The banking industry is moving faster than ever toward full-scale digitalization.

According to Deloitte, over 65% of banks worldwide have already prioritized digital transformation as a top strategic goal. Yet, one question continues to divide decision-makers:

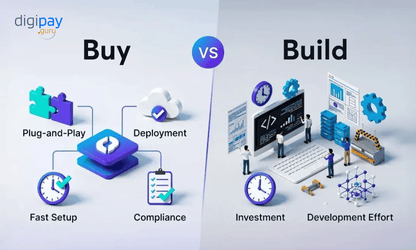

Should a bank build its own digital platform from scratch or adopt a white-label banking solution that’s ready to deploy?

It’s not a simple technology choice. It’s a business strategy decision that shapes how quickly you can innovate, serve customers, and scale operations.

Custom-built software gives you complete control over every feature, but demands time, technical resources, and heavy investment.

White-label banking software, on the other hand, delivers pre-built, compliant infrastructure that you can brand and launch in a fraction of the time.

In this blog, we’ll break down both approaches:

- What they really mean

- How they differ, and

- Which one fits your institution’s goals best?

You’ll walk away with a clearer picture of which model helps your bank stay competitive in an increasingly digital world.

Let’s start by making you understand the basics (if you already didn’t know)!

Understanding White-Label vs. Custom Banking Software

Before comparing the two, let’s understand both the baking models:

A custom banking solution is a system built entirely from scratch, designed, developed, and maintained specifically for one bank. You decide the tech stack, design the workflow, and own every line of code.

A white label banking solution (sometimes called a private label fintech solution) is the opposite. It’s a ready-to-launch platform, built by a fintech provider, that your bank can license, brand, and customize. You get the infrastructure from APIs, KYC, and compliance, to modules already in place.

In other words:

- Custom = control, uniqueness, time.

- White-label = speed, cost-efficiency, scalability.

Both get you to digital banking. The difference lies in how fast and how independently you want to get there.

Now, let’s understand both solutions in more detail in the upcoming sections!

What Is a White-Label Banking Solution?

A white-label banking platform is a plug-and-play foundation for digital banking.

Here, you don’t start from scratch; you start from “ready.”

It’s a pre-built, modular solution offered by a fintech provider like DigiPay.Guru. And your bank licenses it, rebrands it, and customizes features to fit your customers’ needs.

A good white-label banking software comes with:

- Digital wallet and mobile app modules

- KYC and AML integration

- Payment gateways (domestic and international)

- Pre-integrated APIs

- Fraud monitoring and reporting systems

Essentially, it’s a white label digital bank in a box: built for speed, scale, and compliance.

For example, a mid-tier African bank could roll out mobile banking, agent networks, and card management in 90 days using a white-label platform, compared to 18 months if built from scratch.

In short: You own the brand. And the provider handles the technology.

That’s the beauty of the white-label model: fast innovation without technical headaches.

What is a Custom Banking Solution?

A custom banking solution is one you design from the ground up.

Your tech team (or a development partner) builds the architecture, interface, and every single feature. You decide how your banking app looks, how customers onboard, and how products interact.

Sounds ideal, right? Full control, full ownership, full bragging rights.

But here’s the catch: control comes at a price.

Building custom software demands:

- 12–24 months of development

- High investment in infrastructure and licenses

- Continuous security and compliance audits

- A dedicated tech and DevOps team

For large, legacy banks with deep budgets and unique ecosystems, this works.

But, for mid-size or regional banks racing to innovate, it’s often like reinventing the wheel.

In short:

Custom builds give you precision. White-label solutions give you pace.

White-Label vs. Custom Banking Software: Key Similarities & Differences

Both custom and white label models aim for the same goal: For you to get a robust, compliant, and user-friendly digital banking platform.

But they get there differently.

Here’s a quick comparison table for clarity:

| Factor | White-Label Banking Software | Custom Banking Software |

|---|---|---|

| Development Model | Pre built, licensed from a provider | Built entirely from scratch |

| Ownership | Provider retains core IP, depending on the model (License/SaaS) | 100% owned by the bank |

| Time to Market | 2–6 months, (as little as 90 days) | 12–24 months |

| Initial Cost | Lower (subscription/licensing) | High (full development) |

| Customization | Modular customization | Fully flexible |

| Compliance | Pre-integrated (PCI DSS, AML, KYC) | Built and audited manually |

| Maintenance | Provider-managed | Bank-managed |

| Scalability | Cloud-native, API-first | Depends on internal infra |

| Best Suited For | Banks seeking a fast launch and lower risk | Large banks with in-house tech teams |

When you see it side by side, the trade-off is clear: custom = autonomy, white-label = agility.

Advantages and Disadvantages of White Label Solutions vs Custom Banking Solutions

Now you know the differences and similarities between the two solutions. Next, let's understand the advantages and disadvantages that both solution models carry:

Advantages of White-Label Banking Software

Let’s be honest: building everything from scratch can feel like climbing a mountain barefoot. That’s where white-label banking software gives you an edge.

Here’s why so many banks are choosing it today:

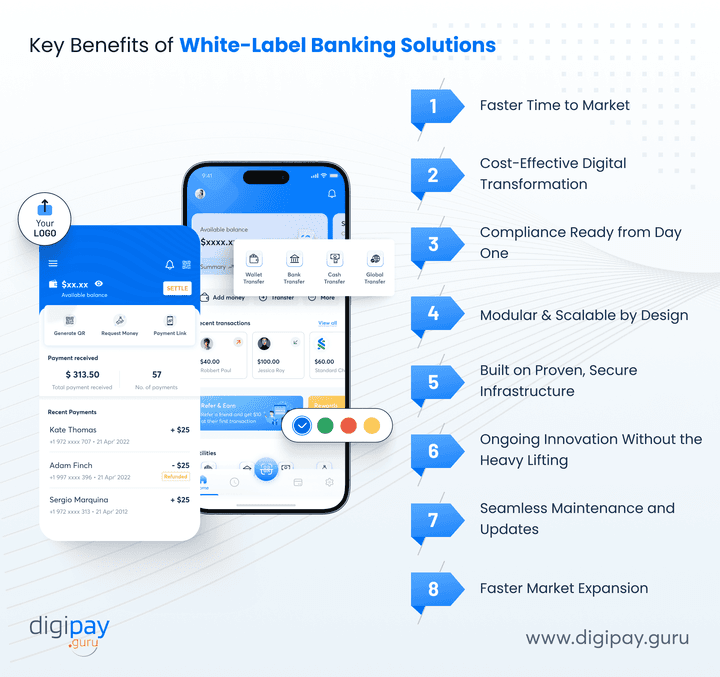

Faster Time to Market

You don’t have to wait 18 months to launch your digital bank. A white-label platform lets you go live in a few months or just weeks, while your competitors are still writing requirement documents.

Cost-Effective Digital Transformation

You save millions in development, infrastructure, and hiring. With a pre-built solution, you pay for proven tech, not trial and error.

Compliance Ready from Day One

You don't need to chase auditors or build KYC and AML from scratch. White-label solutions come pre-built for PCI-DSS, AML, and data security measures, which can save you months of paperwork.

Modular and Scalable by Design

Every bank grows at a different pace. White-label platforms are modular, which means you can add new services like cards, loans, wallets, or remittances, without touching the core system. That’s true scalability.

Built on Proven, Secure Infrastructure

With a white-label solution, you’re not experimenting with new tech; you’re building on a tried-and-tested banking infrastructure that already supports thousands of daily transactions. Reliability is baked in, not promised.

Ongoing Innovation Without the Heavy Lifting

With white-label infra, your provider keeps improving the product by adding features, tightening security, and upgrading performance. And you can stay on the cutting edge of fintech without managing a full-scale IT department.

Seamless Maintenance and Updates

Forget version control nightmares and costly downtime. Because here, updates, patches, and performance upgrades happen automatically and are handled by experts who live and breathe fintech infrastructure.

Faster Market Expansion

When your platform is built to adapt, expansion becomes easy. Whether you want to launch in a new region or offer new currencies, white-label banking solutions scale faster than any in-house system ever could.

Disadvantages of White-Label Banking Software

No solution is perfect, and white label banking isn’t an exception.

But here’s the good news: every challenge you might face can be solved with the right technology partner.

Key challenges you might face include:

Limited Control Over Core Code

You may not own the entire codebase, but a good provider gives you deep configuration rights through APIs and modules. So you still shape the experience, not just rent it.

Dependence on Provider’s Roadmap

You can feel dependent on the provider when it comes to updates in the system. However, the right provider co-creates with you while adding features, integrations, and compliance updates on your timeline, not theirs.

Customization Boundaries

Some platforms feel rigid, which would look like there are limitations on customizations. But modern white-label banking solutions like DigiPay.Guru’s use open APIs. That means you can extend functionality or integrate your own tools anytime.

Brand Similarity

Worried your app might look like someone else’s who also posted for the same white-label solution provider? With custom UI controls and design flexibility, your digital bank still reflects your unique identity and user experience.

In short:

A white label banking platform only becomes limiting when you choose the wrong partner.

The right one gives you flexibility, co-innovation, and total brand independence, all with zero technical baggage.

Advantages of Custom Banking Software

If control is your top priority, custom banking software can feel like your dream setup. It’s built around your needs, your systems, and your customers.

Here’s what makes it powerful when done right:

1. Complete Ownership and Control

With a custom solution, you own the architecture, data, and decision-making. This means: Every feature, rule, and product flow reflects your strategy without any external dependencies.

2. Tailored to Your Exact Business Model

Here, there are no compromises, so no query of “close enough” features arises. You can create just exactly what you want. This is possible because the system aligns with your internal workflows, compliance logic, and regional regulations from day one.

3. Deeper System Integration

It connects perfectly with your existing ecosystem, such as core banking, CRM, treasury, and risk systems. This creates a single, seamless digital backbone.

4. Unique Brand and User Experience

With a custom banking solution, your app looks, feels, and behaves like your brand. Every pixel and interaction reflects your tone, your identity, and your promise to customers.

5. Long-Term Flexibility

When you build it, you decide its future. You can evolve, expand, or re-engineer modules as your business strategy changes, without waiting for anyone’s roadmap.

6. Competitive Differentiation

You don’t just compete on pricing or services. You compete on experience. A custom-built platform gives your bank a distinct digital edge that others can’t replicate.

In essence:

Custom banking software gives you complete autonomy and long-term freedom. The kind that fits established banks with strong IT capabilities and a clear digital roadmap.

Disadvantages of Custom Banking Software

Custom builds sound empowering, but they come with their own hurdles: mostly around time, cost, and maintenance.

The good news is: A strong white label banking app provider can help you overcome almost all of them.

1. High Development Cost

Building from scratch burns through budgets fast. It costs you more than the profit it can earn you in the next 3 years. But a white-label platform gives you a pre-built foundation that cuts development costs dramatically, without sacrificing quality.

2. Long Time to Market

Custom projects can take years to go live. A white-label solution gets you there in months, with its ready APIs, tested modules, and certified compliance layers.

3. Maintenance Overload

Custom systems need constant updates and security audits. With a white-label provider handling maintenance, your IT team can finally focus on growth, not bug fixes.

4. Compliance Complexity

Every new regulation can slow down a custom project. However, white-label providers like DigiPay.Guru stays ahead of compliance changes, which keeps your platform fully compliant automatically.

5. Scalability Challenges

Custom systems can struggle to scale fast due to their in-house storage nature. A modular white-label setup expands instantly with its cloud infrastructure and API efficiency. Whether you’re adding new services or entering new markets, it grows with your business.

Bottom line:

While custom banking software gives you full control, it also ties you to complexity. A trusted white-label provider helps you enjoy the same benefits, minus the delays, cost overruns, and compliance complexities.

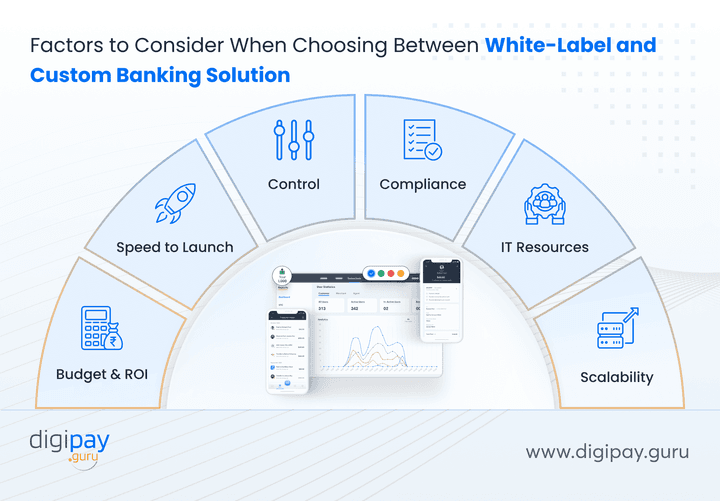

Should You Choose White-Label or Custom Banking Software?

Here’s the golden question: which one’s right for your bank?

Let’s walk through the main factors:

-

Budget & ROI: White-label saves millions in upfront development.

-

Speed to Launch: Go live in under six months with a white-label platform.

-

Control: Custom builds offer full control, but at high cost and complexity.

-

Compliance: White-label comes pre-certified; custom needs time and audits.

-

IT Resources: If your team is small, opt for white-label.

-

Scalability: API-first white-label platforms scale faster across markets.

So, when should a bank choose white-label? When speed, flexibility, and cost-effectiveness matter most.

When should you choose custom? When your business model is highly unique or requires deep integrations not possible through third-party APIs.

To put it simply: White-label fits banks ready to grow fast. Custom fits banks ready to invest deeply.

DigiPay.Guru: Empowering Banks with Scalable White-Label Solutions

At DigiPay.Guru, we’ve seen this transformation unfold firsthand.

Our white-label banking software powers banks, microfinance institutions, and fintechs across the globe.

Here’s how we help:

- Faster Go-Live: Launch your digital bank in weeks. (as little as 90 days)

- Modular Solutions: Add services like remittance, cards, or wallets anytime

- Compliance Built-In: Fully KYC, AML, and PCI ready. (We are also PCI-SSF certified)

- Seamless Integration: API-first design connects easily with core banking systems.

In addition to that, DigiPay.Guru’s every solution is secure, reliable, scalable, flexible, fully-compliant, and built for fintech and banking success.

We don’t just provide a product; we deliver a path to digital evolution.

Conclusion

Both models, custom and white-label, aim to modernize your bank’s digital experience.

The difference lies in approach. It’s about which fits your bank’s goals, capabilities, and timeline.

If you’re a large institution with deep IT resources, a custom solution gives you total control. But if your goal is to go digital faster, scale efficiently, and stay compliant without draining budgets, then a white-label platform is the smarter route.

In the current fast-moving financial landscape, time to market, customer experience, and agility often define success more than ownership of code ever will. That’s why more banks are leaning toward trusted white-label partners to power their digital journey.

And that’s where DigiPay.Guru comes in. With our modular, API-driven white-label banking platform, you can launch, scale, and innovate faster, all while maintaining your brand identity and regulatory confidence.

FAQs

White-label systems are modular and cloud-based, so scaling to new regions, adding new services, or managing transaction spikes happens effortlessly, far faster than with most custom-built systems

White-label banking software is far more cost-effective. You avoid heavy upfront development costs, shorten time to market, and still get a compliant, scalable platform ready for branding and launch.

Both terms refer to the same concept, a pre-built digital banking platform developed by a fintech provider that your bank can customize, brand, and launch as its own. The real comparison is between custom-built and white-label banking solutions.

Yes, absolutely. Modern white label platforms (like DigiPay.Guru’s) use modular and API-driven architecture, allowing you to customize the design, workflows, and product offerings while keeping the core infrastructure intact.

Very secure, provided you choose a reputable provider. Top white label banking providers comply with PCI DSS, ISO 27001, AML, and KYC standards, and include built-in encryption, fraud detection, and tokenization to safeguard transactions and user data.

Many regional and digital-first banks use white-label banking software to power services like mobile wallets, agent networks, and digital onboarding, all branded under their own name but powered by fintech providers like DigiPay.Guru.

DigiPay.Guru offers a comprehensive white-label banking platform with ready-to-launch modules for wallets, payments, cards, and remittance, all API-ready, secure, and fully compliant. Plus, you get speed, scalability, and regulatory assurance under one roof.

The future will be modular, API-first, and collaborative. Expect growth in Banking-as-a-Service (BaaS), embedded finance, and AI-led personalization, all driven by flexible white-label infrastructures that help banks scale faster.

Not at all. White-label solutions are fully brandable, allowing your bank to maintain complete control over customer experience, design, and messaging — customers only see your brand, not your provider’s.

Because DigiPay.Guru combines speed, compliance, and flexibility in one platform. You get to launch faster, innovate continuously, and reduce technical risk, without losing control of your brand or operations.

Yes, they’re highly secure, provided you partner with a trusted provider. Reputable white-label banking platforms come with built-in PCI-DSS, AML, and KYC compliance, plus data encryption, tokenization, and fraud-monitoring systems.

Essentially, you get enterprise-grade security without managing it in-house, your customers stay protected, and your compliance stays effortless.

SaaS (Software as a Service) has completely changed how banks approach digital transformation. With white-label SaaS, your provider handles hosting, updates, and scalability in the cloud so you focus on innovation, not infrastructure.

In contrast, custom SaaS puts all maintenance and upgrades on your IT team. For most banks, white-label SaaS delivers faster launches, stronger uptime, and easier compliance, all without the operational load.