Nigeria is on a mission to reduce its reliance on cash and usher in a more inclusive, secure, and efficient financial future. From roadside kiosks in Kano to tech hubs in Lagos, the country is rapidly embracing digital payment solutions.

One such solution that’s gaining momentum is prepaid cards in Nigeria.

As the Central Bank of Nigeria (CBN) tightens its push through the CBN cashless policy, the entire ecosystem, businesses like yours, are feeling the need to modernize.

And prepaid cards are quickly emerging as a widely accepted alternative to traditional cash-based transactions.

This blog will show you:

-

Nigeria’s cashless economy landscape

-

What are prepaid cards & how do they work

-

Benefits of prepaid cards in Nigeria's cashless movement

-

Growth drivers of prepaid card adoption in Nigeria

-

Institutional and regulatory support for prepaid innovation

-

Technology infrastructure needed to launch & scale, and more…

Let’s begin by understanding the Nigerian Landscape.

Nigeria’s Cashless Economy Landscape

In recent years, the Nigerian financial sector has undergone a great transformation.

With the CBN leading the charge through initiatives like the Payments System Vision 2025, there's a national focus on reducing cash handling and promoting cashless payments in Nigeria.

Here are some major drivers:

-

Limits on daily cash withdrawals from ATMs and banks

-

Incentives and policies to promote digital banking and mobile payments

-

The expansion of fintechs, offering faster and more inclusive solutions

Yet, there are so many challenges remaining in the Nigerian economy:

-

Over 38 million Nigerian adults are still financially excluded

-

Cash still dominates in rural and semi-urban areas

-

Traditional banks often can’t reach these users efficiently

That’s exactly where prepaid cards shine. (you will see how, in the coming sections, stay tuned!)

What Are Prepaid Cards & How Do They Work

Simply put, a prepaid card is a payment card that your user can fund in advance. It’s not linked to a traditional bank account but can be topped up with any banking account or other digital payment options.

Your users can use it for online shopping, bill payments, POS transactions, or ATM withdrawals. Once funds are used up, the card can be reloaded or discarded, depending on its type.

Types of Prepaid Cards

The two major types of prepaid cards are:

Open-Loop Cards: These cards are issued under major networks like Visa, Mastercard, or Verve, and accepted at any merchant or ATM that supports those networks.

Closed-Loop Cards: These cards are designed for use only at a specific retailer, service, or ecosystem (e.g., fuel cards, campus cards, or transport cards). Example: A Starbucks prepaid card can only be used to make payments at Starbucks.

Key Differences between Debit and Credit Cards

-

No Bank Account Needed: Ideal for customers outside the traditional banking system. But yes, they can be topped up with bank accounts.

-

No Credit Risk: Your customers can only spend what’s been preloaded, which eliminates debt risk

-

Faster Onboarding: It comes with fewer verification hurdles compared to account-based cards

-

More Control: These cards are ideal for budgeting, employee expenses, and controlled disbursements. So you can target those kinds of businesses.

Both physical and virtual prepaid cards are widely used in Nigeria today.

And virtual cards, in particular, are gaining traction for e-commerce, subscription services, and mobile app integrations.

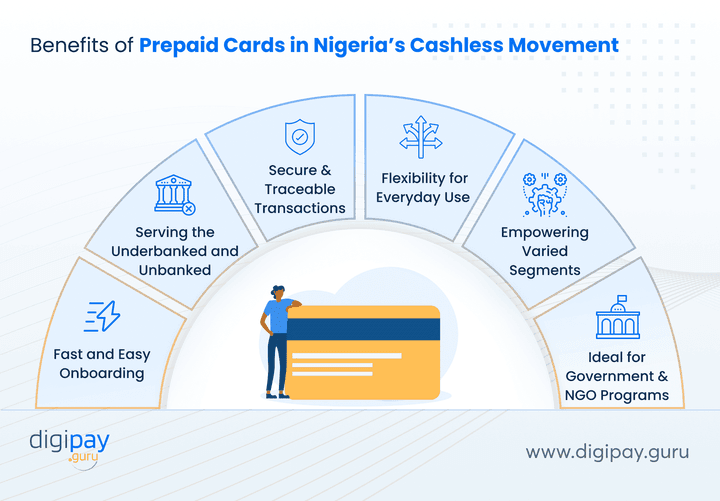

Benefits of Prepaid Cards in Nigeria’s Cashless Movement

As the cashless wave sweeps across Nigeria, prepaid cards aren’t just adapting, they’re accelerating the transition.

Let’s break down how they deliver real value across the board:

Fast and Easy Onboarding

With the Central Bank of Nigeria’s tiered KYC policy, issuing prepaid cards has never been simpler.

In fact, banks and fintechs like yours can onboard users without heavy documentation or lengthy verification cycles.

This helps you:

-

Issue cards digitally or through agent networks

-

Enable real-time access to spendable funds, and

-

Expand reach without expanding infrastructure

Serving the Underbanked and Unbanked

Prepaid cards provide a first step into digital finance for Nigeria’s 38M+ financially excluded adults.

This means it can help you reach the underbanked and unbanked regions with its offline capabilities for payments once the top-up is done.

Plus, they're easy to distribute, easy to understand, and don’t require a bank account.

This gives you essential benefits like:

-

No credit history needed

-

Can be issued via agent locations, apps, or USSD

-

And helps users build digital payment habits over time

Secure & Traceable Transactions

Cash lacks visibility of tracking and is a risky mode of payment. On the other hand, prepaid cards support real-time and trackable payments for you.

How? Well, that's possible with dashboards and tracking systems, which you can get in an advanced prepaid card management software.

This is beneficial because:

-

Transactions leave a digital trail

-

It enables fraud detection and expense tracking

-

It’s safer than carrying physical cash for your customers

Plus, this also aligns with compliance and audit requirements in regulated industries.

Flexibility for Everyday Use

From POS terminals to online platforms, prepaid cards work seamlessly across various touchpoints. So, they’re perfect for handling everyday needs without relying on cash.

Its use cases include airtime top-ups, food purchases, utilities, transport, and more…

In addition to that, it is:

-

Compatible with mobile wallets and QR-based payments

-

Convenient for both consumers and merchants

Empowering Specific Segments

Gig workers, SMEs, and students all face friction with traditional banking. And prepaid cards give them the spending power they need with fewer barriers.

Here’s how:

-

Employers can load salaries or payouts instantly

-

Students can receive allowances with built-in spend controls

-

And SMEs can issue staff cards for expense control

Ideal for Government and NGO Programs

Disbursing aid, stipends, or benefits through cash is slow and risky.

Prepaid cards make it seamless and secure, as they allow you to manage efficient, inclusive, and transparent distributions at scale.

Plus, it helps you facilitate the following for your customers:

-

Load funds remotely and securely

-

Control how and where funds are spent

-

Ensure traceability for compliance and reporting

Growth Drivers of Prepaid Card Adoption in Nigeria

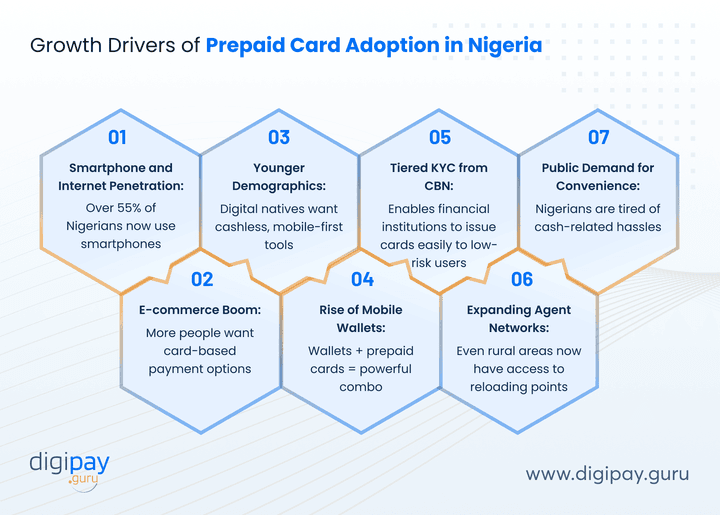

The curve for the adoption of prepaid cards isn’t random. Multiple trends are converging to drive prepaid cards in Nigeria forward. Let's understand them:

-

Smartphone and Internet Penetration: Over 55% of Nigerians now use smartphones

-

E-commerce Boom: More people want card-based payment options

-

Younger Demographics: Digital natives want cashless, mobile-first tools

-

Rise of Mobile Wallets: Wallets + prepaid cards = powerful combo

-

Tiered KYC from CBN: Enables financial institutions to issue cards easily to low-risk users

-

Expanding Agent Networks: Even rural areas now have access to reloading points

-

Public Demand for Convenience: Nigerians are tired of cash-related hassles

In short, the prepaid card adoption is on the rise. The iron is hot; you should hit the hammer on it.

Meaning you should just tap into the Nigerian market for prepaid card adoption. And for that, you need a robust prepaid card issuance and management software.

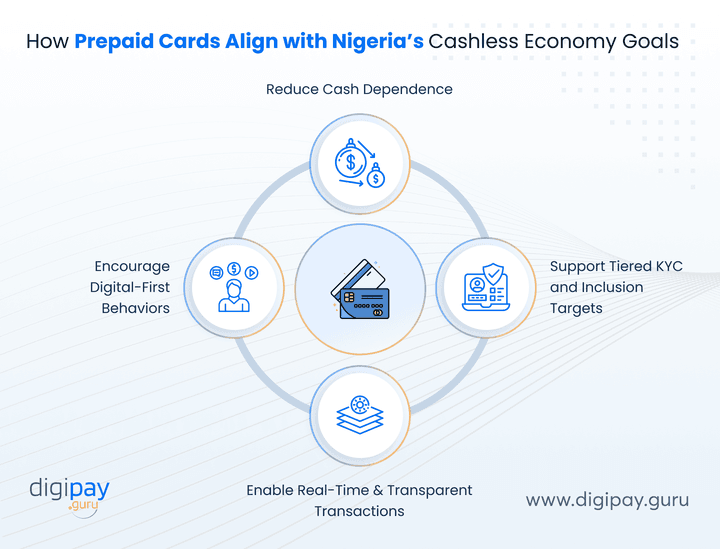

How Prepaid Cards Align with Nigeria’s Cashless Economy Goals

If you're navigating Nigeria’s regulatory push toward a cashless economy, prepaid cards aren’t just compatible, they’re tailor-made for it.

And the CBN’s Payments System Vision 2025 emphasizes reducing physical cash, deepening financial inclusion in Nigeria, and enabling digital channels.

Hence, prepaid cards align with every one of these goals. Here's how they deliver:

-

Reduce Cash Dependence: Prepaid cards replace cash-based transactions with trackable, digital alternatives that help reduce fraud and cash handling costs.

-

Support Tiered KYC and Inclusion Targets: With simplified onboarding under CBN’s KYC tiers, cards can be issued to unbanked users while staying compliant.

-

Enable Real-Time & Transparent Transactions: From social welfare payments to daily spend, all transactions are recorded instantly, which satisfies both user needs and regulatory audit trails.

-

Encourage Digital-First Behaviors: Prepaid cards train users to adopt mobile apps, wallets, and QR payment flows, which accelerates digital adoption across customer segments.

For businesses like yours, this means prepaid cards policy-aligned growth tools that align with compliance, innovation, and customer engagement all at once.

The Business Case for Banks, Fintechs & Financial Institutions

With prepaid cards, you’re not just fulfilling a social need of financial inclusion; you’re opening new profit channels. Here’s how prepaid cards benefit your business:

Unlock new revenue without new complexity

With every card transaction, top-up, or fee, you're adding to your bottom line.

And prepaid cards create multiple streams: float income, interchange, load fees, and inactivity charges without the overhead of full account infrastructure.

Launch fast, scale faster

You don’t need a full digital bank stack to get started with offering prepaid card services.

Your prepaid card programs can be rolled out in weeks (not months) with the help of API-first platforms that plug right into your core systems, mobile apps, or agent networks.

Keep customers in your ecosystem longer

Prepaid users don’t just load and leave the system for the users.

You can layer in services like wallets, rewards, microloans, and insurance, which can turn one card into a cross-sell opportunity across your product suite.

So, it's win-win for you in every way.

Serve niche audiences with custom solutions

If you want to launch a youth card, gig-worker wallet, or closed-loop fuel card, prepaid cards give you the flexibility to design tailored products for specific segments.

This is possible with usage rules, limits, and branding fully under your control.

Stay compliant while staying agile

You can stay compliant at all times with prepaid cards because they align with CBN’s tiered KYC and financial inclusion goals.

This also means that you can grow responsibly while serving more customers without overstepping regulatory guardrails.

All in all, prepaid cards have become a strategic growth lever in the Nigerian fintech market.

Institutional and Regulatory Support for Prepaid Innovation

The Central Bank of Nigeria (CBN) has been supporting the shift to prepaid for a long time. But now it's actively creating the regulatory foundation for it.

So, if you're launching or scaling a prepaid card program, you’re not working against policy; you’re working with it.

Let’s see how prepaid cards are getting the institutional and regulatory support:

CBN compliance and support for prepaid innovation

CBN has released clear guidelines for prepaid card issuance and digital onboarding. It recognizes prepaid as a safe, inclusive way to expand access, especially when aligned with national financial inclusion goals.

Alignment with Tiered KYC model

Prepaid cards fit perfectly within the tiered KYC structure. This means that you can onboard users with basic identification for limited-use cards and upgrade them as needed without losing compliance.

Integration with national switch and payment infrastructure

Prepaid cards in Nigeria are compatible with the country’s major infrastructure:

-

NIBSS for switching and settlement

-

Interswitch for multi-network connectivity

-

Verve for domestic card schemes

This ensures your prepaid cards are widely accepted across POS terminals, ATMs, and digital channels.

Builds trust for regulated institutions

For licensed banks, fintechs, and financial institutions, prepaid cards are a safe and CBN-approved product.

So they can reduce risk, allow real-time tracking, and support transparent digital financial services. This helps you grow while staying aligned with national policy.

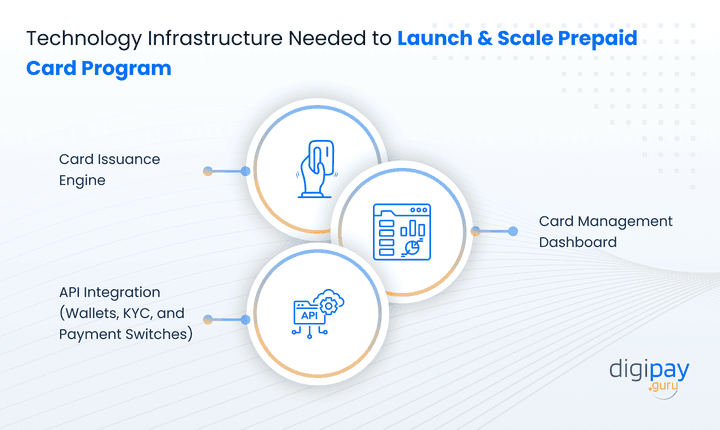

Technology Infrastructure Needed to Launch & Scale

If you're looking to launch a prepaid card program that’s fast, secure, and scalable, the right tech stack makes all the difference.

Here's what your infrastructure should include, and why it matters.

1. Card Issuance Engine

You need a system that allows you to create and issue both physical and virtual prepaid cards in real time. Plus, it should support customizable limits, card types, and delivery modes, all while staying compliant with Nigerian regulations.

2. Card Management Dashboard

Once your cards are live, you need full visibility and control. This includes:

-

Activating and deactivating cards

-

Managing limits, balances, and spend rules

-

And tracking usage trends and customer activity

3. API Integration with Wallets, KYC, and Payment Switches

Your system should easily connect seamlessly with your existing tech stack for smooth and fast implementation. It includes:

-

Wallet platforms for balance top-up and spend

-

KYC/AML systems for onboarding and risk controls

-

Local switches like NIBSS, Interswitch, or Verve for real-time processing

Why Choosing the Right Technology Partner Matters

For prepaid cards, you need a tech partner that understands the Nigerian regulatory landscape, supports custom workflows, and delivers with speed and stability. Because a strong platform:

-

Reduces time to market

-

Minimizes operational headaches, and

-

Ensures you stay fully compliant while scaling confidently

Challenges in the Prepaid Card Ecosystem

Even though prepaid cards are gaining momentum, a few challenges still stand in the way of large-scale adoption. Here's what to watch out for:

- Low public awareness

Many consumers, especially in rural or underserved areas, still don’t understand how prepaid cards work or how to use them safely.

- Distribution & logistics issues

Getting physical cards into users’ hands can be difficult, especially in areas with limited infrastructure or unreliable delivery services.

- POS & merchant acceptance gaps

Not all merchants accept card payments consistently, which limits prepaid card usage for everyday purchases, particularly in cash-first environments.

- Fraud and misuse risks

Without proper limits, controls, and monitoring, prepaid cards can be vulnerable to misuse, scams, or unauthorized top-ups.

- Regulatory and compliance complexity

Staying aligned with Tiered KYC, AML, and evolving CBN requirements takes time, clarity, and a tech partner that knows the terrain.

- Fragmented integrations

Banks and fintechs like yours may face challenges connecting card issuance systems with KYC tools, wallet platforms, or local switches.

But these challenges are not the end of the world. With the right digital payment solutions and prepaid card provider in Nigeria, you can tackle each of these head-on.

Explore more : Digital payment solutions to transform your payment services in Nigeria

How DigiPay.Guru can help?

DigiPay.Guru offers advanced prepaid card issuance and management software that helps you offer reliable prepaid card programs in the Nigerian economy.

Our solution lets you effortlessly issue, activate, and manage prepaid cards while offering your customers a fast, seamless, contactless payment experience.

Plus, we offer robust features like:

-

Contactless transactions with tokenization

-

Advanced analytics & reporting

-

Robust security to protect customer funds & data

-

Complete spending control

-

Offer all - issuance, activation, & management

-

Integrate seamlessly with the existing systems

-

Dashboard to manage & monitor prepaid cards

-

Streamline card management tools

-

Dedicated technical assistance

-

Customizable & configurable capabilities

-

Rewards and loyalty programs

So why wait? Implement our solution today and serve all kinds of customers in Nigeria and the globe.

FAQ's

A prepaid card is a payment card that’s loaded with funds in advance. It’s not linked to a traditional bank account, so users can spend only the amount loaded onto the card.

In Nigeria, prepaid cards are used for:

-

Online and in-store purchases

-

ATM withdrawals

-

Bill payments and airtime top-ups

They’re accepted across POS terminals, mobile wallets, and even government disbursement platforms, which makes them a flexible, cashless payment tool that works for both urban and rural users.

Here’s how prepaid cards stand apart:

-

No bank account required: Ideal for the unbanked or underbanked. (They can be loaded with any payment method, even bank cards)

-

No credit check: Users can’t spend more than what’s loaded, no overdrafts or interest

-

Faster onboarding: Can be issued with basic KYC under CBN Tier 1 guidelines

-

More control: Great for budgeting, salary payouts, or limited-use spending

In short, prepaid cards offer controlled, compliant, and cashless transactions without the risks of credit or the complexity of full account setup.

Prepaid cards are one of the most practical tools for driving financial inclusion and accelerating the shift away from cash.

They directly support the CBN cashless policy by:

-

Reducing reliance on physical cash

-

Enabling real-time, traceable transactions

-

Helping banks and fintechs serve customers outside traditional account structures

Supporting government, NGO, and business disbursements at scale

They’re also a stepping stone to other digital services like mobile wallets, microloans, and savings tools.

DigiPay.Guru offers a complete, white-label prepaid card issuance and management platform built for the Nigerian market.

We help businesses like yours:

Launch prepaid programs with Tiered KYC compliance

Issue both physical and virtual prepaid cards

Manage card limits, reloads, and controls via a smart dashboard

Integrate seamlessly with your wallet, KYC system, or core banking layer

Go live in weeks (not months)

To launch successfully, you’ll need:

-

A licensed issuing partner or your own license (if you're a bank or MFB)

-

A card issuance engine and management dashboard

-

KYC integration that aligns with CBN’s compliance tiers

-

Connections to local payment switches (Interswitch, NIBSS, Verve)

-

A trusted technology provider like DigiPay.Guru to handle the infrastructure

We guide you through each step, from setup to compliance to go-live, so you can focus on growth, not complexity.