Quick Summary

Offering a seamless banking experience to your customers is the foremost priority! Plus, making customer’s financial life easier attracts loyal customers and expands the customer base & profit exponentially. Omnichannel banking makes it possible to achieve all these. Reading this blog, you will know what omnichannel banking is, why it is needed, and how to achieve it to stay ahead of your competitors.

Nearly 98% of the banks prioritized customer experience at their organization!

Why? The reason is simple! Customer preferences and demands evolve with technological advancements. So, if you don’t offer everything that customers need from your bank, you will quickly lose customers to your competitors.

Now you might wonder, how to offer everything they need. Well, you need to offer varied banking channels. This way, they will utilize your services from anywhere, anytime. And will have a seamless omnichannel banking experience.

But, what is omnichannel banking experience? Why is it needed? And if it's beneficial, how do you achieve it?

This blog will answer all the above questions swirling in your mind and help you make an informed decision for your business.

With that said, let's kick things off with the meaning of omnichannel banking!

What is omnichannel banking?

Omnichannel banking refers to the integration of various channels, such as online, mobile, in-person, and digital assistants, to provide customers with a seamless banking experience. It allows customers to access their accounts and conduct transactions through multiple channels.

Omnichannel banking meaning & definition

In simple words, omnichannel banking means that the users can avail of all the banking services from a website, mobile app, bank’s branch, call center, or any other available channel.

Omnichannel banking example

For example, JPMorgan Chase is an omnichannel banking platform that offers its customers a wide range of banking services through various channels, including online & mobile banking and in-person banking at physical branches. They also give a feature where customers can make appointments with bankers online or via their mobile app.

Omnichannel banking isn’t just about convenience—it’s about empowering banks to optimize customer journeys, improve operational efficiency, and stay competitive.

Why does it matters: The benefits of omnichannel banking

Omnichannel financial services is the need of the hour! It not only streamlines banking operations but increases the number of transactions and customers for your bank.

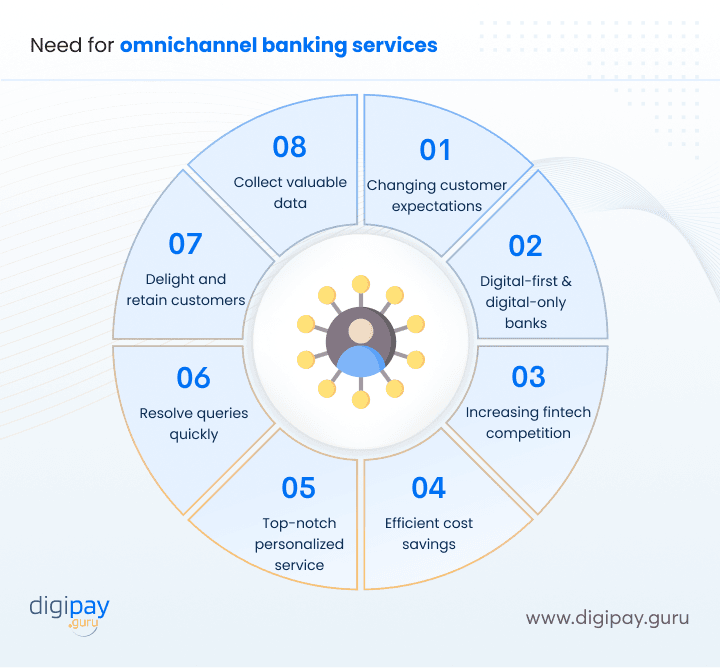

Here, are the major reasons why omnichannel banking services are needed and should be adopted this instant:

Changing customer expectations

When it comes to banking services, customers now expect personalized experience, convenience, speed, and much more. They want to access their accounts and make transactions through multiple channels while seamlessly switching between them as per their needs.

Omnichannel banking addresses these evolving customer expectations by providing a consistent and integrated experience across all touchpoints.

The rise of digital-first and digital-only banks

The emergence of digital-first and digital-only banks, also known as neobanks has disrupted the traditional banking landscape. These innovative players offer customers a fully digital banking experience with user-friendly mobile apps and streamlined processes.

Traditional banks can embrace omnichannel banking to provide consistent convenience and seamless experiences across all channels.

Increasing competition from fintech companies

Fintech companies offer innovative and advanced financial services tailored to specific customer needs. So, they are becoming a big competition and threat for banks. Plus, these companies excel in providing seamless and personalized experiences through digital channels.

Hence, adopting omnichannel banking can help banks match the convenience and personalization offered by fintech companies.

Read More: Impact of fintech on banks and financial services

Efficient cost savings

Implementing an omnichannel banking solution can lead to significant cost savings for banks by making operations smoother.

As you offer online and mobile services alongside physical branches, it reduces duplicate work and manages resources better. Self-service options also minimize the burden on branches and save you even more money.

Provide top-notch personalized service

Omnichannel banking allows you to leverage customer data and insights from multiple channels. You can utilize this data to create a personalized experience.

By understanding customer preferences, behaviors, and past interactions, you can tailor the services, offers, and communications to specific customer needs. This personalization builds stronger customer relationships and enhances loyalty.

Resolve queries at lightning speed

One of the benefits of omnichannel banking is that it allows customers to access banking services through multiple channels. This approach allows customers to switch between channels seamlessly and help you to resolve problems quickly.

For example, if your customer has trouble using the online banking platform, he can switch to the mobile app or call the call center for assistance. The ability to switch channels helps ensure that customers can always find a way to access the help they need and resolve issues on time.

Delight and retain customers

Omnichannel banking boosts customer satisfaction and loyalty by offering consistent, seamless & personalized experiences across all channels.

When customers get great service, they're more likely to stick with your bank and recommend it to others. This reduces customer loss and boosts retention rates.

Collect valuable data

Unified systems collect and analyze data across channels. This allows you to offer insights into customer preferences, pain points, and opportunities to enhance your services further.

Strategies for successfully implementing omnichannel banking

Now that you know the importance of omnichannel banking for your business, it's crucial that you implement it in the right way and strategically.

Read ahead, to learn how you can successfully achieve omnichannel banking and become a leader in your sector.

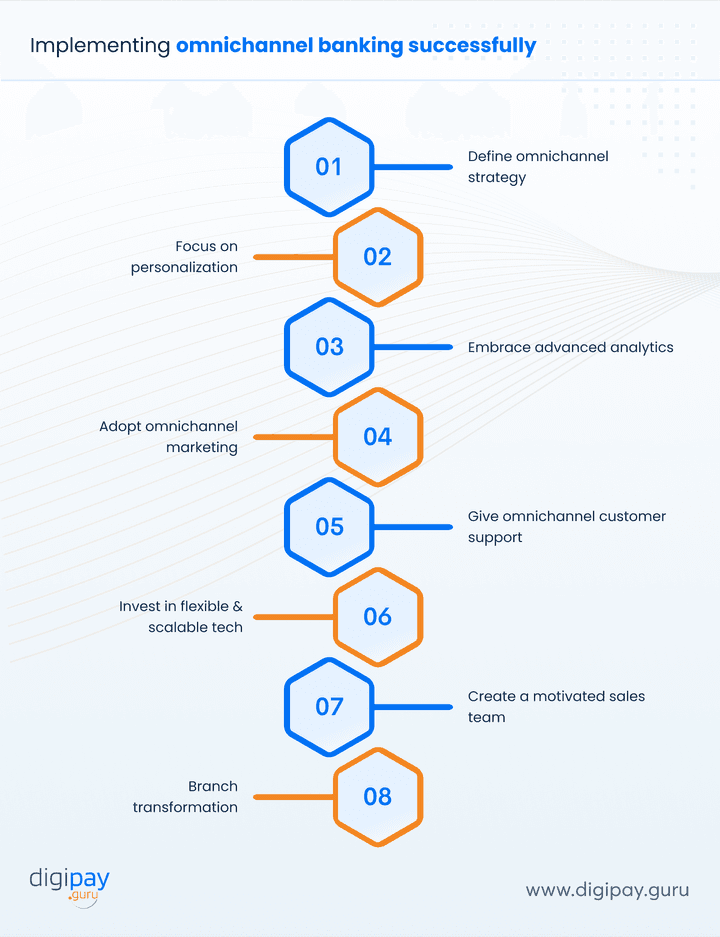

Define omnichannel strategy

Start by defining a clear and comprehensive omnichannel banking strategy. This strategy should align with your bank’s overall business vision, objectives, customer segments, and technological capabilities.

This strategy should outline:

- Which channels to integrate?

- What should be the desired customer experience across each channel?

- What processes and technologies are required for a seamless integration?

Focus on personalization

Personalization is essential to achieve successful omnichannel banking. By leveraging customer insights and analytics, you gain insights across all channels. You can utilize this data to tailor your products, services, and communications to meet specific customer needs and preferences.

This personalized approach enhances customer satisfaction and boosts loyalty and trust.

Embrace advanced analytics

You can achieve effective omnichannel banking with data analytics as you gain insights into customer behaviors, spending patterns, preferences, and journeys across multiple channels.

Implement advanced data analytics tools and techniques to discover patterns, identify pain points, and optimize the banking processes to deliver seamless and personalized experiences.

Adopt omnichannel marketing

Leveraging omnichannel marketing in banking can effectively transform the customer experience and reach. You should integrate marketing efforts across all channels to ensure consistent messaging, promotions, and brand experiences.

This approach of omnichannel marketing strengthens your brand and enables you to reach customers through their preferred channels. This significantly increases engagement and conversions.

Give omnichannel customer support

Customer support is an essential aspect of improving the overall customer experience. Implement omnichannel customer support by providing consistent and seamless support across all channels. This includes;

- Branches

- Call centers

- Chatbots

- Emails

- Social media and more

Also, ensure that customer service representatives have access to a comprehensive view of the customer's interactions and history. This enables them to provide efficient and personalized support.

Invest in modern, flexible, and scalable technology

A true omnichannel digital banking solution requires a robust and flexible technology infrastructure. Invest in modern, cloud-based solutions that can seamlessly integrate data and processes across all channels. Plus, ensure that your technology is scalable to adapt to future growth and new channels as they emerge.

Create a motivated sales team

A motivated and well-trained sales team is essential for driving the adoption and success of your omnichannel banking. You must provide comprehensive training to ensure that your sales team understands the omnichannel approach. This way you can effectively communicate its benefits to customers and guide them through seamless channel transitions.

Branch transformation

While digital channels are crucial in omnichannel banking, physical branches still play an important role, especially for more complex transactions or personalized interactions.

Transform your bank branches to complement your digital channels by leveraging technology. This will enhance the in-branch experience and enable seamless transitions between physical and digital channels.

Challenges of implementing omnichannel strategies

While the benefits are immense, implementing omnichannel strategies in banking comes with challenges:

Overcoming legacy systems: Modernizing outdated infrastructure can be time-consuming and expensive.

Data security concerns: Integrating multiple channels increases the risk of breaches. Robust security measures are essential.

Resistance to change: Teams may struggle to adapt to new processes and technologies. Clear communication and training are key.

High initial investment: Though the ROI is strong, upfront costs can deter some institutions.

How DigiPay.Guru can help?

To offer a seamless omnichannel banking experience, DigiPay.Guru offers robust digital payment solutions that can be easily integrated into your banking system.

These omnichannel payment solutions include:

-

Digital wallet solutions with omnichannel payment modes like QR code, NFC, bank transfers, and omnichannel transaction options like P2P, P2M, utility bill payments & airtime top-ups.

-

Agency banking platform for offering banking services with agent networks in unbanked and underserved areas

-

International remittance solution for offering remittance services across borders and more

This way you can expand your customer base across the globe and stay ahead of your competitors.

Conclusion

Embracing omnichannel banking is no longer an option but a necessity. By providing consistent, seamless, and personalized experiences across all channels, you can,

- Meet the evolving expectations of today's customers,

- Stay competitive against digital-first banks and fintech companies, and

- Boost customer loyalty and retention

With DigiPay.Guru can easily achieve this omnichannel banking experience with its advanced digital fintech solutions for your bank. Plus, you can put your competitors behind and earn next- level profits with our solutions - international remittance, agency banking, digital wallet, and more.