The global digital payments market is projected to reach between $137 billion and $170 billion in 2025. This is proof that the way people pay, get paid, and manage money is transforming at an extraordinary speed.

In just a few decades, we’ve moved from cash to credit and debit cards, and now to mobile-first payment solutions that put speed, convenience, and security in the palm of users’ hands.

Additionally, modern customers expect to pay in seconds, whether they’re tapping a phone at a point of sale, completing online purchases, or making instant transfers.

And two tools have emerged as essential in this landscape: prepaid cards and digital wallets. Too often, they’re compared in a “one vs. the other” debate. But for forward-thinking banks, fintechs, and financial institutions, the real opportunity lies in combining them.

In this blog, we’ll explore prepaid cards vs digital wallets through a collaborative lens. It will cover:

-

Prepaid cards vs digital wallets - key differences

-

Key benefits of prepaid cards in digital wallets

-

Top advantages of digital wallets for prepaid card users, and much more…

Let’s begin by understanding the key differences between the two!

Prepaid Cards and Digital Wallets: A Strategic Comparison

Prepaid cards and digital wallets have one similarity: the convenience of payments. But, how effective are they individually?

Let’s understand this with a brief comparison between digital wallets and prepaid cards:

Convenience and Accessibility

Prepaid cards and digital wallets are extremely convenient and accessible in providing digital payment services.

Prepaid cards excel in universal acceptance. They can be used at physical stores and online. It uses a tap-and-pay system with NFC technology, which enables fast, secure, and seamless payments.

Digital wallets, on the other hand, shine in mobile-first convenience. They enable contactless payments, NFC transactions, and integration with services like Apple Pay. This makes them very convenient.

When combined, you give your customers both worlds: card-based reach and wallet-based speed.

Security & Fraud Prevention

Prepaid card security comes from the fact that these cards are not tied to primary accounts, which reduces exposure in case of a breach or unauthorized access.

Plus, prepaid cards typically offer fraud protection features like chips and biometrics in case of virtual. Moreover, your customers can quickly block/freeze the card if lost or stolen.

To secure users' payment information and prevent unauthorized access, digital wallets have added security features like

-

Advanced encryption

-

Tokenization

-

Biometric authentication, and

-

Real-time transaction alerts

When you integrate the two, you create a dual security layer: the inherent safety of prepaid cards plus the advanced protections of digital wallets.

User Experience

Prepaid cards provide a simple and familiar experience just like traditional debit cards. And in the case of virtual cards, it acts like a digital debit card on mobile.

Whereas digital wallets offer a more tech-savvy approach, with features like

-

Real-time balance updates

-

Transaction history, and

-

The ability to manage multiple payment methods in one place

By pairing them, you enhance user control and transparency.

For example, when your customer makes a purchase with their prepaid card, he instantly gets a wallet notification with updated balance and card details.

Cost and Fee Considerations

Prepaid cards often come with various fees, such as:

-

Activation & issuance fees

-

Monthly maintenance

-

Reload fees, or inactivity charges, and

-

Transaction fees

Digital wallets, while generally free to use for the end users, may have associated costs for linked payment methods or premium features.

And offering both solutions allows you to balance operational costs while giving customers flexible options.

Regulatory and Compliance Requirements

Both prepaid cards and digital wallets are subject to regulatory oversight. However, the specific requirements can vary.

Prepaid cards often fall under traditional banking regulations like PCI DSS, while digital wallets may face additional scrutiny regarding data protection and cybersecurity, like KYC, AML, GDPR, SWIFT, FAFT, and more.

With the right digital payment solution provider, you can manage both under a unified framework.

Flexibility and Customization

Prepaid cards can be branded, tiered, or tailored(customized) to or specific features tailored to target demographics.

Digital wallets typically offer more flexibility and customization options compared to prepaid cards. Users can easily add, remove, or prioritize different payment methods within their digital wallet.

Together, they give you the ability to design targeted experiences that meet different customer needs without building separate systems.

How Do Prepaid Cards Work With Digital Wallets?

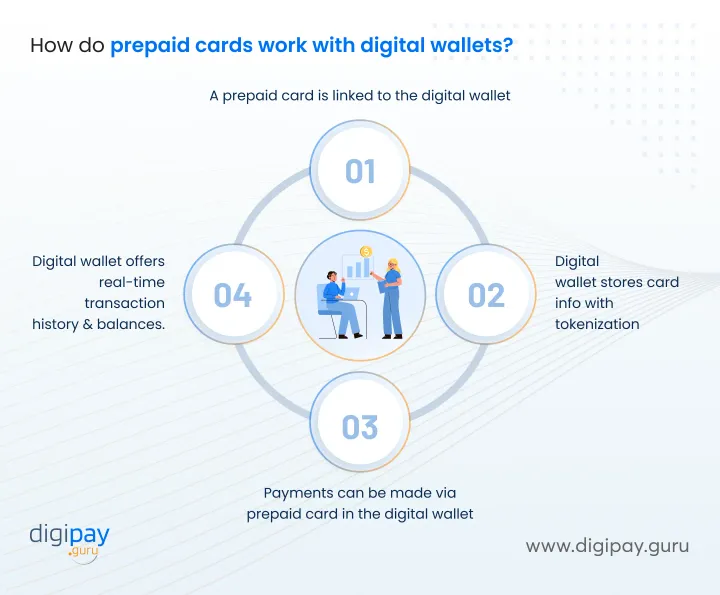

If a prepaid card is integrated into a digital wallet, it can create a powerful combination and can boost your revenue by 10X. Here’s how it works:

-

Users can add their prepaid card information to link it to their preferred digital wallet app.

-

The digital wallet securely stores the card information with tokenization for enhanced security.

-

Users can then make payments using their prepaid card funds via digital wallet. The payment can be made both online and at contactless payment terminals.

-

The digital wallet provides real-time updates on transaction history and current balances & more. This, in turn, offers improved visibility and control over prepaid card usage.

This seamless integration allows your customers to enjoy the benefits of both prepaid cards and digital wallets simultaneously.

Key Benefits of Integration of Prepaid Cards in Digital Wallets

There are numerous benefits of using prepaid cards in digital wallets for your customers. And benefits for customers equal extra benefits for your business. This means you can have loyal customers for life.

Let's explore these prepaid card benefits in detail:

Enhanced Security and Fraud Protection

Digital wallets are already made with robust security in mind. And with prepaid card integration into the digital wallets, you can offer your customers an extra layer of security.

It is because digital wallets typically employ security features like:

-

Biometric authentication & face verification

-

Face verification

-

Tokenization & encryption

-

Periodic web pentesting

-

Anomaly detection & prevention

-

Advanced encryption algorithm

-

Periodic SAST,DAST,SCA scans

-

Straightforward authorization rules and more…

These features can help protect sensitive card information from potential security breaches. And this enhanced security can lead to increased customer trust and reduced fraud-related losses for your business.

Increased Convenience

Digital wallets make it easier than ever for customers to use their prepaid cards.

With just a tap or a click, they can make payments without having to physically present their card. And linked prepaid cards let users tap-to-pay, make in-app purchases, and shop online without re-entering details.

This convenience can lead to increased usage and customer satisfaction, which, in turn, potentially drives more revenue for your business.

Financial Inclusion and Market Expansion

The combination of prepaid cards and digital wallets can be appealing to unbanked or underbanked populations. This combo can reach both mobile-first and cash-dependent customers.

For example:

-

Rural users can load cash to their card and manage it via a wallet.

-

Urban users can pay digitally but still withdraw cash when needed.

By offering a simple, accessible way to manage money without a traditional bank account, you can tap into this significant market segment. And provide valuable financial services to those who may have been previously excluded.

Budgeting and Expense Control

Digital wallets often come with built-in budgeting and expense-tracking features. When combined with prepaid cards, this can provide your customers with powerful tools to manage their spending and improve their financial health.

By offering these value-added services, you can differentiate your institution and foster long-term customer relationships.

Integration with Loyalty & Rewards Programs

Integrating prepaid cards with digital wallets opens up new possibilities for implementing and managing loyalty & reward programs.

With these programs, you can offer personalized rewards, cashback, or points directly through the digital wallet interface. This creates a seamless and engaging experience for your customers.

Operational Efficiency for Institutions

With the best prepaid cards for digital wallets provider, you can launch both a digital wallet and a prepaid card system on a bundled platform. This reduces vendor management complexity, compliance overhead, and time-to-market.

Compatibility with Multiple Payment Methods

Digital wallets allow your users to store and manage multiple payment methods in one place. And customers can link multiple cards, accounts, and funding sources to their wallet, while still having the prepaid card as their primary spending tool.

By ensuring your prepaid cards are compatible with popular digital wallets, you can position your offering as part of a broader and more flexible payment ecosystem.

Reduced Fees and Transaction Costs

The integration of prepaid cards with digital wallets can lead to reduced transaction costs. Digital transactions are often more cost-effective to process than traditional card-present transactions. This potentially improves your bottom line.

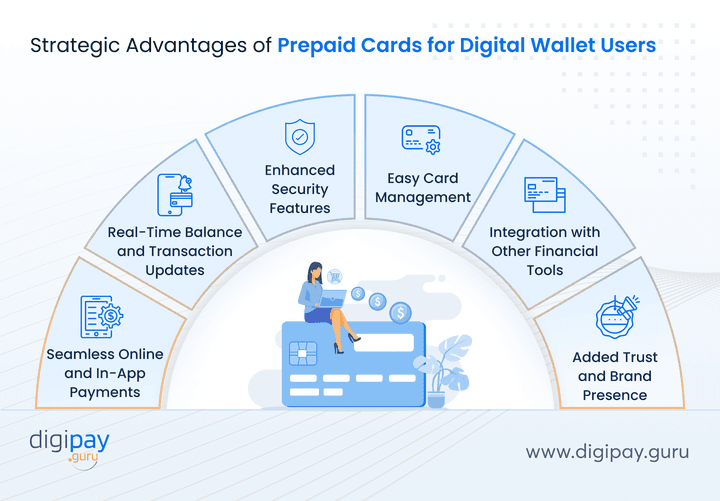

Prepaid Cards for Digital Wallet Users: Strategic Advantages

Using prepaid cards in digital wallets has numerous benefits. Similarly, there are myriad digital wallet benefits for prepaid card users. Such as:

Seamless Online and In-App Payments

With digital wallets, prepaid card users pay instantly in apps or on websites without entering card information each time. This eventually expands the usefulness of their cards.

Real-Time Balance and Transaction Updates

Digital wallets allow users to instantly check their prepaid card balance and recent transactions via the digital wallet interface. This improves trust and engagement.

Enhanced Security Features

Digital wallets come with an extra layer of security with advanced security measures like biometric authentication, tokenization, encryption, and more. This adds an extra layer of security for prepaid card usage.

Easy Card Management

With digital wallets, your users can seamlessly replace, block, or request a new virtual card directly from the wallet. Plus, it enables users to manage multiple prepaid cards all within the digital wallet app.

Integration with Other Financial Tools

Digital wallets can offer so many financial tools that can be easily integrated into the digital wallet system. The tools may include:

-

Budgeting tools

-

Lending products

-

Savings features

-

Financial insights and more…

These tools can help prepaid card users manage their funds better. Plus, it creates a broader financial ecosystem.

Added Trust and Brand Presence

A prepaid card issued alongside your digital wallet reinforces your brand identity. And your customers carry a physical reminder of your business, while also engaging daily with your digital wallet interface.

This dual presence builds stronger loyalty, credibility, and consistent visibility across both physical and digital touchpoints.

Why the Digital Wallet + Prepaid Card Combo Is Essential in Emerging Markets

Emerging markets like Africa, MENA, LATAM, and Southeast Asia present a unique opportunity for offering a combination of digital wallet and prepaid card. Here’s why:

-

Mobile penetration is high.

-

Bank account penetration is low.

-

Cash is still a major player.

And a prepaid card + digital wallet system bridges this gap:

-

Governments can distribute subsidies digitally while allowing cash withdrawal.

-

MFIs can disburse loans directly to prepaid cards.

-

Gig platforms can pay workers instantly, with wallet access for tracking and card access for spending.

For businesses like yours, this is a fast track to financial inclusion and new revenue streams.

Choosing the Right Infrastructure Partner

Not all prepaid card providers or digital wallet companies are created equal. So to get the best of this combination, you should look for:

-

Modular platforms that scale with your needs

-

API-based architecture for faster deployment

-

Compliance-ready systems (KYC, PCI-DSS, AML)

-

Support for both open-loop and closed-loop prepaid programs

-

Seamless integration between wallet and card

The best digital payment partner like DigiPay.Guru helps you launch quickly, stay compliant, and innovate without overhauling your tech stack.

How DigiPay.Guru can help?

DigiPay.Guru is the answer to the question of “Prepaid cards and digital wallets: A perfect match?”.

Here’s how:

DigiPay.Guru offers both solutions - a digital wallet solution and a prepaid card solution for your business.

Plus, with our API-driven efficiency, we can integrate with each other, based on your business needs.

This means, if you provide a digital wallet service, we can integrate prepaid cards into your system. And if you are offering a prepaid card service, then we can integrate a digital wallet into your system.

Besides, we also offer advanced digital wallet features like

- P2P & P2M payments

- Utility bills & airtime top-up

- Referrals and rewards

- Advanced security - biometric, encryption & more…

And robust prepaid card features like

- treamline card management tools

- Advanced analytics & reporting

- Robust security to protect customer funds & data

- Complete spending controls

- Customizable & configurable capabilities

- Rewards and loyalty programs and more…

Conclusion

It’s time to retire the idea of Prepaid Cards vs Digital Wallets as a competition. The real win is Prepaid Cards + Digital Wallets, a combination that delivers security, convenience, and reach for your customers, while unlocking efficiency and growth for your business.

And the top prepaid cards and digital wallets mentioned above are proof that both solutions can seamlessly work together.

With DigiPay.Guru you can become a business leader by offering both solutions under one platform. You can attract customers from both markets across the globe and stay afloat with your and your customers’ needs at all times.

If you’re ready to create a seamless, secure, and scalable payment ecosystem, this is the perfect match to start building today.

FAQ's

The key difference lies in funding and liability. A prepaid card is preloaded with funds by the customer or issuer, and spending is limited to that balance. There’s no credit line or direct link to a customer’s main bank account, which minimizes risk exposure.

In contrast, debit cards connect directly to a customer’s account, while credit cards extend a credit line and involve underwriting. For businesses like yours, prepaid cards are faster to issue, easier to scale, and often carry fewer compliance risks than credit products.

Not every prepaid card can be linked by default. Compatibility depends on whether the card program supports the tokenization standards required by major digital wallet companies like Apple Pay or Google Pay.

Your financial institution must work with prepaid card providers that have wallet enablement built into their issuing platform. With the right infrastructure partner, you can ensure your prepaid cards are wallet-ready, compliant, and fully functional across global digital wallet ecosystems.

Yes, because digital wallets add an additional layer of security. While prepaid cards already reduce fraud exposure by not being tied to core bank accounts, wallets enhance safety with tokenization, biometric authentication, and real-time transaction monitoring.

This means card details are never exposed during a transaction, making it harder for fraudsters to exploit lost or stolen cards. For institutions like yours, this not only reduces fraud claims but also builds customer trust.

Yes, if the program is designed with the right network partnerships and compliance setup. Open-loop prepaid cards (issued via networks like Visa or Mastercard) can be added to digital wallets and used globally: online, in-app, or at physical point of sale terminals.

For institutions serving cross-border markets or remittance corridors, combining prepaid cards with wallets can create a seamless global payment solution for both local and international use.

Absolutely. Many prepaid digital wallet benefits come from engagement features like loyalty, cashback, or tiered rewards. By linking rewards to prepaid card spend tracked through the digital wallet, you can design gamified customer experiences that increase transaction volumes and stickiness.

For example, fintechs can offer cashback on in-app purchases, while banks can create loyalty programs integrated directly into the wallet interface. This approach turns prepaid programs from transactional tools into long-term engagement drivers.

Yes, and you should evaluate these carefully. While many wallets don’t charge customers for linking a card, there may be network fees, tokenization costs, and integration expenses for the issuer.

Additionally, regulatory compliance remains critical, especially around KYC, AML, and PCI-DSS. Working with a provider that supports both card issuance and digital wallet enablement under one platform reduces complexity, keeps costs transparent, and ensures compliance obligations are met.