cards are safer for online spending because they are not directly linked to a primary bank account. Security improves further when tokenization, spending limits, and real-time alerts are enabled. Crypto-related usage depends on issuer policy and UAE regulatory guidelines.

The timeline varies based on licensing, integrations, and BIN sponsorship. With a ready platform like DigiPay.Guru, banks, and fintechs can launch in 15–45 days, depending on the complexity of the program.

Yes. Digital wallet providers can issue virtual prepaid cards by integrating with a compliant card-issuance platform. This allows instant card creation for online purchases, subscription payments, and secure one-time transactions.

Yes. DigiPay.Guru provides a complete white-label prepaid card management and issuance solution for banks, fintechs, remittance operators, and financial institutions. You can issue, activate, and manage both virtual and physical cards with built-in eKYC, AML, NFC, and API-based integrations.