Accessing financial services shouldn't be a luxury. But for many in South Africa, it still is. Millions remain unbanked or underbanked due to limited banking infrastructure, especially in rural and remote areas.

Plus, traditional bank branches are expensive to set up and maintain. This leaves many communities underserved.

This is where agent banking comes in. It bridges the financial gap by bringing banking services closer to customers without an established traditional bank branch.

This is how banks and financial institutions can leverage agent networks to expand their reach without building costly branches.

But setting up and managing an agent banking network is not simple, especially in underserved economies like South Africa.

And that’s where DigiPay.Guru’s advanced agency banking solution comes to the rescue. It helps banks and financial institutions optimize their agent banking operations while ensuring seamless service delivery, security, and financial inclusion.

In this blog post, you will explore what agent banks are and how a robust agency banking solution by DigiPay.Guru can help optimize your agency banking services in South Africa.

Let’s begin with an agent banking overview, its types and how it works.

Introduction to Agent Banking

Before we dive into how DigiPay.Guru optimizes agency banking in South Africa, let’s first clear the air with the basics.

What is an Agent Bank?

An agent bank acts as an extension of a bank that offers basic banking services through local agents like retail stores, post offices, and mobile money operators. These agents serve as the mini bank branches that handle customer transactions on behalf of banks.

Types of Agent Banks

Agent banks can be varies types . The key types of agent banks include:

Super agents – Oversee and manage multiple sub-agents while ensuring liquidity and smooth transactions.

Retail agents – Individual shop owners who provide basic banking services to local communities.

Mobile money agents – Facilitate mobile-based transactions thereby enabling digital payments and fund transfers.

Banking correspondents – Directly affiliated with banks to handle deposits, withdrawals, and bill payments.

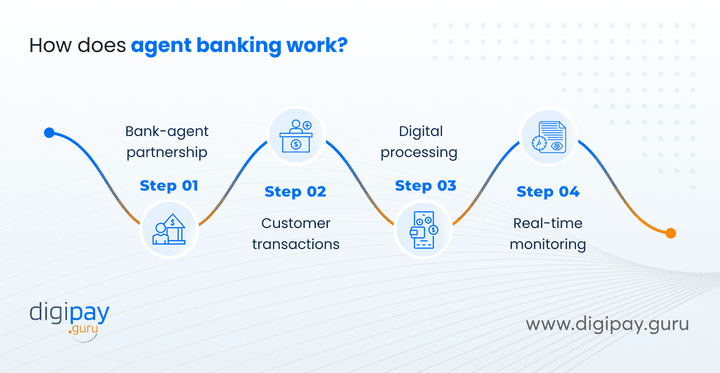

How does agent banking work?

The agent banking process is pretty simple and straightforward. Here’s how it works:

Bank-agent partnership – Banks collaborate with trusted local businesses to act as agents.

Customer transactions – Customers visit agent locations for agent cash in/cash out i..e. cash deposits, withdrawals, fund transfers, bill payments, and KYC registration.

Digital processing – Agents use mobile phones, POS devices, or agent banking apps to complete transactions securely.

Real-time monitoring – Banks oversee agent activity in real-time to maintain security and compliance.

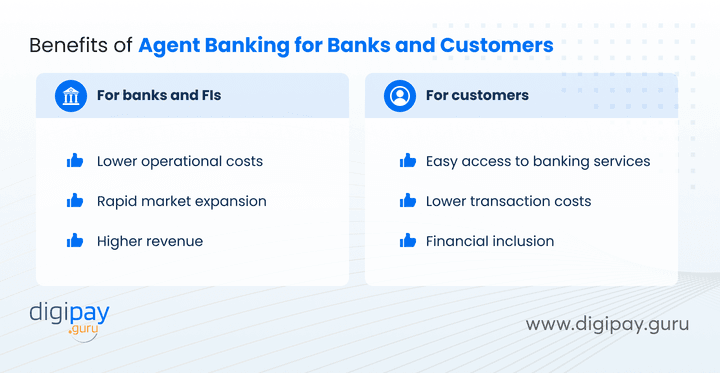

Benefits of Agent Banking for Banks and Customers

Agency banking has brought with it numerous benefits for both you and your customers. Let’s look at the key advantages of agency banking.

For Banks and Financial Institutions:

Lower operational costs – Setting up and maintaining physical branches requires significant investment. Agent banking reduces infrastructure costs by leveraging local businesses, which allows your bank to operate efficiently with minimal overhead.

Rapid market expansion – Reaching rural and underserved areas is a challenge for traditional banks. By partnering with agents, your bank can extend your services to previously inaccessible regions without the need for expensive branch setups.

Higher revenue – Increased customer transactions generate additional income for banks. Plus, service fees from deposits, withdrawals, and bill payments contribute to steady revenue growth while enhancing customer engagement and retention.

For Customers:

Easy access to banking services – Many customers in remote areas struggle to find nearby banks. Agent banking eliminates long-distance travel, thereby providing essential financial services within their communities and ensuring greater banking convenience.

Lower transaction costs – Traditional banking services often come with hefty fees. Agent banking offers a more cost-effective alternative, which makes transactions like deposits, withdrawals, and bill payments more affordable for low-income individuals.

Financial inclusion – Millions of unbanked individuals now have access to essential banking services. Agent banking fosters economic empowerment by enabling customers to save, transact, and access credit, thereby contributing to overall financial growth and stability.

Agent Banking Landscape in South Africa

South Africa faces financial accessibility challenges, especially in rural and peri-urban areas.

The Need for Agent Banking in South Africa

3.5 million + South African adults are completely excluded from the formal financial sector.

Source: World Bank

Agent banking plays a crucial role in providing structured, secure, and regulated banking options to these populations. That’s why it is needed in South Africa. And you can leverage it to expand your customer base, boost financial inclusion and increase your profits in the process .

Key Challenges in South Africa’s Agent Banking Ecosystem

The key challenges faced in South Africa when thinking of implementing branchless banking are:

Security & Fraud Risks

Handling cash and sensitive financial data makes agents targets for fraudsters. Reports indicate that fraudulent mobile transactions increased by 30% in the past year, which highlights the need for secure platforms and risk management solutions.

Limited Digital Infrastructure

Many remote areas lack stable internet connectivity, which affects real-time transaction processing. With only 60% of South African households having access to stable internet, offline-capable solutions are crucial for seamless banking operations.

Regulatory & Compliance Barriers

Banks and financial institutions must adhere to strict AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations. Agent onboarding and compliance checks can slow down market expansion if not efficiently managed.

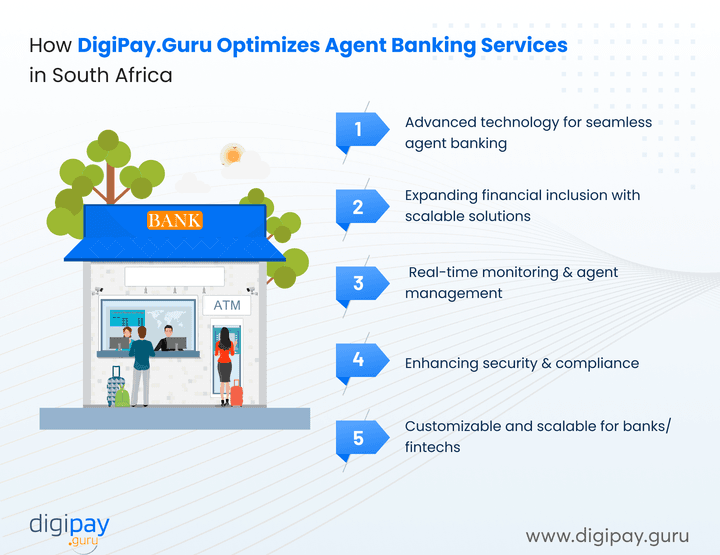

How DigiPay.Guru Optimizes Agent Banking Services in South Africa

DigiPay.Guru transforms agent banking in South Africa with cutting-edge technology, robust security, and scalable solutions. By empowering banks and financial institutions, it enhances financial access, streamlines operations, and drives inclusion across urban and rural markets.

Here’s how DigiPay.Guru optimizes agent banking services in South Africa

Advanced Technology for Seamless Agent Banking

DigiPay.Guru provides a secure, omnichannel platform that supports mobile, web, and POS transactions. And with real-time processing, AI-driven fraud detection, and automated risk management, transactions are seamless and secure.

Plus with advanced analytics, the platform ensures

-

Customer trust

-

Regulatory compliance, and

-

Enhanced fraud prevention

Expanding Financial Inclusion with Scalable Solutions

With DigiPay.Guru, you can onboard agents efficiently and extend financial services to diverse demographics. Plus, the platform supports multilingual interfaces, digital KYC, and eKYC for seamless customer onboarding.

With over 90% mobile penetration in South Africa, DigiPay.Guru ensures financial access reaches even the most remote areas. This can drive banking inclusion at scale.

Read More - Financial Inclusion: Definition, examples, and why It's Important for your business

Real-Time Monitoring and Agent Management

You gain access to a centralized dashboard that delivers real-time insights into agent activity, transaction trends, and agent commission structures.

And with automated payouts and AI-driven analytics, you can track performance, reduce inefficiencies, and maximize profitability.

The dashboard also flags anomalies, which can help your bank proactively address operational risks.

In addition to that, by optimizing agent networks with data-backed decisions, you can expand your services efficiently while maintaining cost-effectiveness.

Enhancing Security and Compliance

South Africa reports rising digital fraud cases, which makes robust security a must. With end-to-end encryption, biometric authentication, and OTP verification, DigiPay.Guru ensures every transaction remains highly secure.

Plus, compliance with AML and KYC regulations helps you mitigate risks while maintaining operational integrity and customer trust.

Customizable and Scalable for Banks and Fintechs

DigiPay.Guru’s white-label solution integrates seamlessly with core banking and mobile money platforms. Plus, its scalable architecture supports expansion, which makes it an ideal choice for businesses seeking growth and a competitive edge in the agent banking sector.

Why DigiPay.Guru is the Best Partner for Agent Banking Solution

DigiPay.Guru isn’t just another provider—it’s your ultimate partner for transforming agent banking. Our platform is trusted by leading banks and financial institutions for its reliability, security, and performance.

Here’s why you should choose us:

Proven success – Financial institutions using DigiPay.Guru has reported exceeded growth in agent transactions and a significant reduction in operational costs within a year.

Unmatched security – End-to-end encryption, AI-driven fraud detection, biometric authentication, and more ensure every transaction is ultra-secure.

Seamless integrations – Our solution connects effortlessly with core banking, mobile money, and payment gateways, thereby eliminating tech headaches.

Scalability without limits – Whether you're launching in one region or scaling nationwide, DigiPay.Guru grows with you, adapting to your needs.

Data-driven insights – Real-time analytics empower you to optimize agent networks, boost revenues, and enhance service delivery.

Frictionless customer experience – Customers enjoy fast, easy, and reliable banking services, which increases satisfaction and trust in your business.

When it comes to agent banking, DigiPay.Guru doesn’t just provide a solution—we drive transformation, fuel financial inclusion, and maximize profitability.

Ready to take your agent banking strategy to the next level? Let’s make it happen.

The Future of Agent Banking in South Africa

With agency banking solutions like DigiPay.Guru in the market, the future of agency banking looks brighter in South Africa.

-

With mobile penetration exceeding 90%, the potential for agent banking in South Africa is immense.

-

Digital solutions will continue to evolve, which will integrate AI and blockchain to enhance security and efficiency.

-

According to market reports, the African digital banking sector is projected to grow at a CAGR of 13.2% over the next five years.

-

With rising demand for accessible financial services, agent banking is set to expand significantly to reach more underserved communities and drive economic inclusion.

-

Banks and financial institutions investing in robust agent banking solutions now will lead the market in the coming decade.

Conclusion

Agent banking is redefining financial access in South Africa. This has enabled banks and financial institutions like yours to bridge the gap for millions of underserved individuals. With increasing mobile penetration and evolving digital banking trends, now is the time for your bank/FI to strengthen your agent networks and optimize financial services.

The good news is - DigiPay.Guru is the go-to partner for businesses looking to revolutionize their agent banking ecosystem. With cutting-edge security, real-time analytics, and seamless scalability, we provide everything you need to enhance your reach, reduce costs, and drive financial inclusion.

Let’s shape the future of banking together—partner with DigiPay.Guru today.

FAQ's

Regulatory compliance can be complex and require strict adherence to AML and KYC policies. Cash management issues, such as liquidity shortages, can hinder transactions, which can affect customer trust. Fraud and security risks are also concerns, as cyber threats and unauthorized transactions pose risks to both banks and agents. Lack of proper training and infrastructure can limit the efficiency of agent banking networks.

Agent banks generate revenue primarily through a commission-based model. Banks share a percentage of transaction fees with agents for services like deposits, withdrawals, bill payments, and account openings. In some cases, banks charge a flat fee per transaction, which ensures steady earnings for their agent network.

Agent banks offer a range of services, including cash deposits, withdrawals, bill payments, fund transfers, account opening, and loan applications. Some agents also facilitate mobile wallet transactions and insurance payments.

Agent banking plays a crucial role in bringing banking services to unbanked and underbanked populations, especially in remote areas. It reduces barriers to financial access by allowing customers to conduct transactions close to home, thereby eliminating the need for long-distance travel.

Agent banking allows banks to expand their reach without the high costs of building physical branches. It increases customer acquisition, improves service accessibility, and generates new revenue streams through transaction fees and financial product adoption.

Agent banking is highly secure when powered by advanced digital solutions. Banks implement end-to-end encryption, biometric authentication, and real-time fraud detection to protect transactions. Compliance with AML and KYC regulations further enhances security.

Agent banking relies on mobile banking apps, POS terminals, USSD codes, and cloud-based platforms. Plus, AI-driven analytics, digital KYC, and secure payment gateways ensure smooth and secure transactions for customers and banks.

Banks can establish an agent network by selecting the right technology provider, onboarding local businesses as agents, and integrating secure digital banking solutions. A scalable, AI-powered platform like DigiPay.Guru helps banks manage agents efficiently while ensuring compliance and security.