Are you tired of carrying around wads of cash or struggling to keep track of your credit card bills? If so, you may want to consider the rising trend of prepaid cards. Prepaid cards are becoming increasingly popular for their ease of use and financial benefits.

In fact, according to a recent study by Globe Newswire, the prepaid card industry is expected to grow to $22.11 billion by 2026 at a compound annual growth rate of 9.7%

But what exactly are prepaid cards? Simply put, prepaid cards are reloadable payment cards that can be used like debit or credit cards. They work by allowing you to load a certain amount of money onto the card and then use that card to make purchases until the funds are depleted.

So why are these cards gaining so much popularity? For starters, prepaid cards offer a hassle-free alternative to traditional banking methods. They don't require a credit check, so they're accessible to anyone regardless of their credit history. Plus, they can be used for various transactions, including online purchases and bill payments.

In this comprehensive guide, we'll cover everything you need to know about prepaid cards. From the different types of prepaid cards available to the benefits and limitations, we'll provide a complete overview of this financial tool.

How do Prepaid Cards Actually Work?

Prepaid cards are a convenient and popular way to manage your finances without the need for a traditional bank account. They can be used for various purposes, from online purchases to bill payments. But how exactly do prepaid cards work? Let's take a closer look.

What are prepaid cards?

Prepaid cards are reloadable payment cards that allow you to spend only the amount of money you have loaded onto the card. They work like a debit or credit card but without the need for a bank account or credit check.

Instead, you can purchase a prepaid card at a participating retailer or online, and load it with a specific amount of money in a digital wallet solution. You can then use the card to make purchases until the funds are depleted.

One example of prepaid card is a prepaid card that can only be used at a specific retailer, such as Walmart or Target.

Purchasing and Activating a Prepaid Card

Finding a Card

Prepaid cards can be purchased from a variety of financial institutions, retailers, and online vendors. You can research the different options available to find one that meets your needs.

Activating the Card

Before you can use your prepaid card, you'll need to activate it. This can usually be done by phone or online. You'll need to provide some personal information, such as your name and address, to verify your identity.

Adding Funds

Once your card is activated, you'll need to load money onto it. This can be done online, by phone, or at a retailer that offers reload services. Some cards have a minimum and maximum amount you can load, so be sure to check the terms and conditions.

How to Use a Prepaid Card

Swiping the Card

Using a prepaid card is just like using a debit or credit card. Simply swipe it at the point of sale and enter your PIN if required.

Online Purchases

Prepaid card services can also be used for online purchases. When prompted to enter your payment information, simply enter the card details as you would with a credit or debit card.

Keeping Track of Your Balance

It's important to keep track of your balance to avoid overspending. You can check your balance online, by phone, or at an ATM that accepts your card.

Reloading a Prepaid Card

Automatic Reload

Some prepaid cards offer automatic reload options. This means that when your balance reaches a certain amount, the card will automatically reload with a predetermined amount.

Manual Reload

If your card doesn't offer automatic reload, you'll need to manually reload it. This can be done online, by phone, or at a retailer that offers reload services.

Types of Prepaid Cards

Prepaid cards come in different forms. Understanding the differences between virtual, physical, and tokenized prepaid cards can help you choose the right type of card for your needs.

Virtual Prepaid Cards

Virtual prepaid cards are advanced mobile money payment solutions in the form of digital cards that exist only in electronic form. One of the best features of virtual prepaid cards is that they don't have a physical presence, but they can be used for online purchases.

Virtual prepaid cards are quick and easy to obtain, can be used for online transactions, and can be delivered instantly to your email or mobile device.

Read more: Virtual cards: How it works & its benefits

Physical Prepaid Cards

Physical prepaid cards are physical cards that can be swiped or inserted at a point of sale. They look and function similar to credit or debit cards, but are not linked to a bank account.

Physical prepaid cards provide more versatility than virtual cards. They can be used for in-person purchases, as well as online transactions. They're also reloadable, so you can add more funds to the card as needed.

Tokenized Prepaid Cards

Tokenized prepaid cards are a newer type of prepaid card that use digital tokens to facilitate transactions. These tokens are unique to each transaction and can't be used for any other purpose.

Tokenized prepaid cards offer enhanced security, as the tokens are only valid for one transaction. They're also versatile and can be used for in-person and online purchases.

Other types of prepaid cards

General Purpose Reloadable (GPR) cards

These prepaid cards are reloadable and can be used to make purchases anywhere that accepts debit or credit cards.

Payroll cards

These cards are issued by employers to pay their employees' salaries or wages electronically. Employees can use the card to withdraw cash or make purchases.

Government benefits cards

These prepaid cards are issued by the government to distribute benefits, such as social security or unemployment, electronically.

Gift cards

These prepaid cards are loaded with a specific amount of money and can be given as gifts to friends and family. They can usually only be used at specific retailers.

Travel cards

These prepaid cards are designed for use when traveling and often offer benefits such as no foreign transaction fees and travel insurance.

Teen cards

These prepaid cards are designed for teenagers and offer parental controls, spending limits, and budgeting tools to help teach financial responsibility.

Prepaid Cards vs Credit Cards vs Debit Cards: What's the difference?

Prepaid cards, credit cards, and debit cards are all widely used for making purchases and managing finances. Each type of card has its own set of advantages and disadvantages, making it important to understand the differences between them before deciding which one to use.

Key Differences

Here's a table highlighting the key differences between prepaid, credit, and debit cards:

| Type of Card | Funding Source | Credit Score Impact | Interest Rate | Fees |

|---|---|---|---|---|

| Prepaid Card | Loaded funds | None | None | Activation, reloading, ATM |

| Credit Card | Borrowed funds | Yes | Yes if balance not paid in full | Annual, balance transfer, late |

| Debit Card | Linked to bank account | None | None | ATM, foreign |

Pros and Cons of Using a Prepaid Card over credit or debit cards

Pros

- No credit check required to obtain a prepaid card.

- Control and limit spending by loading only a certain amount onto the card.

- Protection against overspending and fraud as the card is not linked to a bank account.

- No interest charges or credit card debt.

Cons

- Limited acceptance for purchases and services compared to credit or debit cards.

- There are charges for activation, reloading, ATM withdrawals, and transactions made in foreign currency.

- No credit building potential, as prepaid cards do not report to credit bureaus.

- Not suitable for larger purchases as the card balance may not be sufficient.

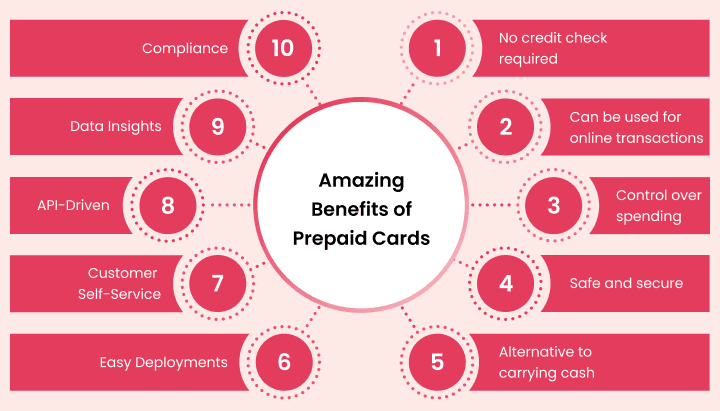

Amazing Benefits of Prepaid Cards

Prepaid cards have become increasingly popular in recent years as a payment option due to their unique benefits. Here are some of the top benefits of using prepaid cards, along with real-life examples:

No credit check required

Unlike credit cards, prepaid cards don't require a credit check to obtain. This can be a great option for individuals who don't have a strong credit history or who want to avoid the potential negative impact on their credit score.

For example, Green Dot's Prepaid Visa Card doesn't require a credit check, making it a popular option for individuals with less-than-perfect credit.

Control over spending

With prepaid cards, you can only spend what you have loaded onto the card, which can help you stay within your budget and avoid overspending.

For example, the American Express Serve card allows users to set up sub-accounts for family members and set spending limits, providing greater control over spending.

Can be used for online transactions

Prepaid cards can be a great option for online transactions, as they provide an added layer of security and can help protect against fraud.

For example, the Netspend Visa Prepaid Card is a popular option for online purchases, as it offers protection against unauthorized transactions.

Safe and secure

Prepaid cards are a safe and secure payment option, as they are not linked to your bank account or personal information.

For example, the Mastercard Prepaid Card offers a zero liability policy, protecting users from unauthorized transactions.

Alternative to carrying cash

Prepaid cards can be a great alternative to carrying cash, as they are widely accepted and can be used to withdraw cash from ATMs.

For example, the Western Union Netspend Prepaid Mastercard allows users to withdraw cash from over 130,000 ATMs nationwide.

Easy Deployments

Prepaid cards are easy to deploy, as they don't require complex underwriting processes or lengthy approval times. They can be deployed both on the cloud and on-premise

For example, Visa's prepaid card program allows companies to quickly issue cards to their employees or customers, making it a popular option for businesses.

API-Driven

Many prepaid card programs are API-driven, making it easy for businesses to integrate the cards into their existing systems and workflows.

For example, the Payoneer prepaid card offers a robust API, making it easy for businesses to automate payouts to freelancers and suppliers.

Customer Self-Service

Prepaid card programs often offer self-service options for customers, allowing them to easily manage their accounts and transactions.

For example, the Greenlight debit card for kids offers a mobile app that allows parents to easily manage their child's accounts and set spending limits.

Data Insights

Prepaid cards can provide valuable data insights for businesses, allowing them to track spending patterns and make informed decisions.

For example, the Visa prepaid card program offers real-time data analytics, allowing companies to monitor transactions and detect potential fraud.

Compliance

Prepaid cards are subject to strict compliance regulations, which can help protect users from fraud and other illegal activities.

For example, the Mastercard prepaid card program adheres to strict KYC (know your customer) and AML (anti-money laundering) regulations, ensuring the safety and security of users.

Challenges and Limitations of prepaid cards

Prepaid cards have been a popular financial tool for many consumers, but they do come with some challenges and limitations. In this section, we will take a closer look at some of the potential disadvantages of prepaid cards.

Fees associated with prepaid cards

One of the most significant challenges of prepaid cards is that they often come with fees. These fees can include activation fees, monthly maintenance fees, transaction fees, ATM fees, and more.

These fees can add up quickly and eat away at the balance on the card, reducing its value.

Limited acceptance at some locations

While prepaid cards are widely accepted at many merchants, they may not be accepted everywhere. Some merchants may only accept credit or debit cards, which can be a limitation for those who rely solely on prepaid cards.

No credit-building opportunities

Another potential limitation of prepaid cards is that they do not offer any opportunities to build credit. Unlike credit cards, prepaid cards do not report to credit bureaus, which means that using them responsibly will not help to improve your credit score.

Amount Loading Limits on the card

Prepaid cards also come with limits on the amount of money that can be loaded onto the card. These limits can vary depending on the card issuer, but they can be a limitation for those who need to make large purchases or transactions.

Some popular use cases of prepaid cards

Prepaid cards are becoming increasingly popular as a versatile financial tool for a wide range of industries and applications. In this section, we will explore some of the most popular use cases of prepaid cards.

Banks and Financial Institutions

Banks and financial institutions often offer prepaid cards as an alternative to traditional debit cards. These cards can be used to make purchases, withdraw cash from ATMs, and manage money without the need for a bank account.

Healthcare

Prepaid cards can be used in the healthcare industry to provide employees with benefits such as health savings accounts or flexible spending accounts. These cards allow employees to pay for healthcare expenses using pre-tax dollars.

Government

Governments can use prepaid cards to distribute benefits such as unemployment or welfare payments. These cards offer a convenient and secure way for recipients to access their funds.

Retail Loyalty Programs

Retailers can use prepaid cards as part of their loyalty programs to reward customers for their repeat business. These cards can be loaded with points or cashback rewards that can be redeemed at the store.

Education

Prepaid cards can be used in the education sector to provide students with financial aid or refunds. These cards offer a secure and convenient way for students to access their funds.

Hospitality and Travel

Prepaid cards can be used in the hospitality and travel industry to provide guests with a convenient and secure way to make purchases or withdraw cash while on vacation.

Transit systems

Transit systems can use prepaid cards as a way for riders to pay for fares without the need for cash. These cards can be reloaded with funds as needed and offer a convenient way to manage transportation expenses.

Theme parks and attractions

Prepaid cards can be used at theme parks and attractions as a way for guests to make purchases without carrying cash or credit cards.

Corporates

Prepaid cards can be used by companies to manage expenses such as travel or employee incentives. These cards offer a convenient and secure way to manage company expenses.

Neo-banking

One of the major benefits of neo-banks for using prepaid cards is that it acts as a way for customers to manage their money without the need for a traditional bank account. These cards offer many of the same features as traditional bank accounts, such as direct deposit and bill payment via prepaid card.

Choosing the Right Prepaid Card

Choosing the right prepaid card is crucial to ensure that you get the best value for your money and that your financial needs are met. Here are some key factors to consider when choosing a prepaid card:

Fees

Pay attention to the fees associated with the card, including activation fees, monthly maintenance fees, and transaction fees. Look for cards with lower fees to save money in the long run.

Features and benefits

Consider the features and benefits offered by the card, such as rewards programs, budgeting tools, and fraud protection. Choose a card that offers features that align with your financial goals and needs.

Security

Ensure that the card provides robust security measures to protect your money and personal information from fraud and theft.

Customer service

Look for cards with excellent customer service that are available 24/7 to address any issues or concerns.

To make sure you're making a smart choice, take the time to do some research and compare different prepaid card options. Check out the fees, features, and security measures of each one to see which is the best fit for you.

And remember, it's important to stay vigilant against scams and fake cards by doing your due diligence and avoiding any deals that seem too good to be true. By following these steps, you can pick the prepaid card that's right for you with peace of mind.

Final Thoughts

Prepaid cards can be an excellent tool for managing your finances, and they offer several benefits over credit and debit cards. From their ease of use to their ability to help you stick to a budget, prepaid cards can be an excellent addition to your financial toolkit.

However, it's important to choose the right prepaid card for your needs and to be aware of any fees or limitations associated with its use. By doing your research and comparing different prepaid card options, you can find the one that works best for you.

If you're looking to implement a prepaid card solution for your business, consider checking out DigiPay.Guru's prepaid card solution. With its easy deployment, API-driven interface, and customer self-service capabilities, Digipay Guru's prepaid card management system empowers businesses and individuals to manage their money with ease, regardless of credit history or financial background.