Neobanking has become a major trend in the banking industry. It's because of the way it redefines the banking sector and showcases how advanced the future of banking can be.

Plus, with the increase in the usage of digital payment services and the expectations of customers for smooth & seamless transactions, the neo banking solutions are surely going to make a bigger impact in the financial industry.

But what exactly are neobanks, and how do they work?

In this blog post, let’s break it down in a simple and detailed way to help you understand what they are and their benefits for businesses like yours that offer innovative digital payment solutions to their customers.

Let’s begin by understanding what exactly a neobank is!

What is a Neobank or Neobanking?

A neobank is a type of digital bank that operates without physical branches. It is completely online and can be called a truly branchless digital bank. While traditional banks still have buildings you can walk into, neobanks function exclusively online through websites and mobile apps. This makes them ideal for customers who prefer banking on the go.

Unlike digital banks, which are often extensions of traditional banks, neobanks are built entirely on modern and agile technologies. This allows them to offer faster services, lower fees, and more personalized experiences.

In short, a neobank is your online bank that runs completely online! And the future of neobanking is here.

How do neobanks work?

Neobanks work on a Banking as a Service (BaaS) model. This means that they rely on partnerships or licenses to provide banking services.

There are three main types of neobanks in the market today:

FinTech partnering with traditional banks

These neobanks don’t have their own banking license. Instead, they partner with a traditional bank and wrap their own services around the bank’s existing products.

Traditional banks launching digital-only neobanks

In this case, a traditional bank creates its own fully digital version. These neobanks offer all the services of a regular bank but operate exclusively online without any physical branches.

Fully licensed digital-only neobanks

These neobanks have their own digital banking licenses, which allows them to operate independently without partnering with a traditional bank. However, this type of neobank is only available in countries that allow stand-alone digital banks.

Currently, most of the neobanks that exist today fall under the first or second type. That’s the reason why the majority of neobanks have a bank as a partner. Banks act as a platform for neobanks to offer core banking services.

Account Setup:

Setting up an account with a neobank is typically much faster and simpler than with a traditional bank. You can open an account within minutes, often with just a few taps on your smartphone, without needing to visit a branch or deal with physical paperwork.

Market statistics about neobanks

The neobank market has seen only an upward trend since it came into existence.

-

The global neo banking market is expected to reach $ 3406.47 billion by 2032 from $143.29 billion in 2024.

-

Europe dominated the global market for neobanks with a share of nearly 38 percent in 2023.

According to Finder’s online bank adoption report, Brazil has nearly 43% of people with neobank accounts. Followed by India with 26% and Ireland with 22%.

One of the most popular neobank is Nubank, with more than 100 million users worldwide.

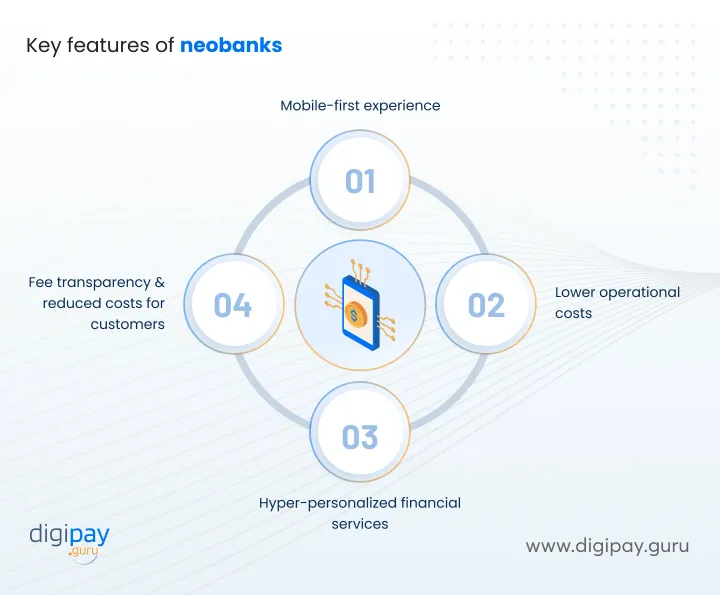

Key features of neobanks

Neobanks have several distinct features that set them apart from traditional banks, especially when it comes to serving the needs of small businesses. These features make neobanks a compelling choice for business owners looking to streamline their finances and reduce costs.

Mobile-first experience

Neobanks are built from the ground up with a mobile-first mindset. This means that every aspect of the banking experience—from opening an account to making payments—is optimized for mobile devices. Your customers can easily manage their finances by phone, which makes banking more accessible and convenient than ever.

Lower operational costs

Because neobanks don’t have the overhead costs associated with maintaining physical branches, they can pass those savings on to customers in the form of lower fees. This can be a game-changer for small businesses that are often hit hard by traditional banking fees, which add up to the fees of the end user.

Hyper-personalized financial services

One of the key advantage of neobanks is their ability to provide hyperpersonalized services. By leveraging data and AI-driven insights, neobanks offer customized financial solutions tailored to the specific needs of their customers.

For example, they can provide personalized budgeting tools, expense tracking, and financial planning services designed to help your business grow.

Fee transparency and reduced costs for customers

Traditional banks are notorious for hidden fees. In contrast, neobanks pride themselves on transparency. Whether it’s zero-fee accounts, low transaction costs, or affordable international payments, neobanks offer clear and competitive pricing that helps your business keep more of its money.

How are neobanks different from traditional and digital banks?

It’s easier to differentiate between neobanks and traditional banks since they are fundamentally so different. However, people find it tough to differentiate between neobanks and digital banks.

So let’s compare neobanks with traditional banks and digital banks and clear the air.

Neobanking vs traditional banking

Neobanks are fundamentally different from traditional banks in almost every aspect. Neobanks are sometimes also referred to as “challenger banks” since they challenge traditional banks by offering more convenient and customer-centric banking services. Let’s try to understand the major differences between neobanks and traditional banks from the below table:

| Feature | Neobanking | Traditional Banking |

|---|---|---|

| Banking Access | 100% online, no physical branches | Physical branches and online services |

| Account Setup | Fast, fully digital onboarding | Typically requires in-person visits or paperwork |

| Cost of Services | Low to zero fees (e.g., zero-balance accounts) | In-person, phone support, and online |

| Customer Support | Primarily digital (chat, email, apps) | Reloadable, no activation fees, rewards, budgeting tools, and direct deposit. |

| Service Hours | 24/7 availability via mobile apps | Limited to business hours for branch visits |

| Transaction Speed | Instant processing (in many cases) | May take longer for traditional transactions |

| Customization and Personalization | Highly personalized services through AI and data | Standardized services |

| Transparency | Fee transparency and lower costs for customers | Hidden charges and complex fee structures |

| Banking License | None, partial, or full | Full |

| Approval process | Quick and automatic | Manual and lengthy |

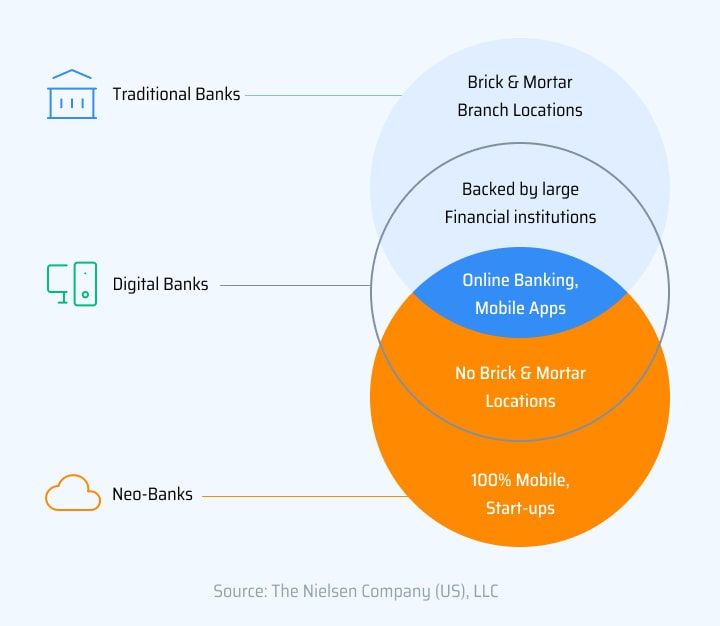

Neobanks vs Digital Banks

People really struggle to differentiate between digital banks and neobanks since they are so similar. Digital banks are known to offer very similar kinds of services as neobanks. They enable users to withdraw, deposit, borrow, transfer, and perform several other bank-related operations.

NeoBanks are independent and are not associated with traditional banks at all. On the other hand, digital banks tend to exist like branches of larger traditional banks. Below is a Venn diagram that clearly differentiates neobanks from traditional and digital banks.

What are the key advantages of neobanking?

Now you have understood what Neobanks are and how they are different from traditional & digital banks. But why are they so talked about? What makes it a buzzword? The answer is the top-notch benefits it offers to its customers.

Low cost

One of the major benefits of the neo banking platform is that it’s cost-effective compared to traditional banks. It’s because neobanks eliminate the operational and labor costs since they do not have physical branches.

Whereas, Neobanks don’t have to pay for the costs of running physical branches. Hence, they can afford to charge little to no fees at all. Also, due to the absence of credit risks and fewer regulations, Neobanks becomes much more cost-effective.

Convenience

NeoBanks offers top-notch convenience to their users since it’s entirely digital. The entire digital setup also means that customers can use all the banking services at the convenience of their smartphone. In addition, neobanks enable users to manage their finances efficiently.

Improved customer experience

From quick account setup to real-time notifications, neobanks offer an intuitive, user-friendly experience that customers and businesses love. Plus, 24/7 support ensures that help is always available.

Smart reporting

Need better insights into your finances? Neobanks come with built-in smart reporting features that allow you to analyze cash flow, expenses, and more, in real-time. Plus, users can see the details of all their payments, transactions, expenditures, saving goals, and balances on a single app.

Furthermore, you can customize reports as per your requirements. Overall, it helps users to have a clear idea about their finances which helps them to make better insight-driven decisions.

Fast processing time

Neobanks are known for their faster processing time compared to traditional banks. For instance, if a user wants to apply for a loan in a traditional bank then he has to undergo several rigid processes which are also time-consuming.

Whereas, neobanks bypass all these time-consuming processes and leverage innovative strategies to speed up the entire process. For example, SoFi enables a user to pre-qualify for loans and interest rates within a few minutes.

International payments at ease

When it comes to making international payments, users may face difficulties in traditional banking. It’s because to make cross-border payments, users have to request to upgrade their debit card to an international debit card.

However, if you have an account in a neobank, the users have to add their card to the mobile app and make payments online to any country without any hassle.

Value-added services

Beyond basic banking, neobanks offer value-added services like expense tracking, automated savings, and even business insights to help your company thrive.

Plus, neobanks utilize customer data, account information, patterns, and more with the help of AI to recommend other financial services to users. Neo banks also recommend services that are based on demographics thus making it easier for customers to make investment decisions.

Advanced security features

Neobanks are also known to leverage some of the most advanced security features. They implement biometric verification, 2FA (2-factor authorization), RBAC (Role-Based Access Control), top-notch encryption technology, and many other advanced security measures to make banking safe for users.

Read More: How biometrics are securing Digital Payment?

Top 10 neobanks of 2025 in the World

If you’re interested in exploring the top neobanks for businesses, here’s a neo bank list of some of the most popular ones making headlines today:

-

Chime - A user-friendly neobank for personal and business use.

-

Revolut - Known for offering international money transfers with minimal fees.

-

N26 - A Europe-based neobank popular for its low fees and mobile-first experience.

-

Monzo - Offering a full range of banking services, including savings and loans.

-

Varo - A US-based neobank offering a zero-fee banking solution.

-

Starling Bank - A UK-based neobank with a focus on small businesses.

-

Aspiration - Known for its environmental focus and socially conscious banking.

-

Atom Bank - A digital-first bank offering loans and savings accounts.

-

Zopa - Originally a peer-to-peer lender, now offering a range of neobank services.

-

Tandem - A neobank focused on green financial products.

Conclusion

Neobanks are quickly becoming a lifeline for businesses that need cost-effective, convenient, and scalable banking solutions. Whether you’re looking to save on fees, improve your customer experience, or expand your business globally, neobanks offer the tools you need to thrive in today’s digital economy.

As the financial landscape continues to evolve, so should your business. DigiPay.Guru is here to help you stay ahead of the curve with our innovative neo banking solutions. If you're looking for a digital platform provider for neobaking, we’ve got you covered.