In today's cashless society, prepaid cards have emerged as a versatile financial tool, offering convenience and control for both individuals and businesses. However, with various types of prepaid cards available in the market, understanding the differences and selecting the right one can be a daunting task.

Enter the world of closed-loop, open-loop, and semi-open-loop prepaid cards – each with its unique features and applications. As financial technology continues to evolve, prepaid cards have become an integral part of the payment landscape.

According to a recent study by Research and Markets, the global prepaid card market is projected to reach a staggering US$4.1 Trillion by 2030, with a compound annual growth rate (CAGR) of 10.2%. These numbers reflect the increasing popularity and adoption of prepaid cards in our modern economy.

Phil Libin, the co-founder of Evernote and All Turtles, once said, "Prepaid cards represent the ultimate form of democratized banking, enabling everyone to participate in the digital economy regardless of their financial status."

In this comprehensive article, we will delve into the intricacies of closed-loop, open-loop, and semi-open-loop prepaid cards. We will explore their use cases, examine their advantages and limitations, and provide predictions for their future trajectory.

By the end, you will have a clear understanding of these prepaid card types and be equipped to make informed decisions tailored to your specific needs.

What are Prepaid Cards?

A prepaid card is a payment card that is loaded with a certain amount of money before it can be used.

The user can then spend the money on goods and services up to the amount that has been loaded onto the card. Prepaid cards are often used by people who do not have a credit card or bank account, or who want to limit their spending.

Different Types of Prepaid Cards

There are three main types of prepaid cards: closed loop, open loop, and semi-open loop.

Closed loop prepaid cards

Closed loop prepaid cards can only be used at a specific merchant or merchant network. For example, a closed loop prepaid card issued by a gas station can only be used to purchase gas at that gas station.

Open loop prepaid cards

Open loop prepaid cards can be used anywhere that accepts major credit or debit cards. This includes online stores, in-store retailers, and ATMs.

Semi-open loop prepaid cards

Semi-open loop prepaid cards offer a balance between the flexibility of open loop cards and the security of closed loop cards. They can be used at a wider variety of merchants than closed loop cards, but they are still subject to certain restrictions.

Closed loop prepaid cards

Closed loop prepaid cards are a type of prepaid card that can only be used at a specific merchant or merchant network. They are often issued by retailers, service providers, and other businesses as a way to reward customers, manage spending, or offer a convenient payment option.

Closed-Loop payment systems like prepaid cards are typically loaded with a certain amount of money, which can then be used to make purchases at the participating merchant or merchants. The cardholder can typically add more money to the card as needed, and the card can be used to make purchases online or in-store.

Use Cases and Examples of Closed Loop Prepaid Cards

Retail-specific closed loop prepaid cards

Many retailers offer their own closed loop prepaid cards, enabling customers to conveniently shop within their stores or online platforms.

Examples include popular department stores, fashion brands, and online marketplaces.

Gift cards and loyalty programs

Closed loop prepaid cards are commonly used as gift cards, allowing recipients to choose their desired products or services from a particular merchant.

Additionally, businesses employ closed loop prepaid card solutions to incentivize customer loyalty by offering exclusive discounts, rewards, or cashback programs.

Transportation or toll payment cards

Closed loop prepaid cards are often utilized in the transportation sector, facilitating convenient fare payments for public transportation systems, toll roads, or parking facilities.

Employee benefits

Closed loop prepaid cards can be used to distribute employee benefits, such as payroll, healthcare, and other expenses. This can help employers save money on processing fees and make it easier for employees to manage their benefits.

Some creative ways to use closed loop prepaid cards

Set spending limits

Closed loop prepaid cards can be used to set spending limits. This can be a great way for parents to control their children's spending or for people who are trying to budget their money.

Track spending

Closed loop prepaid cards can be used to track spending through the closed loop wallet solutions associated with it. This can be a great way to see where your money is going and to make changes to your spending habits.

Save money

Closed loop prepaid cards can be used to save money. Many cards offer rewards, such as cash back or points, for every dollar spent. This can help you earn money back on your purchases or redeem rewards for free items or services.

Pay bills

Closed loop prepaid cards can be used to pay bills. This can be a great way to automate your bill payments and to avoid late fees.

Travel

Closed loop prepaid cards can be used to travel. Many cards offer travel rewards, such as points or miles, that can be redeemed for free flights or hotels. This can help you save money on your next vacation.

Advantages of Closed Loop Prepaid Cards

Enhanced customer experience

One of the important benefits of closed loop cards offer a seamless and streamlined payment process within a specific merchant network, ensuring a tailored and efficient transaction experience.

Promote brand loyalty

By issuing closed loop prepaid cards, merchants can deepen their connection with customers, encouraging repeat purchases and fostering brand loyalty.

Targeted marketing opportunities

One of the advantages of closed loop wallets in form of virtual prepaid cards is that the merchants can leverage closed loop prepaid cards to gather valuable customer data and implement personalized marketing strategies, thereby enhancing customer engagement and driving sales.

Limitations of Closed Loop Prepaid Cards

Limited acceptance

Closed loop prepaid cards can only be used within the issuing merchant's network, restricting their utility in other establishments.

Lack of flexibility

Since closed loop prepaid cards are tied to a specific merchant, users may face limitations when seeking alternative products or services outside the designated network.

Potential expiration and fees

Some closed loop prepaid cards may come with expiration dates or fees associated with inactivity, which users need to be mindful of.

Future Predictions for Closed Loop prepaid Card

Integration with digital wallets

As digital payment methods continue to gain traction, closed loop prepaid cards are expected to integrate with popular digital wallet platforms, providing users with more convenient and versatile payment options.

Enhanced mobile app experiences

Merchants may develop dedicated mobile applications that enable users to manage their closed loop prepaid cards, access real-time offers and rewards, and enjoy a seamless payment experience.

Integration of blockchain technology

The utilization of blockchain technology can provide numerous benefits of prepaid cards such as it enhances security, transparency, and interoperability, enabling more efficient transactions and expanded merchant networks.

Open Loop Prepaid Cards

Open loop prepaid cards are a type of prepaid card that can be used anywhere that accepts major credit or debit cards. They are often issued by banks, financial institutions, and other businesses as a way to provide a convenient and secure payment option for consumers.

Open loop prepaid cards are typically loaded with a certain amount of money, which can then be used to make purchases at any merchant that accepts major credit or debit cards. The cardholder can typically add more money to the card as needed, and the card can be used to make purchases online or in-store.

Use Cases and Examples of Open Loop Prepaid Cards:

General Purpose Reloadable (GPR) prepaid cards

Open loop prepaid cards are commonly used as GPR cards, enabling individuals to manage their personal finances, make purchases, and withdraw cash from ATMs.

Payroll cards and government benefits cards

Many employers and government agencies use open loop prepaid cards to disburse wages, salaries, or benefits securely and efficiently.

Travel and foreign currency prepaid cards

Open loop prepaid card designed for travelers allow seamless international transactions and provide the ability to load funds in different currencies, eliminating the need for foreign exchange.

Advantages of Open Loop Prepaid Cards

Wide acceptance

Prepaid cards are accepted globally, providing users with the convenience of making purchases and accessing funds wherever major payment networks are recognized.

Accessibility and convenience

Open loop cards can be easily obtained from financial institutions or online platforms, making them accessible to a wide range of individuals. In case of virtual cards, this becomes one of the most important advantages of open loop wallets for these cards.

Read more: All about virtual cards - its definition, working, and benefits

Safety and security

One of the most important benefits of open-loop cards is that these cards offer protection against loss or theft, as they are not directly linked to personal bank accounts.

Limitations of Open Loop Prepaid Cards

Potential fees

Open loop prepaid cards may have associated fees, such as activation fees, reload fees, or ATM withdrawal charges. Users need to be aware of these costs.

Dependency on payment network infrastructure

The acceptance of open loop prepaid cards relies on the availability and functionality of payment network infrastructure, which may vary in different regions.

Future Predictions for Open Loop prepaid Card

Integration with digital wallets

Open loop prepaid cards are expected to integrate further with popular digital wallet solutions, enabling users to manage their cards, access transaction history, and make payments conveniently from their mobile devices.

Enhanced security features

As technology advances, open loop prepaid card solutions are likely to incorporate advanced security features, such as biometric authentication or tokenization, to protect against fraud and unauthorized use.

Integration of emerging technologies

Open loop prepaid cards that are virtual in form may adopt emerging technologies like blockchain to enhance security, streamline transactions, and reduce processing time.

Read more: Future of digital payments with virtual prepaid cards

Semi-Open Loop Prepaid Cards

Semi-open loop prepaid cards are a type of prepaid card that can be used at a wider range of merchants than closed loop prepaid cards, but not as widely as open loop prepaid cards. They are often issued by retailers, service providers, and other businesses as a way to reward customers, manage spending, or offer a convenient payment option.

Semi-Open prepaid card is typically loaded with a certain amount of money, which can then be used to make purchases at a wider range of merchants than closed loop prepaid cards, but not as widely as open loop prepaid cards. The cardholder can typically add more money to the card as needed, and the card can be used to make purchases online or in-store.

Use Cases and Examples of Semi-Open Loop Prepaid Card

Prepaid cards tied to specific merchant networks

Many merchants or restaurant chains offer semi-open loop prepaid cards that can be used exclusively within their establishments or affiliated businesses.

These cards provide users with the convenience of a preloaded payment option and often come with rewards or discounts specific to the network.

Co-branded prepaid cards

Semi-open loop prepaid card solutions may be co-branded with financial institutions or other organizations, creating partnerships that provide users with enhanced benefits and rewards.

Examples include co-branded credit cards or prepaid cards offered in collaboration with airlines, hotels, or retail brands.

Prepaid cards with limited acceptance

Some prepaid cards fall under the semi-open loop category when they have restricted acceptance, such as being limited to a specific region or a specific type of merchant network (e.g., fuel stations, grocery stores).

Advantages of Semi-Open Loop Prepaid Cards

Exclusive rewards and benefits

One of the benefits of Semi-Open Cards is that it often offers specialized rewards, discounts, or cashback opportunities within the affiliated merchant network, providing users with unique advantages and incentives.

Enhanced partnerships

Co-branded semi-open loop cards allow organizations to strengthen their alliances, leveraging each other's customer base and creating mutually beneficial relationships.

Tailored experiences

By focusing on specific merchant networks, semi-open loop prepaid cards can offer customized experiences and targeted promotions for users.

Limitations of Semi-Open Loop Prepaid Cards

Limited acceptance

Semi-open loop prepaid cards can only be used within the designated merchant network or affiliated establishments, restricting their utility beyond that network.

Potential exclusivity constraints

Some semi-open loop cards may have limitations on the availability of certain products or services, potentially limiting user options.

Reliance on partnerships

The success of semi-open loop prepaid cards is dependent on the strength and longevity of the partnerships between the issuing organization and the affiliated merchant network.

Future Predictions for Semi-Open prepaid Card

Expansion of partnerships

Semi-open loop prepaid cards are expected to witness increased collaborations between different industries, creating diverse networks and expanding the range of benefits available to cardholders.

Integration with loyalty programs

Semi-open loop prepaid cards may integrate with existing loyalty programs, allowing users to earn points or rewards that can be redeemed within the affiliated merchant network.

Integration of emerging technologies

As technology advances, semi-open loop prepaid cards may adopt features like contactless payments, biometric authentication, or mobile app integration to enhance the user experience and security.

Key differences between the three prepaid cards: a comparative analysis

| Prepaid Card Type | Closed Loop | Open Loop | Semi-Open Loop |

|---|---|---|---|

| Definition | Prepaid cards tied to a specific merchant or limited network | Prepaid cards accepted globally on major payment networks | Prepaid cards tied to specific merchant networks or co-branded partnerships |

| Acceptance | Limited to the issuing merchant or affiliated establishments | Accepted at millions of locations worldwide where major payment networks are recognized | Limited to specific merchant networks or co-branded partnerships |

| Logo/Branding | Often bears the logo or branding of the issuing merchant | Bears the logo of major payment networks like Visa, Mastercard, etc. | May bear the logo of both the issuing organization and the affiliated merchant network |

| Use Cases | Used within the specific merchant network; popular for gift cards, loyalty programs, and transportation payment | General purpose payments, payroll cards, government benefits cards, travel and foreign currency cards | Used within specific merchant networks or co-branded partnerships; popular for prepaid cards tied to specific merchants, co-branded cards |

| Flexibility | Limited flexibility outside the designated merchant network | Offers flexibility to make purchases anywhere the payment network is accepted | Provides a balance between exclusivity and versatility, offering a curated selection of establishments |

| Rewards and Benefits | Merchant-specific rewards and benefits | General rewards and benefits associated with the payment network | Merchant-specific rewards and benefits within the affiliated network |

| Availability | Can be obtained from the issuing merchant or online platforms | Offered by financial institutions, banks, or online platforms | Offered by the issuing organization, financial institutions, or co-branded partners |

| Interoperability | Not interoperable with other merchant networks | Interoperable with any merchant accepting the payment network | Limited interoperability within the designated network |

| Potential Fees | May have fees associated with activation, reload, or inactivity | May have fees associated with activation, reload, or ATM withdrawals | May have fees associated with activation, reload, or specific merchant transactions |

| Security | Provides protection as they are not directly linked to personal bank accounts | Offers protection against loss or theft; security features provided by payment networks | Provides security features based on the issuing organization and payment network |

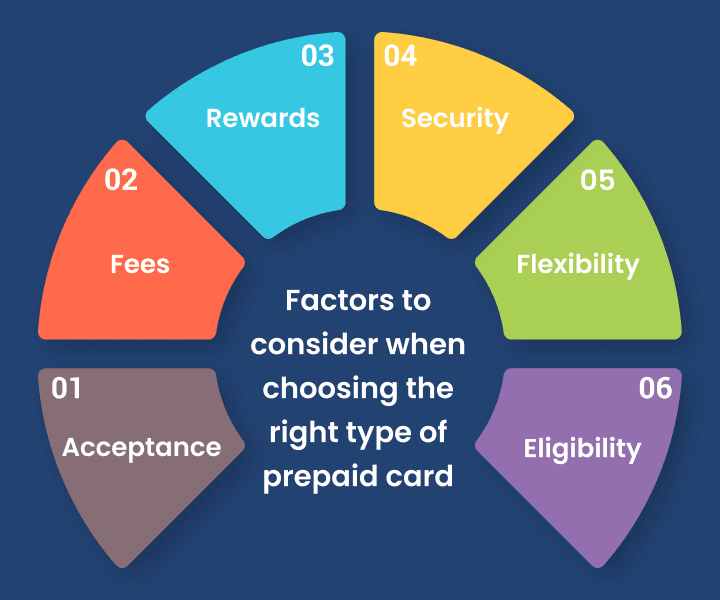

Factors to consider when choosing the right type of prepaid card

When selecting the ideal prepaid card for your needs, it's essential to consider several factors to ensure that you make an informed decision. Let's explore the factors to be considered when selecting the right type of prepaid card.

Acceptance

Consider where you plan to use the card. Closed loop cards are only accepted at participating merchants, while semi-open loop and open loop cards are accepted at a wider range of merchants.

Fees

Prepaid cards can come with a variety of fees, such as monthly fees, activation fees, and loading fees. It is important to compare the fees of different cards before choosing one.

Rewards

Some prepaid cards offer rewards, such as cash back or points. Consider which rewards are important to you and choose a card that offers those rewards.

Security

Prepaid cards offer a high degree of security. However, it is still important to take steps to protect your card, such as setting a PIN and being careful about who you give your card information to.

Flexibility

Prepaid cards offer a high degree of flexibility. You can load money onto the card as needed and set spending limits. Consider how you plan to use the card and choose a card that offers the flexibility you need.

Eligibility

Some prepaid cards have eligibility requirements, such as being enrolled in a loyalty program or receiving benefits from a government agency or employer. Make sure you meet the eligibility requirements before applying for a card.

Conclusion

The choice between closed loop, open loop, and semi-open loop prepaid cards requires careful consideration of various factors. Each type offers distinct features, benefits, and limitations that cater to different needs and preferences.

When selecting the right type of prepaid card, it is crucial to consider factors such as acceptance, flexibility, rewards, fees, security, and specific use cases.

At DigiPay.Guru, we understand the significance of prepaid card solutions in today's digital economy. Our advanced prepaid card issuing and management solution combines technology and expertise to empower businesses with seamless prepaid card management, customization, and integration capabilities.